06 May 2020

Almost overnight, Deutsche Bank relocated more than 65.000 of its employees to working from home locations ahead of Covid-19 lockdown. flow reports on operational resilience and business continuity management

Covid-19 is testing the most resilient of business continuity plans. When structures and processes are complex (such as those in closely-regulated financial institutions) an external shock such as a pandemic, or an atrocity such as the 9/11 attacks, can dislocate entire value chains.

As with previous external shocks Covid-19 impacts the movement of money as organisational needs suddenly change. After 9/11 (and transactions were much more manual then), reflects the St Louis Federal Reserve,1 cheques could not be cleared in the US because flights were suspended, and businesses moved funds from illiquid assets, such as stocks and bonds, to liquid assets such as cash at their banks.

Robust organisations run business continuity management (BCM) scenarios and identify plans of action as part of the overall operations strategy, with a pandemic being one such scenario.

In the 2003 Harvard Business Review classic, The quest for resilience, Gary Hamel and Liisa Välikangas, co-founders of the research organisation Woodside Institute, talk about strategic resilience as “continuously anticipating and adjusting to deep, secular trends that can permanently impair the earning power of a core business”, rather than responding to a one-time crisis or setback. “It’s about having the capacity to change before the case for change becomes desperately obvious.”2

This article takes a closer look at how Deutsche Bank prepared for a crisis like Covid-19, making capacity to change part of business as usual, and is continuing to serve its clients.

Beyond the licence to operate

5,200+

While central banks and governments are responding to a very different crisis now with monetary and fiscal support measures, it falls to the commercial banks to maintain corporate sector liquidity and facilitate government support. For example, Deutsche Bank announced on 29 April that it had, supported more than 5,200 clients applying for German development bank KfW loans worth around €4bn and earmarked a further €20bn for overall new credit extensions to corporate clients.3

This means:

- Ensuring funds reach their intended destinations, whatever the value, volume and timescale;

- Making credit available with a new set of risks to check; and

- Providing post-trade services at a time of record volumes, unprecedented volatility and increased client demand, with all the checks and balances in place.

Deutsche Bank CEO Christian Sewing explains,”We need on average five working days from application to approval," When it came to the more complex individual cases, he adds it was right that banks took a closer look there; not least because public funds are involved in the government aid loans: "There must be a risk assessment. After all, we also have to deal responsibly with taxpayers' money."

On 6 April, US consultants Oliver Wyman released their report, The role of retail banks in fighting Covid-19. While the retail sector is very different from the corporate and investment banking sectors, some commonalities remain.

“Most banks have triggered their business continuity plans (BCP) and are grappling with the immediate impact of the pandemic and new ways of working,” explains the report. “The structures put in place now will determine how individual banks – as well as entire communities – not only weather the storm, but also emerge stronger.4

Their other point about delivering financial products and services to customers when they need them most is also relevant outside the retail sector. “Banks must react to rapid changes in channel usage in the short term and anticipate changes in customer demand that these shifts will drive in the medium term,” they add.

In other words, the licence to operate doesn’t just mean ensuring stable processes, but also going the extra mile for the customers. In an environment where negative interest rates can no longer be absorbed by banks on behalf of their customers and where there is price compression on trade finance, the competitive landscape is redrawn to encourage whoever steps up consistently in a crisis. Doing that well depends entirely on how efficient the engine room is – in other words operational excellence

Business continuity plans

“Banking and capital markets firms around the world are mobilising and taking steps to minimise Covid-19’s effects on day-to-day operations,” observed Deloitte on 16 March, before many of the developed economy lockdowns had started.5

Deutsche Bank was one of many banks that have been continually testing business continuity plans – and these include split work sites, working from home arrangements and rewriting travel policies. The Bank, along with its peers, has put in place health and safety measures, including those addressing potential mental health risks.

“We’re working in exceptional times and people understand that there needs to be a level of understanding and flexibility around that, both from a client and bank perspective,” said Head of Fixed Income and Currency Operations Stephen Bell once lockdown was underway. “As our physical offices close, our virtual channels become more important.”

How can all this be done with so many of the back and middle office teams that make these happen now working from home with no diminution in fulfilment?

A pandemic is very different from a terrorist attack you cannot bring people together physically “When you go back to 9/11, the focus there was getting people into in a disaster recovery site and keeping them there until everything came back online. This time, we have hardly anyone in the disaster recovery site and everyone is at home,” reflects Bill Mott, Deutsche Bank’s Chief Operating Officer, Corporate Bank & Branch Operations.

Mott continues, “So you can see the inflection point where technology is meeting up with how people want to work. This disaster is pushing us to move two to five years faster than the industry would have done if this had not happened. What will the world look like when we all get back to normal? Normal won’t be the same as it was before.”

He reports that as the Covid-19 crisis worsened and global lockdowns began to drive market volatility, Deutsche Bank Corporate Bank saw significant spikes in transaction volumes across multiple products; some by as much as 300% above normal for a single day. “These challenges were managed via increased time worked by employees, by shifting employees from non-line roles into essential support, by cross-product sharing of resources, as well as support from the business as they helped manage client expectations.”

While most groups have moved to a ‘work-from-home’ model, this, adds Mott, “isn’t an option for our staff in the Vault or Document Custody businesses due to the physical nature of the work”.

He goes on to explain how legal requirements and service level agreements with clients meant that around 15,000 documents and 200 boxes were received each day by employees. “To support these teams, the warehouse was divided into zones where employees were assigned to maintain proper distancing from others. In some cases, enhanced digital technologies and workflows have been implemented to allow for more employees to work from home.”

"This disaster is pushing us to move two to five years faster than the industry would have done if this had not happened"

Customer demands

On 21 April Ideas and Action, a London-based marketing consultancy, published the results of a crisis poll conducted 8-14 April among 100 treasurers and chief financial officers around the world. "Maintaining liquidity across the business has been by far the most significant concern during the immediate throes of the crisis" notes the report.6 It adds, “One particular challenge, noted by 38% of respondents, is mobilising cash, with some banks reporting that clients are seeking to extend cash pooling programmes and find ways to unlock pockets of trapped cash that were previously considered less significant.”

At Deutsche Bank, more and more of the Corporate Bank cash management clients are asking for “out of the ordinary” types of payments at very short notice, such as dividend payments. “Clients ask us to go the extra mile to ensure they are executed correctly with more detailed reporting all the way through to the beneficiary bank confirmation,” reflects Dennis de Weerdt, Deutsche Bank’s Global Head of Implementations and Service Cash Management.

One example of a request that required some rapid footwork was when a client’s new legal entity in India needed a capital injection from its parent company in Singapore – both economies being completely locked down. There was an exacting regulatory timeline and a complex FX conversion that had to be seamless. This was further complicated by the fact that the parent company had limits on authorisations preventing them from transferring the capital injection in one go, but the Indian regulations required one lump sum and that the FX conversion was done in Singapore. A solution was found in which the parent company authorisation was updated, but met the lockdown pressures and the tight timeline required.

Other examples of stepping up include the rapid responses of the Bank’s IT teams, which set up flexible processes around digital signatures – given that so many Corporate Bank customers are also working from home. That is in addition to making sure that Skype systems remain stable and able to cope with the ten-fold increase in phone minutes going through its systems.

The user journey with experiences like this one can have a lasting effect and the attitude to what is front, middle and back office has evolved to reflect more of a collective responsibility throughout organisations. At Deutsche Bank, explained Corporate Bank Global Head Stefan Hoops in his article Frontline economics (June 2019), “Everyone is either directly or indirectly linked to service, with 40% of staff in our business lines working in a service-related position”.

Resiliency issues

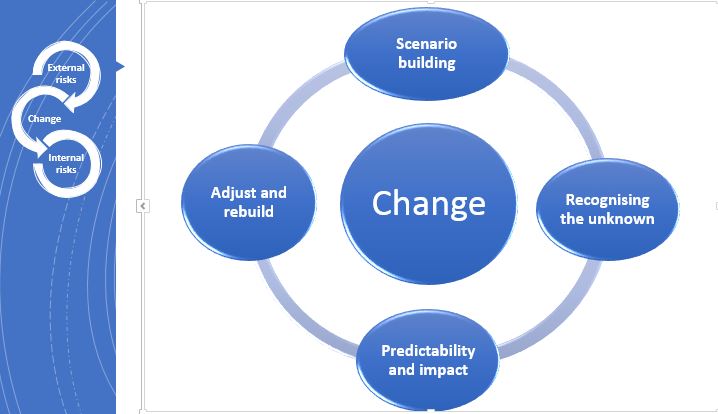

Figure 1: Managing risks in disruptions

Source: Deutsche Bank

“The world today is lucky that the technology and capacity exists to handle large-scale moves to work from home; something that would not have been the case 15 to 20 years ago,” reflects Linda McLaughlin-Moore, Deutsche Bank’s Global Corporate Bank and Branches Operations Executive.

“Managing a change or resiliency event poses a number of common issues, both within the organisation and externally,” she continues and confirms the Corporate Bank’s Managing Risk in Disruptions checklist is honed and updated regularly.

“You have to step back and take a look at your end-to-end ecosystem, your influencers, dependencies, and disruptors, as well as what actions you can take that allow you to move forward in a positive way,” she explains. For the Bank, this included building out scenarios when the pandemic first started, modelling how a debilitating virus would impact more broadly than in China and Asia on Bank staff, clients and suppliers.

“It’s important to understand things you are confident with and understand, things you don’t know, such as a global pandemic impacting all of your hub locations. A lot of us didn’t anticipate this type of global impact with so many of our staff displaced,” reflects McLaughlin-Moore.

In addition, she explains the process of understanding what potential issues could influence or disrupt you. One has to “think through the what, where, when and who of how disruptions can occur”, and practise the impact of all of those in multiple combinations in the scenario planning. “This could be a client, a government, a supplier, a technology infrastructure or a utility – you need to understand those players and learn how to predict and understand inferences and clues,” she adds.

If predictability has been correctly built into the scenario planning, “you will have your plan B”, she says. However, it’s important, when building and running scenarios, she continues, to “fail fast, adjust and test again”. “Many companies have difficulty with moving on to that next stage because of collaborative discussions. These need to happen up front in the planning process versus in the middle of a situation,” concludes McLaughlin-Moore.

"The world today is lucky that the technology and capacity exists to handle large-scale moves to work from home"

Operations 4.0

With meetings and conferences moving from the physical to the virtual and other blurrings of the physical, digital and biological world, digital transformation is part of operational resilience as client/bank relationships evolve to include data analytics and application programme interface (API) connectivity.

In fact, reflects Michaela Ludbrook, Global Head of Securities Services and Head of Corporate Bank Americas at Deutsche Bank, the pandemic has accelerated the digitalisation agenda. “With the crisis precipitating both home and split office working across various locations around the world, we have invoked digital tools such as electronic signatures, transparency around flows, data reporting and lifecycle transparency.”

Getting the nuts and bolts right to ensure resilience and stability has become mainstream. “Operations and technology have never been more important in managing through the day-to-day. Operating and business models will change as the way people execute tasks or the technology they use evolves. AI, data and DLT will be crucial for future transparency around data and people being able to self-service,” she notes.

Three years ago, the McKinsey article Ops 4.0: Fuelling the next 20 percent productivity rise with digital analytics applied the developing Fourth Industrial Revolution (4IR) concept to operations, observing that “the problem now, as a generation ago, is that organisations too often over-invest in technology while underinvesting in the human capabilities needed to make it useful”. The real lesson from technology leaders, the article explains, is that they apply technology judiciously, “as part of a broader transformation of the way they do business, starting with their people”.7

Mark Matthews, Head of Operations for the Corporate Bank, Investment Bank and Captial Release Unit at Deutsche Bank talked to Forbes magazine (24 February) about how his team took a systematic look at Deutsche Bank’s operations processes, systems and data. “Part of this discovery focused on how to get more out of the bank's existing IT systems. This team included employees as well as external experts. Data science team members played a critical role,” noted the article.

Among other innovations, Matthews explains how the Bank automated the integration between systems and third-party systems and used artificial intelligence to screen clients for adverse media; as part of the bank's know-your-customer (KYC) screening processes. “The software scans news sentiment and context for negative news, rather than looking for rudimentary word associations.”

"We have invoked digital tools such as electronic signatures, transparency around flows, data reporting and lifecycle transparency"

Silent heroes

“You are the silent heroes that keep our bank running all over the world,” posted Stefan Hoops on LinkedIn (6 April). With more than 65,000 people working from home, logging in each day, managing record levels of transaction traffic, and no outages, this was a nice reminder that everything really is joined up.

Sources

1 See https://bit.ly/3dvljnt at stlouisfed.org

2 See https://bit.ly/2Wu46DR at hbr.org

3 See https://bit.ly/3oP0Zou at db.com

4 See https://owy.mn/3b79NNt at oliverwyman.com

5 See https://bit.ly/2W4FylJ at deloitte.com

6 See https://bit.ly/3ca2LbO at foleon.com

7 See https://mck.co/2L1kC91 at mckinsey.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

TECHNOLOGY, REGULATION

Beating Covid-19 cybercrime Beating Covid-19 cybercrime

With so many locked down at home in response to pandemic containment, the use of online services is exploding. But what is the risk to businesses? flow shares some tips to stay cyber-safe in a working from home environment

CASH MANAGEMENT

Bank support during Covid-19 Bank support during Covid-19

As the Covid-19 pandemic continues its disruption and dislocation of economies, businesses and supply chains, banks are working with governments and their clients to ramp up support initiatives. Here are some examples of Deutsche Bank activity

Macro and markets, Cash management, Trade finance and lending {icon-book}

US-German trade ramps up US-German trade ramps up

As the US overtakes China to become Germany’s top non-European FDI destination, financial journalist Ivan Castano Freeman provides a deep dive into these burgeoning corridors, drawing on insights from Deutsche Bank experts and the German American Chamber of Commerce, Inc. (GACC New York)