22 September 2022

Ethereum, the second largest cryptocurrency in terms of market cap has shifted to a “proof-of-stake” consensus mechanism, with key implications for energy use, network security – and the crypto landscape. Drawing on Deutsche Bank Research, flow’s Clarissa Dann takes a closer look

MINUTES min read

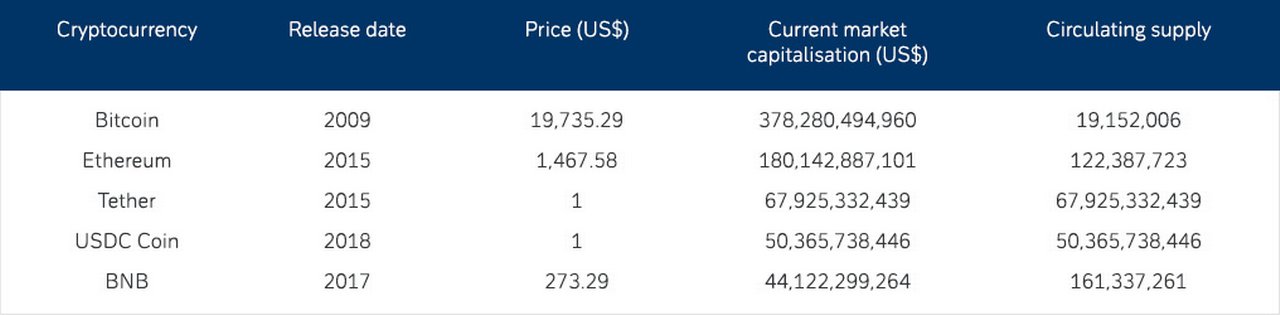

In June 2021, the cryptocurrency Bitcoin had a market capitalisation four times that of the second-most traded Ethereum. But, 15 months later, the cryptocurrency landscape has undergone a profound shift. Bitcoin’s market cap is now little more than two times that of Ethereum – which has just completed “the merge”; its transition from a proof-of-work (PoW) to a proof-of-stake (PoS) coin that gives it improved sustainability credentials.

In her Deutsche Bank Research report, Ethereum’s big merge and the future of cryptocurrencies (14 September 2022), Analyst Marion Laboure explains the significance of the Ethereum Merger for investors. This article provides an overview of Ethereum and its place in the cryptocurrency market, drawing on her main points.

Figure 1: Top five cryptocurrencies by market capitalisation

Source: https://coinmarketcap.com (as at 16 September 2022)

Ethereum operates on a decentralised open source blockchain with smart contract functionality and remains the second most prominent cryptocurrency (see Figure 1). Dubbed the ‘digital silver’, Ethereum has a real use case in day-to-day life; its primary purpose being to facilitate and monetise the operation of Ethereum smart contracts and its decentralised application platform. As Laboure points out, “It is not designed as an alternative monetary system, as is the case with Bitcoin. Perhaps for this reason, most DeFi applications are primarily based on Ethereum blockchain smart contracts.”

Ahead of the merge The Economist article “The future of crypto is at stake in Ethereum’s switch”1 (6 September 2022), hailed the switch as “no mere technical tweak” but rather a “complete overhaul of a US$200bn software project that has been running for seven years”. This article provides a helpful explanation of how the architecture of Ethereum differentiates from Bitcoin, using the blockchain to “keep track of lines of code”. It “allows Ethereum to record transfers of the currency, but also of all the assets and functions that are maintained in ‘smart contracts’, self-executing agreements in which a chain of actions follows when certain conditions are met”. The article continues, “This capability has made it possible for developers to build a large network of financial institutions, such as exchanges and lenders, in code on the Ethereum blockchain.”

“This important update has at least two key implications: energy use and network security”

Energy use and network security

“This important update has at least two key implications: energy use and network security. First, the switch to proof-of-stake is estimated to cut energy demand by 2,000 times. Second, Ethereum anticipates that the cost of attacking the network will double, which should strengthen the blockchain’s security,” says Laboure.

If the PoS system does prove to be a ‘greener’ alternative, then regulators could force the PoW cryptocurrencies to cut down on their energy use, reflects Laboure. Cambridge University’s Cambridge Bitcoin Electricity Consumption Index (CBECI) puts Bitcoin mining cumulative consumption at 381.32 terawatt-hours (tWh) of electricity in the past year.2 Her report notes that Ethereum has been consuming around 83tWh of electricity annually, “which is equivalent to the annual energy consumption of Chile”. Ethereum developers anticipate that power consumption post-merge will fall by 99.95% (i.e 2,000 times more energy efficient). “This improvement in environmental outcomes will likely open the door for institutional environmental, social and governance (ESG)-focused investors to add Ethereum to their portfolios. Desire for sustainable alternative exist in the crypto space. Switching to the more energy efficient PoS method could prove a major step in making Ethereum more palatable for those with ESG objectives,” adds Laboure.

Turning to security, estimates from Ethereum and The Economist put the cost to purchase enough Ethereum to mount an effective attack under the PoS system at US$15bn to US$20bn, substantially more prohibitive than the US$5bn to US$10bn needed to attack the PoW system.

The PoW to PoS journey

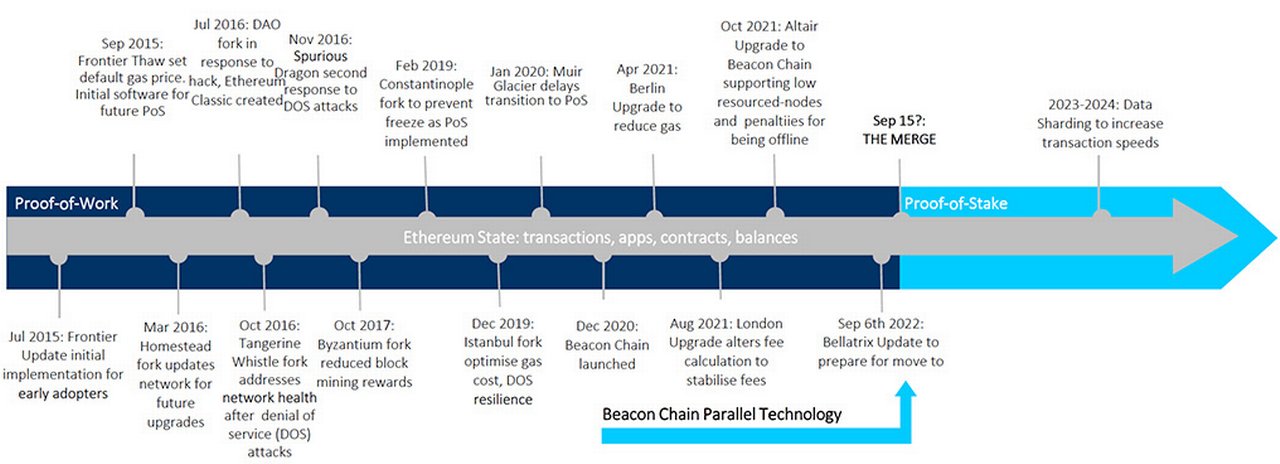

Figure 2: A timeline of all the major upgrades to the Ethereum blockchain

Source: Ethereum, Deutsche Bank

The Ethereum Merge, completed on 15 September 2022, shifts the consensus mechanism from PoW to PoS . The PoW system, used by Bitcoin, relies on transaction verification through a network of participants known as “miners” – who compete to add the newest data or tarnation to the blockchain by solving complex mathematical puzzles. They are rewarded with new cryptocurrency units when they arrive at a solution. “PoW achieves secure peer-to-peer transactions without a third party,” comments Laboure.

A PoS system, however, verifies transactions by selecting validators in proportion to their holdings, rather than relying on miners to produce valid ‘blocks’. Under the new system, PoS validators must stake capital in the form of Ethereum’s native cryptocurrency Ether – and this acts as collateral. If a validator is absent or does not act when required, they may lose some of their stake. Validators are rewarded with interest on deposited Ether. Dishonest or malicious behaviour can mean being “slashed”, in other words destruction of the offender’s capital and their removal from the network. “Ethereum hopes that the switch to PoS will improve security, reduce energy consumption, increase the number of users on the network, and grow its market capitalisation,” says Laboure.

A parallel blockchain technology to Ethereum Mainnet, known as the ETH 2.0 Beacon Chain, was launched in December 2020, and this was used to test the PoS mechanism without impacting Ethereum’s existing functions. The next stage involved switching out of the current PoW algorithm for Beacon Chain in the central Ethereum network. As from 15 September, Ethereum’s PoW system and all mining has officially ended and Ether now functions as a PoS cryptocurrency.

“The Beacon Chain was not originally processing Mainnet transactions. Instead, it was reaching consensus on its own state by agreeing on active validators and their account balances. After extensive testing, it became time for the Beacon Chain to reach consensus on real world data. After The Merge, the Beacon Chain became the consensus engine for all network data, including execution layer transactions and account balances,” states Ethereum.

The shift, notes Laboure’s research, has attracted attention around the world, particularly from Singapore, but also Switzerland, Russia and Canada.

Investor outlook

The Merge, explains Laboure, will not immediately improve Ethereum’s transaction speed and “gas” fees (payments made by users to compensate for the computing energy required to process and validate transactions on the Ethereum blockchain). It remains “one of the more expensive coins with which to transact”, and costs around 20% or more than the actual amount for transactions under US$10.

A subsequent update, known as “sharding” because it will split the entire network into small parts (shards) is expected to improve transaction speeds, lower fees and open possibilities for scaleability, adds Laboure. However, while she agrees the Ethereum Merge has been “an essential step towards the sharding update,” she does not anticipate meaningful improvements to be visible until after 2023.

Despite this, the merge has changed the decentralised finance landscape – and the yield continues to attract interest. As investors place a financial stake in Ether, their transaction fees are distributed to validators. “Stakers”, says Laboure, “can expect yields of 10%–15% annually without factoring in potential capital gains from positive movements in Ether’s price”. Importantly, she concludes, “for institutional investors, these attractive yields could position Ether as an alternative to bonds or commodities”, and “the shift to PoS, which offers a greener alternative for ESG investors, may fuel this trend further”.

Regulatory considerations

“The Ethereum Merge is a highly complex technology upgrade of a global decentralised public blockchain that was initiated on 30 July 2015 by its genesis block. The upgrade adds important evolutionary impacts in the digital asset revolution3, and bodes well for both crypto native and traditional finance ecosystems’ growth,” says Boon-Hiong Chan, Global Head, Fund Services, APAC Head, Securities Market Development & Technology Advocacy, Deutsche Bank Securities Services.

With its transition to a PoS consensus, he continues, the Ethereum’s current roadmap of what its co-founder, Vitalik Buterin, has dubbed “Merge-Surge-Verge-Purge-Splurge4” has other proposed advance features that are likely to enhance it as a public chain choice for cost effective financial inclusion, and growth for traditional finance via neo-financial services. The Merge and subsequent planned upgrades “will also introduce new technology features that can allow it to better address a wave of emerging regulatory concerns about crypto assets and public blockchains.”

According to Chan, the Merge paves the way for the Ethereum blockchain network to be divided into mini sub-networks, or shard chains, to scale transaction throughput by allowing parallel processing of transactions. With other scaleability improvements, a 100,000 transactions per second (TPS) is targeted that references favourably against today’s global credit card rails5 and to meet the traditional financial industry’s needs.

Key technology features

Chan reflects that while the PoS has already led to a concentration of staking pools6 and raised concerns about potential collusion, resilience against 51% attacks7 and censorships, “the planned sharding will introduce a degree of decentralisation from potential new validators who are attracted by its new economic incentives and are able to participate easier from lower hardware requirements”. This decentralisation attribute, he says, will be further helped by other roadmap plans to reduce validators’ needs to maintain large data sizes and the historical data loads. He agrees with Laboure that The Merge has also endowed Ethereum PoS with a new security mechanism that has significantly raise the costs of an on-chain 51% attack (or a reorganisation attack) by validators – more than two-thirds of the validators will be needed for such an attack to be successful and in any such event, these validators will bear punitive economic penalties. It also specifically prevents replay attacks between Ethereum PoW and Ethereum PoS chains – that is to say, transactions on one chain cannot be enacted on the other. Finally, it has allowed the Ethereum public chain to move from probabilistic to a higher deterministic settlement “finality”.

“The Merge is anticipated to already start positive “butterfly effects” in the digital assets ecosystem”

Regulatory requirements

From a cross-industry angle, changes from the Merge and other technology features will, says Chan, “allow Ethereum public blockchain to satisfy traditional finance or regulators’ certain concerns in clearer ways”.

For example, while a concentration of validators is undesirable from a decentralisation view, it also makes it easier to identify “systemic-important” validators for cross-industry or private-public sector collaboration to create accepted risk mitigants that can pave the way for greater adoption. Eventually, regulators may also require these main validators to be appropriately licensed. By being licensed – or governed by agreed industry practices and appropriate risk management standards – these validators can better fulfill eventual conditions around cryptocurrency “operators of transfer and settlement systems” that are being assessed by authorities9. By doing so, it can facilitate growth of digital bonds and other digital assets, including permissioned decentralised finance applications and decentralised identities, to be issued and transacted on the Ethereum public chain. As a public chain with higher certainty of settlement “finality” level, its algorithm to randomly selected one validator to propose a block10, on-chain security and other planned characteristics add assurances to regulatory focus on investor protection11, orderly market trading, systemic and/or technology risks. These are important features since digital assets on public chains mean that the industry’s transition into digital assets opportunities and adoption by traditional finance and investors will be more cost effective in realising anticipated growth and potentials.

Completing the digital asset roadmap

As a public chain, concludes Chan, “the merged Ethereum is like a global public utility that allows open participation and the traditional industry to immediately tap on its ever-increasing network effect, volume and liquidity to innovate financial activities quickly and with scale”. It would also allow the industry to avoid multiple memberships to private consortiums, reduce required effort on counterparty due diligences and provide access to a larger pool of skilled resources to create futures of digital finance with more agility.

The journey to complete the roadmap will take several more years and is likely to see its fair share of risks, challenges and pivots in its path. However, the Merge is anticipated to have already started positive “butterfly effects”12 in the digital assets ecosystem.

Deutsche Bank Research reports referenced

Future payments: Ethereum’s Big Merge and the future of cryptocurrencies, by Marion Laboure, Research Analyst (14 September 2022)

Sources

1 See economist.com

2 See ccaf.io

3 See corporates.db.com

4 See volt.capital

5 See pymnts.com

6 See decrypt.co

7 See This is when a malicious user in a network acquires control of a given blockchain’s mining capabilities

8 See A term from chaos theory where a small change in one state of a deterministic non-linear system can result in large changes in a later state

9 See bis.org

10 See ethereum.org

11 See iosco.org

12 See A term from chaos theory where a small change in one state of a deterministic non-linear system can result in large changes in a later state

Corporate Bank solutions Explore more

Find out more about our Corporate Bank solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

MACRO AND MARKETS, CASH MANAGEMENT

Is the crypto party over? Is the crypto party over?

The presumption that Bitcoin and its peers offer a hedge against inflation has been debunked by recent sharp falls. The plunge extended to stablecoins, which are supposedly far less volatile. flow summarises Deutsche Bank Research analysis on crypto perception and reality

TECHNOLOGY, MACRO AND MARKETS

Metaverse – The next e-commerce revolution Metaverse – The next e-commerce revolution

The Metaverse, roughly defined as 3-D virtual worlds that mimic the real world, has drawn much attention since late 2021. It could usher in the next e-commerce revolution as it starts to gain traction with advances in technology and becomes more mainstream. Financial services firms have a significant role in powering this e-commerce explosion, say Deutsche Bank’s Sabih Behzad and Akash Jain

CORPORATE BANK SOLUTIONS

The triple revolution in securities post-trade The triple revolution in securities post-trade

Digital assets custodial capabilities are under scrutiny and digital ecosystems such as decentralised finance (DeFi) and stablecoins in the cryptocurrency space have expanded the post-trade possibilities. Our new flow special white paper explains the implications for post-trade securities services