23 November 2023

Market liberalisation, digitalisation and settlement compression were among some of the main themes discussed at the 2023 Network Forum (TNF) Middle East Meeting in Muscat. flow provides a summary along with insights of what is impacting post-trade in the Gulf Cooperation Countries

MINUTES min read

After the success of the TNF Middle East Meeting in Abu Dhabi in 2022, the event returned to Muscat, Oman on 9–10 October for the first time since 2019. Attended by more than 100 industry experts from leading custodians, buy-side firms, technology companies, international and local financial market infrastructures (FMIs), TNF took place at the Al Bustan Palace hotel, where the atmosphere was buzzing, not least because the venue was full of foreign ministers and senior political leaders attending the 27th Gulf Co-operation Council (GCC) – EU Joint Council and Ministerial Meeting.1

GCC economies lead the charge

Unlike many other global markets which are facing protracted economic recoveries, the GCC is thriving. Rising oil prices have facilitated growth across several of the major GCC markets such as the United Arab Emirates (UAE), although a rebound in tourism and positive spill-overs from the 2022 World Cup in Qatar have also helped. While oil prices are healthy now, GCC markets are still trying to diversify their economies away from hydrocarbons, with several, including Oman, increasingly prioritising sustainable infrastructure projects, according to Deutsche Bank Research’s CEEMEA Macro & Strategy Weekly report.2

“The energy price spike has helped GCC economies generate surpluses and weather various crises”

This outlook was developed by TNF speakers in Muscat. “The energy price spike has helped GCC economies generate surpluses and weather various crises, but the leadership is still staying the course and pursuing a policy of economic diversification,” said Hammad Izz-Hamid, Head of Securities Services, Middle East & Africa, Deutsche Bank, speaking on a TNF panel on day one titled ‘Will we see more cross border investment in GCC markets and what are the agent bank/provider & regulatory requirements required?’ alongside Rainer Kasch, Head of KSA Securities Services , First Abu Dhabi Bank; Mohamed Kassem, Securities Services Head for Saudi Arabia and Gulf Cluster, Citi; and Alex Krunic, Advisor to the Chairman, Commercial Bank of Kuwait – Al Tijari.

Panelists on: ‘Will we see more cross border investment in GCC markets and what are the agent bank/provider and regulatory requirements required?’. Left to right: Alex Krunic, Commercial Bank of Kuwait; Hammad Izz-Hamid, Deutsche Bank; Rainer Kasch, First Abu Dhabi Bank; and Mohamed Kassem, Citi

GCC primary markets go from strength to strength

In marked contrast to other regions where listings have been far and few between, the GCC’s primary markets are booming, buoyed by a steady supply of initial public offerings (IPOs). For instance, Middle East IPOs raised mor than US$23bn from 48 listings in 2022, versus US$7.52bn from 20 IPOs in 2021.3 During Q1 of 2023, IPOs in Abu Dhabi alone raised US$3bn, and accounted for 14% of all global listings.4 In fact, TNF coincided with the closing of the largest ever listing in Oman, OQ Gas Networks, in what one speaker said would add US$748.6m5 to the market capitalisation of Muscat’s Stock Exchange.

A TNF audience poll found 50% of people believed Saudi Arabia would become the next major global market. Kasch said there are currently 23 IPOs in the pipeline in Saudi Arabia, while a further 73 are being evaluated. Izz-Hamid added there is no reason why Saudi Arabia will not become a leading capital market in the next few years. “Saudi Arabia is home to one of the largest pools of natural resources in the world and has some of the largest sovereign wealth funds. We expect to see a lot of inward investment coming into the country and a lot of overseas investment going out,” he continued.

Liberalising measures continue to gain momentum

Capital market reforms have been ongoing for more than a decade in the GCC. In addition to making it easier for foreign investors to access their markets (i.e. lifting of foreign ownership restrictions, simplification of account opening processes, introduction of Euroclearability channels for fixed income products, etc.) a number of GCC economies have also rolled out new investment products and tools.

Speaking to flow during TNF, Fawaz Mohanna, Head of Securities Services for Saudi Arabia, Deutsche Bank, said Saudi Arabia has launched derivatives products, including single stock futures, and announced single stock options on 29 October.6 The rule changes come not long after Saudi Arabia’s regulator permitted securities lending, securities borrowing and covered short-selling.

Cross-border connectivity schemes are accelerating in the region too.

On a panel titled ‘Regional CSD Activity in the region: Different models in different markets. With the drive to innovation, what collaborative methods are required to work with the regulators?’, speakers discussed the Tabadul Digital Exchange scheme, which lets investors in Abu Dhabi, Bahrain, Oman and Kazakhstan trade on each other’s stock exchanges via local brokers. More markets are expected to join the Tabadul, with one speaker telling TNF that talks are happening with 11 other exchanges in the Middle East, Asia and Europe about possible membership of the scheme. “This marks the beginning of an exciting new chapter, and we are determined to enhance market efficiency and foster economic growth on a global scale,” said Abdulla Salem Al Nuaimi, CEO at Abu Dhabi Securities Exchange (ADX).7

Although these initiatives in the GCC are bold, Deutsche Bank’s Izz-Hamid said the region should take inspiration from what is happening in Latin America, where the stock exchanges of Chile, Colombia and Peru are consolidating into a single holding company, allowing an issuer listed in one country to be traded across all three.8 While regional consolidation of exchanges and other financial market infrastructures (FMIs) can improve liquidity across participatory countries, achieving consensus on these schemes is often fraught with difficulty.

However, familiar issues were raised during TNF about some of the frictions encountered by foreign investors when opening accounts in multiple GCC markets. “The pain-points here are the documentation requirements for each of the GCC markets when obtaining a National Investor Number (NIN). Until we get sharing of know-your-customer (KYC) data across these markets, then account openings will continue to be a complex process. Saudi Arabia has also unveiled a data localisation rule, which means you cannot transfer data cross-border, and this is causing problems too,” stressed Kasch.

The Middle East and the move to T+1

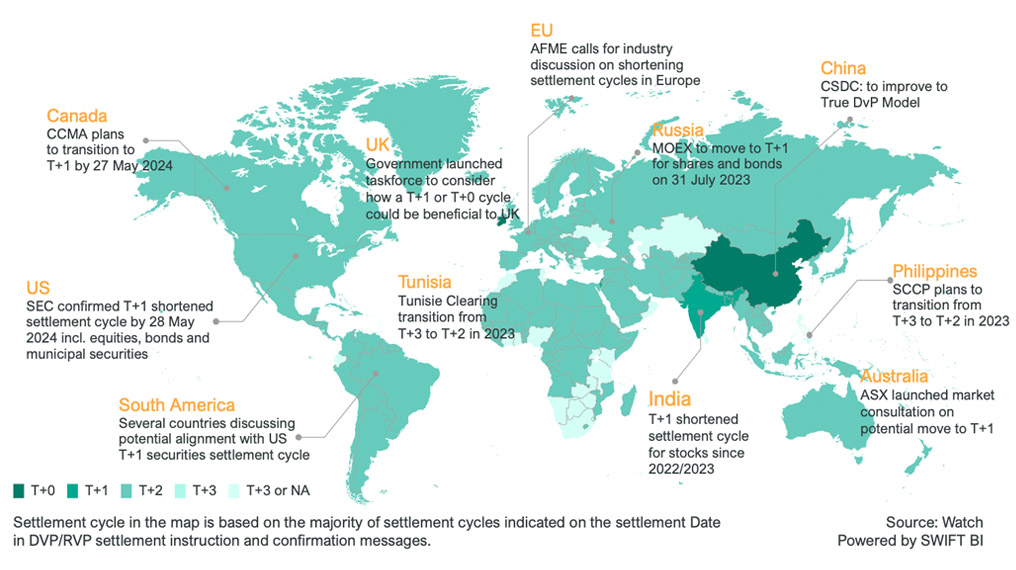

Similar to the rest of the world, the North American (and possibly eventually the EU and UK) transition to T+1 will have permutations for the Middle East. While T+1 has plenty of benefits (i.e. scope for capital and liquidity savings), others believe it will result in increased fails, and possible cash penalties. See Figure 1.

Figure 1: Global equities settlement cycles

Source: Watch Powered by Swift BI

On the panel, A Global View on T+1 and possible implications for the Middle East, Jennie Baisch, Securities Expert, Go-to-Market at Swift, reminded delegates that most large markets are operating at T+2, but major equity markets are moving towards or exploring feasibility of accelerated settlement (see Figure 1). The panel reflected that operating out of distant time zones and with less time to carry out post-trade processing, T+1 could cause problems in certain markets, in areas such as FX, securities lending, corporate actions and cross-border settlements of global depository receipts, exchange traded funds, and dual listed securities.

Jennie Baisch, Securities Expert, Go-to-Market at Swift explains the benefits of the Unique Transaction Identifier to mitigate settlement fails in the current settlement compression climate

Speaking to flow, Jim Micklethwaite, Managing Director, Financial Markets at Thomas Murray (providers of data, risk assessments and analytics on global capital markets and financial counterparties), said Middle Eastern markets may face some challenges if they were to follow a global transition to T+1. “Several markets in the Middle East have operated at T+2 for many years in line with the optimal conditions for foreign investors given the T+2 FX market, widespread lack of pre-settlement process automation, not to mention the inherent barrier of time zone differences between clients and local settlement operations. The notable exception was Saudi Arabia, which previously operated on T+0, but adopted T+2 to facilitate foreign investment as part of their economic diversification plans. Like many emerging markets GCC countries will need to evaluate the cost-benefit of T+1, particularly for foreign investment flows, and whether this could be an enabler to drive more efficient post-trade processes”, noted Micklethwaite. Although some regulators in the region are probably discussing the impact of T+1’s roll-out in North America on the Middle East, no GCC market has yet to confirm that it will adopt T+1.

Nonetheless, Baisch urged more institutions to leverage the Unique Transaction Identifier (UTI), a unique alpha numeric code that is assigned to a securities trade, enabling for trades to be tracked from end to end throughout the whole settlement lifecycle. By incorporating the UTI into the settlement process, counterparties will be able to identify operational risks or problems during the transaction lifecycle, helping them to avert potential fails, as highlighted in the flow special white paper Breaking the settlement failure chain.

Leading the way on digital

Digitalisation has been a dominant theme at TNFs for several years now. Whereas before, a lot of the conversations in the industry about innovation were very much hypothetical and orientated around speculative proofs of concepts, the industry has since matured and is starting to see tangible results.

Panelists on: ‘Innovation in the spotlight’. Left to right: Bernard Ferran, Euroclear; Manoj Aidasani, Deutsche Bank; Seamus Donoghue, Metaco; Gunsal Topbas, Citi; and Ahmad Naseer, First Abu Dhabi Bank

“In the last year, Euroclear has built a distributed ledger technology (DLT)-based issuance platform, and it is now in production. It is available to issuers who want to undertake issuances digitally. At the same time, we need to take a measured approach with the technology, to ensure the digital issuances can be converted into the current Euroclear system. This means investors have a choice and can choose which platform to use whether it be digital or traditional,” said Bernard Ferran, Chief Commercial Officer at Euroclear, speaking on a panel titled Innovation in the spotlight, alongside Manoj Aidasani, Head of Securities Services, GCC, Deutsche Bank; Ahmad Naseer, Head of Product Development and UAE Securities, First Abu Dhabi Bank; Seamus Donoghue, Chief Growth Officer, Metaco; and Gunsel Topbas, Managing Director, Citi.

“We have seen more demand in the industry for providers to start supporting these new digital asset classes”

Custodians are also taking action. Following the sudden collapse of FTX in 2022, institutional investors have been repeatedly calling for regulated custodian banks to start servicing digital assets, including crypto-currencies. “We have seen more demand in the industry for providers to start supporting these new digital asset classes. As an institution, we are looking to provide digital asset custody for selected crypto-currencies and Stablecoins, and we will offer this service to our institutional and corporate clients. We have applied for a digital asset custody license from BAFIN in Germany,” explained Aidasani.

Inroads on digitalisation are being made in the GCC. Aidasani said DLT-enabled non-fungible tokens (NFTs) and smart contracts could play a meaningful role in helping to settle money market instruments in Saudi Arabia (a point he has elaborated on in the flow article, Dawn of a Saudi Securities Services solution). In Saudi Arabia, money market instruments are traded OTC and the settlement process is inefficient. This is because the current settlement model restricts the role of custodians to that of record-keeping, cash transfers and reporting, thereby contributing to payment delays. By leveraging this technology, it could facilitate better post-trade settlement efficiency for OTC securities, he added.

For digital assets to become more widely accepted, regulators need to be on board too. Aidasani noted that Dubai has made progress here. For example, the Virtual Assets and Related Activities Regulations 2023 stipulates that the digital assets industry be overseen by a new regulatory body, the Virtual Assets Regulatory Authority (VARA).9 Other countries in the region are likely to follow Dubai’s lead. One speaker said Oman’s Capital Market Authority (CMA) is currently consulting on a regulatory framework to supervise virtual assets and virtual asset service providers. The CMA said, “The proposed new regulatory framework is envisaged to cover activities such as crypto assets, tokens, crypto exchanges, and initial coin offerings, among others. The regulation for virtual assets in Oman is important as it will provide a clear and secure framework for the growth of the virtual assets industry.”10

Until 2024….

As an investment destination, the GCC is becoming more popular. Although many of the GCC economies are currently being shielded from the global volatility by high oil prices, the region's leadership is not losing its reform zeal. “Since I have been visiting the GCC, the changes I have seen over the years have been nothing short of remarkable. As recently as 10 years ago, investors were unable to access Saudi equities, and look where we are today. Events such as TNF bring together global financial institutions and local market participants to share best practices and ideas, and these encounters shape the market changes we are seeing today,” concluded Andrew Barman, TNF MD.

The Network Forum Middle East Meeting 2023 was held in Muscat, Oman, 8–9 October 2023

Sources

1 See consilium.europa.eu

2 Deutsche Bank Research, Emerging Europe Middle East Sub-Saharan Africa, CEEMEA Macro & Strategy Weekly (13 October 2023)

3 See thenationalnews.com

4 See thenationalnews.com

5 See bloomberg.com

6 See arabnews.com

7 See aix.kz

8 See worldmarketsdaily.com

9 See vara.ae

10 See cma.gov.om