23 November 2023

TÜV Rheinland, a global testing service provider, has revamped its cash management operation in Asia-Pacific. Head of treasury Julien Muet tells flow’s Desirée Buchholz how his team rethought its banking strategy, centralised liquidity and streamlined processes in a project with Deutsche Bank

MINUTES min read

2022 was a special year for TÜV Rheinland: The company, founded in 1872, celebrated its 150th anniversary. What started as a small “Verein zur Überwachung der Dampfkessel” (Association for the Inspection of Steam Boilers) in Wuppertal – then one of the most heavily industrialised regions of Germany – has now grown into a truly global testing service provider over the past 150 years.1

In 2022, TÜV Rheinland carried out some 400,000 industrial inspections worldwide, testing around 300,000 products as well as training 150,000 people in numerous professions on the latest international standards. With 20,870 employees, the company now generates revenues of nearly €2.3bn – half of which come from outside Germany – and earnings of €180m. Contributing a revenue share of 20.2%, Greater China is now its second most important region.2

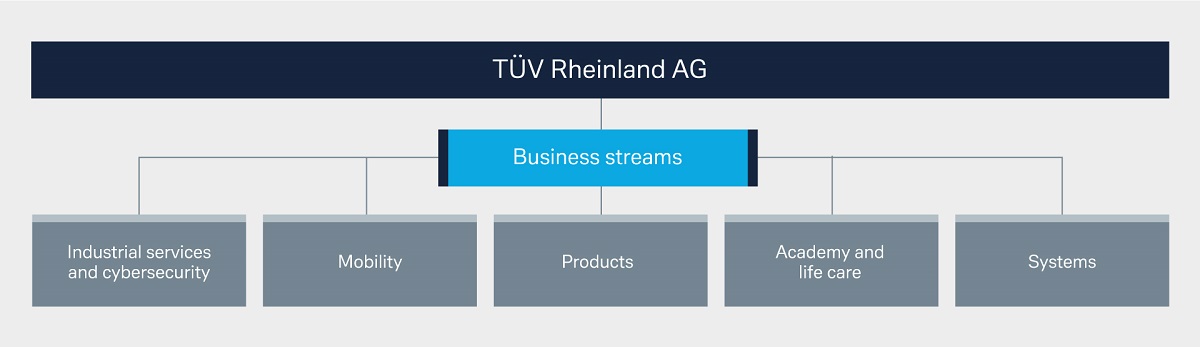

While TÜV Rheinland is well-known for its vehicle inspections – German drivers must submit their vehicle for a safety check every two years – its business consists of much more than the traditional mobility offering (see Figure 1). The company tests and certifies technical systems, products and services, supports projects and designs processes for companies. In addition, it provides services related to information security, occupational health and safety at work, training and professional qualifications. Industrial and cybersecurity testing, product testing and mobility services together constitute more than 75% of the entire business of TÜV Rheinland.

Figure 1: TÜV Rheinland business streams

Source: TÜV Rheinland

In general, sustainability is an important driver for TÜV Rheinland’s business, which conducts materials inspection, pollutant analysis and the certification of green gas, electricity and hydrogen.3 In 2022, the company generated around €529m in revenues in the environmental, social and governance (ESG) segment, about 21% of its total revenues – and this share is set to increase over the next years.

Moving from local to a central treasury function

As the company grows, so do requirements on the treasury function. “Test and audit being part of our DNA, we have been fostering standardised, secured and efficient processes within treasury,” Julien Muet, Head of Corporate Treasury at TÜV Rheinland, tells flow. In 2019, when he joined, the company’s bank strategy was predominantly managed decentrally with a total of 800 bank accounts worldwide.

“In 2020, we started a paradigm shift towards building a strong central treasury function”

Recalling the set-up he found when joining the company, Muet admits, “at that time, we worked in a heteroclite banking environment with too many banks, a multitude of local payment formats and numerous host-to-host bank communication channels. Availability of cash was hindered, processes inefficient and local bank charges and FX conversion margins too high.”

In 2020, aiming for more efficiency and a higher level of control around cash management and payment processes, the company started building up centralised, standardised and controlled group processes for cash management and payments. “This initiative was part of a paradigm shift towards creating a strong central treasury function which sets guiding principles for the group in the areas of cash and liquidity, corporate finance, financial risk, asset and guarantee management and has a clear focus on process standardisation and technology.”

One of the first measures to be taken as part of the new treasury strategy was to reinforce the partnership with six global relationship banks, including Deutsche Bank. The banks were selected for their financial strength as well as their product and geographic coverage, and “the relationship was strengthened through a syndicated revolving credit facility,” Muet says.

Once the bank relationship strategy was defined, Muet and his team began consolidating TÜV Rheinland’s cash management activities among the six relationship banks in each of its eight business regions: Germany, Western Europe (excluding Germany), Central and Eastern Europe, North America, South America, India/Middle East and Africa, Greater China and Asia-Pacific.

Consolidating cash management in China and Asia-Pacific

In early 2022, TÜV Rheinland decided to partner with Deutsche Bank for its cash management activities in China, South Korea, Thailand, Malaysia, Singapore, Vietnam, Indonesia, and Australia. “Deutsche Bank best met our cash management requirements in the region, offering professional services for cash management, foreign exchange and structured financing with a strong advisory role in often very restricted financial markets,” explains Muet.

The project goals were clear:

- harmonise payment processes throughout Asia-Pacific and China with the implementation of a global Swift gateway, improving process efficiency, controls and IT security;

- achieve a high level of standardisation for payments (PAIN.001) and account statements (CAMT.0537 and MT940) across the region;

- rationalise bank accounts and thereby reduce bank charges and FX conversion margins;

- increase control over local cash and reduce trapped cash.

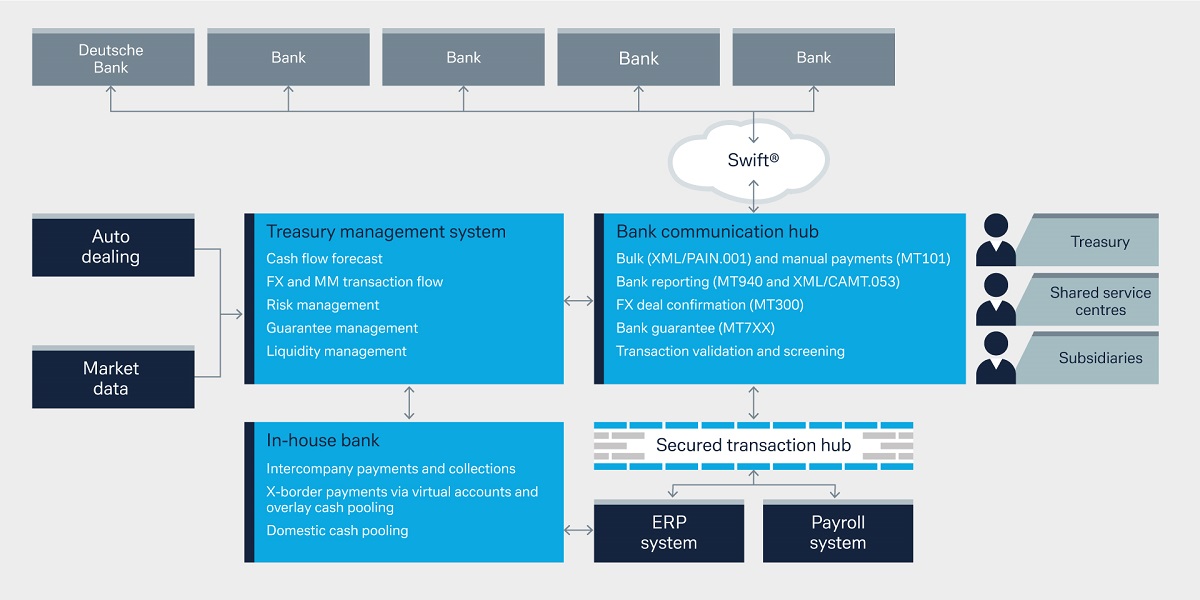

The Swift capability was a major decision maker in the RFP process when selecting Deutsche Bank. According to Muet, “when looking for a global platform, Swift remains the most secure communication gateway to banks on the market for corporates”. Hence, the testing provider decided to replace all existing host-to-host channels with Swift connectivity (see Figure 2).

Figure 2: Treasury system and process landscape at TÜV Rheinland

Source: TÜV Rheinland

When rationalising bank accounts, Asia-Pacific is not an easy region to work in. Firstly, compliance in most Asian countries means maintaining local bank accounts for tax and other statutory payments. Secondly, there are specific payroll payment requirements in all Asian locations TÜV Rheinland does business in, making the choice of the banking partner critical.

“Deutsche Bank has direct membership to all major high value, low value, and paper-based clearing systems in each APAC country that we are directly present in,” says Christian Plewe, Senior Relationship Manager for TÜV Rheinland at Deutsche Bank. “Moreover, in locations where there are regulatory or market restrictions that only local banks are allowed to make tax payments, we are able to leverage our alliance with local banks to execute the payments for our customers.”

Another approach to reduce costs was to streamline and automate FX conversion. TÜV Rheinland decided to use the Deutsche Bank solution for FX Transaction, FX4Cash, which combines FX conversion with the payment and collection processing a single infrastructure. “By using this offering, companies can make payments in more than 130 currencies, with no need for separated currency accounts,” says Plewe.

Making use of an umbrella credit facility

While fostering the centralisation of treasury and financing activities, countries with capital controls often require specific and tailored solutions for trapped cash and financing. “With increasing cost of borrowing and a growing awareness on country risk, the centralisation of so-called trapped cash has become even more important to corporates4,” says Muet.

Financing decisions in restricted countries in the form of intercompany loans, equity or bank loans are mainly driven by financial, statutory and tax factors. With the recent growing geopolitical tensions, however, corporates are increasingly taking country risk considerations as an additional key element while structuring loans5.

In the case of TÜV Rheinland, all local bank financing has been arranged under a global umbrella credit facility with Deutsche Bank. In this structure, the German parent company provides a corporate guarantee for liabilities of its subsidiaries covered by the umbrella credit facility. This allows the bank to give a local loan to the subsidiary in Asia, and to absorb part of the country risk. “This structure provides the central treasury with full control over the credit allocation while leaving enough flexibility to incorporating local specifications,” says Plewe.

“The umbrella credit facility provides the central treasury with full control over the credit allocation while leaving enough flexibility”

Dennis Lampe, Corporate Coverage APAC at Deutsche Bank, adds: “The centralisation of treasury activities of a multinational corporate is a complex project that demands a high degree of automation and standardisation across countries with vastly different regulatory requirements. From a banking perspective, this requires a central coordination approach with a deep understanding of each local market throughout Asia-Pacific.”

Increasing transparency and gaining control

A year has passed since TÜV Rheinland started introducing its new cash management strategy in Asia-Pacific and China. Asked to quantify the benefits from the new central treasury approach, Muet listed the following four improvements:

- standardisation and automation of processes have led to an increase in efficiency and freed up capacity for higher value-added activities;

- reduction of FX conversion margins;

- lower bank fees (fewer accounts and less host-to-host connections);

- increase in controls and IT security and thus reduction of the risk of fraud.

“Even though the new strategy is not yet fully deployed, we already see a considerable increase in efficiency in the way we manage cash and payments in the region. Thus, we consider ourselves as being well equipped for facing a dynamic geopolitical and financial environment,” the treasurer concludes.

Sources

1 See tuv.com

2 See tuv.com

3 See tuv.com

4 See Three key facts on managing liquidity in restricted markets at flow.db.com

5 See Navigating geopolitical risks in treasury at flow.db.com