31 January 2023

The rapid rise and fall of the cryptocurrency exchange FTX reflected a volatile crypto market in 2022 and echoed previous high-profile corporate collapses two decades ago. Now, as then, a tighter regulatory framework is needed concludes the latest Deutsche Bank Research paper. flow’s Clarissa Dann reports on its findings

MINUTES min read

Crypto assets are high-risk products that can cause significant personal losses, warns Deutsche Bank Research analysts Marion Laboure and Cassidy Ainsworth-Grace in their first commentary of 2023 – and latest instalment of a series on the future of payments. Crypto – FTX: A recap on what we learned and the major collapses in history, was published on 5 January in the wake of the collapse of Sam Bankman-Fried’s short-lived cryptocurrency exchange and crypto hedge fund.

While this article was being prepared, on 20 January news broke that cryptocurrency lender Genesis had also filed for Chapter 11 bankruptcy in the US, becoming, as the Guardian put it, “the latest victim of the shakeout in the digital asset market”.1

Launched as recently as May 2019, FTX – an abbreviation of Futures Exchange – had attracted more than one million users and established itself as the third largest cryptocurrency exchange by volume by July 2021. At the start of 2022 the company attracted a valuation of US$32bn2 and received funding from institutions such as BlackRock, SoftBank, Temasek, Tiger Global and the Ontario Teachers' Pension Plan.

The company’s subsequent decline and fall was as swift as its rise. Over the summer of 2022 FTX and its sister trading house, Alameda Research, rescued several crypto players in distress such as BlockFi, Voyager Digital and Celsius. So, there was consternation on 8 November when the world’s largest cryptocurrency exchange, Binance, announced that it had signed a non-binding agreement to buy FTX.com to help cover its rival’s “liquidity crunch”.3

Three days later FTX filed for bankruptcy and Bankman-Fried resigned as CEO, handing over the role to John J. Ray III, an expert liquidator who handled the bankruptcies of Enron and Nortel. Ray questioned the competence of Bankman-Fried and his executive team, declaring that he had never seen “such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

The Economist was equally scathing in its issue of 17 November 2022.4 “To the gushing venture capitalists of Silicon Valley [SBF] was the financial genius who could wow investors while playing video games, destined, perhaps, to become the world’s first trillionaire,” it said. “Today there is nothing left but one million furious creditors, dozens of shaky crypto firms and a proliferation of regulatory and criminal probes.

“The high-speed implosion of FTX has dealt a catastrophic blow to an industry with a history of failure and scandals. Never before has crypto looked so criminal, wasteful and useless,” reflected the newspaper.

Michael Barr, the Federal Reserve’s vice chair for supervision5, said that the crypto market volatility had “highlighted the risks to investors and consumers associated with new and novel asset classes and activities when not accompanied by strong guardrails”.

A rapid rise and fall

Laboure has long warned against the various unfounded assumptions that some have attributed to cryptocurrencies, such as Bitcoin and its peers could offer a hedge against inflation (see flow’s June 2022 article Is the crypto party over?) and examined thorny issues such as the industry’s energy usage and network security (Ethereum’s ‘Great Merge’, September 2022)

In their 5 January article, Laboure and colleague Cassidy Ainsworth-Grace focus on the aftermath of FTX’s collapse; continued uncertainty over the future of the crypto ecosystem – particularly Binance and the largest stablecoin, Tether; and parallels with the major collapses of the late 20th and early 21st century; namely the dotcom boom-to-bust, the bankruptcy of Enron and the 2008 collapse of Lehman Brothers.

“A well laid-out comprehensive regulatory framework should help bring stability and order in the crypto ecosystem”

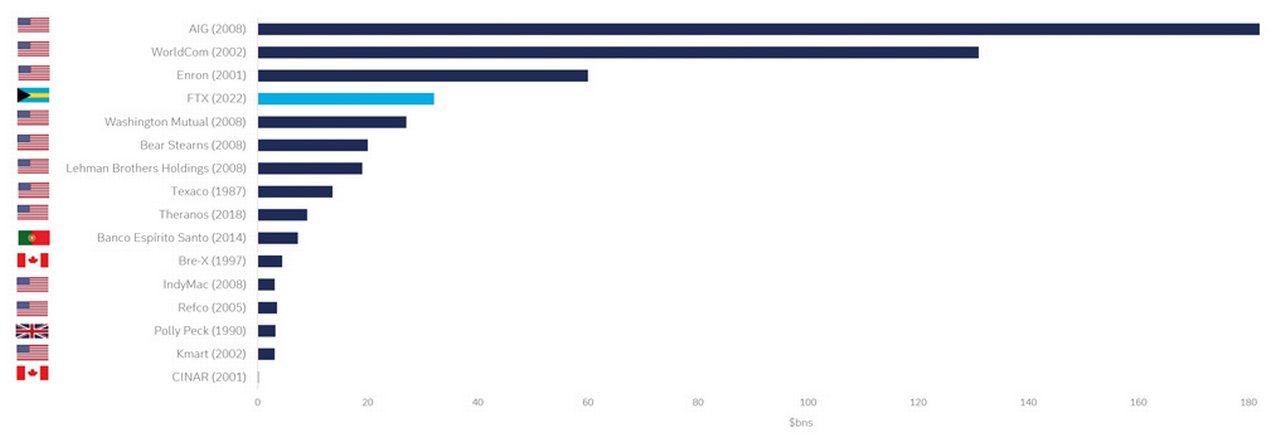

They point out that FTX’s peak valuation last January of US$32bn was roughly half the size of Enron’s market capitalisation before its demise in 2001. A more recent comparison is that of the ill-fated health technology company Theranos, valued at US$9bn prior to its collapse in September 2018. Theranos’ founder Elizabeth Holmes was found guilty of fraud last November and jailed for 11 years, while the Commodity Futures Trading Commission (CFTC) “has identified over US$8bn in customer losses, as of 13 December.”

In December 2022, US prosecutors6 charged Bankman-Fried on eight criminal counts, including conspiracy to commit wire fraud on customers and lenders, money laundering, and campaign finance law violations relating to FTX. Following his extradition from the Bahamas, SBF appeared before US district judge Lewis Kaplan on 3 January 2023, pleading not guilty to all counts, while by contrast the ex-CEO of Alameda Research Caroline Ellison and FTX’s ex CTO and co-founder, Gary Wang pleaded guilty to their respective charges. SBF is now set to face trial on 2 October 2023 and according to a Bloomberg report could face a maximum of 115 years in prison if convicted of all charges against him.

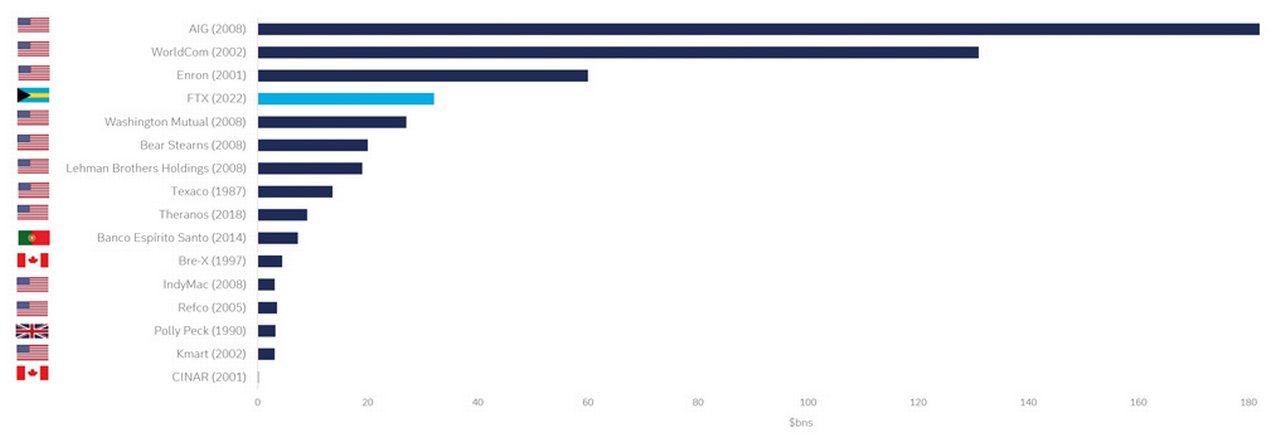

Figure 1: Selected major corporate collapses (by market capitalisation/valuation of corporates prior to their crash*)

Source: Deutsche Bank, Bloomberg Finance LP, Kmart, The Financial Times, CNN Money, Fortune 500 Archive, Wall Street Journal, Reuters, American Economic Association.

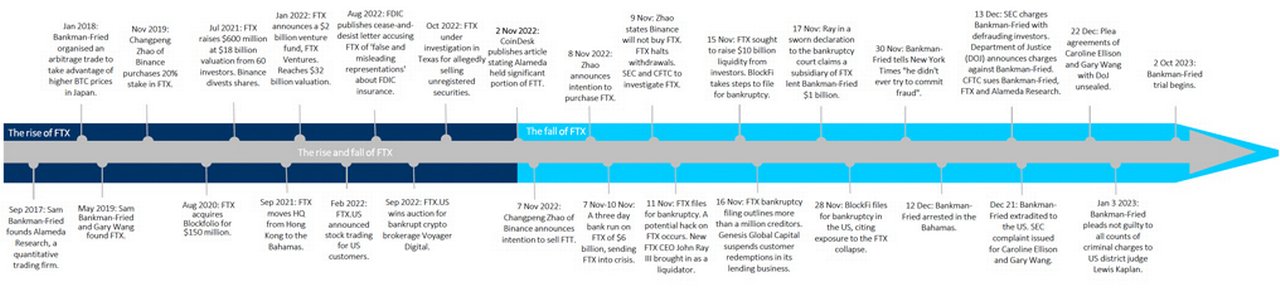

Figure 2: Timeline of the rise and fall of FTX

Source: Deutsche Bank

Echoes of Enron?

With crypto assets already established as high risk, further uncertainty has been created by the recent problems with issuers, exchanges and the sharp fall in crypto prices, comment Laboure and Ainsworth-Grace, who suggest that regulators might consider requesting crypto companies to comply with the stringent rules imposed on traditional investment products. “It won't immediately solve all the issues, but this would help restrict crypto companies from fishing for consumers without financial expertise while governments develop overarching regulatory frameworks,” they add.

The average consumer may be susceptible to misleading information and a well laid out comprehensive regulatory framework should help bring much-needed stability and order in the crypto ecosystem. US attorney for the Southern District of New York, Damian Williams, described FTX’s collapse “one of the biggest financial frauds in American history”, echoing earlier corporate collapses during the dotcom bubble, Enron and the 2008 financial crisis.

Figure 3: Selected major corporate collapses (by market capitalisation/valuation of corporates prior to their crash)

Source: Deutsche Bank, Bloomberg Finance LP, Kmart, The Financial Times, CNN Money, Fortune 500 Archive, Wall Street Journal, Reuters, American Economic Association.

The crypto boom echoes what Alan Greenspan – and economist Robert Shiller – dubbed “irrational exuberance” that characterised the dotcom era, says Laboure. The low interest rate period of the late 1990s cut the cost of borrowing, encouraging a dramatic increase in the number of start-ups linked to emerging internet technology.

But many of the entrepreneurs behind these launches lacked concrete and formalised ideas for their products and firms. However, they capitalised on:

- high information barriers, as the technology was new;

- venture capitalists keen to buy into novelty; and

- high valuations making it easier to raise capital.

As the unsustainable business models became apparent and competition from established firms increased, many of these companies began to fail. The Nasdaq surrendered all gains amassed during the dotcom bubble, falling 78% from its peak in October 2002.

While many companies failed during this period, the technology it was built upon endures and is used daily; Laboure and Ainsworth-Grace say it will likely be the same for digital assets and blockchain. Many traditional media firms recognised the potential of the internet, using it as an additional channel to distribute their publications and increase advertising revenue. As many internet business clients failed, telecom companies experienced overcapacity, reducing the cost of internet connectivity, and facilitating greater uptake through greater affordability. During this crypto winter, many crypto firms may likely face intense pressure. However, in many ways, Schiller's view on “irrational exuberance” may ring true for crypto – it’s essential for building anything significant.

The collapse of FTX mirrors that of Enron; both firms spearheaded by a charismatic CEO. Enron’s Jeffrey Skilling was a media star, who claimed that Enron was “on the side of angels.” Under Skilling, Enron adopted “mark-to-market” accounting, valuing anticipated profits using present value rather than historical costs- most notoriously in its 2000 deal with Blockbuster Video, claiming US$110m in profits before the project had begun.

FTX priced its thinly traded FTT token mark-to-market on its balance sheets, and then it applied the pricing to FTX and Alameda's large illiquid holdings. FTX’s liquidator, Ray, who described the challenges as dwarfing those he previously experienced at Enron and Nortel, highlighted the “compromised systems integrity and faulty regulatory oversight abroad” and “the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals.”

Recent SEC and CFTC filings allege that Bankman-Fried orchestrated a multi-year fraud, the SEC identifying three vectors:

- Undisclosed diversion of customers' funds to Alameda Research;

- Undisclosed special treatment afforded to Alameda, including a virtually unlimited “line of credit” funded by customers, exempting Alameda from risk mitigation; and

- Undisclosed risk from FTX's exposure to Alameda's holdings of illiquid assets, like FTT. Preferential treatment was derived from code written into the platform, allowing Alameda to execute transactions without sufficient funds

“Tragedies such as FTX will… help shift the development of crypto assets closer to well-governed and on-shore financial markets”

According to SEC Chair Gary Gensler, Bankman-Fried “built a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto”. Paul Maley, Deutsche Bank’s Global Head of Securities Services reflects that “whenever any individual or company loses money due to financial maleficence, it is calamitous for the victims and there is too often a genuine human cost”. It is, he adds, “a strong indicator that we hope will encourage investors to keep their hard-earned money with a highly regulated and highly capitalised financial institution”. Maley’s point is that client asset protection is an inherent part of all the securities services a global bank such as Deutsche Bank offers. “Tragedies such as FTX will, I hope, help shift the development of crypto assets closer to well-governed and on-shore financial markets.”

Regulation required

The lack of a comprehensive regulatory framework for cryptocurrencies has permitted the rapid development of the market around the world, reflect Laboure and Cassidy Ainsworth-Grace. As Gurbir S. Grewal, Director of the SEC’s Division of Enforcement remarked, “FTX’s collapse highlights the very real risks that unregistered crypto asset trading platforms can pose for investors and customers alike.”

Its absence has exposed investors to massive losses across all crypto platforms. A recent example was the May 2022 crash of TerraUSD, a popular algorithmic stablecoin designed to reduce volatility, which triggered huge losses across the crypto market. In the week following both the TerraUSD and the FTX crash, crypto market capitalisation fell by nearly 24%.

In the absence of meaningful government regulation, entire financial sectors can implode, as evidenced when the subprime lending bubble burst in 2007. At that time, the banking sector had benefited from weak regulation, loans were extended to homeowners with poor credit histories and to risky borrowers. The combination of low interest rates and deregulation triggered a surge of demand for US housing and risky credit. However, when interest rates increased, the housing bubble burst, homeowners were unable to pay debts, and many subprime lenders filed for bankruptcy. Stock prices rapidly fell. Lehman Brothers, a “too big to fail” firm, filed for bankruptcy.

Laboure and Ainsworth-Grace conclude with a reminder of how the US government was forced to extend significant bailouts to prevent a depression. Following the crisis, U.S. lawmakers strengthened the regulatory framework, specifically by passing the Dodd-Frank Act 2010 that imposed stricter rules on banking and financial services.

Hence, the collapse of FTX has led to calls for more regulation from all quarters, across the world, to better police the crypto industry and to protect investors’ assets.

Deutsche Bank Research report referenced:

Future Payments: Crypto – FTX: A recap on what we learned and the major collapses in history by Marion Laboure and Cassidy Ainsworth-Grace (5 January)

Sources

1 See theguardian.com

2 See ft.com

3 See reuters.com

4 See economist.com

5 See bloomberg.com

6 See justice.gov

Cassidy Ainsworth-Grace

Analyst, Deutsche Bank Research

Marion Laboure

Senior Strategist, Deutsche Bank Research

Paul Maley

Global Head of Securities Services, Deutsche Bank

Securities services solutions Explore more

Find out more about our Securities services solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-up