21 June 2022

Agile working promises to make companies more dynamic. How? flow’s Desiree Buchholz and Clarissa Dann report on how this is happening on the ground, providing insights from Deutsche Bank Corporate Bank’s own agility journey together with that of the SAP treasury team

MINUTES min read

As geopolitical and economic shocks such as the Covid-19 pandemic and the Russia/Ukraine conflict become more frequent, nimble reactions to new market conditions have become hallmarks of successful companies. Firms that can quickly relocate supply chains, adjust investment decisions, and adapt their offerings to changing customer needs – (such as expanding online sales channels during lockdowns) gain competitive advantage.

In general, this is nothing new – back in 1988 US business management author Toms Peters observed, “unprecedented volatility … demands continued quick response, since the average enterprise no longer knows who its future competitors will be, next month's exchange rate or what new use of technology is about to make obsolete half its product line and/or distribution system.”1

However, during the past couple of years, Covid-19 accelerated digitalisation of transaction flows and the emergence of start-ups have increased the pressure on incumbent market players. The ‘just do it’ approach of the former can make the latter appear slow and cumbersome.

Enterprise agility gains traction

Given this new landscape, more firms are questioning traditional project management methods. Every element of a critical path is examined for necessity and “enterprise agility” is gaining traction among human resources teams and organisational behaviour consultants. A global survey conducted in October 2020 showed that only 25% of the 2,190 organisations that responded had no plans to implement agile working in their organisation while 44% are currently engaging in agile transformation.2

So, why do agile methods outplay traditional ways of management? And how can companies ensure a successful transformation? “Agile at scale is a way of working – and thinking – that can take organisations from rigid to resilient. It’s more collaborative, more open, more creative, and more efficient than other models,” notes the Boston Consulting Group (BCG).3

The consultancy refers to enterprise agility as “a way of working that stresses collaboration and responsiveness. Cross-functional teams break down the walls within organisations while iterative cycles mean feedback, and improvements, are incorporated quickly”.4 Organisational energy, adds BCG, can “hide under rigid structures, behind long chains of command, sliced up in silos and tied up in approvals”. What, they ask, “if you could unleash that power, release what is inside, talent, teamwork, creativity, the courage to experiment and learn and get better every time?”

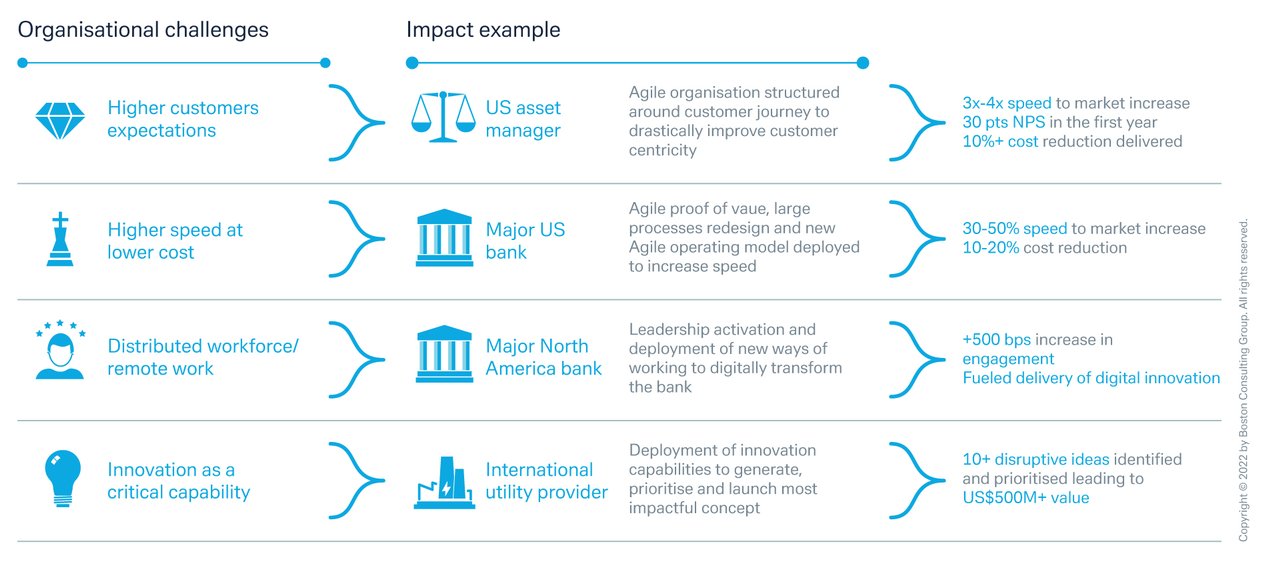

BCG has supported Deutsche Bank on its own agility transformation for the past three years, and details of the Group Agile Accelerator journey and learning points can be found in the joint white paper, Don’t let complexity crush your agile transformation published on LinkedIn in 2021.5 See Figure 1 for a summary of agile acceleration outcomes.

Figure 1: Enterprise agility addresses organisational challenges by making organisations align, iterate and grow

Source: BCG

New mindset and leadership

The concept originated in the software industry to speed up development and launch times of new releases. But nowadays, enterprise agility initiatives can be found right across industries – from companies such as Dutch beer brewer Heineken6 to American pharma giant Pfizer7 – that are embracing this. In short:

- Agile fundamentally changes the whole organisation – to transform successfully it needs support from the top.

- Agile affects cultures and behaviours – people in charge need to change the way they think and lead – but leaders need to show the way.

- Agile takes time – leaders need to stay on track and not slip into the old ways.

Nevertheless, even though agility has gained in popularity over recent years, “few companies have been able to implement enterprise agility,” highlights BCG.

"Agility needs the business in the driving seat"

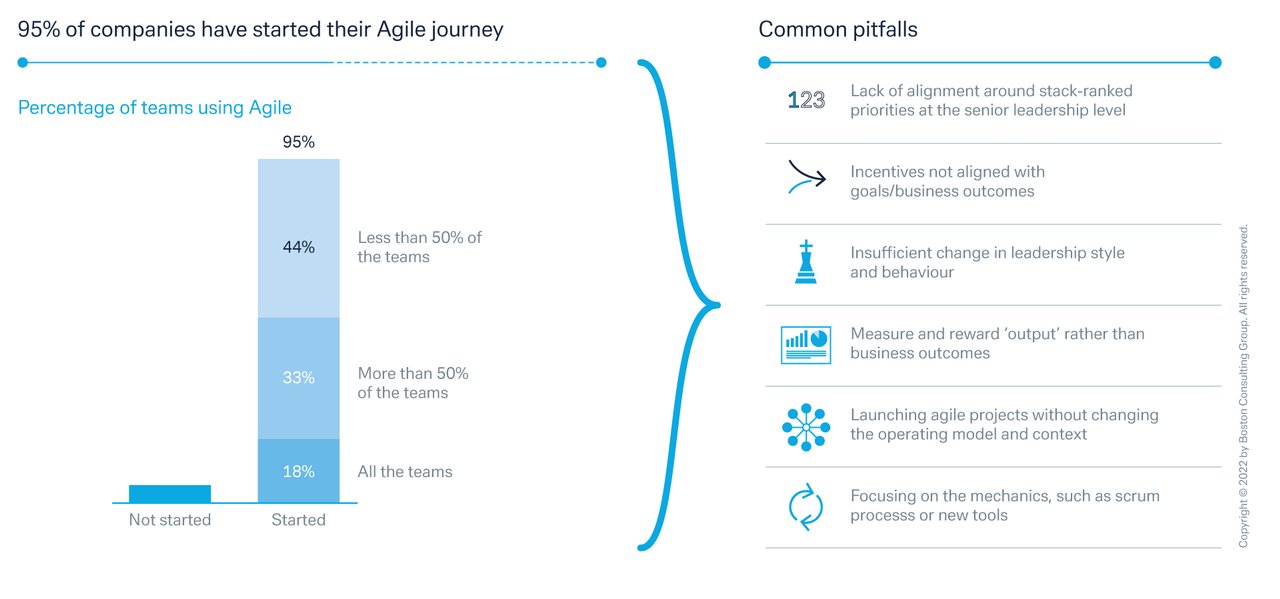

One of the points made in the Deutsche Bank/BCG paper was that it is vital in large complex organisations that a central team “leads and enables the overall transformation, removes roadblocks, ensures transparency and fosters knowledge exchange across all units”. In other words, while hybrid models and pilots are all very well, unless there is enterprise-wide scaling up and consistent support from the top, there is a risk the benefits would not be realised. Figure 2 summarises some common pitfalls.

Figure 2: Many companies embarked on an Agile transformation but must struggle to do Agile right and leave money on the table

Source: Annual state of Agile reports 2020 (14th edition)

Implementing agility at Deutsche Bank

Within non-tech corporate structures, agility initiatives can get stuck in IT departments, explains Julia Rutsch, Global Lead Agile Accelerator Deutsche Bank Corporate Bank. This, she says, “is a missed opportunity” and “you need the business in the driving seat”. Having pitched a change delivery methodology to the senior leadership of the Corporate Bank in 2021, it was grasped with alacrity, despite the fact it turns traditional command and control organisational culture upside down, allows people to experiment with ideas and learn without fear of failure, and that the whole point is the open exchange of information and ideas across the business, operations and technology.

The next step was to develop an ‘Agile leadership manifesto’ and the Deutsche Bank HR team. This formed the basis for an in-house “Agile leader” report and is now part of the bank’s selection process of key agile roles, part of the performance and rewards process as it supports the “how” and not the “what”. Executive coaching was put in place in groups and on a one-to-one basis, followed by round table ‘lighthouses’ where agile leaders and coaches worked with groups on the agility agenda.

"Managing Agile actually is demanding and rewarding at this same time – while you benefit from smarter subject matter experts to find ways to reach goals without a top-down directive"

flow asked Ole Matthiessen, Deutsche Bank’s Global Head of Cash Management how he found the experience. “Managing Agile actually is demanding and rewarding at this same time – while you benefit from smarter subject matter experts to find ways to reach goals without a top-down directive,” he reflects.

He explains how the structure requires you to formulate strategy and goals that are very easily understood and actionable. “If we achieve this, I can’t think of anything more rewarding than operating as a team with purpose and influence at all levels and an improved outcome.” Nevertheless, “stepping back and giving up control still feels tough at times, though”, he adds.

3500 colleagues are already trained in agile fundamentals

How did the Corporate Bank make Agile happen throughout the enterprise? Four development phases were agreed for building agile leadership and behaviours:

- Ignite and inspire senior leaders to create a base for culture change – starting with the leaders themselves

- Articulate the top agile success behaviours and areas for improvement

- Activate by building new and visible behaviours embedded into daily leader routines and “drumbeats”

- Embed new ways of working in organisational context to monitor and sustain the change

Quarterly ‘pulse’ surveys were set up to keep track of how the roll-out was going and a ‘tribe’ structure with (non-hierarchical) leaders was set up, using the surveys as well as an agile learning journal as assessment tools.

By the time Deutsche Bank CEO Christian Sewing and told shareholders in March 2022 that “we want to increase speed, with less complex structures, leaner hierarchies and agile teams across the bank”,8 the Corporate Bank ‘Agile Organisation’ programme was well underway. Some 3500 colleagues had been trained in agile fundamentals, there was good engagement with the German Workers Councils, and the routine of a quarterly pulse check to highlight areas of improvement firmly in place. The framework for rolling it out comprised the following five key pillars:

Figure 3: Objectives of a streamlined Corporate Bank

Source Deutsche Bank

Corporate perspective

Agile ways of working also seem to be welcomed by the bank’s clients. As Steffen Diel, Head of Global Treasury at software provider SAP recently put it in the flow InCorporateTreasury Podcast, “It is not a must that banks and other third-party providers embark on the same agile journey as SAP treasury, but what we wish for is an open mind-set on the side of our partners (…) to jointly discuss non-traditional solutions to problems in terms of digitalisation for example when it comes electronic signatures.”9 While for him it is not important which working methods banks apply to achieve these goals, he states that reacting quickly to new market conditions is key – and as outlined above, agile work allows for this.

At SAP treasury, several members of Diel’s team are already engaged in agile ways of working supporting the companies’ IT department in co-developing SAP’s own cash management and treasury solution portfolio. But the wider agile transformation programme has only just started. To address concerns of employees, explains Diel, SAP treasury started out with a few earlier adopters “who were really keen to engage in new ways of working” and then over time, more team members are pulled in by showing the success of agile projects.

“It takes time to develop an agile mindset and leadership around it,” Diel reflects, something Deutsche Bank’s Rutsch agrees with.

“To thrive in a competitive environment, the Corporate Bank must quickly adapt at scale to changing market trends and customer needs – this lies at the heart of our Global Hausbank identity,” says Rutsch. A clear sign of cultural change is the first ever “Agile People Week” from 20 to 24 June comprising more than 100 events. “We’ve already got more than 2500 acceptances – and I can already see how behaviour is shifting,” she smiles.

Sources

1 See https://bit.ly/3b2ykJ3 at tompeters.com

2 See https://mck.co/3xAHcNB at mckinsey.com

3 See https://on.bcg.com/3xAHqEr at bcg.com

4 See https://on.bcg.com/3Qrxg1E at bcg.com

5 See https://on.bcg.com/3O4aF9Q at bcg.com

6 See https://on.bcg.com/3HwWh7k at bcg.com

7 See https://on.bcg.com/3tHp2se at bcg.com

8 See https://bit.ly/3tHwiVl at investor-relations.db.com

9 See Why agile working is the future at flow.db.com

Julia Rutsch

Global Lead Agile Accelerator Deutsche Bank Corporate Bank

Ole Matthiessen

Global Head of Cash Management and Head of Corporate Bank APAC & MEA

Corporate Bank solutions Explore more

Find out more about our Corporate Bank solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

TECHNOLOGY, CASH MANAGEMENT

From the engine room From the engine room

Almost overnight, Deutsche Bank relocated more than 65.000 of its employees to working from home locations ahead of Covid-19 lockdown. flow reports on operational resilience and business continuity management

CASH MANAGEMENT {icon-book}

Heart of the enterprise Heart of the enterprise

Business software provider SAP leads a consistent programme of innovation, the latest being its digital boardroom. Head of Global Treasury Steffen Diel demonstrates why leaving one’s comfort zone and being permanently curious can work miracles

Trade finance and lending {icon-book}

Frontline economics Frontline economics

In an environment where banking products are becoming increasingly commoditised, providers seek to differentiate their offerings with outstanding client experience. But in a world of self-service and chatbots, how does the personal touch play out? Stefan Hoops shares his perspective