13 May 2024

Growing non-oil revenues and deploying oil wealth for infrastructure investment around the world has been part of the Gulf Cooperation Council countries’ strategy in the Middle East for some years. flow’s Clarissa Dann reports on the new opportunities for investors and lenders

MINUTES min read

“To reimagine the future, we must be open to new possibilities. Join us on a journey to 2071. Pioneer new worlds and ways of living and return to shape today’s world for the better.” This is the invitation from Dubai’s Museum of the Future, where visitors can “explore near-future technologies from the world’s leading innovators”.

This tourist attraction is a good example of how the wider Gulf Cooperation Council (GCC) region is no longer content to sit on its hydrocarbon laurels. The region is blessed with deep natural resources and some of the largest sovereign wealth funds in the world, and its sights are firmly set on the future. This means growing non-oil revenues and deploying oil wealth to invest in huge infrastructure projects such as Saudia Arabia’s US$500bn NEOM (a special economic zone in Saudi Arabia that aims to create a zero-carbon, circular economy and a living laboratory for entrepreneurship),1 and in fintech. As the Middle East Institute pointed out in 2021, “as almost half of the 400 million people in the region are under the age of 25 years, we believe the push for digital-first solutions across sectors like payments, banking, and lending will continue to surge.”2

Given the backdrop of diversification from oil revenues, huge sovereign wealth funds, clean energy initiatives and ongoing geopolitical tensions, this article examines what this means for trade and supply chain flows, and the region’s continued attractiveness to investors.

Museum of the Future, Dubai (photo © Deutsche Bank)

Growth of the GCC

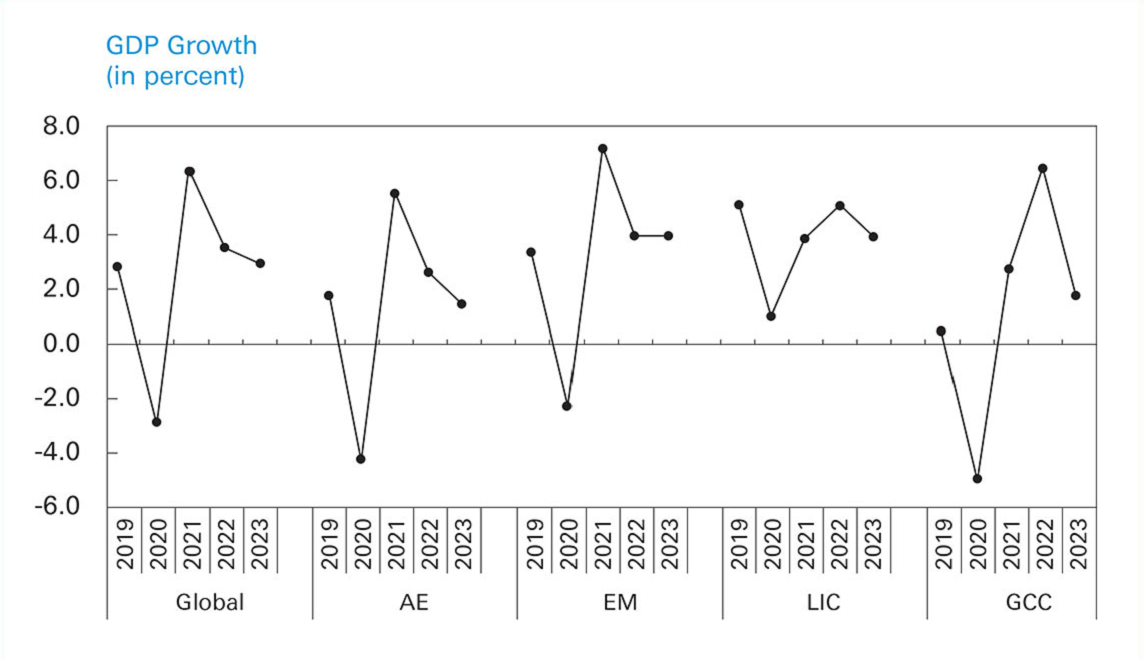

Headquartered in Riyadh, the GCC trade bloc comprises Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE). Decades of petroleum revenues, combined with a boom in oil and natural gas revenues, underpin the region’s building and investment surge – and it now comprises some of the fastest-growing economies in the world. Figure 1 sets out the region’s gross domestic product (GDP) growth compared with those of advanced economies, emerging markets and low-income countries (note the negative areas of the chart related to the Covid-19 pandemic).

“The UAE and Saudi banking systems are poised to continue their growth above the rest of the region, with strong credit demand led by a dynamic non-oil sector and economic diversification programs. We also expect credit growth in Oman to remain robust,” noted S&P Global in January 2024.3

GCC countries, the IMF Country Report No 23/413 points out, have set out ambitious reform agendas – as shown in the government initiatives Saudi Vision 2030, We the UAE 2031, Oman Vision 2040 and Qatar National Vision 2030. Implementation has been progressing well and has accelerated after the pandemic. The main areas of progress are social and business-friendly reforms, efforts to enhance fiscal sustainability and resilience, investments in strategic industries and digital and green infrastructure. Going forward, stepped-up implementation of these reforms will be critical to enhance productivity, diversify economies, and prepare for the energy transition.”4

Figure 1: Relative GDP growth (%) of GCC countries

Sources: Bloomberg L.P., International Energy Agency (IEA), Haver Analytics, and IMF staff calculations. GCC PMI reflects simple average of Qatar, Saudi Arabia, and the UAE. AE=Advance economies; EM=Emerging markets; LIC=Low-income countries

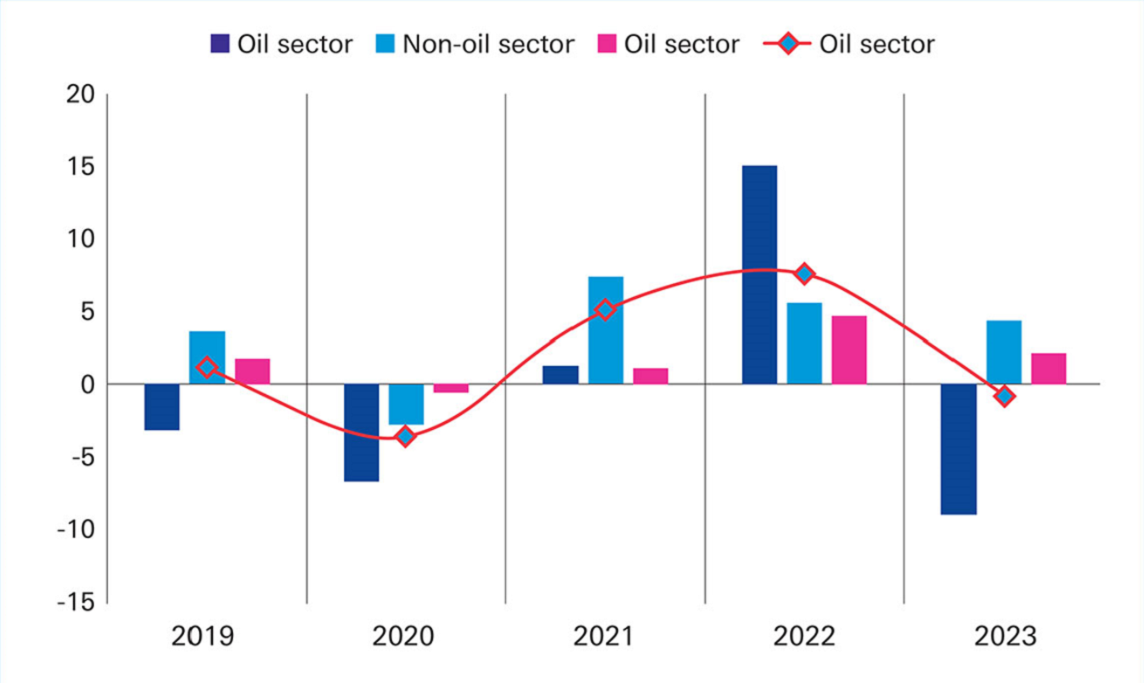

Deutsche Bank Research anticipates that Saudi Arabia’s growth (anticipated to rebound at around 2.4% for 2024. Albeit the carry-over effect of oil production cuts announced in mid-2023 will likely continue to weigh on growth in 2024, economic activity will continue to be supported by sizeable investments aimed at diversifying the economy. Non-oil economic activity “should continue to benefit from large-scale investments under the Vision 2030 agenda,” said economist Samira Kalla in her report, Saudi Arabia: an economic renaissance amid global challenges.5

Figure 2: Saudi Arabia 2023 growth affected by lower oil activity, but non-oil sector remains robust

Source: Haver Analytics and Deutsche Bank

Saudi Arabia’s moderate level of debt (26% of GDP in 2023), and other positive factors such as fiscal prudence and a favourable oil environment have, adds Kalla, “helped improve the country’s credit rating and wider investor sentiment” – evidenced by successful bond issuances in 2024.

"Saudi Arabia has a lot of money going into diversified interests outside of oil"

The wider GCC region is rich in liquidity, with sovereign wealth funds investing their oil money in businesses offshore. “Look at Saudi Arabia – now it is hosting the World Cup 2034, it will be building stadiums, more hotels and the infrastructure around this. They are investing in the core franchise and have bought football clubs – so, this is a lot of money going into diversified interests outside of oil,” says Kees Hoving, Head of Corporate Bank Coverage MEA at Deutsche Bank.

Energy transition and infrastructure

As the region implements policies to increase non-oil revenues, it is putting in place large projects boosting the wholesale, retail trade, construction, utilities (e.g. water purification and renewable energy) and transportation sectors. These are attracting private investment as well as lending.

Vikas Arora, Head of RTM, UAE and Saudi Arabia Corporate Coverage, works with global corporate clients that have subsidiaries in the region. “As the region seeks to generate more non-oil-related revenues, we are seeing large projects in the renewable energy space, in addition to the massive infrastructure build-out in Saudi Arabia to attract more tourists to the country,” he explains. “As an outcome, key EPC (engineering, procurement and construction) companies are winning large projects and needing banking services.” These include not only project finance but also transactional requirements around trade finance, FX and cash management/payments.

“Key EPC companies are winning large projects in Saudi Arabia and need banking services.”

Responsible development is a key focus of GCC member governments, and the wider ESG impact of infrastructure development and energy transition is a key theme of the Future Investment Initiative (FII) Institute, with its Riyadh 2023 summit dubbed “Davos in the Desert.” Established in October 2019, its agenda is: “Impact on Humanity. Global, inclusive and committed to environmental, social and governance (ESG) principles.”6 For Deutsche Bank’s Kees Hoving, the FII (which has more than 5,000 participants) “is an excellent conference to meet many clients and other stakeholders and to learn about the latest developments in, for example, technology, energy and healthcare”.

Diversifying supply chains

The UAE has functioned as a regional hub for subsidiary businesses of large corporates – an advantage that positions them well for the entire Middle East and the African continent. GCC countries have, by deploying local content policies, upgraded to logistics and technology infrastructure along with investment promotion reforms to encourage foreign direct investment (FDI) and keep supply chains localised where possible.

One example of how diversification away from hydrocarbons has spawned a new industry is Saudi Arabia’s burgeoning coffee exports. In 2022, the Kingdom launched the Saudi Coffee Company as part of a US$320m investment to develop its national coffee industry and boost production from 300 to 2,500 tons per year.7

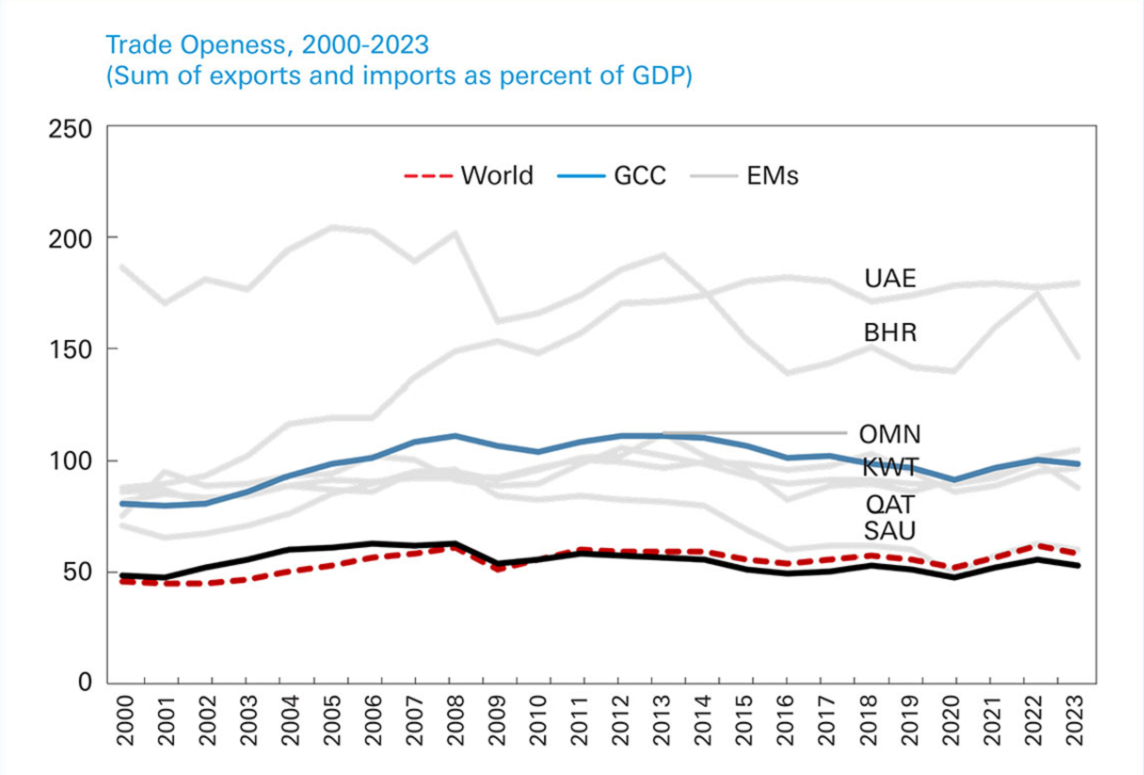

Figure 3: Trade openness 2000–2023

Source: World Economic Outlook, UNCTAD, and IMF staff calculations.

GCC trade and openness indicators improved in 2022 (see Figure 3), supported by the negotiation of free trade agreements and regional initiatives. On 1 January 2024, the UAE, Saudi Arabia, Egypt, Iran and Ethiopia joined the BRICS bloc, doubling the original membership of Brazil, Russia, India, China and South Africa and renaming the bloc BRICS+. “With two top oil producers — UAE and Saudi Arabia, the bloc gained power and influence in the world for multilateral trade developments,” noted a UAE newswire.8

Digitalisation and fintech centres

Fintech Saudi was launched in 2018 by the Saudi Central Bank and the Capital Market Authority to promote fintech industry growth in the Kingdom. As explained in Saudi Vision 2030, this is to position it as “a leading fintech hub by building a strong and responsible ecosystem that includes banks, investors, companies, and government institutions”. Initiatives have included workshops and training for students, investors, corporates and banks – as well as support for SMEs.

"The countries in the GCC region are making tangible efforts to ensure their targeted economic and financial reforms happen"

“The UAE’s drive to develop its financial capital markets extends beyond the traditional asset classes and into the new economies that are underpinned by financial technologies – the region has taken strides to position itself as a hub for an end-to-end ecosystem for digital and virtual assets,” says Hammad Izz-Hamid, Head of Securities Services, Middle East, at Deutsche Bank. He cites the establishment of the Abu Dhabi Global Market (ADGM) regulatory framework in 2018 and Dubai’s Virtual Assets Regulatory Authority (VARA) in February 2022. “By establishing a legal framework for businesses related to virtual assets including crypto assets and non-fungible tokens (NFTs), this landmark law reflects Dubai’s vision to become one of the leading jurisdictions for entrepreneurs and investors in blockchain technology,” noted US legal journal the National Law Review on 7 April 2022.9 In addition, VARA has also pioneered its MetavHQ, becoming the world’s first regulator to venture into the metaverse.

Capital markets and investor behaviour

“The countries in the GCC region are making tangible efforts to ensure their targeted economic and financial reforms happen, and they are achieving the goals in their respective visions – this is leading to diversification in various economies on varied fronts, be it Saudi Arabia and UAE that make the headline news or in the likes of Oman that is also taking meaningful steps,” continues Deutsche Bank’s Izz-Hamid. Together with the focused strategy of governments and regulators to pivot growth on the back of economic diversification and fiscal discipline with significant regulatory reform, the approach has “eased access to financial markets, upgraded market infrastructure, and paved the way to attract capital portfolio flows,” he adds. The collective stock market capitalisation of Middle Eastern markets surged past US$4.5trn in March 2024.10

In March 2022, the Saudi Tadawul Group announced several modifications to its post-trade infrastructure to help attract further international investment into the Kingdom – summarised in flow 2022.11

Multiple areas of investment are opening up, whether it be in hospitality, tourism, travel or infrastructure, different workstreams are being created. There are new trading hubs (for example, the Dubai International Financial Centre (DIFC) is positioning Dubai as a future global hub for hedge funds)12 and a focus on privatisation. Such privatisation means that government entities, and even smaller private enterprises, are launching initial public offerings (IPOs) not only in Saudi Arabia and the UAE but also in Oman and Qatar, evidenced by lower values per offering – in 2023, the GCC region raised US$10.6bn in IPO proceeds through 47 offerings, compared with US$22.9bn through 48 offerings in 2022.13

Capital is flowing two ways with these IPOs, explains Izz-Hamid – generating interest from international investors in GCC growth on the one hand and presenting selective investment opportunities for state-owned enterprises as part of their broader economic diversification agenda, increasingly looking towards Asian markets. “This is really interesting for Deutsche Bank, both as a service provider and as an adviser, being well positioned to bridge the portfolio and investment flow corridors between the Middle East and international markets, supported by its wide network and significant market expertise,” he reflects. For example, the bank was the sole financial adviser to China’s Dalian Wanda on a US$8.3bn investment for a 60% stake in Newland Commercial Management from a group of investors led by private equity firm PAG – most of the consortium being from the Middle East.14

The investor profile and investment interest traffic is progressively broad-based and diverse in the Middle East; with asset managers such as institutional mutual and hedge funds, as well as sovereign wealth funds, private banks and family offices, reflecting well on the region as a capital source and an avenue for capital deployment.

In turn, wealthy families and conglomerates have set up in the Gulf, bringing with them their wealth management needs. Assets under management in 2022 grew more rapidly in the UAE than in any other booking centre, noted the Boston Consulting Group in Global Wealth Report 2023: Resetting the Course. “The UAE has gained respect in recent years here as a booking centre that provides an attractive playing field for banks and investors alike,” it reflected.

Regional outlook

GCC countries are not only well on their way towards their goals of diversification from hydrocarbons and fintech hub status but are well placed to use the same vision and capital that metamorphosed Dubai from a small trading centre almost five decades ago to what is now a US$60bn economy. “This economic expansion is consistent with the goals of the Dubai Economic Agenda D33 to double Gross Domestic Product (GDP) growth over the next decade and consolidate the emirate’s position as one of the world’s top three urban economies,” Sheikh Hamdan bin Mohammed, Crown Prince of Dubai commented in 2023.15

And it is not going to stop there.

Sources

1 See neom.com

2 See mei.edu

3 See spglobal.com

4 See imf.org

5 Published by Deutsche Bank Research 26 March 2024

6 See fii-institute.org

7 See comunicaffe.com

8 See khaleejtimes.com

9 See natlawreview.com

10 See economymiddleeast.com

11 See "Saudi Arabia’s new capital markets infrastructure" - flow article

12 See difc.ae

13 See markaz.com

14 See reuters.com

15 See forbesmiddleeast.com