10 March 2025

Digital transformation and infrastructure investment are top priorities in the Middle East as the region diversifies away from oil and gas. How does this impact the corporate treasury teams of companies operating in the region? flow’s Desirée Buchholz reports and shares two client examples from the Asia-Middle East corridor

MINUTES min read

On 10 February NEOM, the futuristic USS$2trn sustainable megacity taking shape in northwest Saudi Arabia, and DataVolt, a Saudi-based developer of data centres, announced a partnership to create the country’s first net-zero artificial intelligence (AI) data centre in NEOM’s floating port city of Oxagon. In a first phase, they plan to invest US$5bn to establish a 1.5 Gigawatt (GW) factory integrating “a wide range of computing densities and energy efficient architectures”. The end goal is that the facility will be powered solely by renewable energy.1

The initiative comes after the International Energy Agency’s (IEA) analysis that data centres’ power consumption is set to “grow strongly until 2030” with advancements of generative AI. Currently, data centres consume about 1% of global electricity demand.2 Hence, there is a widespread demand across the digital industry for more sustainable power generation strategies.

The cooperation reflects the two key trends that will shape economic growth in Saudi Arabia and other countries of the Gulf Cooperation Council (GCC): (Green) infrastructure investment and digital transformation. As described in the May 2024 flow article After the oil in the Middle East since 2016 the GCC countries have launched ambitious reform agendas to reduce reliance on oil revenues, drive private sector investments and become an economic hub connecting Asia and Europe. The earlier piece examined what this means for trade flows and how capital market reforms are contributing to investment inflows.

Following on, this article focuses on the Middle East through the lens of the corporate treasurer: How can they support their company in developing the full potential of new business opportunities the region offers? And what’s Deutsche Bank’s role in this?

Trend 1: Massive infrastructure investment increases demand for trade finance

Driven by the region's strategic location at the crossroads of East and West, the GCC has ambitions to become a major logistics hub to facilitate the flow of goods and services. The UAE's Dubai Logistics City Is one example; a US$30bn project that will become one of the world's largest logistics hubs, while Saudi Arabia's King Abdullah Economic City is set to become a major trade gateway.

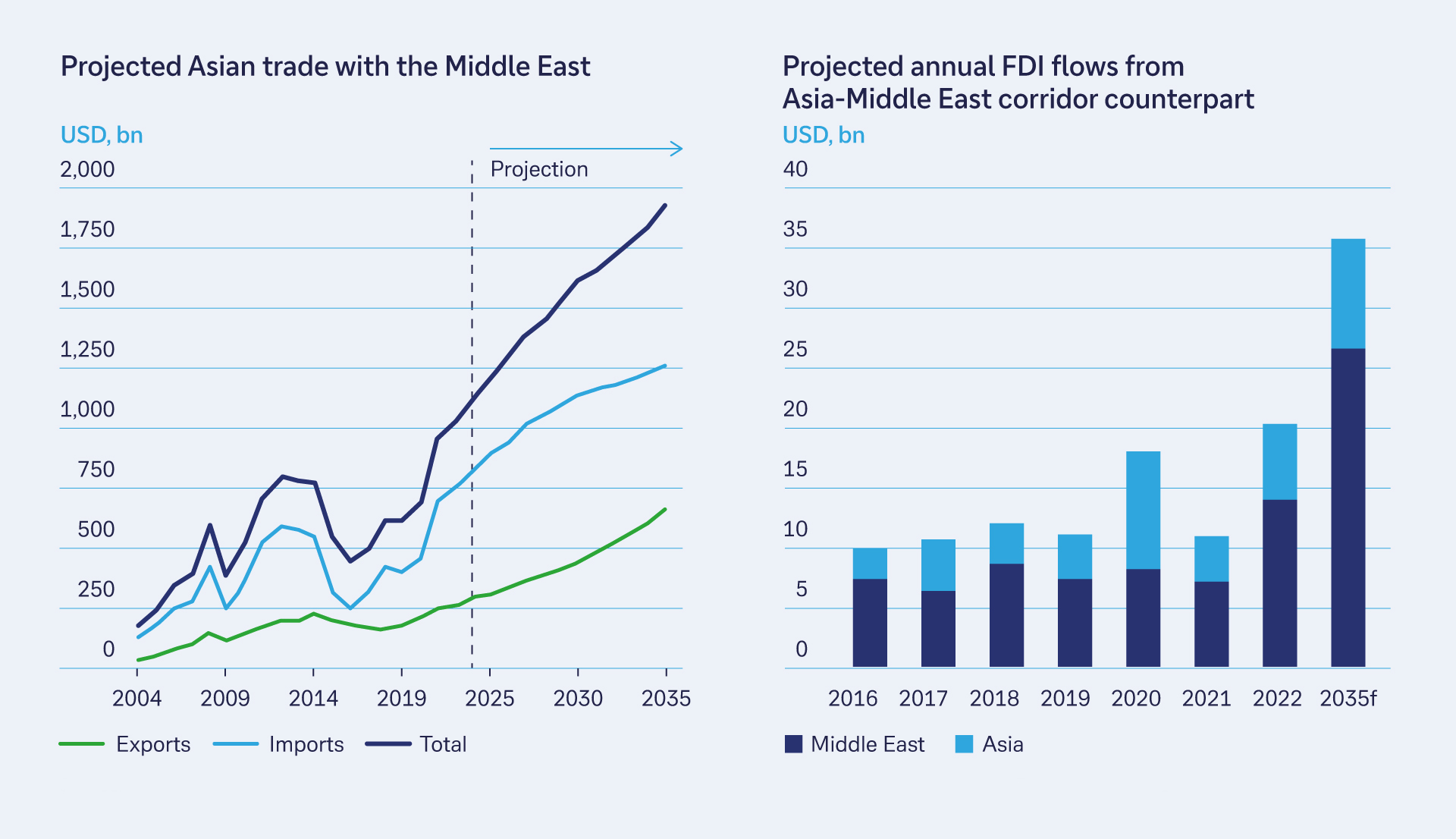

Already, trade and investment flows between Asia and the Middle East have surged. According to HSBC Global Research, cumulative foreign direct investment (FDI) flows between Asia and the Middle East are expected to total more than US$270bn over the next 10 years, which would almost double the previous decade’s level (US$140bn). While the India-MEA corridor is driven particularly by the digital economy, the China-MEA corridor benefits from infrastructure investment as defined under China’s Belt and Road Initiative (BRI).

Figure 1: Middle East-Asia trade corridor is projected to grow

Sources: IMF, HSBC, CEIC, ASEAN Stats Data Portal

Among the corporates investing in the Middle East is the Chinese construction company CSCEC. Its local subsidiary CSCEC ME LLC – set up in 2006 – runs operations in Saudi Arabia, the UAE, Kuwait, Qatar, and Oman. Over the years, it has developed large-scale projects across the region in housing, transportation and infrastructure.

In January 2025, Deutsche Bank structured a US$150m revolving credit facility which enables the company to bid for new contracts and ensure smooth project execution. Deutsche Bank also provided sight and usance letters of credit (LCs) to CSCEC ME, which support the company’s procurement activities and working capital needs, ensuring timely delivery of materials for ongoing and future projects.

“We are happy to start the collaboration with Deutsche Bank in our most strategic region”, confirms a CSCEC spokesperson. “Leveraging on the bank’s global network and professionalism we see seamless communication across products and teams in China and the Middle East. Deutsche Bank is an important partner for us to achieve our ambitious business target via innovative solutions.”

Zorawar Singh, Head of Corporate Bank Middle East, adds: “This deal is more than just a financial transaction, it reflects Deutsche Bank’s strategic focus on the China-Middle East corridor. By supporting a major industry leader such as CSCEC ME, we continue to play a vital role in the region’s economic growth while strengthening our global footprint.”

L&T India and Deutsche Bank cooperate in the GCC

Another focus of the GCC’s infrastructure investments is an aim to increase the share of renewable energy in the region. The UAE for example plans to invest US$54bn in energy and renewable sources until 2030, including green hydrogen, solar, nuclear power and carbon capture technology.3 This creates opportunities for companies such as India’s multinational Larsen & Toubro (L&T).

Established in 1938, Mumbai-based L&T initially focused on engineering and construction services but rapidly expanded its operations and expertise. Today, the company is India’s largest engineering conglomerate with group revenues of US$27bn and a key presence across infrastructure, energy, high-tech manufacturing, IT & technology, finance and defence.4

“We value the strategic dialogue with Deutsche Bank and their increasing commitment in the region”

Accounting for 37% of its order book as of end of December 2024, the Middle East is a key region for the Indian company. L&T has already executed several marquee projects in the GCC region, including football stadium construction for the FIFA World Cup 2022 in Qatar5 and Saudi Arabia’s King Abdulaziz International Airport expansion.

The Middle East offers further significant business opportunity for L&T, which is committed to achieve water neutrality by 2035 and carbon neutrality by 2040.6 In December 2023, the company was chosen as engineering, procurement and construction contractor to establish various systems involving renewable power generation and water utilities for Saudi Arabia’s Amaala project – a luxury tourism destination along the country’s northwestern coast.7 Deutsche Bank acted as the main bank and credit provider to the project via a €300m trade finance facility, showcasing the bank’s strategic commitment to support investments in the APAC to MEA corridor.

“We are pleased to expand the cooperation with Deutsche Bank in the Middle East as we are contributing to the build-up of sustainable energy infrastructure in the region”, says Ramaswamy Govindan, Senior Vice President Finance & Chief Risk Officer at Larsen & Toubro Ltd. “We value the strategic dialogue with Deutsche Bank and their increasing commitment in the region.”

Trend 2: Growing outbound investment by GCC companies

Growing inbound investment accompanies more outbound investment. As the region diversifies away from hydrocarbons, several GCC companies ramped up their activities around the globe: In October 2024, Abu Dhabi’s state-owned oil firm ADNOC announced plans to acquire German chemicals firm Covestro to diversify its portfolio.8 Saudi Aramco has recently bought a 10% equity stake in UK-based Horse Powertrain Limited to “develop new mobility solutions with the potential to reduce transport emissions”9 as well as assets in Poland10 and Chile11 to expand Aramco global downstream and retail business. And in September 2024, Dubai-based logistics firm DP World announced a US$3bn investment in India’s port infrastructure.12

“The expansion of their business is resulting in treasurers having to think beyond managing cash locally,” explains Sameer J. Shah, Head of Cash Management Sales for MEA & Africa at Deutsche Bank. “As their treasury operations grow internationally, they need the help of global banks who can support them in not just managing their cash more efficiently but also to hedge FX and interest rate risk as well as manage their working capital across the globe.”

Trend 3: Significant business opportunities for the digital economy

As the region diversifies away from oil and gas, it is also undergoing a rapid digital transformation. Under its reform agenda Vision 2030, over the nine years since the launch Saudi Arabia has started to digitalise its industries by enhancing cloud infrastructure, leveraging 5G technology and fostering AI adoption. This year, the country wants 19.2% of its GDP to come from the digital economy.13 To put this into perspective: In recent years, oil still accounted for approximately 40% of Saudi GDP and 75% of its fiscal revenue, with substantial fluctuations reflecting oil price movements each year.

The United Arab Emirates (UAE’s) Digital Economy Strategy, unveiled nearly three years ago, includes measures to support the growth of the digital economy from the current 12% of non-oil GDP to 20% by 2030. A PwC study estimates that AI alone will contribute US$96bn to the UAE economy by 203014 and account for 13.6% of GDP.15

This digital transformation creates new business opportunities for global companies operating in AI infrastructure and data centre businesses: In the UAE, Saudi Arabia, Bahrain, Oman, Kuwait, and Qatar data centre investments is projected to reach US$7.22bn by 2029, growing at a CAGR of 10.4%.16 This is driven by the presence of companies such as AWS, Oracle, and Google Cloud and also benefits IT infrastructure providers such as Cisco, IBM, or Huawei Technologies as well as companies such as ABB and Siemens that supply cooling systems.17

Trend 4: Stablecoins are becoming more popular in the GCC

The growing importance of fintech hubs like Dubai and Riyadh is driven by tech-friendly policies around digital assets, such as stablecoins and Central Bank Digital Currencies (CBDCs). “Dubai’s Virtual Asset Regulatory Authority (VARA)18 and the Abu Dhabi Global Markets (ADGM)19 have both introduced robust regulatory frameworks for digital assets to foster new business models in the region”, explains Premdeep Shah, who is responsible for Deutsche Bank’s fintech and platforms coverage in the Middle East.

“Robust regulatory frameworks for digital assets have attracted several companies operating in the virtual asset space to GCC countries”

This has attracted several companies operating in the virtual asset space. “Many global crypto exchanges, broker dealers, digital asset custodians, tokenisation companies, neo-brokers and traditional investment platforms now offering decentralised finance (DeFi) products have started serving residents of GCC countries, which has led to this region representing some of the largest trading volumes for many of these companies,” continues Shah.

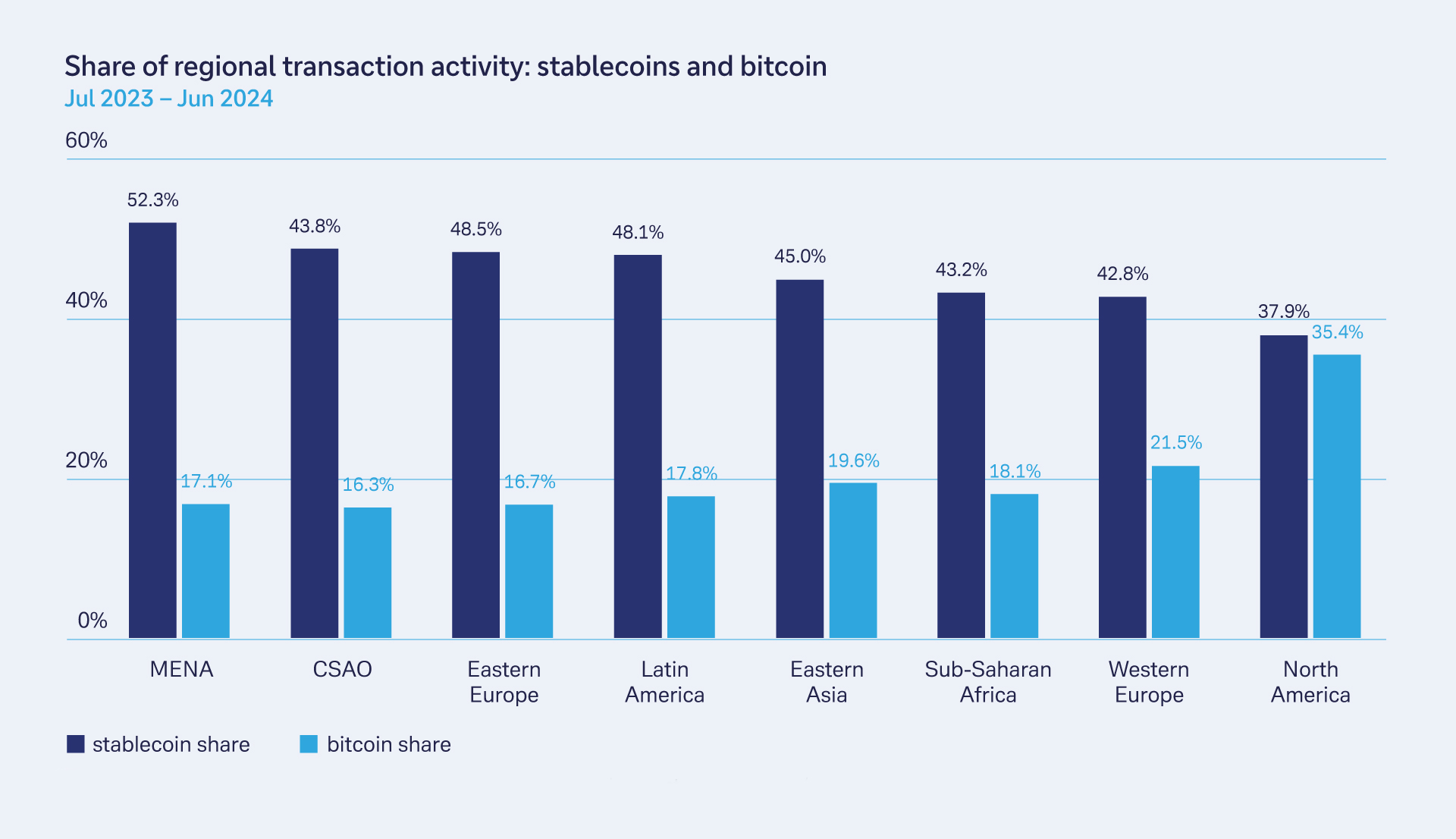

According to the blockchain data platform, Chainalysis “the UAE received over US$30bn in crypto, ranking the country among the top 40 globally in this regard”.20 Stablecoins in particular have gained traction (see Figure 1): In December 2024, the country introduced its first-ever UAE dirham (AED)-backed stablecoin – AE Coin, launched by AED Stablecoin LLC, following approval from the UAE Central Bank ("CBUAE") under the Payment Token Services Regulation.21

Figure 2: Middle East and Africa (MENA) leads in terms of stablecoin transaction activity

Source: Chainanalysis: https://www.chainalysis.com/blog/stablecoins-most-popular-asset/

“This is leading to innovation in cross-border transfer solutions, with many companies looking at remittances and treasury payments using stablecoins and creating bilateral stablecoin settlement networks like AED to Philippine peso (PHP) or AED to Hong Kong Dollar (HKD)”, says Shah. In January 2025, DP World announced it would develop its own stablecoin to “simplify and accelerate international transactions” in emerging markets such as Asia and Africa, where businesses often “grapple with prolonged settlement times, restricted access to finance, and a lack of transparency”.22

Emirates, one of the world’s largest airlines, had already announced in May 2022, it would accept Bitcoin as a payment method and add non-fungible tokens (NFT) collectibles on the company’s websites for trading.23 “These initiatives also mean that there will be increasing demand for bank rails and FX services especially for on ramp/off ramp kind of services as more and more stablecoins uses cases emerge for real world transactions,” adds Shah.

As the region diversifies away from hydrocarbons and creates a tech-friendly environment, several companies are set to benefit. For corporate treasurers seeking to support business growth, a robust and efficient treasury set-up is therefore key in the GCC.

Sources

1 See neom.com

2 See iea.org

3 See fersoesg.com

4 See larsentoubro.com

5 See larsentoubro.com

6 See larsentoubro.com

7 See larsentoubro.com

8 See covestro.com

9 See aramco.com

10 See euro-petrole.com

11 See aramco.com

12 See meobserver.org

13 See vision2030.gov.sa

14 See trade.gov

15 See pwc.com

16 See tradingeconomics.com

17 See prnewswire.com

18 See vara.ae

19 See adgm.com

20 See chainalysis.com

21 See mondaq.com

22 See dpworld.com

23 See arabnews.com