10 February 2026

Cashflow visibility and supplier engagement are among the benefits that result when financial services are embedded into non-financial platforms. flow’s Clarissa Dann examines corporate appetite for embedded finance and shares how Deutsche Bank has combined the innovation and agility of a start-up with the safety of a Tier-1 European bank to make this available to clients

MINUTES min read

Exploring new ideas, products and services without the constraints of market and revenue pressures or regulatory frameworks has been happening for decades – particularly in the finance, healthcare and tech sectors. ‘Innovation sandboxes’ will often be found in forward-looking organisations seeking the agility of a start-up and comprise a pipeline of ideas that could determine the future of that organisation.

In corporate banking this approach to innovation can be seen in the challenge presented by embedded finance – the integration of financial services into non-financial platforms, products, or services.

“The financial system of the future won’t be built in banks – it’ll be embedded in the apps, platforms and services people already use. Redefining how financial services are accessed and delivered, embedded finance is at the forefront of fintech innovation,” declared Astra Tech CEO Tariq Bin Hendi at the World Economic Forum’s TradeTech Forum in Abu Dhabi on 8 April 2025. More reassuringly, he added, “Rather than signalling the end of traditional banking, this shift offers institutions a chance to evolve.”

Banks are reassessing how they approach embedded finance. This is not merely an extension of existing products to deepen client relationships but across the broader commercial and operational value chain of their clients.

Without this evolution, there is a growing risk of banks being relegated to the role of back-end financial infrastructure, rather than remaining trusted advisers at the centre of client-decision making.

This article summarises the embedded finance journey. It then demonstrates how Deutsche Bank has combined the agility and innovation of a tech start-up with the trust, safety and expertise of a Tier-1 European bank to evolve an embedded finance offering to clients.

After Open Banking

When Open Banking – introduced eight years ago through the EU’s Payment Services Directive 2 (PSD2) – required banks to give regulated third parties access to account data, it sparked a wave of new, retail-led use cases – from checkout financing and in-app wallets to subscription-management tools.

What began in retail and broader consumer applications is now extending into corporate settings, where expectations are rising for the same level of convenience and integration. New use cases are emerging that change how corporates interact with their banks, their financial data and their internal systems. By using APIs, functions such as banking, payments, liquidity and lending can now be embedded directly into enterprise resource planning (ERP) and treasury management systems (TMS).

Software providers offering ‘software as a service’ (SaaS1) platforms quickly recognised this opportunity. They already offered strong user interfaces, cashflow forecasting and liquidity analytics, and by integrating banking APIs they could add payments and other financial services seamlessly, expanding their value to clients and widening their revenue pool.

Out of Big Data

“I see myself at the nexus of data, product and technology,” reveals Deeptasree (Dee) Mitra, Head of Synthix (a separate legal entity within the wider Deutsche Bank organisation) who joined Deutsche Bank in 2018. “My focus has always been data, product, and enabling customers to use something without unnecessary complexity.”

Her career has featured heading multiple large-scale data platform transformations. As head of data products and solutions at British Gas, Mitra spearheaded the UK’s first enterprise-grade big-data platform, consolidating ERP, CRM and other datasets into a unified model. She later brought this expertise to the Bank of England, where she was tasked with tackling the institution’s next-generation data-platform challenge.

In 2020, at Deutsche Bank she helped secure a 10-year strategic deal with Google Cloud, which would provide cloud computing capabilities and help transform the bank’s IT systems and architecture. This has paved the way for the development of embedded finance offerings.

Once the cloud foundation was in place, the next question emerged: could the bank begin exposing its products as APIs – effectively creating channels for external access to core banking services? As Head of API Strategy for the Corporate Bank, Mitra established the API governance and architectural foundations that would later underpin the bank’s embedded finance journey.

“Embedded finance is the integration of financial services into non-financial platforms and customer journeys”

“We weren’t looking to compete with TMS or ERP providers, but to be inspired by how corporates could better consume banking services – to build our own technology offering that solves the problems no one else was addressing, and to create an entity capable of delivering digital products closer to the bank,” explains Mitra.

Embedded finance

Corporate treasurers are generating efficiencies when they can bring their preferred fintechs, payment service providers (PSPs) and data providers into a single environment. This is where embedded finance plays its role – with the integration of financial services such as payments, lending accounts, insurance or investments into non-financial platforms and customer journeys.

In November 2025, Mastercard conducted a survey of 1,185 senior procurement and accounts payable decision-makers at large B2B companies across Australia, Brazil, Canada, France, Germany, Japan, Saudi Arabia, Singapore, Spain, the UK and US. A key takeaway from the findings was that “while some organisations remain cautious, those adopting embedded finance report meaningful improvements in cash flow visibility, compliance, security and supplier engagement”.2

Embedded finance, Mitra explains, “brings financial capabilities directly to the point where a customer is already engaging with a product or service, rather than requiring them to go to a separate financial institution’s front end or customer journey."

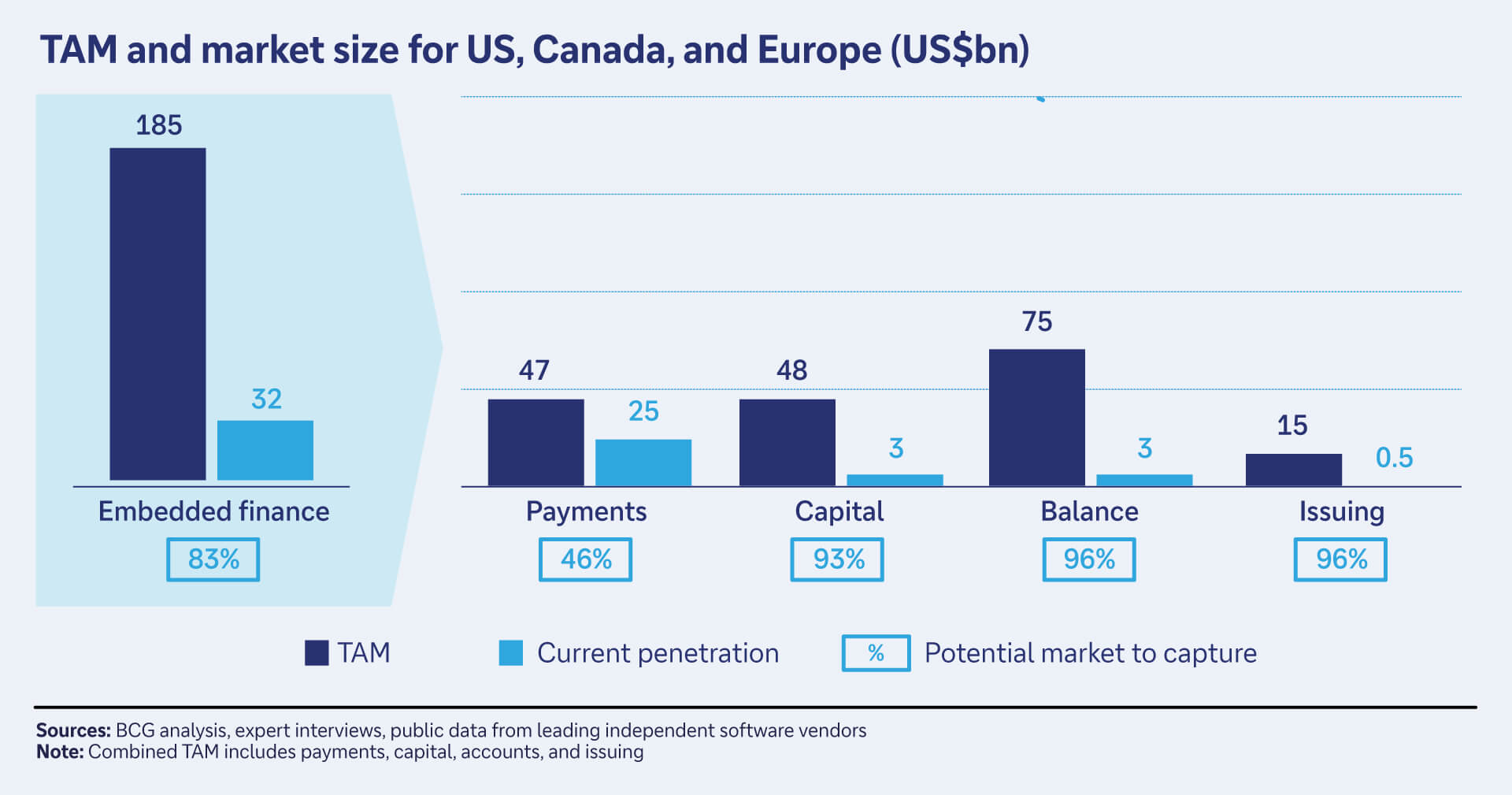

The commercial potential of embedded finance is significant: in North America and Europe, PSP company Adyen and consultancy BCG estimate a total addressable market of about US$185bn, compared with current penetration of roughly US$32bn.3 See Figure 1.

Figure 1: Total addressable market for embedded finance

Against this backdrop, financing, payments, risk management and even advisory services are becoming embedded within clients’ underlying business processes. A bank will already have the licence to operate and payment rails in place, and a corporate’s ability to consume these services now depends on how well they are technically integrated and connected into their wider enterprise systems.

Their task, says Mitra, is all about “addressing the needs of our clients on multiple fronts – strengthening data security and privacy foundations, navigating increasingly complex consumer and data-protection regulation, and developing software capabilities that automate end-to-end workflows”. All of this, she adds, means extending “well beyond traditional domains such as payments and liquidity management”.

“Synthix’s architecture lets corporates plug in account, transaction and invoice data from their internal systems, multiple banks and PSPs into a single environment”

Embedded finance in action – Synthix

New ecosystems with financial services embedded within banking clients’ own preferred digital platforms are emerging. One example of this is Synthix, which creates and builds SaaS offerings that:

- Provide financial visibility, analytics and workflow solutions; and

- Package ‘licensed offerings’ from Deutsche Bank (and/or other fintechs) and ‘non-licensed digital services’ from third-party software providers.

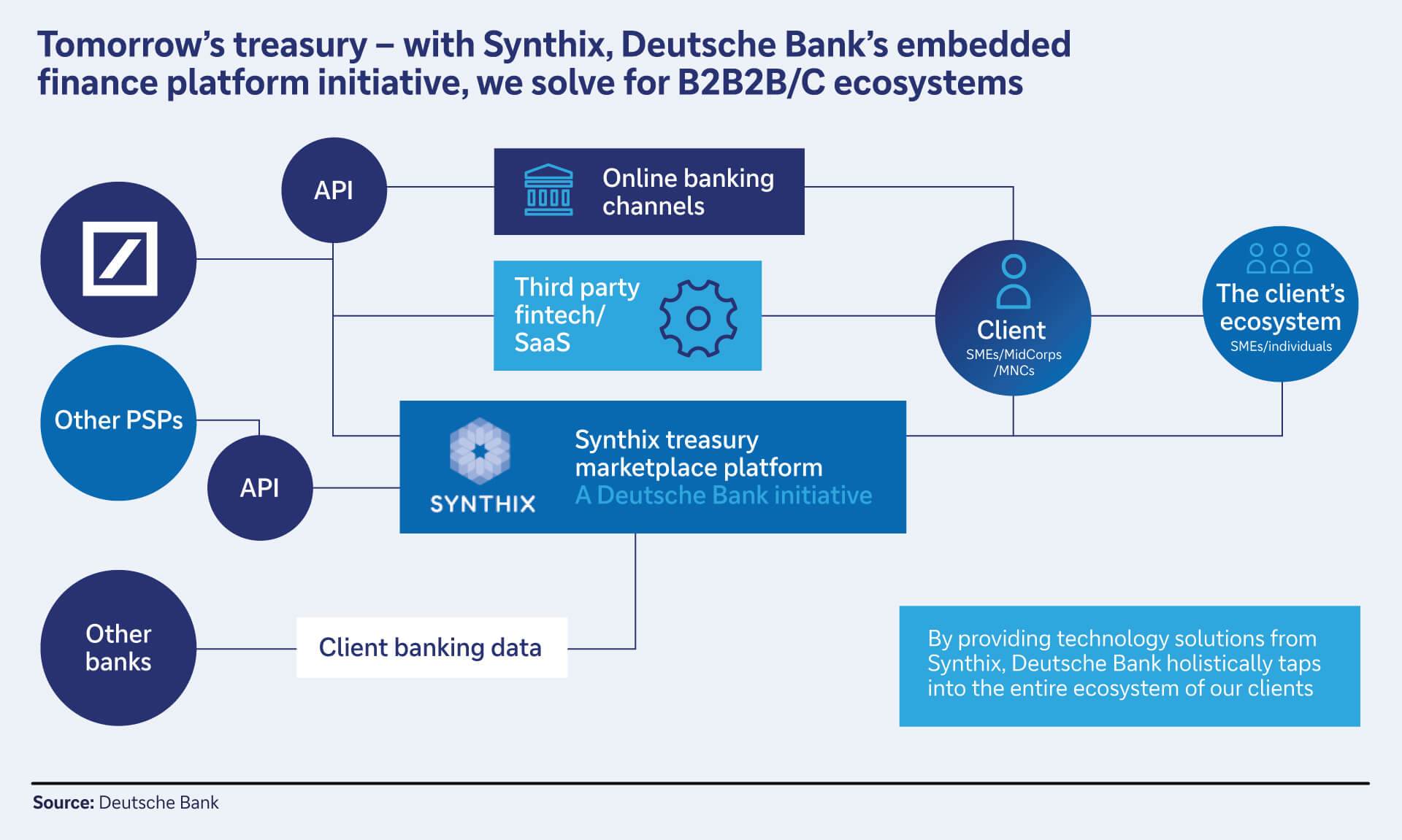

Mitra explains, “The value lies in bringing different providers into one place. Synthix’s modular, API-based architecture lets corporates plug in account, transaction and invoice data from their internal systems, multiple banks and PSPs into a single environment, then consume Synthix products on top – creating a technology-first marketplace of financial workflows around their business needs.”

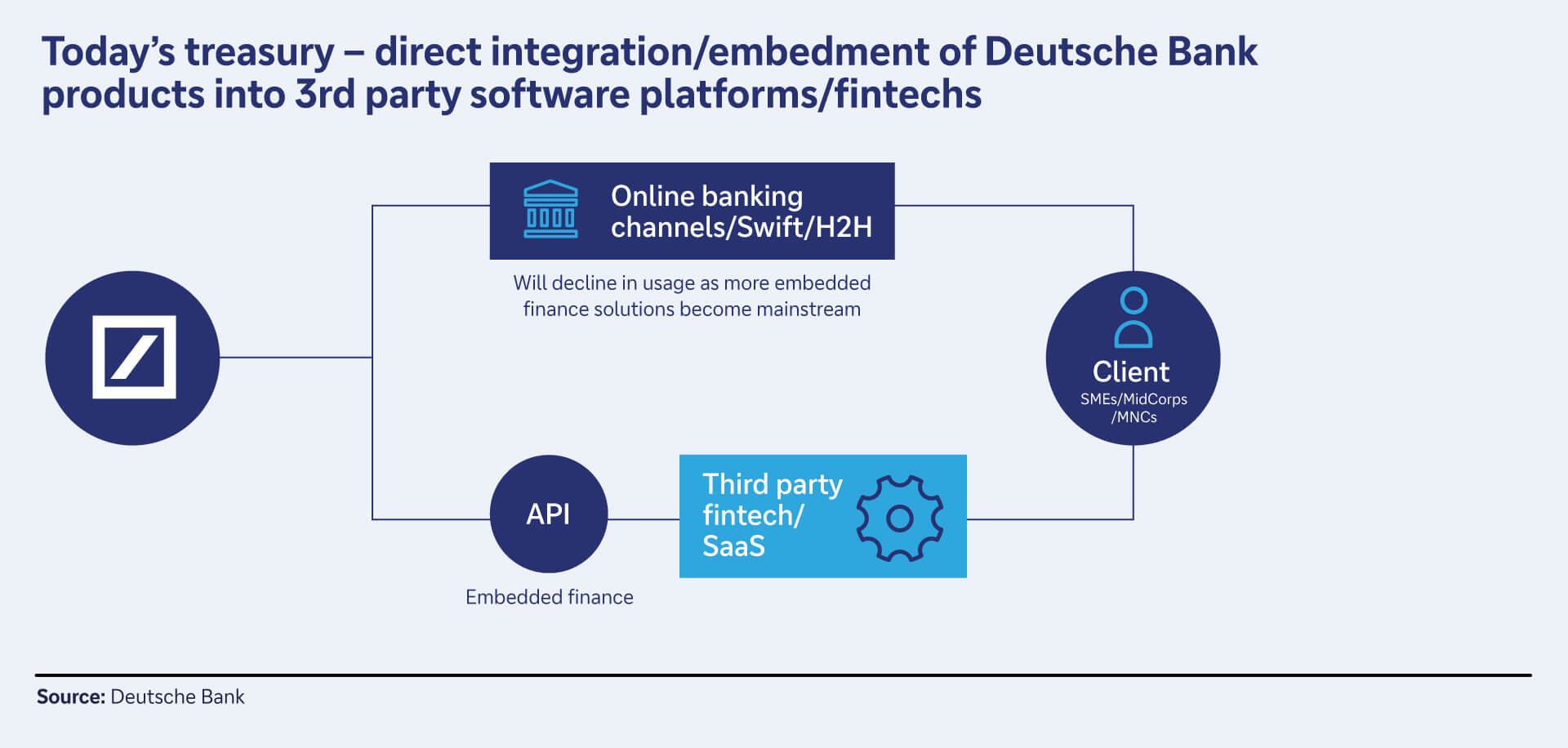

Figure 2: Today’s treasury

Figure 3: Tomorrow’s treasury

Clients can connect to Synthix in several ways: through Single Sign-On (SSO), via the web, or – for corporates with more sophisticated infrastructure – via APIs, enabling them to synchronise data from their ERP systems or embed Synthix workflows directly into their own environments.

The marketplace serves not only the client, but also the client’s wider ecosystem. “When you attempt to streamline a client’s back-office processes, those processes inevitably involve interacting with the client’s customers and payers. Synthix therefore offers white-label portals that clients can deploy across their networks,” says Mitra.4

Users can connect into two platforms:

- Synthix Flow – a workflow engine focused on solving back-office challenges for collections and payouts.

- Synthix Finance – a multi-bank cash-management insights tool designed for real-time cash management, payment services and advanced data-insight capabilities.

Curating the marketplace

While several third-party providers are already live – and more are in development – the roadmap will ultimately be shaped directly by client demand. As Mitra notes, treasurers increasingly want the freedom to bring their preferred fintechs, PSPs and data providers into a single environment. Synthix’s role is to curate this marketplace, integrating the partners that matter most to clients.

“Looking ahead, I see Synthix evolving much like the Apple ecosystem – where every product connects effortlessly with the next. With your iPhone, you can instantly pair your Apple Watch, AirPods, iPad, Mac or Apple TV. That experience is what makes people fall in love with Apple,” she explains. “That’s where we want to take Synthix. We want it to be a platform that offers our products to clients – and non-clients – so seamlessly that they fall in love with Deutsche Bank.”

Sources

1 This is where the software offering is accessed over the internet without the requirement for users to download and install

2 See How embedded finance can unlock procurement value at mastercard.com

3 See Moving Embedded Finance from Promise to Practice at bcg.com

4 See Synthix | Financial software company at synthix.com