12 August 2024

As the US overtakes China to become Germany’s top non-European FDI destination, financial journalist Ivan Castano Freeman provides a deep dive into these burgeoning corridors, drawing on insights from Deutsche Bank experts and the German American Chamber of Commerce, Inc. (GACC New York)

MINUTES min read

Trade and investment flows between the US and Germany are entering a new, and much accelerated, phase. So much so that analysts examining data from the German Federal Statistical Office expect the US to eclipse China as the top trading partner of European nations by 2025.1

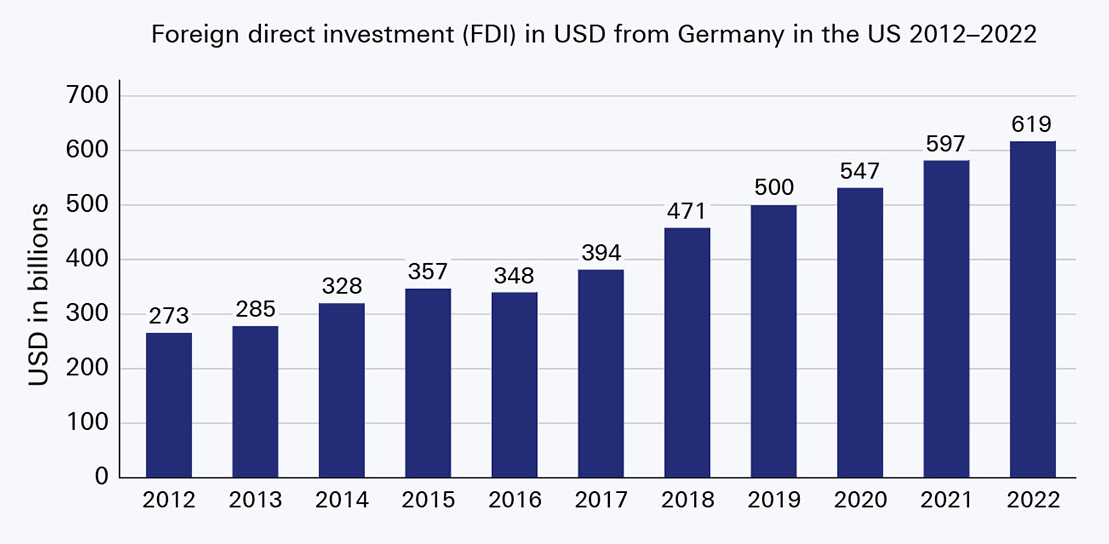

German companies are rushing to boost capital investments in the US, much more so than in recent years. In 2023, they announced a record US$15.7bn of capital commitments in US projects (total FDI having also risen (see Figure 1), up from US$8.2bn in 2022, drawn by Washington’s generous tax incentives and a robust and stable economic outlook, according to consultancy fDi Markets (reported by the Financial Times in February 2024)2. In contrast, Germany pledged just US$5.9bn to China.

Figure 1: German investment in the US has more than doubled in the last 10 years

Source: 2024 Germany American Business Outlook (US Bureau of Economic Analysis, US Department of Commerce)

German and European companies have been drawn to the Biden administration’s huge stimulus programmes, notably the Inflation Reduction Act (IRA) and the CHIPS and Science Act (CHIPS), which were enacted nearly two years ago and offer more than US$400bn in tax credits, loans and other aid to bolster manufacturing while tackling climate change. Although the subsidies are mainly geared toward US entities, subsidiaries of German and European companies can also benefit.

As a result, German firms announced 185 capital projects in the US during 2023, of which 73 were in the manufacturing sector, fDi said. The data also highlighted how Volkswagen’s Scout Motors electric vehicle (EV) subsidiary led the pack with a US$2bn commitment to build a factory in South Carolina.3 Mercedes-Benz followed suit with a US$1.9bn pledge while e-VAC Magnetics and ZF Friedrichshafen earmarked US$500m each and Merck KGaA US$300m.4

“When you look at the last quarter, the trade relationship between Germany and the US has surpassed China for the first time over the past few years,” says Volker Baer, Chairman of the German American Chamber of Commerce, Inc. (GACC New York), adding that America-bound exports reached US$70bn compared to US$62bn to China. US stimulus aside, a desire by German firms to de-risk from China amid supply-chain risks, while remaining close to key American markets, has also fuelled the trend, according to Baer. He highlights the 2024 Germany American Business Outlook (GABO), which reported how 96% of German companies plan to boost US investments by 2026.5

The US’s low energy prices – at least compared to Europe, where the Russia-Ukraine war has raised costs – is also helping lure a wide range of German and European industrial and machinery firms such as cranes and hydraulics supplier Palfinger, which plans to double its US footprint in coming years.

“The US has had its own inflation issues, but levels are not nearly as high as what we’ve had in Europe,” confirms Paul Maley, Deutsche Bank’s Global Head of Securities Services and Regional Head of Corporate Bank Americas, adding, “This differential has a strong influence in German companies’ investment decisions.”

Transportation and energy leaders

German automakers are top beneficiaries of the burgeoning US-German flows. “EV makers are building gigafactories in the US as they seek to electrify their fleet,” says Maley, adding that the push is also fuelling semiconductor investments. “The average US car price is higher than in China (the biggest automotive buyer) and that benefits the type of automaker that comes from Germany, such as our BMWs, Audis and Mercedes. They are already making cars here. The question is, will they build more in coming years? The answer is, probably, yes.”

“It was always our intention to grow the rail business in North America”

“We have been present in the US for decades with our rail and truck division,” explains Kai Gloystein, Vice President Corporate Finance & Treasury at Munich headquartered Knorr-Bremse. In 2002, the German manufacturer of braking systems for rail and commercial vehicles acquired Bendix Commercial Vehicle Systems from Honeywell. “But it was always our intention to grow the rail business in North America as well,” he continues. The company announced its acquisition of the rail signalling technology business of Alstom Signaling North America in April 2024, a move that takes the company into the attractive control, command and signalling (CCS) segment of the rail market.6 “This was an opportunity to transform the existing US business, and Deutsche Bank has been a longstanding partner for us – from cash management and trade finance solutions to financing and hedging FX risk.”

Germany’s leading power firms, such as RWE, also plan to continue the country’s expansion in the US as the IRA rewards sustainable and green manufacturing, a practice in which many of them have built strong credentials. Following RWE’s acquisition of Con Edison Clean Energy Businesses, Inc two years ago, RWE has its sights firmly set on being “one of the top leading renewable energy companies in the United States”.7

Burgeoning opportunities

The US Department of State points out that “Germany is consistently ranked as one of the most attractive investment destinations based on its stable legal environment, reliable infrastructure, highly skilled workforce and world-class research and development,” noting that US investment continues to account for the third-largest share of Germany’s foreign direct investment (FDI) after Luxembourg and the Netherlands.8

As ties between the two economic giants strengthen, financing opportunities are expected to surge.

Maley expects demand for structured finance with an import and/or export component to rise significantly, in addition to corporate banking, working capital and trade finance products.

The US-to-Germany corridor is also projected to see a growth in opportunities. Sal Vitale, Head of US Corporate Coverage at Deutsche Bank, sees a growing number of American firms targeting Germany for further investment. He notes that government incentives and the size and scale of existing German infrastructure are attractive to companies looking to structure investments in a way that diversifies supply chains. Microsoft, for instance, has announced a €3.2bn investment in Germany to double its artificial intelligence and cloud data centre capacity by late 2025.9 Meanwhile, Alphabet and IBM are pouring roughly US$3bn into similar high-tech investments while pharma major Eli Lilly is writing a US$2.5bn cheque to build an injectables drug-making site in Alzey,10 near Frankfurt. GlobalFoundries, meanwhile, intends to spend US$8bn to double production at its chip-making plant in Dresden.11

"We are looking at the US positively because of its growth outlook"

This comes on top of Intel’s plans to build a massive, €30bn chip factory in Magdeburg – billed as Europe’s biggest single FDI project in history – to benefit from €10bn in expected government subsidies.12 And not to be forgotten is the US$3.8bn undertaking by Taiwan’s TSMC in Dresden.13 Vitale says these investments are a response to America’s IRA and CHIPS acts as EU countries continue to hone policies to attract large-scale investments from US entities, with a keen focus on technology investment which enables local companies to simplify sourcing of required components from within the EU.

Bridging the gap

Meanwhile, the German American Chambers of Commerce in the US (GACCs) support German companies by finding investment opportunities through offices in major cities such as Atlanta, Chicago, New York, San Francisco and Washington, DC. According to Baer, “Companies are seeing increased business and higher profit margins from the US stimulus,” that is also generating jobs across the pond. Both small and large German firms are also showing a keen interest in participating in clean energy projects.

However, the GABO research noted that attracting the necessary skilled workers remains a challenge. This is why the GACC New York is ramping up its apprenticeship programme, with which it partners with American businesses and community colleges to train US students in high-tech fields. The companies pay both a scaling wage over the course of the training period and the educational costs for the related technical instruction. Based on the German dual-training model, this provides a training pathway that is directly tailored to industry needs, according to Susanne Gellert, President & CEO of the GACC New York. An example of this support in action is the iTEC initiative in the Lehigh Valley, Pennsylvania.14

Gravitational pull

Many German firms expanding in the US are in it for the long haul, planning projects for the next 10 to 20 years, Maley says. Therefore, the November 2024 presidential elections or when the Federal Reserve begins cutting interest rates have little bearing on their strategy. Also, even if the next government winds back the current stimulus programmes, most of them are being earmarked in Republican states, so even a new Republican administration would be less likely to want to scrap them immediately, he adds. What matters more is the perception that the US economy is expected to remain strong and stable in the face of global recessionary and geopolitical pressures.

“Even if rates stay higher for longer, we are still looking at the US positively because of its growth outlook,” Maley notes. “It makes dollar financings more expensive, which is definitely a headwind. But if you are a CEO or CFO in the German heartland and you want to decide where you will put your next investment to work, are you going to pick the economy that’s still growing strongly or the one that’s likely to shrink?”

Ivan Castano Freeman is a freelance financial journalist

Sources

1 See reuters.com

2 See ft.com

3 See scoutblythewood.com

4 See ft.com

5 See gaccsouth.com

6 See ir.knorr-bremse.com

7 See rwe.com

8 See state.gov

9 See reuters.com

10 See investor.lilly.com

11 See bloomberg.com

12 See intel.com

13 See reuters.com

14 See lehighvalley.org