15 January 2025

In the first of two articles, flow’s Clarissa Dann sets out the Indian government’s strategy for increasing its renewable energy capacity, with insights from REC Limited, the country’s prominent “Maharatna” public sector enterprise

MINUTES min read

India, the world’s most populous country, is its third-largest consumer of energy and is in transition from a mainly thermal energy-based economy to one centred around renewable energy. This shift has not only been driven by its commitment to achieve net zero by 2070 under the Paris Agreement,1 but the government’s commitment to attain at least 50% (around 500 gigawatts (GW)) of cumulative electric power installed capacity from non-fossil fuel-based sources by 2030.2

The country has set about reaching its goals via policy, government expenditure and various targeted initiatives. “India's total electricity generation capacity has reached 452.69GW, with renewable energy contributing a significant portion of the overall power mix,” stated India’s Ministry of New and Renewable Energy (MNRE) on 13 November 2024.3 “As of October 2024, renewable energy-based electricity generation capacity stands at 203.18GW, accounting for more than 46.3% of the country's total installed capacity. This marks a major shift in India’s energy landscape, reflecting the country’s growing reliance on cleaner, non-fossil fuel-based energy sources.”

This article sets out the background to India’s renewable energy journey and explains the renewable energy project life cycle and structure. This should be read in advance of the second article covering the financing of renewable energy projects, ‘REC: financing India’s renewable energy strategy (2)’.

“Building renewable energy projects is always a capital-intensive undertaking”

The MNRE anticipates that most ongoing investment will come in the solar and wind sectors – as a tropical country, India is one of the best recipients of solar energy and it estimates the country’s potential at around 748GW, assuming 3% of India’s waste land is covered by solar photovoltaic (PV) modules. “From an energy security perspective, solar is the most secure of all sources since it is abundantly available. Theoretically, a small fraction of the total incident solar energy (if captured effectively) can meet the entire country’s power requirements,” it reports.

Building renewable energy projects is always a capital-intensive undertaking, and private power companies would soon run out of balance sheet capacity if all the projects they sponsored were taken to their own balance sheets, explains Gaurav Khurana, India Sales Head – Trade Finance and Lending at Deutsche Bank. But the Indian government’s involvement in each step of the value chain – by acting as an offtaker, a distribution company (DISCOM) and support provider – means it sets out to absorb risk in the ecosystem and thus encourage private power producers to participate in the renewable energy market with reduced risk. Additional incentives are provided through a combination of policy frameworks such as the National Solar Mission (from the MNRE), and other state and central agencies such as the Solar Energy Corporation of India (SECI)4 that are instrumental in driving renewable energy auctions and capacity additions.

Ongoing challenges

Indian power sector financier REC Limited5 notes that the country’s renewable energy sector, despite its significant growth and ambitious targets, faces several challenges that can impede the pace of its development. These obstacles span across technical, financial, regulatory, and social aspects such as:

- Intermittency and grid stability. Solar and wind energy are intermittent sources of power, meaning they do not provide a constant or predictable supply of energy. This intermittency can cause grid instability and reliability issues, especially as the share of renewables in the energy mix increases. Managing supply and demand fluctuations requires significant investment in energy storage, flexible grid systems, and balancing mechanisms.

- Transmission and distribution (T&D) infrastructure. India’s existing transmission and distribution networks were designed for centralised, fossil-fuel-based power generation. Renewable energy, especially solar and wind, is often generated in remote areas far from major demand centres. This creates a mismatch between power generation locations and consumption centres.

- Land acquisition and environmental concerns. Large-scale renewable energy projects, such as solar parks and wind farms, require significant land. In India, and land acquisition can be a complex, time-consuming process due to regulatory hurdles, community resistance, and environmental concerns.

- Technological challenges. The renewable energy sector is still evolving, and certain technologies –such as offshore wind, green hydrogen, and advanced energy storage solutions – are not yet fully commercialised or require significant development. Research and development (R&D) investments, along with government support for pilot projects and commercialisation of emerging technologies, can accelerate innovation and reduce costs over time.

- Energy storage limitations. While energy storage solutions are essential for balancing intermittent renewable energy generation, current storage technologies, especially batteries, still have limitations in terms of capacity, efficiency, and cost.

The company calculates “based on the targets and the investment estimates for renewable energy generation, energy storage, grid energy in India by 2030 under the 14th National Electricity Plan could range from US$450bn to US$500bn”.

Renewable project life cycle and structure

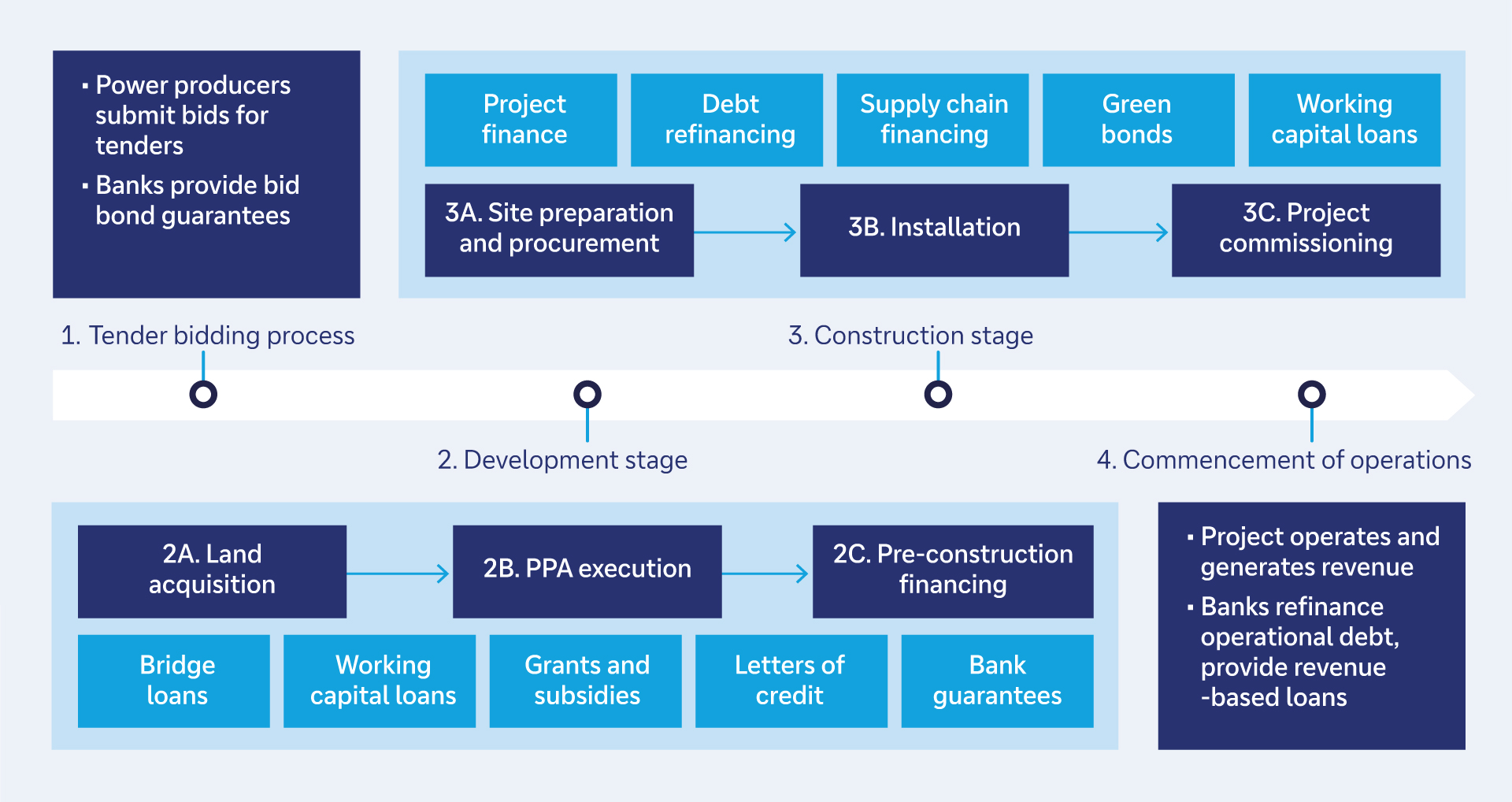

A typical timeline for a renewable energy project is around 25 years with different financing products deployed at each critical stage. See Figure 1.

Figure 1: Stages of a renewable energy project alongside financing products used in each stage

Source: Deutsche Bank

- Tender bidding process

The government comes up with tenders for power projects in various locations and with different levels of output. The tender submission is for the price at which each unit of power will be sold during operation stage. It is at this stage that a bank will support with a bid bond guarantee as part of the documentation required for tender submission. And it is here that the relationship between the bank and the power producers commences.

Then the nodal agencies open the bids submitted by various power producers and announce the outcome. This awards the tender to the preferred bidder. After the award is made, the designated land upon which the project will be constructed is provided to the power producer to start the construction. - Development stage

Power purchase agreements (PPAs) are signed between the power producer and the offtaker. This obliges the offtaker to purchase an agreed amount of power at a pre-determined price, helping to manage the price and volume risk of the project once it is successfully completed. It assists the power producer with a stable stream of cashflows against the power supplies made under the PPA. - Construction stage

This is the point at which the project owner/power producer secures the bridge funding required to execute the project in line with the timelines. The project owner would approach banks such as Deutsche Bank to provide credit limits to meet the requirements across bank guarantees, letters of credit, term loans etc. This is a pivotal part of the mix as it involves the construction, and the risk is very high. - Commencement of operations

Technical feasibility is assessed after the construction is completed and once the plant is found fit for use, the operations stage begins where power starts getting generated. The long-term project finance is raised to pay out the pre-construction loan in this stage, but it can also be raised at the 60%–70% construction completion stage. This timeline is around 25 years and project finance is used to repay the pre-operation lending (see above).

Risks that lenders assess include:

- Failure to obtain necessary and approvals at the tender process.

- Delays, cost overruns, technological or design faults, geopolitical risk and possible regulatory risk at the construction stage.

- Debt tie-up and credit risk of the off-takers – i.e. the prospective purchasers/distributors of the power.

Given all of this, the value chain of renewable energy projects is mainly quite robust. How does this look like in practice at REC? Read our second article REC: financing India’s renewable energy strategy to find out more.

Sources

1 See pib.gov.in

2 See powermin.gov.in

3 See pib.gov.in

4 See seci.co.in

5 See recindia.nic.in