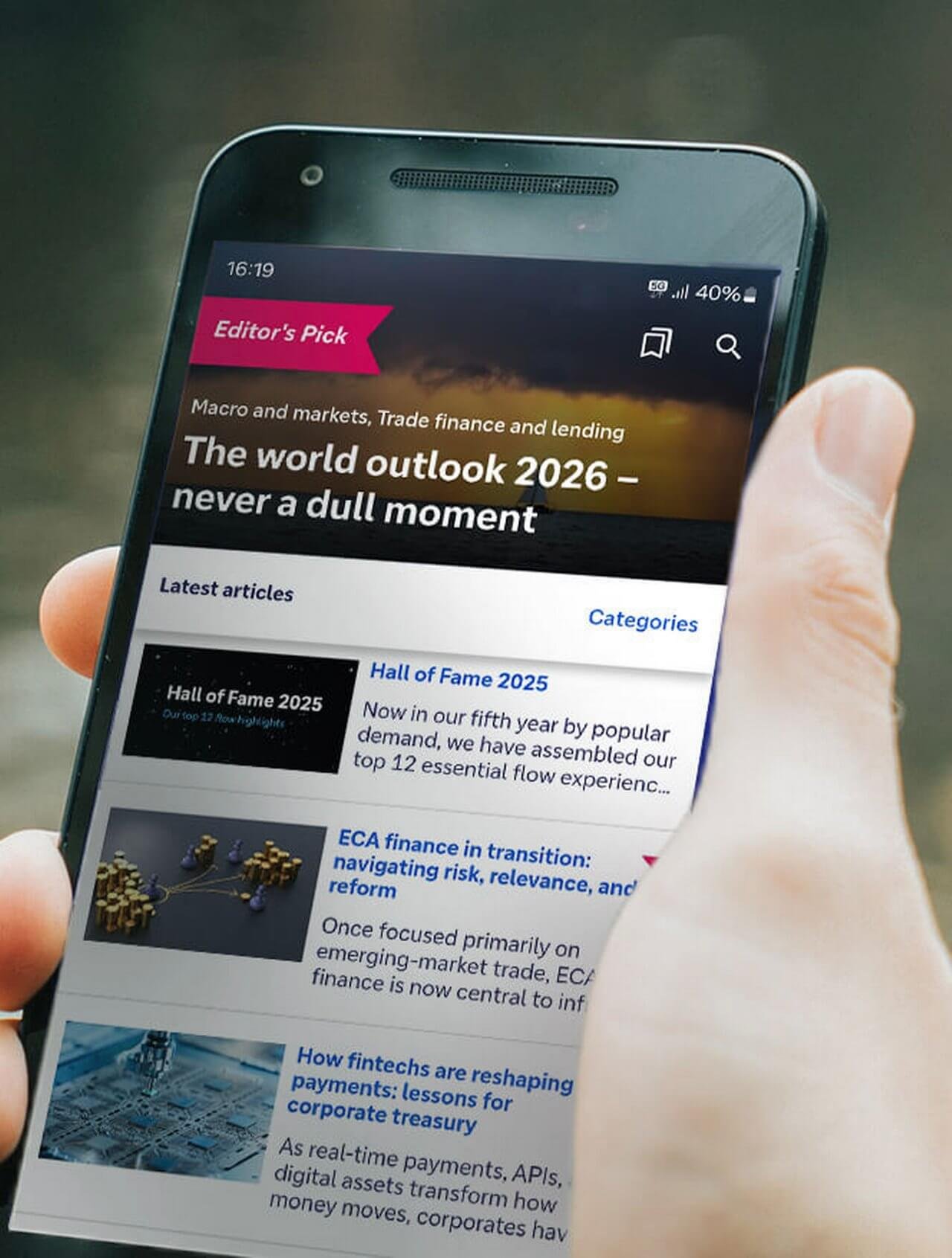

flow provides you with essential corporate and transaction banking content and unique insights from Deutsche Bank Corporate Bank. The three latest articles are displayed; scroll right for more insights

Home

Home