February 2021

The Bahamas launched the sand dollar, a nationwide central bank digital currency (CBDC) last October. flow’s Graham Buck reports on why its move will be followed by others around the world over the coming months as CBDCs take on cryptocurrencies

Central banks worldwide, which initially responded to digital currencies with either antipathy or hostility, have since warmed to the concept, reported flow in December. The Covid-19 pandemic has accelerated this sea change; hastening the decline of traditional cash by four or five years, increasing the need for digital cash and intensifying competition between companies and countries to develop digital currency solutions, reports Deutsche Bank Research analyst Marion Laboure. “The world has shifted from asking whether digital currencies will succeed, to how and when they will become mainstream,” she adds.

In her latest white paper, The Future of Payments Series 2 - Part II. When digital currencies become mainstream, Laboure examines how cryptocurrencies are increasingly mainstream, forcing central banks – which are increasingly working on their own central bank digital currencies (CBDCs) – to join the race. “In the long run, CBDCs will displace private cryptocurrencies and become the norm,” she predicts.

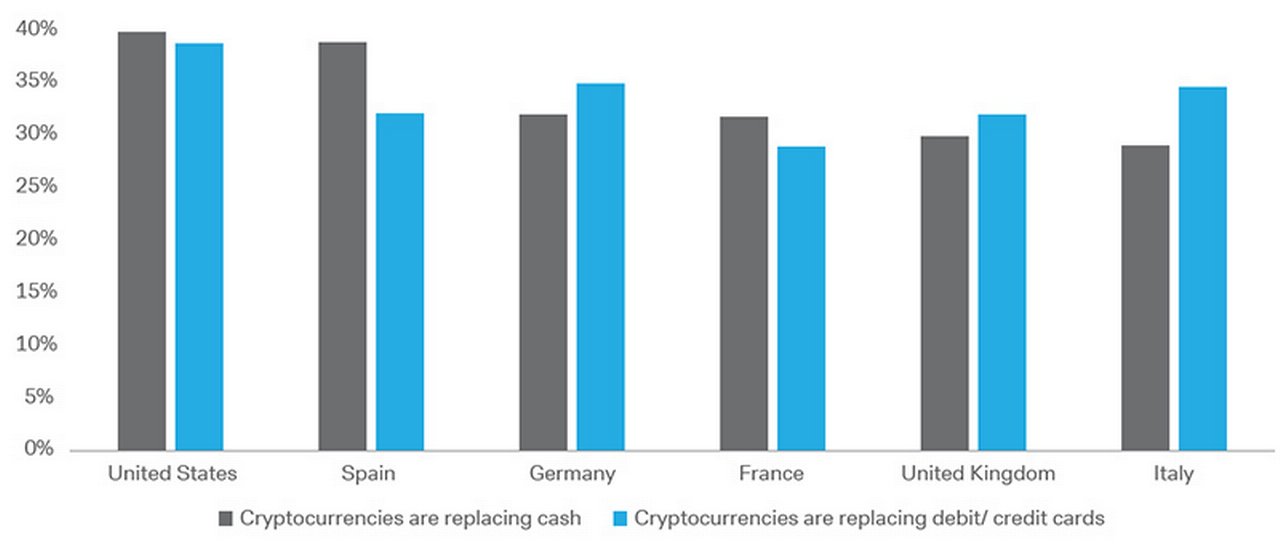

As per Figure 1 an accompanying survey of over 3,700 people in the US, UK and Europe finds at least one in three millennials expects cryptocurrencies to displace cash and credit/debit cards:

Figure 1: Millennials who think that cryptocurrencies are replacing cash and debit/credit cards

Source: Deutsche Bank/dbDIG

Survey responses show a clear generational divide; older people believe that cryptocurrencies create volatile financial bubbles such as the dotcom boom-bust, and regard them as low-liquidity financial instruments. Many have either only a limited understanding or no idea of how they work.

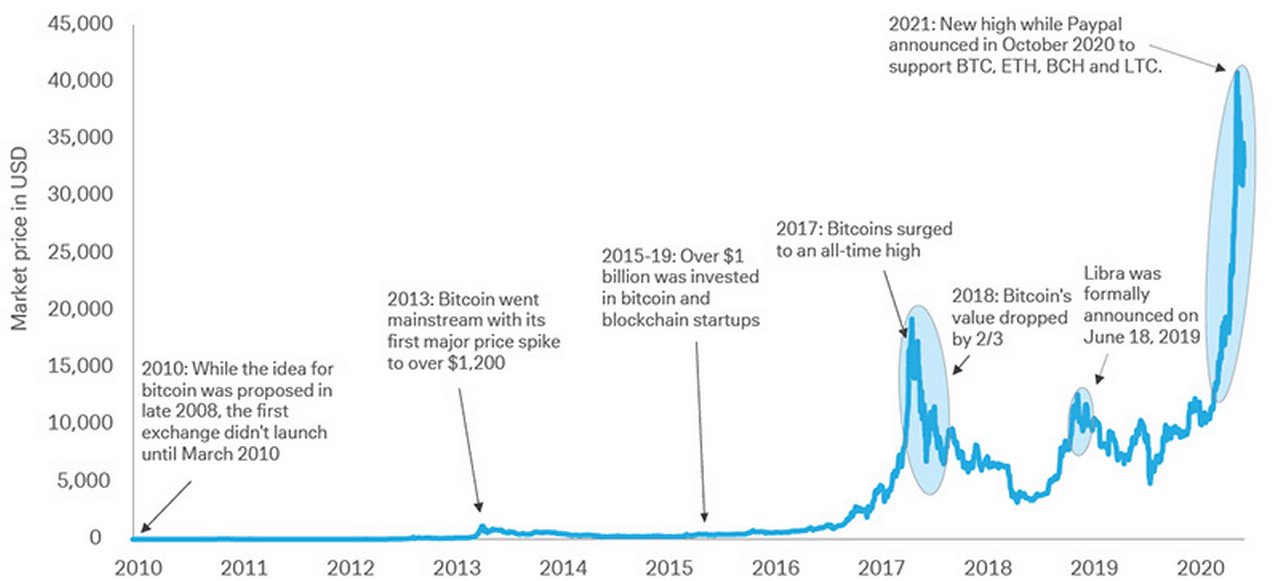

Younger people are more likely to adopt cryptocurrencies more rapidly. As the report notes, while the number of blockchain wallet users worldwide is still relatively small it grew from 11 million in 2016 to 63 million by 2020. BRD (also known as Breadwallet), bitcoin’s digital wallet company, recently set records for the number of downloads, with CEO Adam Traidman telling Bitcoin.com in December 2020, “We’re nearing nearly three million users worldwide now”. 1 However, many overlook the dangers of bitcoin whose value has fluctuated sharply in recent years, along with other non-CBDC cryptocurrencies.

Figure 2: Bitcoin is too volatile to be a reliable source of value (market price in USD)

Source: Bloomberg Finance LP/Deutsche Bank

"The world has shifted from asking whether digital currencies will succeed, to how and when they will become mainstream"

Cryptocurrencies head to the mainstream

Facebook made waves in June 2019 with plans for its own cryptocurrency. “With over 2.7bn users [it] has the potential to compete with traditional online payment platforms and advance digital currencies into the mainstream,” notes Laboure, although “Facebook’s strategy has shifted toward more emphasis on cheapening payments, rather than competing with governments on creating a parallel means of payments.”

Formerly Libra and now rechristened Diem, Facebook’s cryptocurrency “has evolved from being pegged to a basket of leading currencies to being denominated in individual sovereign currencies,” noted The Banker’s managing editor, Joy Macknight in her February 2 blog post2. Diem is now “expected to launch later this year with a potential billion-strong community from the get-go.”

PayPal, among the world’s biggest payment service providers with more than 300 million customers, announced in October 2020 that cryptocurrency capability was being added to its wallets.3 It saw strong early adoption and a bigger-than-anticipated waiting list in the US. The roll-out will, it says, be expanded internationally in H1 2021 and to the rest of its platform – including the Venmo mobile payment service – so users can complete transactions for goods and services leveraging their digital currency.

Visa and Mastercard are following the trend. Visa CEO Alfred Kelly said that digital currency backed by fiat will be an emerging payment technology when Visa filed last May a patent for a “digital fiat currency” that indicated a CBDC use case. In December 2020, Visa partnered with P2P payments tech Circle to let card issuers integrate stablecoin USD coin (USDC) payment capability.4

Mastercard announced a card deal with Wired in July, under which Wired’s multicurrency Mastercard debit card users can buy, hold, exchange, and sell up to 18 traditional currencies and cryptocurrencies, and make free international ATM withdrawals up to a limit. Mastercard also launched a customisable CBDC testing platform in September.

2020 also saw the US Office of the Comptroller of the Currency (OCC) announce in July that national banks can provide custody solutions for cryptocurrencies.5 In September, the OCC confirmed that banks can hold reserve deposits behind stablecoins. In December, the Swiss Exchange also announced plans for an “Institutional Digital Asset Gateway” in 2021 to get banks into crypto.

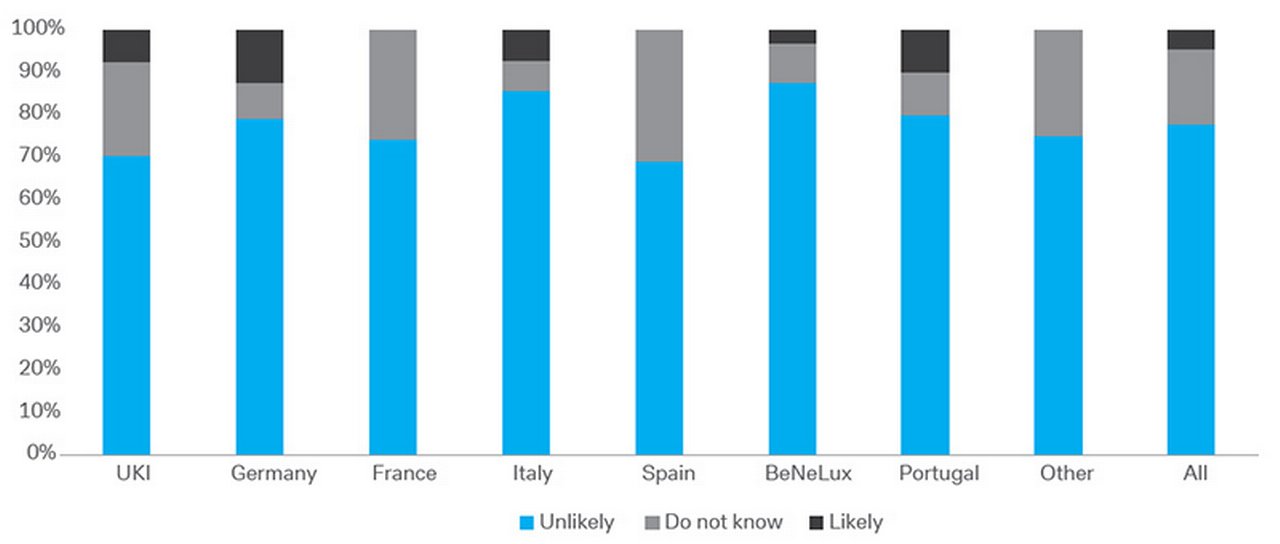

Globally – particularly in the US, China, and Russia – major businesses including travel firms, online shopping companies and retailers now accept cryptocurrencies; Coinmap.org reports there are nearly 15,000 venues worldwide. However, companies in other sectors and their treasury teams are unlikely to join for now. As shown in Figure 3, the survey suggests only one in 20 corporate treasurers plans to use and receive cryptocurrencies by mid-2022.

Figure 3: In the next 18 months, how likely is your company to use cryptocurrencies?

Source: dbDIG Research

Added to the absence of crypto asset regulation, barriers to wider acceptance include a lack of scalability and the energy consumption required for cryptocurrencies. Bitcoin uses significant amounts; those wanting a coin must compete for it by using mining operations that require huge amounts of computing power.

Central banks fight for monetary control

Challengers of Facebook’s Diem initiative include US Federal Reserve chairman Jerome Powell and Christine Lagarde, the European Central Bank (ECB) president, addressing the risk to the financial stability to the existing monetary systems. As noted in Digital currencies, differing motives, pre-2016 central banks rarely communicated on digital currencies. Since then, and accelerated by the publication of Facebook’s white paper, Libra, in 2019 (now hosted on the Diem Association website after the change of name),6 central banks and governments have understood that cryptocurrencies are here to stay – and their benefits can only be fully realised when integrated into solid regulatory frameworks and financial ecosystems.

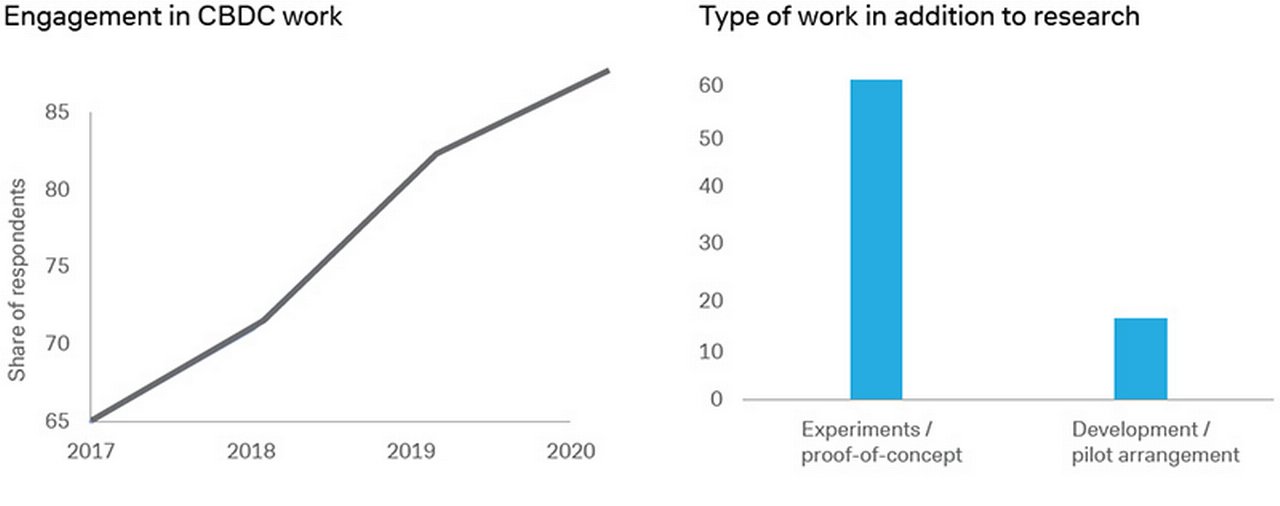

Over the past three years, central banks and governments have multiplied and accelerated digital cash initiatives, reports Laboure. A Bank of International Settlements (BIS) 2021 survey found 86% of central banks developing a CBDC, with 14% already running pilot projects and 60% experimenting proof-of-concept. Central banks representing one-fifth of the world’s population are likely to issue a general purpose CBDC by 2024.

Figure 4: Central banks involved in CBDC projects

Source: Bank of International Settlements, Deutsche Bank

In advanced economies, central banks’ motivations for issuing a CBDC are primarily to improve payment security among and may also include financial stability, monetary policy implementation, financial inclusion and payments efficiency (domestic and cross-border). Emerging economies generally have a wider array, especially when a CBDC aims to complement or replace cash.

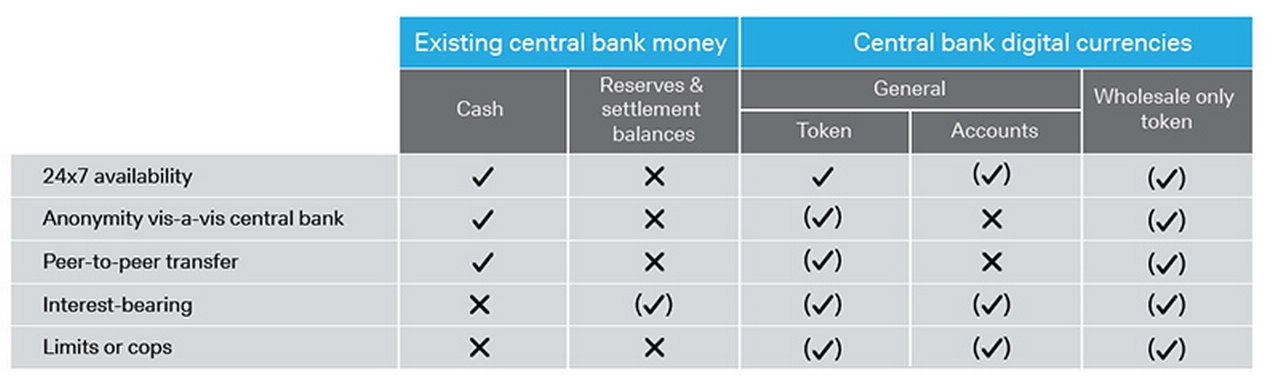

A CBDC could take two forms:

- retail: a widely accessible and public electronic currency available for retail transactions; and

- wholesale: a restricted electronic currency available only for large business transactions.

The retail form of a CBDC would be intended to play same role as cash, whereas the wholesale form would be like the reserves held by banks and other financial institutions.

Figure 5: Key design features of central bank money

Source: Bank of International Settlements (2018). Note: X = existing or likely feature, ( ) = possible feature, = not typical or possible feature

CBDCs could be interest-bearing, potentially making a negative interest rate policy more effective and directly affecting consumers. They offer 24/7 availability, and are traceable via a footprint of each transaction. The implications of CBDCs for corporations are immense, as they could permanently change consumers’ habits, moving them away from cash, cheques, and probably cards; impacting the payment infrastructure; and reducing transaction fees.

Leaders and also-rans

The Bahamas took the lead with last October’s launch of the sand dollar, a nationwide CBDC based on digital ledger technology (DLT) at its foundation with a hybrid wireless network at the top to connect mobile devices. The latter provides connectivity in exacting ecosystems where hurricanes can cause power outages. The sand dollar bears low transaction fees, pays no interest and is restricted to domestic wholesale and retail transactions.

Sweden, where cash in circulation has steadily declined since 2007, research on a CBDC began in 2017. In February 2020, Sweden began the first trial of its digital-krona project, the e-krona and the government could implement its digital currency nationally this year.

In the Eurozone, the European Central Bank issued its report on a possible digital euro in October; the consultation phase ended 4 January 2021 and a decision on whether to proceed is expected mid-2021. The digital euro envisaged by the ECB was detailed in flow’s December 2020 article. In the UK, the Bank of England (BoE) released a CBDC discussion paper in March 2020 but has also yet to decide on whether to progress further.

For the US, Fed Chairman Jerome Powell stressed that the central bank is not concerned with not being first in the CBDC race and that the US dollar’s status as the world reserve currency already gives it a “first-mover advantage.”

Nonetheless, in a 13 August press released, the Fed “highlighted the research and experimentation undertaken to enhance its understanding of the opportunities and risks associated with central bank digital currencies” and added, “The initiatives complement a broad set of payments-related innovation projects currently underway within the Federal Reserve System”.7

The Boston Fed is working with Massachusetts Institute of Technology’s (MIT) researchers to build a hypothetical digital currency oriented for central bank use. Any code base developed from the initiative will be offered as open-source software for experimentation.

The Fed has also assembled a team of application developers from the reserve banks in Cleveland, Dallas, and New York, who are working with a policy team at the Fed board to study “the implications of digital currencies on the payments ecosystem, monetary policy, financial stability, banking and finance, and consumer protection”.

China leads the way

In the report’s concluding sections Laboure considers what advanced economies must overcome for populations to adopt digital currencies. She cites two barriers: lower interest rates and cultural/privacy norms.

Many still regard cash is regarded as a “store of value” and a “safe haven”. One in three Americans and Europeans name it as their favourite payment method, and more than half of the people in developed countries believe cash will always be around. Over the three months to May 2020, banknotes in circulation in the eurozone increased by a record €75bn – more than in the period following the 2008 collapse of Lehman Brothers.

“Higher interest rates are necessary to bring the end of cash as a store of value,” says Laboure. Deutsche Bank Research’s analysis of cash in circulation and interest rates within advanced economies shows a strong negative association between the level of central bank interest rates and cash in circulation. “Proving a causal relationship between cash in circulation and interest rates would require more work; however, we can say that low central bank interest rates certainly play a role in increasing cash in circulation,” she adds.

With central banks in advanced economies lowering interest rates to near/sub-zero, inflation likely to remain low and growth depressed, consumers have little incentive to deposit or save money, so, explains Laboure, “moving cash from under the mattress into a bank account is unlikely to happen (at scale) in the near term.”

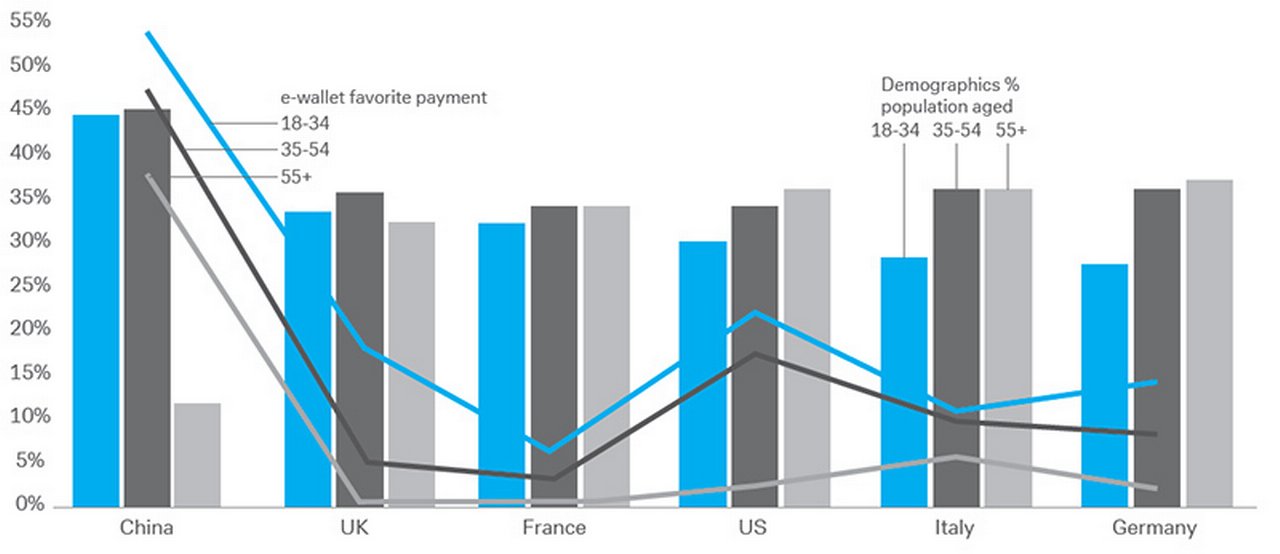

Cultural factors related to convenience, usage, and privacy also influence adoption rates, suggests Laboure. While cash transactions do not generate digital data, digital currency transactions, although convenient, leave a traceable footprint.

The survey suggests that citizens in advanced economies worry more about privacy than their peers in emerging economies. Only 10% of Chinese survey participants reported concerns about anonymity and traceability; other percentages range from 19% for Italians to 42% for Germans.

This indicates a relatively swift take-off for the adoption rate of China’s government’s CBDC. The pandemic has accelerated an ongoing shift among younger populations from cash towards digital payments, particularly in Asia. At end-2018, around 73% of internet users in China used online payment services (versus 18% in 2008). According to the World Bank, 85% of Chinese adults purchasing items online also paid online. In other emerging economies 53% of adults making an internet purchase in the past year paid cash on delivery (COD).

Figure 6: Demographics and digital wallet favourite methods of payment – comparison between China and advanced economies

Source: Deutsche Bank db.DIG. Note: Demographics account for the percentage population represented in the 18-34, 35-54, and 55+ brackets. This excludes people under the age of 18. The representation of China is of those with internet access living in cities ranked as tier

In our earlier article, flow reported on the tests conducted during 2020 for the digital yuan. In December e-commerce giant JD.com announced that it will accept digital yuan as payment for products on its online mall, while Hong Kong Monetary Authority (HKMA) Chief Executive, Eddie Yue, said that the Peoples Bank of China (PBoC) and HKMA are preparing to test the digital yuan for cross-border payments.

Evidence suggests that China’s CBDC is not built on a blockchain, the digital ledger used by bitcoin and other private cryptocurrencies. In August 2018 Mu Changchun, deputy director of the PBoC’s payments department, suggested that a blockchain platform could not provide the throughput needed for retail, which suggests that an electronic renminbi (e-RMB) will be centralised and issued first by the central bank to local commercial banks. China’s four major state-run banks – China Construction Bank, Bank of China, Industrial and Commercial Bank of China, and Agricultural Bank of China - have started large-scale internal testing of the digital RMB wallet.

Laboure reports that the digital currency plan will be backed by the central government and pegged one-to-one to the RMB. To initiate a payment, consumers and businesses download a digital wallet on a mobile phone and transfer e-RMB from a commercial bank account to the digital wallet. Users will be able to transfer the e-RMB seamlessly with their phones using NFC technology and the internet. Offline transactions – digital transactions that the central bank can’t track in real time – would be saved and processed once the digital wallet is back online.

The offline feature aims to lend appeal for areas with limited internet coverage and/or access to commercial banks. But unlike with cash, the e-RMB would allow regulatory authorities to see and trace each transaction.

Could CBDCs disintermediate banks?

Laboure concludes by considering CBDCs’ potential to disintermediate the banking system. With bank accounts currently paying little interest people might opt to hold their money directly at the central bank, thereby disrupting legacy bank franchises and impacting financial stability.

Were credit card volumes, interchange fees, payment transaction fees, and deposit interest margins to be seriously affected, it would shake the current two-tier system and create additional responsibilities for central banks, such as KYC issues and disputes; monitoring transaction levels; preventing money laundering and terrorism financing (AMLCFT); and tax compliance.

It is for these reasons, that most central banks are considering measures to minimise the risk of disintermediation and the functioning of the two-tiered monetary system that provides the liquidity for the economic growth. As such, the digital currency model favoured by most central banks appears to be two-tier issuance. As with a traditional currency, transactions would be decentralised and supply would be centralised.

Summary of Deutsche Bank Reports referenced

- The Future of Payments Series 2 – Part II: When digital currencies become mainstream, 3 February, by Marion Laboure

Sources

1 See https://bit.ly/3qbXWpx at news.bitcoin.com

2 See https://bit.ly/3a3fY7Q at thebanker.com/

3 See https://bit.ly/2LH5PEy at newsroom.paypal-corp.com

4 See https://bit.ly/2Olgy8t at forbes.com

5 See https://bit.ly/3rGoBuU at occ.gov

6 See https://bit.ly/3aXSCjo at diem.com/

7 See https://bit.ly/3cZVdvF at federalreserve.gov

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print