19 July 2023

Digitalisation and changes to the network management operating model were among the key themes to emerge from The Network Forum (TNF) Annual Meeting 2023 in Athens.flow’s Clarissa Dann reports on the conversations

MINUTES min read

When its Managing Director, Andrew Barman opened the main proceedings of The Network Forum’s (TNF) Annual Meeting 2023 in Athens, he remarked on the cyclical nature of the industry and the custody community. “We were here in Athens four years ago – and the Annual Meeting, which was planned for Warsaw this year, once again had to be moved due to ongoing market concerns with the conflict in neighbouring Ukraine”.

But this curated community of custody and post-trade professionals is accustomed to Black Swan events – not just from the pandemic – the joyous post-Covid reunion in London last year was punctuated by a fire alarm, and the Hong Kong meeting in 2019 was held against a backdrop of riots.

Around 400 network managers, chief operating officers, direct custody providers, central securities depositaries and fintech innovators descended on the Athenian Riviera, just up the coast from the ancient Temple of Poseidon at Sounion.

Yianos Kontopoulos, CEO, ATHEX, summarises Greece's consistent substantial economic growth

A modern odyssey

Turning the focus from circa 700 BC to the past eight years, the event’s local host, Yianos Kontopoulos (pictured above), CEO of the ATHEX – the MiFID II licensed Market Operator of the Hellenic Capital Market (part of the AthexGroup), reflected on Greece's return to consistent substantial economic growth. He pointed out that it was ranked by the Economist Intelligence Unit (EIU) Business Environment rankings for Q4 2022 as the most improved economy out of 82 countries from 2019 to 2022. The EIU had commented that Greece’s 16-place rise “reflects its poor starting point, given a long-delayed recovery from the government debt crisis that began in 2009,1 but also the impact of a pro-business majority government that has undertaken reforms, cut taxes and restored confidence in the country”.2

Unlike other areas of the eurozone grappling with recession and inflation, Greece’s economy is projected to grow by 2.4% in 2023, and its headline inflation figure is expected to drop from 9.3% in 2022 to 2.4% by 2024 as energy prices continue to ease, added Kontopoulos.

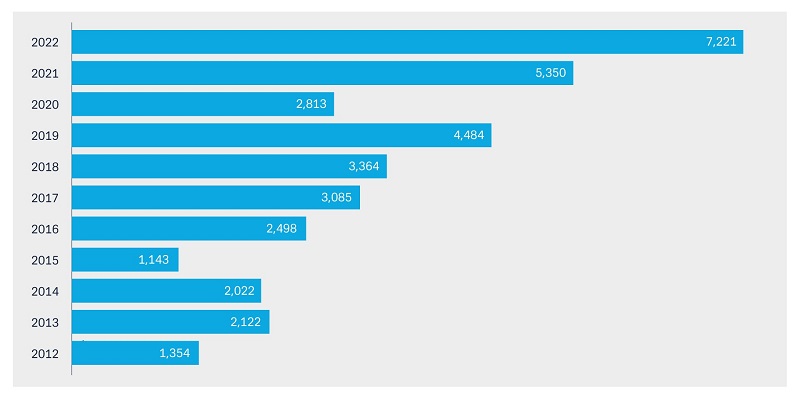

It marks a major turnaround from the dark days of 2015, when Greece’s ballooning debt pile resulted in its credit rating being downgraded to junk status. Reforms implemented since then, however, have paid off, and are improving the country’s long-term business and investment outlook. This has resulted in strong inbound capital flows, said Kontopoulos. “The future looks good, and the growth of Greek capital markets is tangible and remarkable”, he concluded – a point echoed by parent company AthexGroup’s Chief Operating Officer, Nikolaos Porfyris in a networking event later that day. Porfyris also distributed an ATHEX presentation, highlighting investor interest in Greece. “Net Foreign Investment flows in Greece for 2022 amounted to €7.2bn, the highest since 2002, confirming the upward trend course of the Greek economy,” he said. See Figure 1.

Figure 1: Net foreign direct investment (FDI) flows – Greece

Source: ATHEX Group and Bank of Greece

A panellist from the ‘Operational resilience and crisis management’ session that followed this welcome address observed that the word “crisis” comes from the Greek “krisis”, which means “judgement and decision”. When faced with a crisis “you really do need to have sound judgement and good decision-making”. This set the scene for consensus on the importance of “knowing the network”, trusting one’s instincts and being certain who the underlying custodian is.

Third-party risk management

Network management is a role that rarely stays still, and invitees to the Network Manager Only discussion day on 20 June agreed, one constantly being shaped by changing macro dynamics, regulation, and the emergence of new risks. Discussion covered how to prepare better for political/macro-economic disruption in the custodian network and the scope available for industry-wide alignment and communication between network management teams, particularly now that FX is becoming more of a common oversight space within network managers.

Speaking to flow during TNF, Sharon Hunt, Global Head of Network Management at Deutsche Bank, said regulatory guidance issued by the Federal Reserve and other agencies including the UK’s Prudential Regulation Authority (PRA) detailing how banks should approach third party risk management, “could have a transformative impact on network”.

The Fed’s guidance, for example, covers various third-party risk management practices, including planning, due diligence and selection, contract negotiation, ongoing monitoring and termination.3

“Regulators are expecting banks to manage all of their third parties consistently”

“We are going through a journey of incorporating financial institutions which include sub-custodians, cash correspondent banks and financial market infrastructures (FMIs) to existing third-party vendor management policies, which network management never had to do before,” said Hunt “While network managers have always had robust selection and due diligence processes, traditional vendor management systems are very different, but the regulators are driving change.”

This is likely to force network managers to ramp up their due diligence on providers even further. To comply with the new guidance, Hunt said the Association for Financial Markets in Europe’s (AFME) Due Diligence Questionnaire (DDQ),4 a standardised due diligence template, might need to be expanded.

“The AFME DDQ could become an AFME DDQ plus, with more questions being inserted to cover domains such as cyber-security and Infosec,” commented Hunt. “These themes are areas of intense focus in vendor management policies. The approach should not be to add these questions individually, but to go back to AFME and enhance the questionnaire collectively, as an industry.”

These increased requirements into the AFME DDQ are likely to frustrate agent banks. While the AFME DDQ was originally designed to standardise and streamline due diligences, critics point out that network managers are now continuously adding their own customised questions into the document, which is making life complicated for agent banks. Maintaining alignment to an appropriately enhanced industry standardised model would deliver efficiency and confidence in response.

One expert, speaking on a panel titled “Due Diligence Updates – Automation, DDQ interoperability, and Standardisation for the Market” (21 June) – suggested AFME should hire a technical author to comb through the questionnaire and edit it down to something more bite-sized. “If you remove around a third of the AFME DDQ questions, then it will become more manageable,” said the expert.

The KYC dual carriageway

Returning to the theme of Know-your-customer (KYC) that underpinned many of the discussions at TNF, dealing with uncertainty highlighted how KYC is much more of a shared responsibility than before.

Recent geopolitical events could be a driver behind the volume and detail agent banks are requesting from their clients.

“The incoming volume of KYC requests that network managers are receiving from agent banks has considerably increased, as has the content,” said Hunt. “Agents require information about the underlying transaction flows for accounts. They do not need to know who our clients are per se, but rather what activities they are engaging in, and the jurisdictions they are located. Agent banks want more KYC transparency throughout the custody chain”.

Custodians on a digital journey

Custodians have spent the past 20+ years digitalising and automating their core operations, whether it is de-materialising physical securities or developing standardised Swift messaging enabling for the delivery of real-time information on transaction flows.

Despite the industry’s willingness to innovate, the fundamental nature of the end-to-

end investment and settlement chain has not changed, although members are trying to improve the process. This was highlighted in the Deutsche Bank white paper Breaking the settlement failure chain, published in June 2023 in advance of TNF Athens.

Left to right: Steve Pemberton, CEO, Europe, Coherent; Bruno Campenon Head of FI&C Client Line for Securities Services, BNP Paribas; Mike Clarke, Global Head of Product Management & Head of UK&I Region, Securities Services, Deutsche Bank; Alexis Francis Thompson, Head of Global Securities Services, BBVA; and Leda Glyptis, Chief Client Officer, 10x Banking

“The issue we have now is that there are lot of innovative technologies emerging, such as distributed ledger technology (DLT), large language models (LLMs) or artificial intelligence (AI), but our processes are still the same,” said Mike Clarke, Global Head of Product Management and Head of UK and Ireland Region, Securities Services, at Deutsche Bank. Speaking on a panel titled “Digital Transformation – navigating a new era”, he added “These processes will need to be changed if we are to meet client expectations for shorter or even same day settlements, for example. We must therefore alter the way the chain operates, by moving away from a linear workflow towards a multiparty workflow”.

Although adopting recent technologies can unlock operational efficiencies and improve customer experiences, one panellist said clients are often reluctant to pay for the benefits of digital transformation. “People expect digitalisation to be cheap or free,” added another speaker.

Is mutualisation the solution?

Given the intense cost pressures facing the industry, Clarke suggested providers should consider leveraging mutualised platforms or utilities for post-trade activities where there is no competitive advantage in the service being delivered. “Corporate action processing is a good example here. Custodians scrub the data and push it out to their clients. It would make more sense if there was a single golden source of corporate action data being delivered through a mutualised entity.”

He cited Proxymity, a digital investor communication provider, as an “excellent instance of how the industry collaborated to solve a common problem around proxy voting, by investing into a mutualised platform, which then became an independent company”.

By mutualising commoditised activities and lowering cost bases, custodians can focus on delivering more value-add services to clients. “The revenue models for custodians will need to be recalibrated. Instead of generating revenues from processing settlements, custodians need to think about providing clients with intraday liquidity or repo,” said Clarke. He added that from his perspective, custody is the provision of “last mile operational technology services as an extension to the local market for our clients and therefore driving operational efficiency is inherently tied to revenue models”.

As technology becomes more integrated into the operating models at custodians, firms will need the right talent and expertise to accommodate these changes. To navigate digitalisation, custodians cannot merely hire vast numbers of technologists, said Clarke, adding that support roles, such as compliance, anti-money laundering and risk, need to be fully involved in the digital transformation process, and educated about how these technologies work.

Delegates heard how some firms had changed the way they scouted for new employees – looking at the fintech/tech university talent pools instead of more traditional sources of graduates. Developing this talent requires investment, reflected Kamalita Abdool, Deutsche Bank’s Head of Securities Services Americas/Global Custodian Coverage in an offline interview with flow. “Talent is a multi-dimensional topic where we need attract, retain and develop talent by providing a clear path to career growth. Market changes such as T+1 creates opportunities for hiring managers to break away from the traditional mould and attract a wider more diverse talent pool to deliver business outcomes,” she reflected.

Digital assets

Participants at TNF also talked about digital assets, a topic which Deutsche Bank has covered extensively.

While most custodians are avoiding cryptocurrencies, they do have an active interest in helping clients invest into tokenised securities that can be created using potential different technologies. These come in many forms, and can include both digitally native instruments, and also digitalised versions of either traditional securities or illiquid/real world assets.

Relative to cryptocurrencies, the market for tokenised securities is currently nascent and hence illiquid. It mostly involves bilateral over-the-counter (OTC) issuances. However, the industry is confident the tokenisation market will grow over the next five to 10 years. When Deutsche Bank concluded Project DAMA (Digital Assets Management Access), a Monetary Authority of Singapore (MAS) Financial Sector Technology and Innovation (FSTI) Proof of Concept (POC) granted on 5 August 2022, this helped demonstrate technical viability and adoption potential. “With DLT bolt-on capabilities, traditional investment servicing systems can support tokenised funds and DLT-based distribution to minimise technology investments, facilitate go-to market readiness and support new roles like a reporting aggregator of mixed digital-traditional assets,” said Boon-Hiong Chan, Head of Fund Services and Head of Securities Market & Technology Advocacy at Deutsche Bank when the report was published in early 2023.

“The clear layout of EU regulation provides security for implementing digital asset strategies”

At TNF Athens, panellists agreed that tokenisation could help investors achieve better returns and risk diversification, as this provides access to a wider pool of financial instruments. One speaker on a panel titled ‘Tokenization and the Wider Digital Asset Product Universe’ highlighted that tokenisation will help mobilise illiquid assets (i.e. commercial real estate, private equity funds, art, etc.), as the ability to fractionalise assets into smaller tokens will lower the entry barriers for investing.

Left: Katrin Koller, Global Head, Metaco Advisory; centre Stefan Teis Head of DLT and Digital Asset Service at Deutsche Bank

Unlike cryptocurrencies which will be largely governed by the Markets in Crypto Assets Regulation (MiCAR), the new regulatory regime for cryptoassets, security tokens fall under existing securities legislation, according to Stefan Teis, Head of DLT and Digital Asset Service at Deutsche Bank, and a participant in the ‘Building a Digital Asset Custody Offering: Technological, Operating, and Servicing Model Essentials’ panel at TNF (pictured above).

The clear layout of EU regulation provides security for implementing digital asset strategies. Under the rules, security tokens will fall under the Markets in Financial Instruments Directive (MiFID). The majority of other digital assets will be subject to MiCAR,” said Teis.

Through the adoption of tokenised money (for example, wholesale central bank digital currencies [w-CBDCs]), financial institutions will reap several operational efficiencies too, continued Teis. “Once tokenised money becomes available, it will be possible for financial institutions to do things such as atomic settlement, which is basically simultaneous and instant settlement of both trade legs. However, this reduction in settlement risk comes at the expense of increased liquidity risk,” he said.

As client appetite for digital assets accelerates, custodians are developing digital asset custody solutions.

“Will we make money out of digital assets in five years?” asked one provider. “No, but it is an investment. If I do not invest in digital asset capabilities now, but in five years, then I might be too late. If a client in five years’ time wants to trade digital assets and I cannot support them, then there is a risk that I will lose that business”.

Traditional custodians are well-placed to develop digital asset custody services for several reasons. First, last November’s failure at FTX is forcing investors to think more judiciously about risk when choosing their crypto-asset service providers. “Investors trading digital assets want to know that their digital asset custodians are regulated and that they keep their clients’ assets separate from their own proprietary assets,” said Teis.

Second, investors will also likely hold a combination of traditional and digital securities in their portfolios, meaning they will want to use a custodian who can support them across multiple asset classes. A traditional custodian offering digital asset custody, will be in a strong position here.

The depth of ancillary services available at traditional custodians, versus purely crypto-asset service providers, is also a compelling selling point. “If you are trading tokenised equities, for example, investors will need to ensure they are on top of things such as dividends and taxes” added Teis.

Warsaw 2024?

TNF’s MD Andrew Barman, who opened the event, wrapped up by saying, “We had a truly wonderful week in Athens, and it was a pleasure to be amongst such an energised and engaged group of post-trade professionals. It is our hope to be in Warsaw in 2024, but as TNF is community led, we need to review a number of contingent locations as the market mood dictates.”

For Bogumil Kloc, Head of Continental Europe Sales, Securities Services at Deutsche Bank, Warsaw would be something of a homecoming and a beautiful place to engage. He concludes, “regardless of where we meet, I am fully convinced this will be again an excellent event where market professionals spend time together to discuss emerging trends like mutualisation opportunities, operational resiliency or technology enabled use cases, but also debate more how to attract talent into post-trade industry, which is a key element to stay relevant and successful in the future. The Network Forum Annual Meeting is the place to be next year!”

Members of the Deutsche Bank Securities Services team at the Network Forum. From left to right: Maria Bonardi, EMEA Sales; Bogumil Kloc, Head of Continental Europe Sales; Kamalita Abdool, Head of Securities Services Americas/Global Custodian Coverage, and Mike Clarke, Global Head of Product Management and Head of UK and Ireland Region

The Network Forum Annual Meeting 2023 was held in Athens, Greece, 20–22 June 2023

Sources

1 See thenetworkforum.net

2 See services.eiu.com

3 See federalreserve.gov

4 See afme.eu

5 See "Regulatory outlook in securities services 2023" at flow.db.com