29 March 2023

The boom in digital assets over recent years has been driven more by investor “magical thinking” than by practical considerations, suggest two Deutsche Bank Research reports by Marion Laboure and Cassidy Ainsworth-Grace. flow’s Clarissa Dann reports on the volatile journey towards mainstream asset adoption so far

MINUTES min read

The crypto world has been hit by a series of setbacks, with three US crypto-friendly banks – Silvergate, Signature and Silicon Valley Bank (SVB) – having closed their doors during the first quarter of 2023. In addition, broader financial market fragilities still persist following the collapse of SVB and with First Republic facing persistent liquidity concerns. “Although Bitcoin has performed strongly, jitters remain across the crypto market, and the Tinkerbelle effect is needed now more than ever,” reflect Deutsche Bank Research analysts Marion Laboure and Cassidy Ainsworth-Grace.

This balance between learning from the casualties of the crypto fall-out, while maintaining readiness for market developments characterises the main messages of their two reports published in February and March 2023.

Digital assets – the end of magical thinking? launched the fourth series of The Future of Payments reports in February 2023. This was followed by the paper, Crypto – A recap of the last two weeks and Bitcoin emerging as the North Star? (22 March 2023), where the duo recap the events that have occurred since the collapse of FTX in November 2022, look at how and why Bitcoin could be emerging as the “North Star’ in the crypto market, and then conclude on the real value added of digital assets. In addition, they observe that “lending and borrowing have mostly been contained within the crypto industry, with crypto players assuming the role of de facto banks”. Because of such interconnectedness, “contagion risk within the crypto industry is significant”, they explain.

While traditional banks have not embraced the crypto market due to regulatory and reputational risks, the more forward-looking institutions are keeping a close eye on the development of cryptocurrency, the metaverse and non-fungible tokens (NFTs) – not least because of the expected demand for digital asset post-trade and custody services.

It was said by US economist Robert J. Schiller on the dotcom era: “Nothing important has ever been built without ‘irrational exuberance,” but Laboure and Ainsworth-Grace reflect on how “irrational exuberance” must pass and the true value-add of these developments must make itself apparent. Digital assets and blockchain-based technologies could follow a similar pattern, they say.

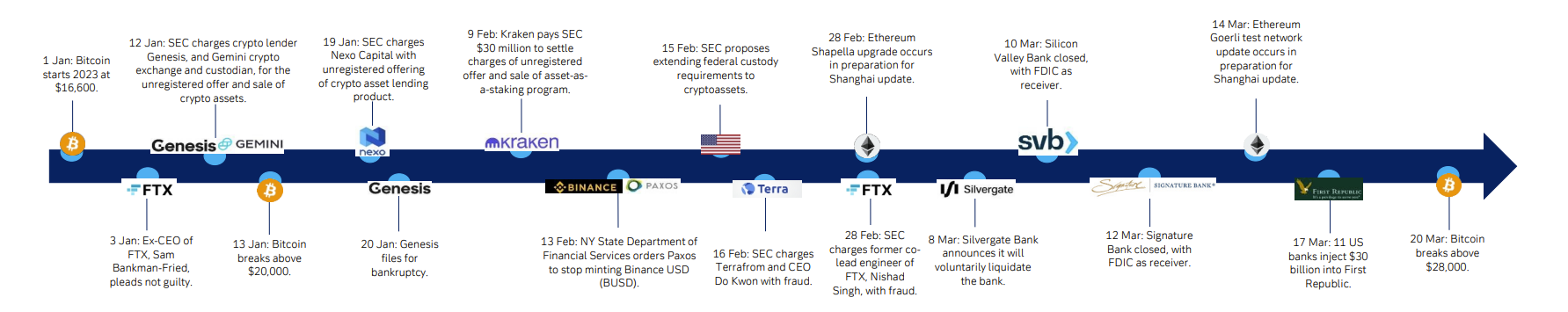

Figure 1: Timeline of major events in the crypto ecosystem (2023)

Source: Deutsche Bank, SEC, FDIC, Bloomberg Finance LP, CoinDesk. (Click on image to expand)

The crypto bubble

Laboure and Ainsworth-Grace observe that the macroeconomic landscape of 2020–21 of low interest rates and high liquidity created a unique growth environment for non-traditional investments such as cryptocurrency (see Figure 1). But in 2022, high inflation, monetary tightening, and slowing economic growth burst the bubble, and high-profile scandals such as the collapse of FTX highlighted the urgent need for regulation.

“The crypto boom… mirrors the “irrational exuberance” of the 1990s dotcom bubble”

Regulators are responding and the Deutsche Bank Research authors point out that there has been a clear increase in scrutiny by US regulators following FTX’s demise “with the SEC cracking down on crypto players such as Nexo Capital, Gemini crypto exchange, Kraken crypto exchange, Paxos, Binance”.

The crypto boom, they note, mirrors the “irrational exuberance” of the 1990s dotcom bubble, when lower borrowing costs encouraged start-ups linked to emerging internet technologies. Entrepreneurs often lacked concrete and formalised ideas for their firms, but could still raise capital thanks to high information barriers, novelty, and overvaluation of the technologies. The unsustainability of these business models was exposed once competition from established firms increased and liquidity dried up.

As many internet business clients went bust, telecoms companies experienced overcapacity, reducing the cost of internet connectivity, and facilitating uptake. So, while many companies failed during the dotcom bubble, the technology at its heart (the internet) remained. Laboure and Ainsworth-Grace believe this is more than likely to turn out the same for digital assets and blockchain. “In the current crypto winter, many firms have seen, and will likely continue to see, significant pressure. Nevertheless, in the hands of the right actors, the technology possesses significant potential.”

Can crypto gain a wider role?

In addition to the high-liquidity and low-interest-rate environment, the pandemic also played its part in the crypto boom. In November 2021, Bitcoin’s price topped US$65,000 and the crypto market peaked at US$2.9trn. The rapid gains plus extra cash from pandemic stimulus payments encouraged new investors into the market. At the end of 2021, 65% of cryptocurrency users were first-time investors.

Hopes for quick gains were soon dashed. By June 2022 flow was asking Is the crypto party over? as both cryptocurrencies and supposedly more reliable stablecoins suffered sharp falls. The collapse of the TerraUSD stablecoin triggered a chain of bankruptcies including Alameda Research, which borrowed client funds from digital currency exchange platform FTX and used the illiquid token FTT as collateral to finance repayment. The “Gordian knot” exposed by the failure of Alameda, FTX and FTT was examined in Crypto assets: a lesson from history.

On a more positive note, crypto’s dramatic fall has abated fears of contagion risk into traditional markets. The crypto market, equivalent to around 4% of the New York Stock Exchange’s market capitalisation is too small to pose systemic risk. And in early 2023 the crypto market rallied strongly thanks to three factors:

- A reduced risk of recession as economies remained resilient despite interest rate hikes;

- Inflation seemingly peaking in late-2022; and

- Expectations that interest rates will rise less steeply than previously anticipated.

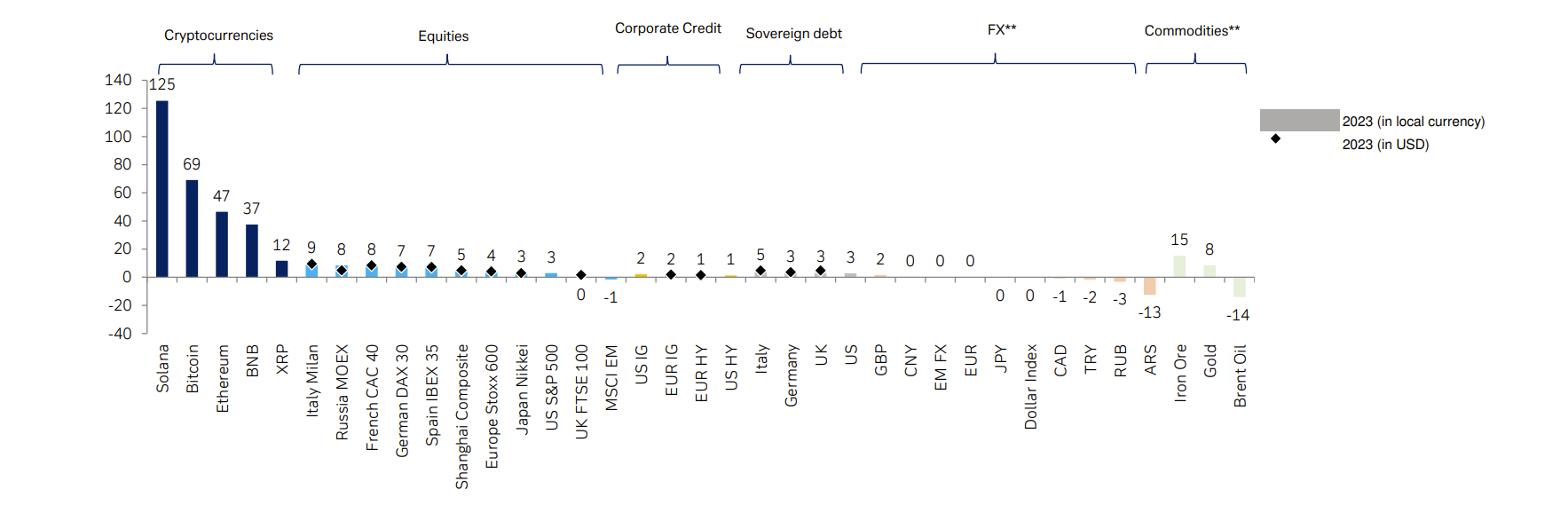

Figure 2: Returns* per asset class in 2023 YTD

Source: Deutsche Bank, Bloomberg Finance LP. Note: (*) Total return accounts for both income (interest or dividends) and capital appreciation. (**) FX, commodities are spot returns. Updated as of 20 March 2023

(Click on image to expand)

By 22 March, Bitcoin had pushed higher, hitting more than US$28,500, its best level since June 2022. “This is nearly 70% higher than its price at the beginning of the year, making it the best performing asset class (by comparison the S&P 500 was up by ~4%). But such volatility is hardly a surprise. Laboure and Ainsworth-Grace point out that the price increase has been driven by:

- Expansion of the Federal Reserve (the Fed) balance sheet and the resulting increase in liquidity following the announcement of the Bank Term Lending Programme on 12 March;

- Renewed hopes of a more dovish Fed as markets price in rate cuts from the second half of 2023;

- A rush to sell other cryptocurrencies and hold Bitcoin following a ‘flight to quality’ within the crypto market, with Bitcoin dominance increasing nearly 10% from the start of March; and

- Further ripple effects of FTX already priced in by the market.

Stablecoins, led by Tether have, they note, “grown massively since 2020, driven by demands for a store of value, liquidity and more leverage trading”. Over the past two years, stablecoins’ share has grown from 3.3% to 12.5% of total cryptocurrency market capitalisation. Stablecoin pegs are popular for exiting trades denominated in other cryptocurrencies by offering USD or other asset exposure without exiting the ecosystem. Used in 92% of all crypto trading, stablecoins act as a lubricant. Exchanges have issued stablecoins to improve platform liquidity and they serve as a source of leverage in derivatives.

Despite a mid-year bout of market turmoil, continue Laboure and Ainsworth-Grace, “the unique role of stablecoins likely made them relatively resilient during 2022 although the space is afflicted by a key structural vulnerability known as the Binance-Tether axis”. Crypto exchange company Binance relies on the Tether for liquidity within its derivatives arm. Tether makes up ~82% of the volume of futures trading and the volume of Tether on Binance Futures was nearly 67% of Tether’s total supply. This interconnectedness is worrying, suggest Laboure and Ainsworth-Grace – as “a joint explosion would not only precipitate a liquidity crunch but a systemic crypto collapse impacting both retail users and institutional investors”.

Real value still elusive

Adopting cryptocurrency as legal tender has appeal for emerging markets keen to lessen their dependency on the US dollar, but macroeconomically is yet to prove sound, reflect Laboure and Ainsworth-Grace. In 2021, El Salvador adopted Bitcoin as legal tender for that reason, only to encounter fiscal vulnerabilities. The Central African Republic (CAR), whose estimated poverty rate is 75%, followed suit in April 2022 apparently seeking principally to buck persistent colonial ties to France through its use of the CFA franc. According to the World Bank, few of CAR’s citizens have internet access in 2020 or own mobile phones.

“[Cryptocurrency] value could be realised in creating a global cross-currency coin for fast, affordable cross-border transactions”

For advanced economies, adopting cryptocurrencies as legal tender offers little value-add. The associated risks require them to be more than just private or stable before they offer meaningful value to North America or Europe. In many ways, the hard currencies in use are already secure, stable, and have the potential to be anonymous through the use of cash. Value could instead be realised in creating a global cross-currency coin for fast, affordable cross-border transactions. This could take the form of a wholesale central bank digital currency (CBDC) backed by regulation to protect consumers and investors and provide transparency.

Fantasy or reality?

Laboure and Ainsworth-Grace conclude, “Only children believe in fantasy beings like Santa Claus and the Tooth Fairy. Eventually, they wake up and realise it was just wishful thinking. In a similar way, we have reached a point in the development of cryptocurrency, the metaverse, and NFTs, where we must move past wishful thinking and begin to ask what technological developments they might bring.”

Indeed, the cryptocurrency space has been maturing and consolidating, with fantasy projects failing and dropped amongst the growing number of informed participants. Nevertheless, cryptoassets’ attraction, improvements and innovation remain, notes Boon-Hiong Chan, Head of Fund Services and Head of Securities Market & Technology Advocacy at Deutsche Bank. As already noted in this article, the Bitcoin market price has returned to above the US$28,000 level in March, Ethereum continues its scalability upgrades with a roster of changes dubbed the “Shanghai Hard Fork” targeted for April 2023, and there are Layer “Zero” projects for needed interoperability. Lessons from unforeseen vulnerabilities continue while law enforcement agencies’ advance in their successes to rein in crypto-facilitated crimes such as the recent shutdown of darknet cryptocurrency mixing service ChipMixer.

As for the metaverse, adds Sabih Behzad, Head of Digital Assets & Currencies Transformation, Deutsche Bank, the bank sees this as a potential megatrend, having published the paper, Metaverse – the next ecommerce revolution in 2022. While this suggested that there is an opportunity to realise US$2trn of retail ecommerce revenue by 2030, it cautions there are challenges to address before it can reach its full potential, including improvements to the fidelity of the experience (augmented and virtual reality (AR/VR) devices, graphics, 5G, etc), data privacy, security and financial crime concerns. “Digital identity and verified credentials are also expected to have a sizeable role to play, enabling interoperability between ecosystems,” says Behzad.

In short, practical innovations persevere in the traditional financial industry, including tests of new operating models such as institutional-adapted decentralised finance (DeFI), in collateral management, green digital bonds, tokenised funds, containerised digital-asset investment strategies and distribution.

Reflecting this movement, in January 2023 Deutsche Bank concluded Project DAMA (Digital Assets Management Access), a Monetary Authority of Singapore (MAS) Financial Sector Technology and Innovation (FSTI) Proof of Concept (POC) granted on 5 August 2022. “It successfully proved traditional investment servicing systems can support tokenised funds and DLT-based distribution with digital identity, smart contract fund expense management, embedded payment gateway and open-architecture digital custody,” says Chan.

DAMA is one of many examples that reflect how regulators, banks, technology companies and investors are already on board for the journey, striving for more applications from the digital assets revolution.

Deutsche Bank Research reports referenced:

The Future of Payments, Series 4 - Part 1. Digital assets: The end of magical thinking by Marion Laboure and Cassidy Ainsworth-Grace (February 2023)

Crypto – A recap of the last two weeks and Bitcoin emerging as the North Star? by Marion Laboure and Cassidy Ainsworth-Grace (22 March 2023)

Marion Laboure

Senior Strategist, Deutsche Bank Research

Cassidy Ainsworth-Grace

Analyst, Deutsche Bank Research

Securities services solutions Explore more

Find out more about our Securities services solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-up