15 January 2025

In the second of two articles, flow’s Clarissa Dann explains how renewable energy projects in India are financed, the role of non-bank financial institutions, concluding with a profile of REC Limited and how Deutsche Bank has supported this NBFI with lending

MINUTES min read

In ‘REC: supporting India’s renewable energy structure (1) (Part 1)’, we provided a background to India’s renewable energy journey, and how its solar and wind sectors are leading the renewables ramp up. In this second part, the role of REC Limited as a key financing enabler is explained, together with Deutsche Bank’s role in lending support.

“In terms of financing, infrastructure development in India is largely driven by grants from central and state government or dependence on borrowing from domestic and international markets including multilateral development banks (MDBs), which have limited financing capacity or investment preference. However, to sustain the infrastructure growth momentum, government has been encouraging adoption of innovative financing mechanisms such as public-private partnerships and other structured financing instruments,” explains KPMG’s Vivek Agarwal in a July 2024 article, ‘Transforming India’s infrastructure’.1

As explained in Part 1, the funding sequence comprises:

- Initial capital formation

- Construction phase financing; and

- Post-construction financing.

Key participants in the renewable/energy transition space

In summary, the financing mix will include the following groups:

Government entities. The main ones are:

- Ministry of New and Renewable Energy (MNRE). This formulates policies, offers subsidies, and provides tax incentives.

- Indian Renewable Energy Development Agency (IREDA). A government-backed financial institution specialising in renewable energy project financing.

- State Renewable Energy Development Agencies (SREDAs). They facilitate project execution and manage state-specific subsidies and incentives.

Banks and financial institutions:

- Public sector banks (PSBs). They lead the debt financing of large-scale projects requiring really long-term financing (more than 15 years).

- Private banks that participate in syndicated loans and green bond investments (for, example Deutsche Bank).

- Non-banking financial institutions (NBFIs) – they provide term loans, project financing and bridge financing (for example, REC Limited).

- Development finance institutions (DFIs) such as the World Bank, Asian Development Bank (ADB), and KfW, which provide concessional loans and technical assistance.

Developers and equity investors:

- Project developers include companies such as Tata Power Renewables, Adani Green Energy, and ReNew Power, which undertake the construction and operation of renewable energy assets.

- Private equity (PE) funds. These invest in projects at various stages of development, seeking long-term returns.

- Institutional investors, such as pension funds and insurance companies that invest in renewable energy bonds and infrastructure funds.

Multilateral and bilateral agencies. These include organisations such as the International Finance Corporation (IFC) and Green Climate Fund (GCF), which contribute by providing concessional finance and grants.

Capital markets where green bonds issued by companies and financial institutions fund renewable energy projects. In addition, renewable energy companies bundle operational assets into YieldCos to raise equity in public markets.

Role of NBFIs

The financing market for India’s infrastructure projects is dominated by government-owned public sector NBFIs. Banks not only lend directly to the power producers, but also lend to NBFIs.

“[NBFIs] play an instrumental role in ensuring India meets its ambitious renewable energy targets”

The NBFI sector has grown substantially over the past decade, supported by policy reforms, digital transformation, and growing credit demand. They operate across a range of segments, including asset financing (eg vehicles), microfinance for rural businesses, housing finance, and infrastructure finance where they lend on long-term infrastructure projects. It is here they have gained prominence and play a pivotal role in bridging the funding gap for large-scale renewable energy projects, mitigating risks such as long-gestation periods, high upfront costs, and policy risks.

The main players to finance India’s renewable energy sector are:

- REC Limited (REC). The focus of this case study and a key financier for the entire value chain in the power sector i.e. conventional generation, transmission and distribution, and green energy projects.

- Power Finance Corporation Limited (PFC). A government backed NBFI, PFC specialises in power projects, including renewables.

- Indian Renewable Energy Development Agency (IREDA). A dedicated renewable energy financier offering concessional loans for solar, wind, and other green projects.

“By stepping up investments, offering financial structured products, fostering infrastructure development, and supporting innovation, these institutions play an instrumental role in ensuring India meets its ambitious renewable energy targets,” explains Shri Harsh Baweja, Director (Finance), REC Limited. He continues, “They have a larger appetite to fund renewable power projects, this is up to 30% of their Tier 1 capital to a single borrower and 50% of their Tier 1 capital to a single group of borrowers.”

REC Limited

Company background

REC is a prominent “Maharatna” (big or great jewel) public sector enterprise in India, primarily engaged in financing and promoting power sector projects across the country. It commands a market share of around 20% in power sector financing.

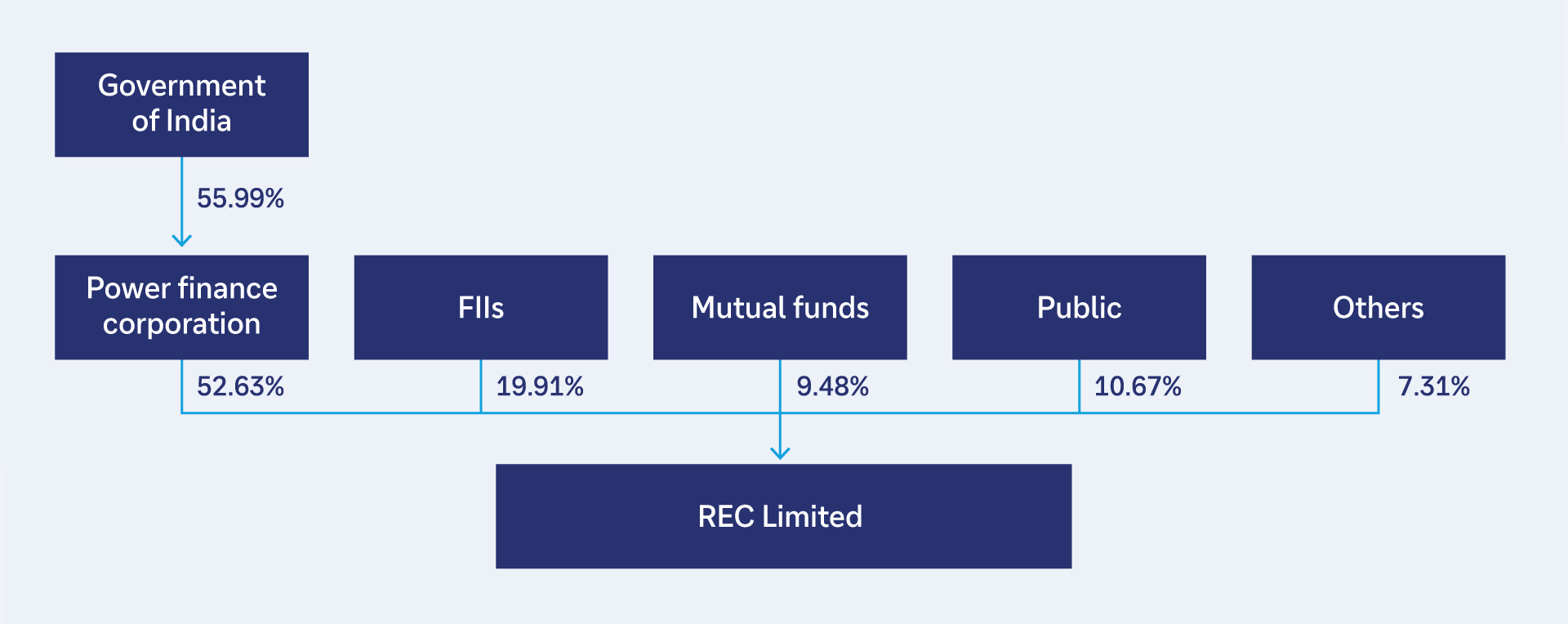

Figure 1: REC relationship with the Indian government

The company was established in 1969 under the Ministry of Power, Government of India. Initially, its primary objective was to finance and promote rural electrification projects. Over the years, REC has expanded its mandate to include financing power generation, transmission, and distribution projects, as well as renewable energy projects – with an aim to grow its renewable loan book portfolio of 9% to 30% by the end of 2030. In 2022–23, REC expanded the business portfolio with lending to the non-power infrastructure and logistics sector, including roads/highways, airports, metro rail networks, healthcare infrastructure and ports. In addition, REC has been appointed as the National Program Implementing Agency for the ‘PM Surya Ghar Muft Bijli Yojana’, which aims to install rooftop solar systems on 10 million residential households by March 2027, targeting a total renewable energy capacity of 30GW.

With a market capitalisation of €16.24bn (as of Dec 2024) and rated BBB- / Stable by Fitch and Baa3 / Stable by Moody’s, REC is a listed sovereign NBFI providing financial services to state, centre and private infrastructure companies for the creation of India’s infrastructure assets.

As an NBFI, REC provides financial assistance to state electricity boards, state governments, central and state power utilities, independent power producers, rural electric cooperatives, and private sector utilities. The company’s financial products include long-term loans, short-term loans, and debt refinancing.

Key functions and services include project financing – where REC provides loans for thermal, hydro, and renewable energy projects, including solar, wind and biomass. It also finances the development and enhancement of transmission and distribution networks to ensure efficient power delivery. Its loan book stood at €57bn in March 2024, with the portfolio consisting of conventional power generation, transmission, distributions projects and renewable energy. As of 31 March 2024, the asset portfolio is well diversified with no single borrower representing more than 10% of the portfolio. Foreign currency borrowings contribute 29% of the company’s overall borrowings, 99% of which are hedged until maturity. The company states, “It is expected that foreign currency borrowings shall continue to constitute 30% to 35% of incremental funding requirements of REC.”

Relationship with Deutsche Bank

According to REC, “The ever-changing regulatory environment coupled with global and international market factors requires all the financiers, including REC, to look for funding options beyond the domestic market – which not only gives higher liquidity and a diversified investor base, but also reduces reliance on domestic markets” – a key factor given RECs expanding funding requirements. This is where foreign banks such as Deutsche Bank see opportunities to provide support.

For example, in July 2024, Deutsche Bank’s GIFT City branch collaborated with REC Limited (REC) to provide a US$200m (in equivalent JPY) external commercial borrowing (ECB) loan facility aimed at financing eligible green projects in India and represents the first green loan of its kind provided to an Indian government entity by Deutsche Bank since establishment of a presence in The Gujarat International Finance Tec-City (GIFT City) in July 2022.2

GIFT City, launched 10 years ago and located in Gujarat, is India’s first operational smart city dedicated to financial and technological services, comprising a competitive regulatory environment specifically designed to facilitate offshore and cross-border financial activities. Deutsche Bank’s Gaurav Khurana, India Sales Head Trade Finance and Lending explains that here, Indian corporates can raise capital in foreign currencies at lower cost via facilitating ECBs and structured financing solutions by removing specific domestic restrictions (such as India’s Foreign Exchange Management Act (FEMA)), providing tax incentives and efficient infrastructure (such as advanced data centres and real-time financial market access). “For banks, GIFT City offers opportunities for growth by providing a competitive, tax-efficient, and technology-driven platform. With the potential to channel global investments, enhance cross-border trade and promote financial innovation, GIFT City in an important part of India’s emergence as a global financial centre,” says Khurana.

NBFIs regard foreign currency-denominated ECB loans as a diversified source of raising funds for further lending. Furthermore, ECBs via GIFT city are beneficial to banks since there are no liquidity and Large Exposures Framework (LEF) constraints and it has a favourable tax regime.3