May 2019

In an environment where banking products are becoming increasingly commoditised, providers seek to differentiate their offerings with outstanding client experience. But in a world of self-service and chatbots, how does the personal touch play out? Stefan Hoops shares his perspective

When Jan Carlzon joined Scandinavian Airlines as CEO in 1981, he changed the focus from technical operational excellence to client focus, because he believed that the only true assets are satisfied clients, all of whom expect to be treated as individuals.

In his best-selling management book, Moments of Truth, he explains how the first 15-second encounter between a passenger and the frontline people, from ticket agent to flight attendant, sets the tone of the entire company in the mind of the client. “We used to fly aircraft, and we did it very successfully. Now we have to learn the difficult lesson how to fly people,” he reflected at the time.

More than three decades later, the same principles apply – client satisfaction determines the share of market wallet and profitability.

Consistency of client journey

In a transaction-based business, profits are driven by good client experiences, a point made time and again in research and taught in professional marketing education. Banking is a mature market, and we are not alone in shrinking our client perimeter. The adage from Principles of Marketing that in such a market “it might cost five times as much to attract a new client as to keep a current client happy,”1 is more pertinent than ever. Clients like consistency of experience, something the authors of McKinsey’s 2014 Customer satisfaction survey: Who’s up and who’s down,2 reinforce when they state that companies with a “close and personal connection with customers relative to their competitors do better”. They add: “This may explain why credit unions rate comparatively highly in the banking industry and why small banks outperform large banks.”

Further, there is a direct correlation between client experience and profit growth. Forrester research published in June 2016 demonstrates how customer experience (CX) leaders grow revenue faster than CX laggards. This conclusion comes from analysis of the US-based Forrester Customer Experience Index, which was built from 2010 to 2015 using data from Securities and Exchange Commission filings: “When we compared the total growth rate of all CX leaders to that of all CX laggards, we saw that the leaders collectively had a 14 percentage point advantage.”3

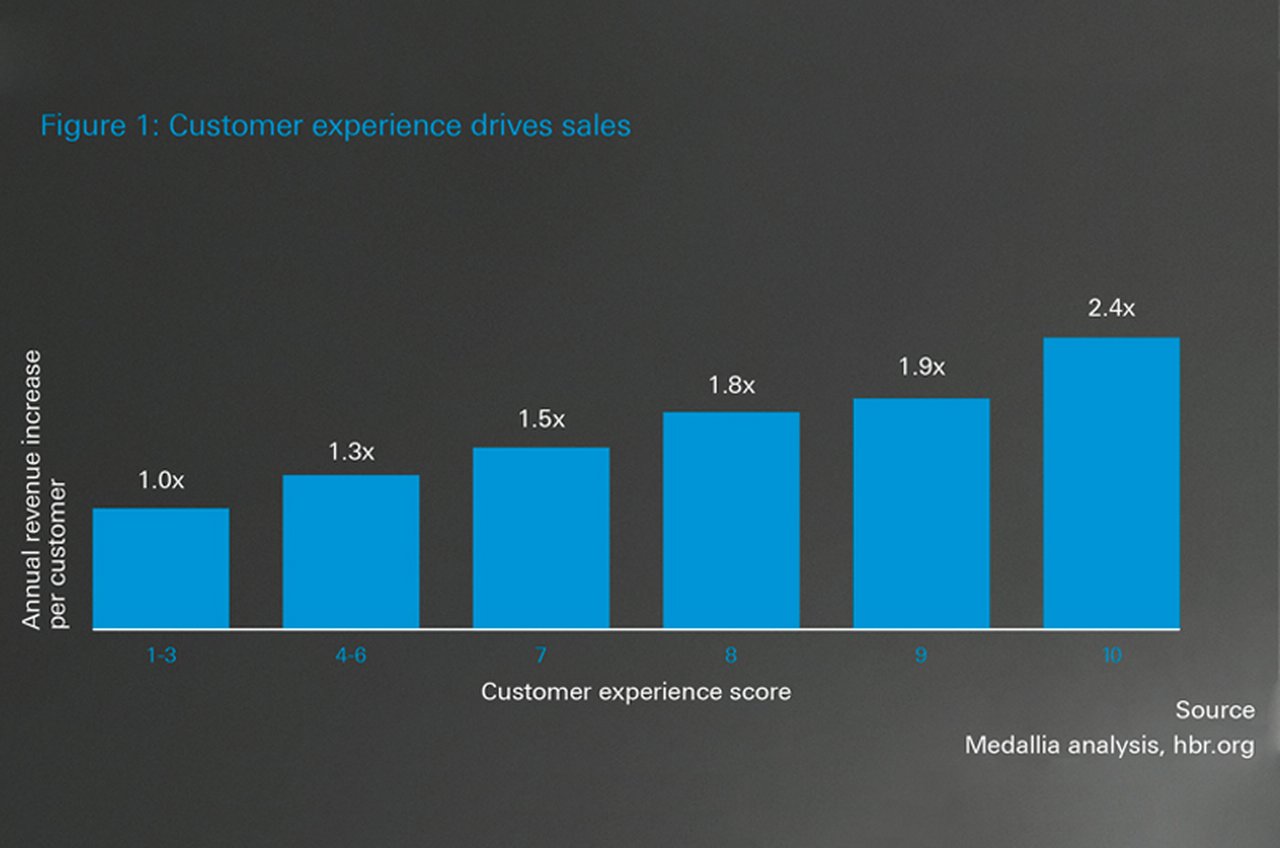

And just to drive the message home, Medallia’s Peter Kriss, writing in the Harvard Business Review, reveals that customers who had the best past experiences spend 140% more compared to those who had the poorest past experience.4

Personal connection

At this point I thought I would share our approach to client experience at Deutsche Bank. Of course, we are not the only financial institution that operates a service-based structure, but I feel it is important to explain why it works – for both this bank and our clients – and concurs with management research.

Everyone in this organisation is either directly or indirectly linked to service, with 40% of staff in our business lines working in a service-related position. They are vital sources of intelligence about our clients and they are there to make it easier for clients to do business with us. Our personal touch in service provision is often cited by clients as a key differentiating factor when choosing a banking provider.

Myriad moments of truth

In our Cash Management business alone, we complete around 4,500 client implementations a year and cover approximately 900,000 logged service tickets, which adds up to around 1.5 million client interactions. In addition, the 150 service reviews per quarter conducted with our top-tier clients provide intelligence on processing patterns, and on how client enterprise resource planning and treasury management systems are behaving. It is that very first moment of truth when becoming a client for the first time during the product/account onboarding process that is so crucial. The same applies where the client has an issue or a business event and needs our services. A good experience will be shared with peers, but a bad one will take a long time to be forgotten.

We observe the same facts in Trade Finance. Dealing with documents from clients and third parties right along the transaction journey, from origination to payment, opens up many ‘moments of truth’ for client interaction. The touchpoints arise from the significant level of manual processing still in the system, despite the digitalisation progress so far. With €59bn of documentary credits, collections and guarantees on our books, this is a huge opportunity to interact positively.

Fast turnaround is also key to the client service journey. Feedback from our trade finance surveys feature responsiveness in the top five aspects of service most valued by clients, along with product/solution availability and accurate transaction execution. To emphasise timely service delivery, Deutsche Bank’s Trade Finance service staff operate according to the aspirational motto Heute gebracht – heute gemacht, which translates as the ambition to deliver defined products and services on the same day.

Given all of this, we see our service professionals as gatekeepers to a wealth of information. Aggregated and benchmarked, this information in turn can deliver business value back to our clients. For example, we can point out how often one makes a certain type of payment in Brazil, or suggest to another an optimum guarantee structure.

Humans and machines

In a world of artificial intelligence where Facebook knows what you want to buy before you do, we keep a close eye on the balance between the convenience of smart systems and automation, and where interaction and a personal touch is needed.

Around 90% of the issues our clients call us about could be resolved on a self-service basis using a real-time dashboard. But where is the scope for a warm and personal relationship if the current raft of touchpoints disappear? Do we run the risk of disintermediation if even service itself is commoditised? Should we worry about clients being too self-sufficient?

Of course not, is the answer. But personal interaction and a well-thought-out customer journey are key. A client can be pointed to a self-service route, perhaps with telephone assistance while learning a procedure – such as setting up a new account − for the first time. Or they can take another direction where a consultant is at the wheel to get them to where they need to be. In our Transaction Banking business we operate a hybrid approach, not unlike that seen in the retail space with ‘click-to-chat’ options (the sense of a person at the other end is key) that can then progress to a call or possibly a site visit, depending on the problem.

This is finding its way into the corporates space and presents huge opportunities – something we discovered in our Securities Services business when we launched our chatbot ‘Debbie’ to provide client trade status information quickly, securely and accurately in June 2018.5 Similar opportunities were presented by innovations such as eVault, a secure digital repository for the exchange of documents, in our Trust & Agency Services business. This advancement to our document custody platform6 is already helping Deutsche Bank to speed up the lending process, enhance efficiency and deliver a much-improved, superior service to clients.

"Everyone in this organisation is either directly or indirectly linked to service"

From the flight deck

Our service reviews tell us that we are good at getting clients into the air all the time, but need to get better at teaching them to direct their own flight paths. With smart processes, intuitive self-service and bots at hand to deal with 90% of routine enquiries, we hope to not only turn our clients into service ambassadors, but help them future-proof their businesses too.

Stefan Hoops is Head of Corporate Bank, Deutsche Bank

Sources

1 Principles of Marketing, Kotler, Armstrong, Saunders and Wong, 2nd edition, 1999 (Prentice Hall)

2 See https://mck.co/2UA6fuN at mckinsey.com

3 See https://bit.ly/2AUxRVZ at go.forrester.com

4 See https://bit.ly/1xShNeD at hbr.org

5 See Could a chatbot help resolve the speed and accuracy need in trade queries? at flow.db.com

6 See How can mortgage lenders reap the benefits of the paperless revolution? at corporates.db.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

Trade finance and lending {icon-book}

Across the Great Divide Across the Great Divide

Trade economist Dr Rebecca Harding reflects on the US Exim Bank’s annual spring conference compared with the ICC Banking Commission event in Beijing and notes how polarised attitudes to trade have become and that is businesses that trade and not governments

Trade finance and lending {icon-book}

Under the rainbow Under the rainbow

Floods, political upheaval and investor caution have created infrastructure shortfalls in much of Latin America. Ivan Castano Freeman reviews project progress, re-routed trade flows, and opportunities for banks and export credit agencies

Trade finance and lending

Trade re-set? Trade re-set?

Independent economist Rebecca Harding shares three reasons why she believes trade will never be quite the same again