30 September 2024

In April 2024, German automotive supplier Stabilus Group acquired US industrial automation specialist DESTACO to expand its industrial business. To close this transformational M&A deal, Stabilus had to set up a legal entity in India that fulfilled all financial requirements within six months, explains CFO Stefan Bauerreis. flow’s Desirée Buchholz reports on how the company achieved this goal

MINUTES min read

More than 4,000 miles separates India and Koblenz, Germany, where Stabilus Group has been headquartered since its foundation in 1934. In fact, it’s a 14-hour flight to Pune, where the company set up a new legal entity in April 2024, making India the 19th country in which the automotive and industrial automation supplier has established a local presence.

Yet, from the office of Stefan Bauerreis, Group CFO of Stabilus, India seems to be much closer – given the amount of time the manager has spent on setting up the company’s business in the country. “Establishing the local legal entity was one of the key requirements to close the acquisition of DESTACO within the timeline we announced to our shareholders in October 2023,” Bauerreis recalls in the interview with flow.

Stabilus had agreed with Dover Corporation, DESTACO’s former parent company, to take over DESTACO – an industrial automation expert serving customers in the consumer goods, packaging, aerospace, automotive, life sciences, and nuclear sectors – for a purchase price of US$680m. Closing was planned within the first half of 2024.1 DESTACO is based in Auburn Hills, Michigan, US and employs approximately 650 employees across 13 locations – out of which India and Thailand were the only two countries new to Stabilus’ global footprint.

Without a legal entity in India, the company had two options – to postpone the entire closing or agree on a two-step closing with India following at a later stage, Bauerreis explains – but both would have increased costs and been difficult to explain to the capital markets. “This is why we worked very hard together with our partners to meet the deadline. It wasn’t always easy, but, in the end, we managed to get it done,” says Bauerreis.

The tasks included opening a bank account and ensuring equity injection and intercompany lending for its new subsidiary in cooperation with Deutsche Bank and its legal adviser in less than six months. Before taking a deep dive into how Stabilus managed it, let’s take a step back and explore why the DESTACO transaction – which was successfully closed in April 2024 – is so important for the company.

Expanding into industrial automation via M&A

During the course of its 90-year history, gas springs and dampers have always been Stabilus’ most important product. Traditionally, they have been used by the automotive industry to ensure that doors, engine hoods and trunks open easily, and driver seat and steering columns can be adjusted smoothly.

Following its initial public offering (IPO) on the Frankfurt stock exchange in 2014,2 Stabilus began to significantly expand its industrial automation applications via a series of M&A deals.

- In 2016, the company purchased the industrial suppliers ACE, HAHN Gasfedern, Fabreeka and Tech Products from its Swedish competitor SKF Group.3

- This was followed in 2019 by the acquisition of General Aerospace, a supplier of motion control solutions for the aerospace industry, and CLEVERS and Piston, manufacturers of gas springs and dampers based in South America and Turkey, respectively.

- And in 2021, Stabilus partnered with Italy-based Cultraro to further expand the product range in the field of motion control4 – a partnership which was extended in 2023 as Stabilus increased its ownership stake to 60%.5

Driven by these transactions combined with organic growth, Stabilus almost tripled its turnover within a decade – from €460m in 20136 to €1.2bn in 2023.7 By 2030, the company aims to grow its sales to €2bn and to achieve a 50-50 revenue split between the automotive and industrial business units, explains CFO Bauerreis: “We want to become the leading global provider for intelligent motion control systems.”

“We knew … that the foundation of a legal entity India would become challenging in respect of timing”

Two megatrends will drive global demand for industry automation: “First, labour shortages and rising costs due to demographic change will limit production capacity and economic growth,” he predicts. “Second, the reshoring of industrial production to Europe and Americas in the light of geopolitical tensions as well as increasing ESG requirements to reduce global CO2 footprint with a focus on local present close to customers further increases the need for automation – in order to remain competitive.”

This is where DESTACO came into play. “Put simply, the DESTACO product moves the parts in production and the Stabilus product controls this motion,” Bauerreis explains. “This allows us to offer in future integrated technological competence to our industrial automation customers.”

Adding the “icing on the cake” of the transaction, as the CFO puts it, the regional footprints of US-based DESTACO – which is very strong in the Americas – and European-centred Stabilus complement each other. In Asia-Pacific, the combined company has now reached a critical mass, which allow “for a more intensive market development”.

Manoeuvring through bureaucracy in India

While Asia-Pacific is a key growth region for Stabilus, currently the supplier only generates 22% of its revenue in APAC, of which China takes the lion’s share. It’s also a challenging region when it comes to meeting local regulations.

“From experience, I knew that the foundation of a legal entity in India would become difficult,” admits Bauerreis. In his previous role as regional CFO for EMEA at the automotive supplier Schaeffler, he was for several years also responsible for India as well. “On the one hand, the country has made good progress with respect to digitising administrative processes. On the other hand, this also means that you don’t have a contact person who can answer your questions,” he reveals.

“Deutsche Bank has a very good footprint in India”

That makes it essential to have people on the ground who “you know and trust”. His own go-to was Satish Patel, named CEO of Stabilus India at the end of 2023 and who had also worked for Schaeffler before. Bauerreis also needed an experienced banking partner, which the company found in Deutsche Bank.

“First of all, Deutsche Bank has a very good footprint in India,” says Bauerreis, explaining why he chose to work with the bank, although it was not a partner of Stabilus prior to the DESTACO transaction. “Second, it was important for us to have a central go-to person in Germany who helped us to coordinate all regulatory and administrative processes. And finally, going forward, we wanted to concentrate all financial services in India under one roof – be it intercompany financing or the daily transactional business. Deutsche Bank is the only bank that can deliver this.”

Stefan Bauerreis (left) at the office inauguration in Pune with the local team

Equity Injection and ECB Loan in India

After having chosen the legal adviser and the banking partner the next steps were to incorporate the entity and thereafter to set up a bank account locally as soon as possible.

Yet, the road to getting a bank account was rocky. Apart from the usual Know Your Customer (KYC) procedures, several notarial certified documents were needed for the incorporation of a new entity. “It’s important to have a local general manager who can take care of all red-ink requirements. And you need a very clear and structured project plan for the account opening with your bank,” Bauerreis advises.

This was needed both to pay local staff and suppliers and to receive money from customers following the DESTACO take-over. Moreover, having a local bank account is also a pre-requisite for receiving a Goods and Services Tax Identification Number (GSTIN) and an Importer-Expert-Code (IEC) from the Indian government –which companies need to do business in the country.

Even before the legal entity was set-up, Stabilus began with the funding preparations for its future Indian business. “Due to the closing deadline, we didn’t have the time to work sequentially, which is something we had to explain to the local authorities in cooperation with Deutsche Bank,“ he adds.

Deciding on the optimal funding structure suited to the Indian dividend tax regime, the CFO opted for a minimum amount of equity (foreign direct investment – FDI) only and instead relied on an intercompany loan. In India, this is a highly regulated instrument, a so-called External Commercial Borrowing (ECB) loan. Deutsche Bank acts as Authorised Dealer for Stabilus’ ECB loan. In this role it collects all necessary approvals and manages the pay-out processes.

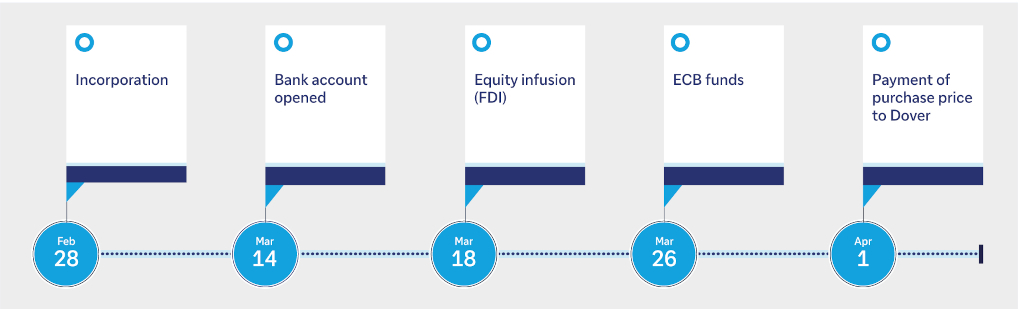

Figure 1: Timeline for Stabilus India

Source: Deutsche Bank / Stabilus

“Setting up an ECB loan requires a good preparation and an understanding of the key factors that which have to be in line with the rules set by the Reserve Bank of India (RBI)”, explains Denny Alpert, German desk in India at Deutsche Bank. For example, the RBI has imposed a Minimum Average Maturity Period (MAMP), which is depending on the purpose of the ECB loan, and a maximum cost that companies can charge as an interest rate to be paid from the subsidiary to the parent organisation.

Moreover, while it is possible to set up an ECB loan in foreign currency as well as in local currency (INR), different requirements apply. “As Deutsche Bank is acting as an Authorised Dealer in these transactions, we have a dedicated team to advise our clients on the rules of the Foreign Exchange Management Act (FEMA).”

Outlook

Since April 2024, DESTACO has been part of Stabilus. Following a six-month ‘tour de force’ to get from signing the contract with Dover to closing the deal – in which establishing a presence in India was a small but significant roadblock that had to be removed – Stabilus is now working hard to integrate the DESTACO entities into the Group to deliver on the promises it made to its shareholders when announcing the takeover. That includes the leveraging of revenue and cost synergies globally.

In India, in particular, Stabilus can now build on a legal and financial set-up which will allow the company to ramp up its local business – for DESTACO products and Stabilus products alike. “We have overcome all administrative hurdles which now gives us a much better access to the thriving Indian market,” explains Bauerreis. “We are currently evaluating how we will position our industrial automation – and at a later stage perhaps also some automotive business – in India and what is needed to make use of the opportunities in the market.” The foundation is there, now it needs to grow.

Note: all images are © Stabilus Group

Sources

See group.stabilus.com

See ir.stabilus.com

See ir.stabilus.com

See ir.stabilus.com

See group.stabilus.com

See ir.stabilus.com

See ir.stabilus.com