7 June 2022

The presumption that Bitcoin and its peers offer a hedge against inflation has been debunked by recent sharp falls. The plunge extended to stablecoins, which are supposedly far less volatile. flow summarises Deutsche Bank Research analysis on crypto perception and reality

MINUTES min read

In its 13 years of existence, Bitcoin has regularly enjoyed increases in value punctuated by sharp and sudden falls. The 30% drop experienced over the week ending 15 May 2022 that pushed the cryptocurrency below US$30,000 – against the previous November’s peak of US$67,000 – should have been no surprise.

TerraUSD, the third biggest stablecoin, was supposed to have a ratio of 1:1 to the dollar, but plummeted to US$0.1 per coin, while its sister coin Luna lost almost 100% of its price and triggered a broader cryptocurrency sell-off.

“Sentiment towards cryptocurrencies in general is strongly correlated to tech stocks”

In their 16 May report Crypto currency: Is Perception Reality? Deutsche Bank Research analysts Marion Laboure and Galina Pozdnyakova review the drivers of the recent crypto sell-off. They cite interest rate hikes by several of the world’s major central banks as a contributing factor by triggering the reallocation of investments from cryptocurrencies safe haven assets.

Tied up with tech stocks

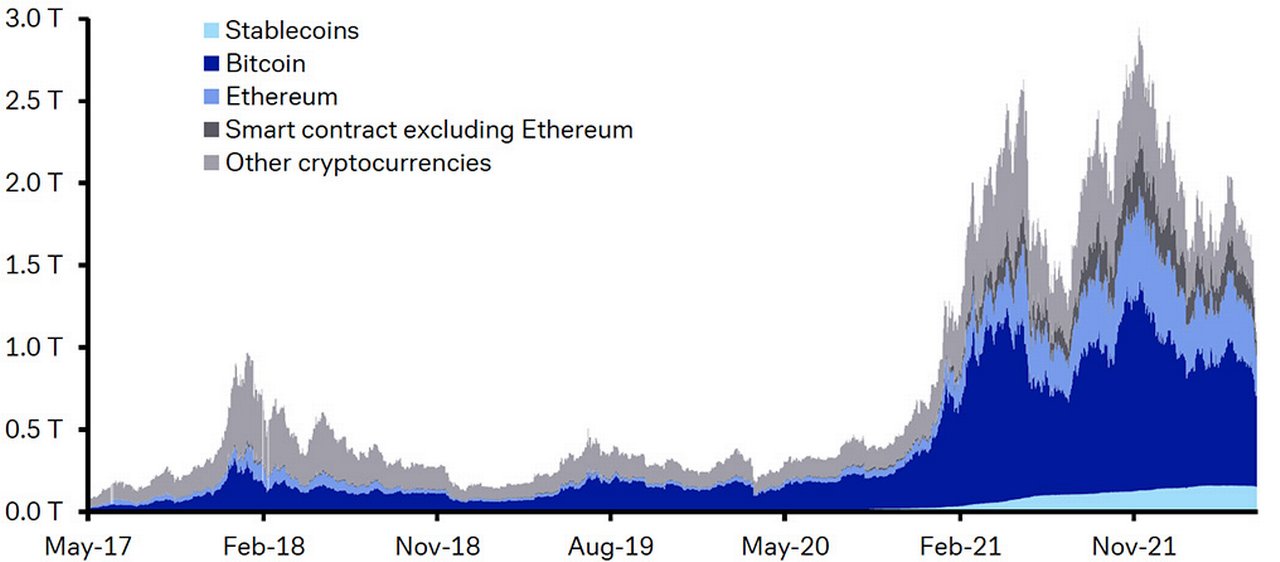

Figure 1: Market capitalisation for crypto assets in US$trn

Source: Bloomberg Finance LP, CoinGecko, and Deutsche Bank calculations

The most recent drop points to a future where cryptocurrencies will be increasingly impacted by macroeconomics, especially interest rate hikes. The fall also evidences that cryptocurrencies are increasingly correlated to tech and US equity stocks, with the fluctuations in bitcoins and Wall Street’s tech stock indices highly correlated.

“This indicates that sentiment towards cryptocurrencies in general is strongly correlated to tech stocks,” note Laboure and Pozdnyakova. “This has been further reinforced in the last six months, as correlation with the Nasdaq composite and the broader S&P 500 increased from 20% to nearly 80% most recently. Both tech stocks and cryptocurrencies are highly exposed to monetary policy concerns.”

The belief that crypto provides a hedge against inflation is being undermined as the correlation between Bitcoin, Ethereum, Binance coin (BNB) and their peers with the stock market – and tech stocks particularly – increases. “Cryptocurrencies, as an asset class, are now less independent. They can now be seen as a substitute for technology exposure,” the authors suggest.

So, although cryptocurrencies enjoyed price increases as inflation picked up in 2021, this was more due to excess liquidity that also drove tech stocks higher. But with the US Federal Reserve now turning increasingly hawkish and a series of interest rate hikes underway, cryptocurrencies have followed the tech sell-off and tanked, despite the US Consumer Price Index touching 8.5%.

The Tinkerbell effect

Referencing the so-called “Tinkerbell effect”—a term drawn from Peter Pan’s assertion that the fairy Tinkerbell existed simply because children believed it so, the report concludes that the value of a Bitcoin is entirely based on wishful thinking. Among the supporting evidence:

- The supply of Bitcoins is limited to 21 million, of which around 90% is already in circulation. Demand from institutions, businesses, and consumers has been increasing

- Bitcoin’s liquidity is low compared to other fiat currencies. As an investment asset it is high relative to other cryptocurrencies, but a more volatile and less liquid instrument than blue chip stocks. In 2022, 636,000 bitcoins changed hands per day on average (3.3% of total circulation), compared to 96 million shares of Apple per day on average (0.6% of its shares outstanding). Thus, trading in bitcoin has higher volatility and price impact.

- The regulation factor: cryptocurrencies are now on the radar of central banks and other regulators, which will have impacts on the market.

The stablecoins difference

The May 2022 crypto volatility extended to stablecoins – as illustrated by the collapse of TerraUSD – which should theoretically maintain a 1:1 peg to a currency or commodity. This approach is promoted to cryptocurrency buyers as an alternative way to “stay in cash” without relying on the fiat financial system. Stablecoins can also be used to facilitate payments and operate across different exchanges. The two ways to achieve this ratio are collateralisation or a peg to another cryptocurrency.

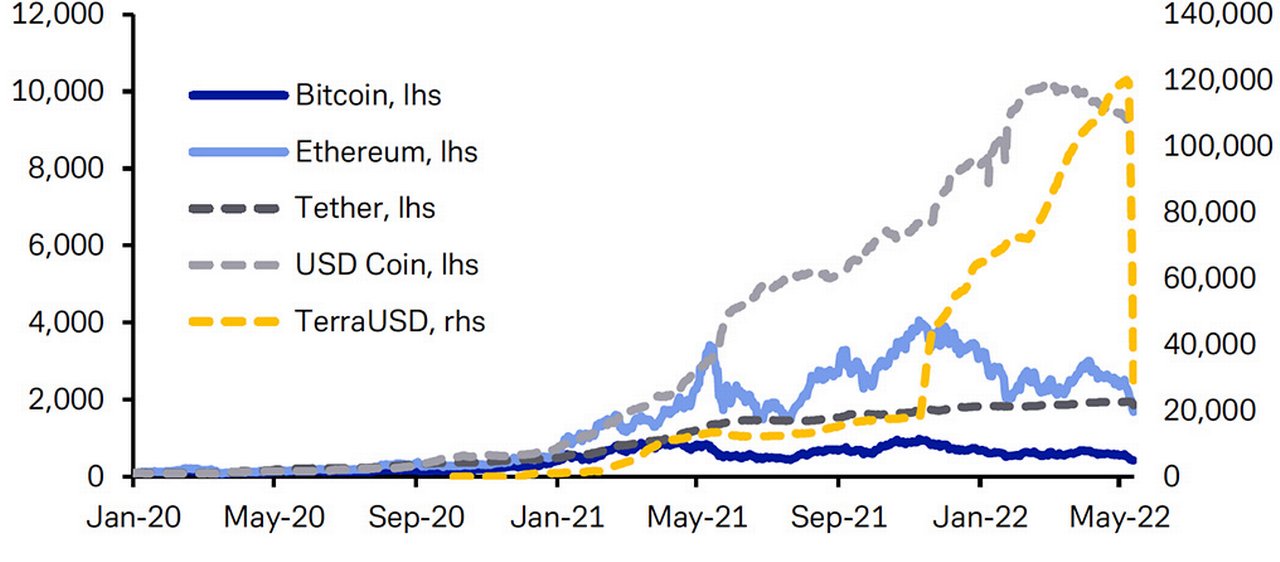

Figure 2: Fast and furious stablecoins? Market capitalisation, Jan 2019=100

Source: Bloomberg Finance LP, Deutsche Bank. Note: stablecoins are in dotted lines

Stablecoins such as Tether (the largest) and USD coin, achieve collateralisation by holding liquid assets and cash equal to the value of the stablecoins they issued. In theory, at any given point in time, the issuer can provide the ‘peg’ of US$1 for each coin. Stability of this peg in the marketplace partially depends on whether market participants believe that the issuer has enough reserves to honour the ratio. Tether briefly fell to US$0.95 on 12 May but has since restored dollar parity.

TerraUSD differs in not using asset reserves as collateral, and instead relying on an algorithm to keep the coin pegged to the dollar by trading its sister cryptocurrency Luna, explains the report. Traders could get US$1 worth of Luna for each TerraUSD, thereby creating an incentive to keep dollar parity via arbitrage. But this system is based on a “circular” belief in Luna – itself reliant on confidence in TerraUSD, which evaporated earlier in May and resulted in the collapse of both.

Crypto-regulatory response

Could anything positive emerge from TerraUSD’s crash? Brian Shroder, president of Binance US – the American partner of Binance, the world’s largest cryptocurrency exchange – believes so. He told the Wall Street Journal in a video interview that the event might prove the catalyst for tougher regulation of the industry and “could accelerate the Biden administration’s efforts to regulate stablecoins”.1

Laboure and Pozdnyakova agree, noting that with a market capitalisation of almost US$1.35trn– despite the May 2022 downturn – crypto-assets can no longer be ignored. “This growth, however, could lead to their demise. As cryptocurrencies increasingly pose a threat to monetary and financial stability, central banks and governments are unlikely to sit idly by,” they predict. Laboure’s 28 October 2021 report: ‘Cryptocurrencies: When regulation becomes mainstream’ underlines just how busy they have been developing regulatory controls, and that was seven months ago.

“Regulating cryptocurrencies is not that difficult and it is coming. The Bank for International Settlements (BIS), the G7, and the G20 all have cryptocurrencies on their agenda as a key priority. In the latter part of 2022 and early 2023, we could see a turning point for cryptocurrencies around the world,” conclude Laboure and Pozdnyakova.

Deutsche Bank Research report referenced:

Cryptocurrencies: Is Perception Reality? by Marion Laboure and Galina Pozdnyakova (16 May 2022)

Cryptocurrencies: When regulation becomes mainstream by Marion Laboure (28 October 2021)

Note the data for Figure 2 was that available at 16 May 2022

Marion Laboure

Research Analyst, Deutsche Bank Research

Galina Pozdnyakova

Research Analyst, Deutsche Bank Research

Summary of key points

- The cryptocurrency market cap fell sharply in May 2022 reaching a low of US$1.14trn on 12 May and the top three coins— Bitcoin, Ethereum, and BNB — have dropped by -13.4%, -20.5%, and -18.0% that week, respectively.

- Rate hikes and declines in tech stocks were among the underlying factors

- As cryptocurrencies begin to seriously compete with regular currencies and fiat currencies, regulators and policymakers are taking action

Corporate Bank solutions Explore more

Find out more about our Corporate Bank solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

CASH MANAGEMENT, MACRO AND MARKETS

CBDCs: what’s not to love? CBDCs: what’s not to love?

As Jamaica prepares to launch its own central bank digital currency and China’s digital yuan is fast gaining traction, Deutsche Bank Research’s recent white paper on the future of cash offers a progress report on CBDC launches and initiatives. flow shares its core findings

CASH MANAGEMENT, MACRO AND MARKETS {icon-book}

Central bank digital currencies: the game changers Central bank digital currencies: the game changers

Despite their volatility, cryptocurrencies are gaining acceptability as an alternative asset class. However, mass adoption is unlikely, and in the meantime, central bank digital currencies are gaining traction, reports flow’s Graham Buck

CASH MANAGEMENT, MACRO AND MARKETS

When will digital currencies become mainstream? When will digital currencies become mainstream?

The Bahamas launched the sand dollar, a nationwide central bank digital currency (CBDC) last October. flow’s Graham Buck reports on why its move will be followed by others around the world over the coming months as CBDCs take on cryptocurrencies