3 June 2025

With the geopolitical environment getting rougher and corporates rethinking their supply chains, cash visibility and control are more important than ever. flow’s Desirée Buchholz hosts a debate on how uncertainty is impacting liquidity, funding and FX

MINUTES min read

Participants

Dr Cornelia Ballwießer, CFO, SUSS MicroTec SE

Ameet Paranjape, Group Senior Vice President Treasury, DP World

Magnus Svensson, Regional Treasurer Americas, TE Connectivity

Christof Hofmann, Global Head of Corporate Cash Management, Deutsche Bank

Gourang Shah, Head of Cash Sales – APAC & MEA, Deutsche Bank

There have always been times of crisis and volatility, but when this debate took place on 22 April 2025, the macro landscape was changing on an almost daily basis. On 2 April, the US administration had announced so-called reciprocal tariffs on goods from more than 180 countries and territories.1 Only a week later, the US government backed down, suspending these tariffs for 90 days to allow for negotiations with most of its trading partners– except for tariffs on the world’s second-largest economy, China.2 On the contrary, over the course of April, the US and China kept raising duties on each other’s imports.

While global trade policy was shifting radically, geopolitical tensions in other areas of the world continued: the Russia-Ukraine war, the conflict in the Middle East, including ongoing attacks from the Houthis in the Red Sea and the Gulf of Aden, and political uncertainty surrounding Taiwan, are all still looming.

Since these geopolitical tensions are impacting business decisions, what does this mean for corporate treasurers? That’s the overarching question for this year’s big debate, featuring insights from three Deutsche Bank Corporate Bank clients.

Desirée: Let’s start with the big picture. Cornelia, SUSS is a leading manufacturer of equipment and process solutions for the semiconductor industry. Your company is headquartered near Munich in Germany but generates more than 85% of its global revenues from Asia-Pacific. As US-China tensions over semiconductor chips continue, how is SUSS impacted? And what’s the knock-on effect for the semiconductor industry?

Cornelia: Alongside Taiwan and South Korea, Mainland China is a very important market for us and one that we want to continue to supply. We are monitoring the situation closely, as, on the one hand, the US regulations in force could affect us as a German manufacturer. On the other hand, the EU and Germany regulate high-tech exports to China as well. Compared with front-end lithography players, however, we are not pushing the physical boundaries of semiconductor equipment technology as much. This is why the focus of regulation is mostly targeted at leading-edge technology companies.

Desirée: SUSS is currently expanding production capacities in Taiwan, investing to open a new facility locally. Why did you decide on that geography, and what role did geopolitical uncertainties in the region play when making the investment decision?

Cornelia: SUSS has been running operations in Taiwan for many years – and we are very successful there. In 2024, we even needed to significantly expand our local production capacity at short notice to be able to serve the rising AI-driven demand from our clients and to prepare for future growth. Now, we are in the process of merging our various locations in the country into one bigger location to boost efficiency.

“From our point of view, the opportunities still outweigh the risks. Taiwan is the most important advanced chip manufacturer, with around 60% of global supply”

From our point of view, the opportunities still outweigh the risks. Taiwan is the most important advanced chip manufacturer, with around 60% of global supply produced in the country. And, even more importantly, 90% of high-end chip production globally takes place there. This fact cannot be changed overnight, and investing locally allows us to localise our supply chain.

Finally, we find highly motivated and skilled workers in Taiwan who want to work for us. We have not only established ourselves as an important supplier to the leading domestic semiconductor manufacturers, but SUSS is also a key employer, extending our workforce from 55 employees in 2020 to 400 in 2025.

Desirée: Ameet, DP World is a Dubai-owned ports and logistics company which manages ports and operates warehouses and logistics parks globally. In the light of increasing geopolitical uncertainty, research conducted by your company shows that many firms are engaging in ‘nearshoring’ and ‘friendshoring’,3 i.e. sourcing and/or producing locally or in countries that are regarded as allies. Some are also creating parallel supply chains to mitigate geopolitical risk. What does this mean for your business model?

Ameet: First, we don’t believe that globalisation is disappearing any time soon – it’s evolving. Companies are diversifying their supply chains, but this takes time. Manufacturing cannot be moved easily due to economies of scale and other factors, as Cornelia explained.

Overall, I think, nearshoring and friendshoring provide opportunities for us at DP World. We see ourselves as a trade enabler, which means that our investments follow the key trade corridors. We have operations in 79 countries, and nearly 75% of our port capacity is based in emerging markets.

For instance, following the introduction of tariffs under the first Trump administration, we saw US direct imports from China declining. But at the same time, indirect imports into the US from China went up. This shows that companies have managed to reroute their supply chains. Today, intra-Asia trade has overtaken Asia-Europe and Asia-US as the most important trade corridor – which is why Asia is now a huge focus for us.

Desirée: How flexible are you in terms of following your clients? In other words, how quickly can you adjust investment decisions if necessary?

Ameet: Ports will take at least two to three years to build, while logistics parks and warehouses can be developed and adapted much more quickly. But look, as moving manufacturing takes time, we can wait and see how the current tariff situation evolves. Our investment planning considers long-term trade flows, but we retain the flexibility to pivot if structural shifts accelerate. In the meantime, we’re closely tracking customer expansion plans and macro developments, so if necessary, we’ll have enough time to realign our investments – adjusting to our clients’ setup and following the direction of emerging trade corridors.

“Our investment planning considers long-term trade flows, but we retain the flexibility to pivot if structural shifts accelerate”

Desirée: Magnus, TE Connectivity is an Irish technology company that designs and manufactures connectors and electronic components for various industries. How is your company impacted by the current tariff discussions?

Magnus: Given current market conditions, I cannot comment on this question.

Desirée: Christof, having heard from SUSS, DP World and TE Connectivity, to what extent are these typical of Corporate Bank clients? And how do geopolitical risks shape client discussions generally?

Christof: We serve clients globally from all kinds of industries and regions, and clearly, the exposure to geopolitical risks varies with these factors. However, in general one can say that geopolitics are at the forefront of many client discussions. This is not completely new, but the nature of geopolitical risks has changed significantly in recent years – and with it the priorities for treasurers. It began with the Covid pandemic, a global health crisis with geopolitical implications. The Russia-Ukraine war has dramatic consequences for people and businesses in the region. Many treasurers are feeling the consequences of sanctions on financial flows directly. Now the rules of global trade are being rewritten and it seems as if the macro landscape is changing every week – with potential consequences for supply chains. There is just so much uncertainty that many clients tend to wait and see how to react.

Desirée: Let’s look at this in a bit more detail. What are the most pressing concerns for corporate treasurers when it comes to dealing with geopolitical risks?

Gourang: It’s the level of uncertainty. The United States is the largest economy in the world and the phrase ‘When the US sneezes, the rest of the world catches a cold’ has often been quoted. In some senses, this is what is happening now. Businesses usually like certainty before they invest, so until there is more clarity about global trade policy, it will take some time for business spending to recover.

In this environment, typically what happens is that corporate treasurers become more risk-averse. It’s like driving in the rain; your visibility goes down. In treasury, if you don’t know how your business cashflows will be impacted, you usually tend to increase cash buffers and consolidate liquidity into your home or functional currency as much as possible. These are some of the actions that a treasurer might take now until there is more clarity on how things will unfold. Risk management is important right now.

Christof: Absolutely, and this is why a modern, state-of-the-art treasury function is so important. You need to ask yourself: are you able to access your global liquidity and bank accounts centrally? Do you have an in-house banking structure in place? Do you get information such as account balances in real-time, or only T+1 or T+2? Have you automated your processes to free up time for strategic decisions? All this is critical in a crisis. Corporate treasury has to take decisions that reflect the strategic decisions made by the management board. If, for example, a company adjusts its supply chains, treasury needs to be able to react quickly and support the business in terms of providing the necessary liquidity, funding and FX hedging. The more automated and centralised your treasury department is, the more reactive and adaptable you are in a crisis.

“The more automated and centralised your treasury department is, the more adaptable you are in a crisis”

Cornelia: I fully agree. What’s difficult at the moment is that you don’t know what will happen tomorrow. But you need clarity, visibility and transparency to make informed decisions.

Desirée: In order to get this transparency, SUSS is currently revamping its treasury setup, introducing a new global cash pooling structure. Could you share some insights on why you are doing this?

Cornelia: At the end of 2024, we started to redesign our treasury structure to increase transparency, efficiency and control over our global liquidity. Currently we are introducing a new treasury management system (TMS) which allows us to access all relevant treasury data in one place and manage processes centrally. This project is independent of the current situation, but of course, improved control and visibility are helpful in times of uncertainty. Finally, we intend to have a global cash pool to reduce costs.

Desirée: What’s the situation like at TE Connectivity?

Magnus: Over the past few years, we have managed to implement an extremely centralised structure. We have a global cash pool where zero balancing pools are feeding a notional pool consolidating cash in over 27 different currencies. Also China is part of the cash pool: the RMB is swept into Singapore, Singapore sweeps US dollar equivalent to Europe, and Europe then sweeps on to the US. We feel very comfortable with this structure.

Desirée: How far has DP World come in terms of centralising and automating its treasury function?

Ameet: As you mentioned earlier, we are currently growing our freight forwarding business. This business has very different working capital needs to the port business, where you encounter large upfront investments but working capital is light. With logistics and freight forwarding, it’s the other way around – operationally intensive, with tighter liquidity cycles – which is why it requires a different treasury approach. That shift has meant rewiring parts of our treasury setup: we’re currently migrating to a new treasury management system, and integrating recent acquisitions into a common enterprise resource planning (ERP) and billing framework to give us better visibility and enable more real-time liquidity decisions across the group.

We’re also developing an intercompany settlement platform to centrally net payments, manage FX at group level, and settle positions periodically – helping us reduce transaction costs and improve FX and liquidity risk management. Moreover, we have also grown by acquisitions in the past.

Desirée: … which usually goes hand in hand with a lot of integration work for the treasury department to ensure an efficient setup.

Ameet: Indeed. We are currently integrating these entities onto a common ERP and billing system, and we are moving from our current TMS provider to a new one to support greater scale and control. So, we are deep into this journey, and while there is still some way to go before we reach the level of sophistication we’re aiming for, we are getting there. For example, we are setting up a central intercompany settlement platform for our freight forwarding business. The goal is to have treasury net all intercompany payments, execute FX centrally, and settle the net positions on a periodic basis – reducing transaction volumes, improving FX efficiency, and strengthening liquidity management. As our business diversifies, this level of integration is critical for agility and resilience.

Desirée: Christof, from what you have heard so far and from your talks with other companies, what are the key priorities for corporate treasurers in a volatile geopolitical environment?

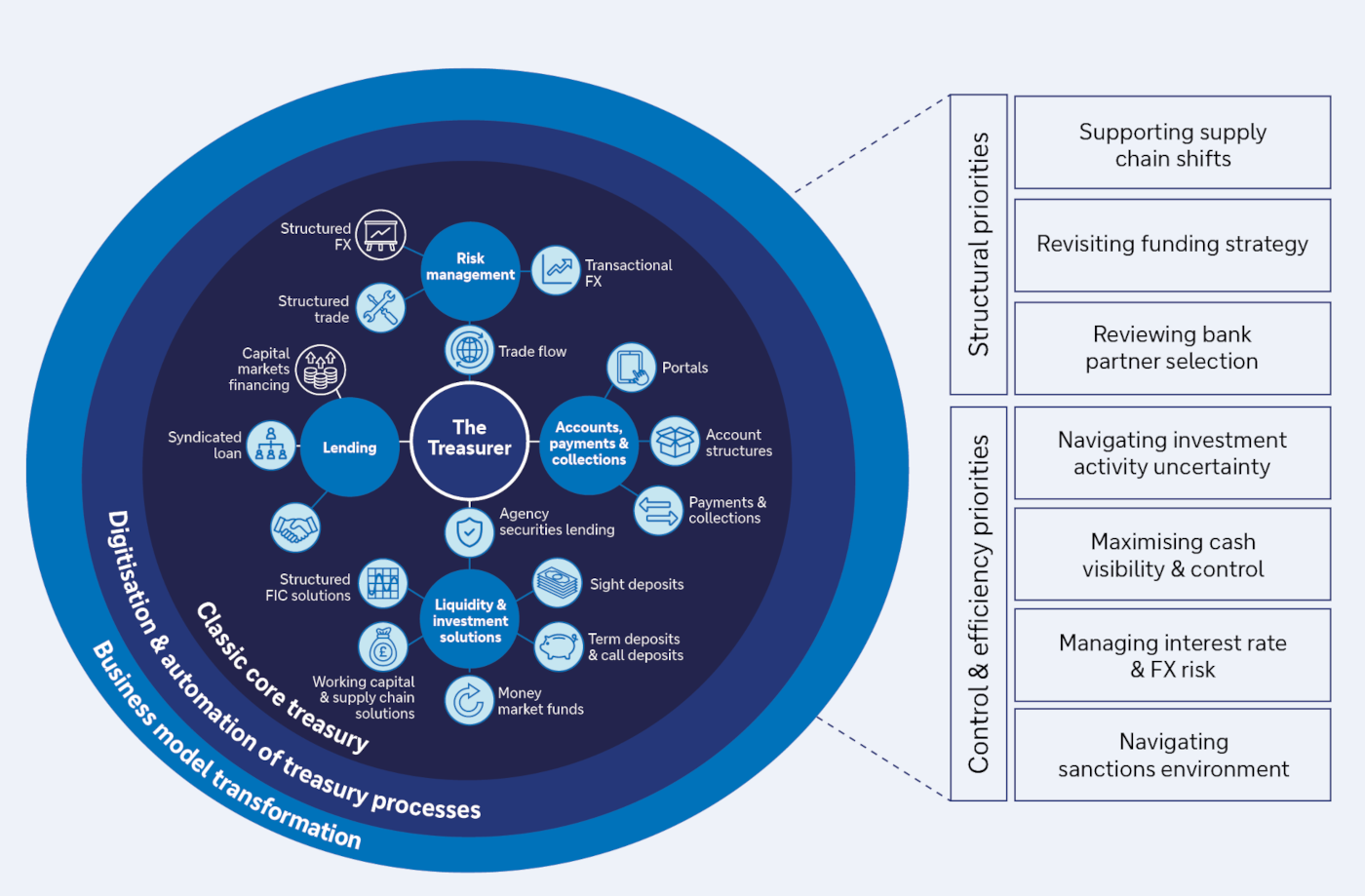

Christof: I would structure the priorities in two parts: first, responding to structural topics and second, reviewing the daily business in terms of control and efficiency. (See Figure 1.)

Structural topics include:

- Supporting supply chain shifts. De-risking supply chains has been an ongoing topic since the outbreak of the Covid pandemic, and in the light of tariff discussions, these trends could now be intensified.

- Revisiting the funding strategy. In an ideal world, treasurers usually prefer intercompany loans to finance local subsidiaries, as this is most cost-efficient. But in the light of geopolitical risks, it may make sense in some cases to fund your entities locally to allow for some independence and flexibility.

- Reviewing bank partner selection. Clients ask how committed banks are to a certain country and region. They may not want to put all their eggs in one basket, in case a bank pulls out of a certain market due to geopolitical tensions.

Control and efficiency focus on:

- Navigating investment activity uncertainty. We see that several companies are putting investment plans on hold. Treasurers need to assess the resulting change and uncertainty in their long-term liquidity forecasts.

- Maximising cash visibility and control. We have touched on this already, but I feel it’s important to say it again: without visibility over your global liquidity, effective and timely concentration of cash and sufficient automation, it will be difficult to react to crisis situations or black swan events. Real-time treasury, i.e. getting the relevant information at the relevant point in time, will help to further improve decision-making.

- Managing interest rate and FX risk. In the light of increased FX volatility and an uncertain outlook for FX markets and the development of interest rates, corporates need to ask themselves whether they need to start hedging positions that were previously considered within their risk appetite. Moreover, structural supply chain shifts may leave established natural hedges ineffective.

- Navigating a sanctions environment. This topic is particularly pressing in the Russia-Ukraine context. Yet, in general, sanctions risks are constantly increasing and need to be managed for goods as well as for financial flows.

Figure 1: The role of the treasurer – Key priorities in a volatile geopolitical and market environment

Desirée: Let’s look in more detail at liquidity risk and the question of whether the cash buffer should be increased. Magnus, what’s TE Connectivity’s view on this?

Magnus: Our cash buffer is currently lower than usual – but that’s due to the fact that we just acquired Richards Manufacturing, a US-based company serving the energy distribution industry. Usually, we run the company with a €500m cash buffer. In light of market uncertainty, there are discussions on whether to increase this buffer. But so far, nothing has changed.

There are two factors you need to know about TE. First, we are fortunate enough to have an investment-grade rating, which means that we can go to the commercial paper market if we need liquidity. Second, our business is very cash-generating, as our customers are generally very good at paying us on time. This is why, so far, we feel comfortable with our cash management as it is. But we continue to monitor developments closely to ensure we can react quickly if something unusual pops up.

Cornelia: Our cash buffer currently stands at €130m and for the time being we are keeping it at this level in order to be able to act flexibly in these more volatile times.

Ameet: The same holds true for DP World; we have not significantly changed our cash buffer. We are a global company and have a structure of revolving credit facilities in place with our bank partners. We feel comfortable with this setup.

Christof: Our investment team basically echoes what you have just said. The situation is very different now to that, for example, during Covid, when every company soaked up liquidity and prepared for the crisis ahead. This time – and I should add that this observation is not evidence-based, but an impression from the market – it feels a bit like business as usual. Obviously, everybody who follows the news knows that’s not the case. But there may simply be too much short-term uncertainty to take decisions with a longer-term impact.

Desirée: Let’s look at hedging: could you elaborate on your FX risk management? Has this changed in light of the geopolitical tensions (e.g. by adding new tools or redefining risk appetite)?

Magnus: We try to be where our customers are. So if we have a customer in Germany, we produce in Germany, which means we have ‘euro in and euro out’. For intercompany payments, we use intercompany netting – cashless in many cases – wherever possible. So, regardless of what currency our entities have as functional currency, that would be hedged internally – either through a net investment hedge or by offsetting against the exposure of other entities – Christof mentioned natural hedging earlier.

In general, we manage our FX exposure on a daily basis, hedging our cashflow and balance sheet risk with a time horizon of maximum 30 days. This is because we are not hedging based on a speculation, we hedge on facts – and for 30 days we have a pretty good view of in- and outflows. Only for commodities, we take a layered hedging approach for 18 months, adjusted on a monthly basis. It’s not about foreseeing market behaviours, but rather to smooth out the highs and lows.

“We are not hedging based on a speculation, we hedge on facts”

One issue we monitor, i.e. in mid-April, is that the US dollar has dropped like a stone. But we are managing this risk as part of the usual hedging routine. One place where we are really seeing a change in terms of currency is in China.

Desirée: What’s the trend you are seeing there?

Magnus: Over the past months, we have seen an increase in US dollar exposure by our Chinese customers and suppliers – which is odd, because in the current environment you would expect Chinese companies to opt for the renminbi more and more. We have not looked into this trend in great detail yet, given that the RMB is a rather small exposure for us. But if this keeps increasing, we might do a deep dive to explore why this is happening.

Desirée: Ameet, FX risks will play an increasingly important role for DP World, as you are ramping up your freight forwarding business with local currency billing. Could you elaborate on how this is impacting treasury?

Ameet: Logistics tends to be a dollar-based industry, which is why we prefer to hedge our FX exposure to the US dollar – to the extent that is allowed by local regulation. Seventy-five percent of our activities are based in emerging markets, and currency control sometimes don’t allow us to repatriate cash or use hedging. In the countries of the Gulf Cooperation Council, which is an important region for us, we benefit from the fact that most of the currencies are pegged to the US dollar, so this geography does not worry us as much. But in the other destinations – in particular in Asia – we hedge FX exposure to the extent that is possible.

Desirée: SUSS hardly uses local currencies in APAC; your business is largely conducted in euros, with your clients carrying the FX risk. So how do you look at FX volatility in terms of potential impact on the business?

Cornelia: As you rightly said, our main business is in euro, but of course there are some currency risks. Even if the US dollar business is not that big, it has an impact on us. In my view, however, the use of hedging instruments for forward transactions is difficult in the current volatile times, as you have to be able to predict future inflows and outflows in different currencies with a sufficiently high degree of certainty in order to get hedge effectiveness. This predictability is currently limited, as a change in the customs situation can also have an impact on the delivery dates for our tools, and therefore on cash flows.

Desirée: A key focus area for CFOs and treasurers is the structure and resilience of the cross-border funding strategy of subsidiaries. How can this be impacted by heightened geopolitical risks?

Gourang: It’s still in its very early stages, but I am seeing four developments regarding cross-border funding in China.

- We see certain US companies in China building relationships with non-US banks to prepare for a situation where US banks may reduce their activities in the country.

- Certain clients are now looking into local borrowing for their Chinese subsidiaries, to isolate the risk and to benefit from low interest rates in China.

- Certain Chinese companies have started converting their business flows from US dollars to RMB, which links back to what I said earlier: in a crisis situation, companies tend to convert to their home currencies.

- In terms of investment, some companies are now going into shorter tenors.

As I said before, this is only true for a few clients so far, but if uncertainty continues for a longer period, these developments could become trends.

Christof: I think this sums it up quite well: we are at a time of uncertainty where the situation can change week by week. So, the key priority for many corporates is to be able to react and prepare for different scenarios. Some treasury departments are better equipped for dealing with geopolitical risks than others due to the centralisation and automation work they have done in the past. Therefore, this situation is yet another wake-up call to get your systems and processes in order. In any case, we will help our clients to get through this period of uncertainty.

Image credit: © z_wei/iStock