7 June 2022

The Shanghai-based travel platform Trip.com aims to regain its pre-pandemic growth path. Head of treasury Xuelin Chen tells flow’s Desirée Buchholz about the challenges this creates for her department – and how a project with Deutsche Bank offers both standardisation and digitisation

MINUTES min read

The global travel and tourism sector has been hit hard by the Covid-19 pandemic. In 20201, the virus crisis almost led to a complete standstill of the industry with global revenues collapsing from US$9.2trn in 2019 to US$4.7trn in 2020. The airline sector alone lost 60% of its passengers over the same period2.

With 2021 proving equally challenging, at last there is hope on the horizon: According to research published by the World Travel & Tourism Council in February 2022, the global travel and tourism sector’s contribution to the global economy could reach US$8.6trn this year, which is only 6.4% below pre-pandemic levels3.

Both the slump and recovery are keenly felt by Trip.com Group – one of the world’s largest online travel agencies operating platforms for booking flights, hotels, trains, car rentals and attraction tickets. Founded in 1999 and listed on Nasdaq since 2003, the portfolio of the Shanghai-based tech company includes online platforms like Ctrip, Qunar, Trip.com and Skyscanner, which were experiencing tremendous growth until the pandemic struck4.

While the path to recovery remains bumpy for the whole sector, the company has used the past 12 months to “further [expand] our product offerings and [improve] our content capabilities, which pave the way for our sustainable growth in the longer-term”, said James Liang, Executive Chairman. In 2021, the group’s net revenue increased by 9% to RMB20bn (US$3.1bnx5) – but was still well below its pre-pandemic figure of RMB35.7bn for 2019.

"Whenever the business introduces a new product – which often happens within one or two weeks as we are in the tech space – we need to incorporate this into our treasury processes"

New products and new destinations mean that for Trip.com Group’s corporate treasury department, which is run by Xuelin Chen, requirements are changing quickly. “Treasury follows the operational business. So, whenever the business introduces a new product – which often happens within one or two weeks as we are in the tech space – we need to incorporate this into our treasury processes,” she tells flow.

International expansion presents new challenges

One of the biggest transitions began six years ago, when the travel specialist started to expand its overseas operations through the acquisitions of the global online travel platforms Skyscanner (2016) and Trip.com (2017). Prior to 2016, the company – at that time still known as Ctrip.com – was primarily focused on providing flights, hotels, and entertainment to domestic Chinese customers. Today, the company’s services are offered to clients in 52 countries and over 30 languages via Skyscanner and in 20 languages and 31 local currencies via Trip.com.6

The globalisation strategy meant that the finance department was suddenly confronted with new challenges, Xuelin recalls: “We needed to connect to international banks, but the interfaces are very different compared to what we had known from Chinese banks.” As early as 2008 Trip.com had started to build its own treasury management system (TMS) based on API connectivity with Chinese banks. International banks, on the other hand, were later connected via SWIFT or host-to-host.

The downside of running an inhouse TMS is that the developers are no treasury specialists but rather IT experts, “which means that we need to explain our financial concept to them,” Xuelin adds. “This is still very time-consuming even today.” To complicate matters further, the China domestic business units are run on different systems than the company’s cross-border operations.

Against this background, Xuelin and her team are particularly eager to make use of the latest technology available on the market to standardise and automate treasury processes. “When it comes to payments, our biggest pain point is that we still have to conduct a lot of manual work,” she explains. “As we are operating on different systems, we need to manually move data from one system to another. However, we only have so many people in our treasury department, so we need to make processes more efficient to handle growth.” Pre-pandemic, the travel platforms’ annual cross-border business growth was in double-digit percentages.

Deutsche Bank as digitisation partner

Keen to standardise and automate treasury processes, Trip.com decided to partner with Deutsche Bank in a proof of concept (PoC) in 2021 as part of the “Blue Water Fintech Space” that the Bank had set up in Shanghai in September 20197. “Building on the concept “Innovation-as-a-service”, the idea of this hub is to provide our clients with new ideas for digital treasury transformation leveraging technologies like robotics, artificial intelligence and machine learning,” explains Zhu Yi, Head of Innovation and Digital Solution Cash Management at Deutsche Bank.

"By rolling-out this ‘industry first’ case study for Trip.com, we leverage an innovative data and process mining solution"

In the case of Trip.com the first project was built on process mining – a visual approach to analyse and monitor processes. Using existing historical data, the technology helps to identify pain points in a specific process while also demonstrating the potential time savings a company could reap by removing or optimising these steps. “Hence, process mining provides companies with practical tools to reduce costs and improve efficiency,” Zhu Yi says.

In a first step, Trip.com used this technology to assess its FX payment process from end-to-end and get a clear vision on shortcomings and potential improvements. “We chose this process, as it is less manual than other treasury processes and we had enough historical data with clear time stamps to draw on for the analysis,” explains Trip.com’s Xuelin. This provided a good starting point to learn how process mining works and what the benefits are.

“Deutsche Bank’s digital capabilities are part of a long-term commitment to our clients,” says Chintan Shah, Head of Corporate Cash Management APAC at Deutsche Bank. “By rolling-out this ‘industry first’ case study for Trip.com, we leverage an innovative data and process mining solution to quickly identify client’s key pain points among payment/collection process and opportunities for improvement.” “We are proud to be part of Trip.com treasury automation journey to further cement the foundation in embracing digital economy transformation,” adds Peter Qiu, President of Deutsche Bank China Co., Ltd.

Identifying bottlenecks in the FX payment process

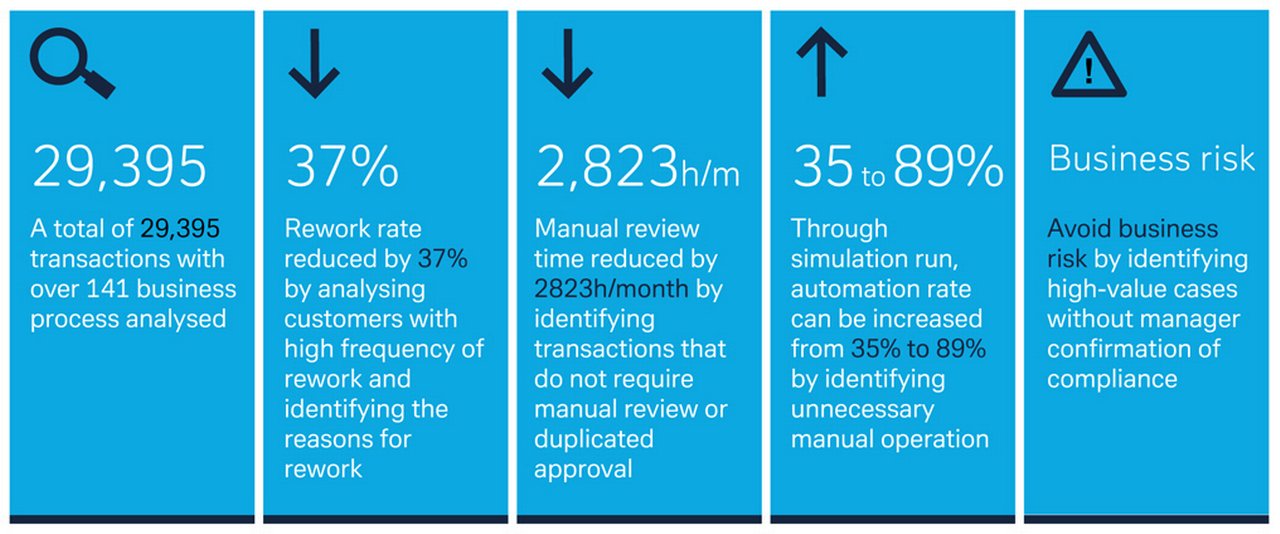

After the company’s treasury team had extracted nearly 30.000 payment data points from their systems, Deutsche Bank’s innovation team used a process mining software to identify bottlenecks and inefficiencies in the FX payment process (see Figure 1).

Figure 1: Scope of process mining at Trip.com

Source: Deutsche Bank

Among the findings was that in addition to the usual control steps, the company had introduced a further check point where data showed the approval quote as 100%. “This step will now be removed as it offers no real control and only slows down the process,” Xuelin reports. “It was very valuable to have Zhu Yi and his team looking at our processes with fresh eyes and challenging the way we do things.”

Moreover, the data analysis showed no consistency in how the tech company interacts with different banks for FX payments, so Trip.com’s treasury department has now started implementing a standardised approach with the business units. This ensures that whenever changes are made on the client-facing payment platforms of the travel agency, the connection to the TMS follows a certain standard. The treasury department is now implementing the changes recommended by the process mining exercise. “I expect efficiency gains to show within the next three months,” says Xuelin.

More tech projects in the pipeline

The cross-border payment process became the starting point for a broader digital treasury transformation project that Trip.com is working on with Deutsche Bank. In a next step, the company already plans to improve domestic payments in China. Another project under review by the treasury department is whether artificial intelligence (AI) can identify accounts receivables which – if proved successful – would help to speed up reconciliation of incoming payments.

"A good treasury needs to hire visionary people and be open-minded for new technology"

“We want to understand how we can incorporate robotics and AI to take our treasury function to the next level,” Xuelin says. “It’s an exciting time to work in corporate treasury as we are seeing so many innovations that will change the way we are working. From my point of view, a good treasury needs to hire visionary people and be open-minded for new technology. This is the key for success.”

Sources

1 See https://bit.ly/3m5irE3 at wttc.org

2 See https://bit.ly/3ziUctX at iata.org

3 See https://bit.ly/3GHBGNf at wttc.org

4 See https://bit.ly/3NhJhVl at trip.com

5 See https://bit.ly/3Mbokdr at trip.com

6 See https://bit.ly/3m8L2IE at trip.com

7 See https://bit.ly/3zerytU at db.com

Corporate Bank solutions Explore more

Find out more about our Corporate Bank solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

Cash management, flow case studies

Boosting treasury in India Boosting treasury in India

German vibrant science and technology company Merck has turned its treasury business in India inside out. Jörg Bermüller tells flow’s Desirée Buchholz how his team reduced FX risks, optimised liquidity and streamlined processes in an award-winning project with Deutsche Bank

Cash Management, flow case studies

Connecting cash Connecting cash

Wieland is a fast-growing German copper and copper alloy specialist. After a series of M&A acquisitions in the US, the treasury team found the successive legacy cash management systems were impeding efficiency. flow’s Desirée Buchholz reports on the turnaround

flow case studies, Cash management {icon-book}

Smart payments for smart cameras Smart payments for smart cameras

Azena, an IoT-based security equipment start-up funded by Germany’s engineering and technology giant Bosch, is revamping its digital payment strategy. flow’s Desirée Buchholz reports on its partnership with Deutsche Bank to improve the customer experience and meet the needs of a fast-growing B2B marketplace