25 June 2021

Despite its volatility, Bitcoin can no longer be ignored and one country has made it legal tender. Where does this leave corporate treasurers and investors – and the financial services industry? Clarissa Dann reports on the prospect of a brave new tokenised world

MINUTES min read

When El Salvador’s 39-year-old President Nayib Bukele revealed on 5 June in a videotaped announcement that he is submitting a bill to congress for the leading crypto currency Bitcoin to become legal tender, a threshold of widespread use was crossed. “This will generate jobs and help provide financial inclusion to thousands outside the formal economy,” he pledged.

“[Bitcoin’s] use as legal tender will go into law in three months and the bitcoin-dollar exchange rate will be set by the market. In three months, all businesses must accept payment in the cryptocurrency unless they have technological restrictions,” explains Deutsche Bank Research’s Marion Laboure in her paper, Bitcoin: The End of the Beginning? (10 June 2021).

However, when El Salvador’s Finance Minister Alejandro Zelaya asked the World Bank for technical assistance with the implementation of the cryptocurrency as an official method of payment, this was not forthcoming. “This is not something the World Bank can support given the environmental and transparency shortcomings," its spokesperson told Reuters.1

“This will generate jobs and help provide financial inclusion”

With Bitcoin having surged past US$1trn in market capitalisation three months ago before its most recent dip, regulators, governments and financial institutions are ensuring they are ready to manage and engage with the potential widespread adoption of digital assets and currencies, despite the current volatility and difficulties in setting a target price.

This article provides a snapshot of the current landscape of tokenised assets, with a closer look at Bitcoin.

Definitions

Two years ago, when Deutsche Bank published Regulation Driving Transformation Second Edition (September 2019);2 the white paper explained that there was no single agreed definition of crypto-assets other than the umbrella terms of cryptoassets from the Financial Conduct Authority “to define cryptographically secured digital representations of value or contractual rights that are powered by forms of distributed ledger technology (DLT) and can be sorted, transferred or traded electronically”.3

As for what a cryptocurrency actually is, the European Banking Authority’s explanation in its January 2019 position paper remains helpful. “Cryptocurrency is a type of cryptoasset, which typically does not provide rights, but is used as a mean of exchange – for example, to enable the buying or selling of a good provided by someone other than the issuer of the cryptocurrency, or for investment purposes or for the storage of value.”4

Deutsche Bank Research Macro Strategist Marion Laboure also provides some useful background to Bitcoin and other privately operated cryptocurrencies (in other words those not issued by a central bank, government, economy or territory). In her 10 March report, Bitcoins: Can the Tinkerbell Effect Become a Self-Fulfilling Prophecy? she explains that a cryptocurrency is a digital “asset” using peer-to-peer networking, is decentralised and widely accessible... “The asset is a digital “token” with no backing or intrinsic value.”

Since 2011, she adds, cryptocurrencies have gained momentum from investors and captured media attention, particularly after Bitcoin’s price rose dramatically in 2013. Since Bitcoin launched, many new cryptocurrency companies have been created, including Litecoin (2011), Ripple (2012), Ethereum (2015), and Bitcoin Cash (2017).

In total, there are more than 5,000 cryptocurrencies worldwide, but Bitcoin, the first blockchain-based cryptocurrency in the world, by far tops the crypto ranking of cryptocurrencies in terms of market capitalisation. Bitcoin’s current market cap is quadruple that of the second-most-traded Ethereum. Most cryptocurrencies work the same way, with limited supply – see Figure 1 for the top five as at 22 June 2021.

Figure 1: Most cryptocurrencies work the same way, with limited supply

As at 22 June 2021. Source: https://coinmarketcap.com/

Laboure explains that “Miners” use cryptographic code to process large quantities of data to earn coins. “The underlying algorithm fixes the maximum quantity of bitcoins to 21 million tokens, and so far an estimated 18.7 million are in circulation. It is estimated that the full amount of 21 million bitcoins will be mined by 2140.”

It is the limit on supply that differentiates Bitcoin from the fiat currencies controlled by central banks, which have been increasing in recent years via their QE programmes, adds Laboure. “Higher supply of one currency relative to others should theoretically drive down the price of that currency in the long run. Of course one needs to account for how the demand to hold assets in these currencies changes as well (if demand to hold USD starts to decline or stagnate even as the Fed continues to print USD, this would show up in relative USD weakness down the line).”

“As cryptocurrencies begin to seriously compete with regular currencies and fiat currencies, regulators and policymakers will crack down”

Regulatory responses and volatility

While the low level of crypto-activity in January 2019 did not, according to the EBA publication, “give rise to implications for financial stability, it did point out that “typical activities involving crypto-assets fall outside the scope of EU banking”. The EBA added that “payments and electronic money regulation and risks exist for consumer that are not addressed at the EU level”.

Fast-forward two years and the warning to consumers has become more direct. “In September 2020, the European Commission presented a legislative proposal for a regulation on markets in crypto-assets. Consumers are reminded that the proposal remains subject to the outcome of the co-legislative process and so consumers do not currently benefit from any of the safeguards foreseen in that proposal because it not yet EU law.”5

But where does this leave corporates and their banks? For a start, reflects Laboure in her 10 June paper, Bitcoin: The End of the Beginning? most G20 countries are unlikely to follow El Salvador’s laissez faire example and intend to regulate crypto assets. “These nations do not want to allow private cryptocurrencies to compete with government-backed fiat currencies. In terms of regulatory measures, we expect 2021 to be a game changer and that by 2022 most advanced economies will have a strong crypto asset regulatory framework in place,” she says. In other words, the technology has matured and regulators around the world are currently preparing the necessary groundwork for a sustainable transformation of the industry towards the use of digital assets and currencies.

The other point to consider, something that the authors of Regulation Driving Transformation Second Edition articulated in 2019 is that if cryptocurrencies such as Bitcoin become widely established as a payment tool, “central banks would be forced to factor them into their monetary policy decisions – yet without the necessary mechanisms to influence their supply, this could undermine the effectiveness of monetary policy.”

“Similarly, the supply of a cryptocurrency created by a private company could mean that company ultimately having an impact on the overall “money supply”, leaving domestic economic performance dependent upon the flows of such cryptocurrency.”

It is therefore hardly surprising that there has been a ramp-up in central bank digital currency development. Our February 2021 flow feature, When will digital currencies become mainstream? summarises how, over the past three years, central banks and governments have multiplied and accelerated digital cash initiatives.6

Aside from government-backed alternatives, volatility is the other inhibitor of widespread private crypto currency adoption.

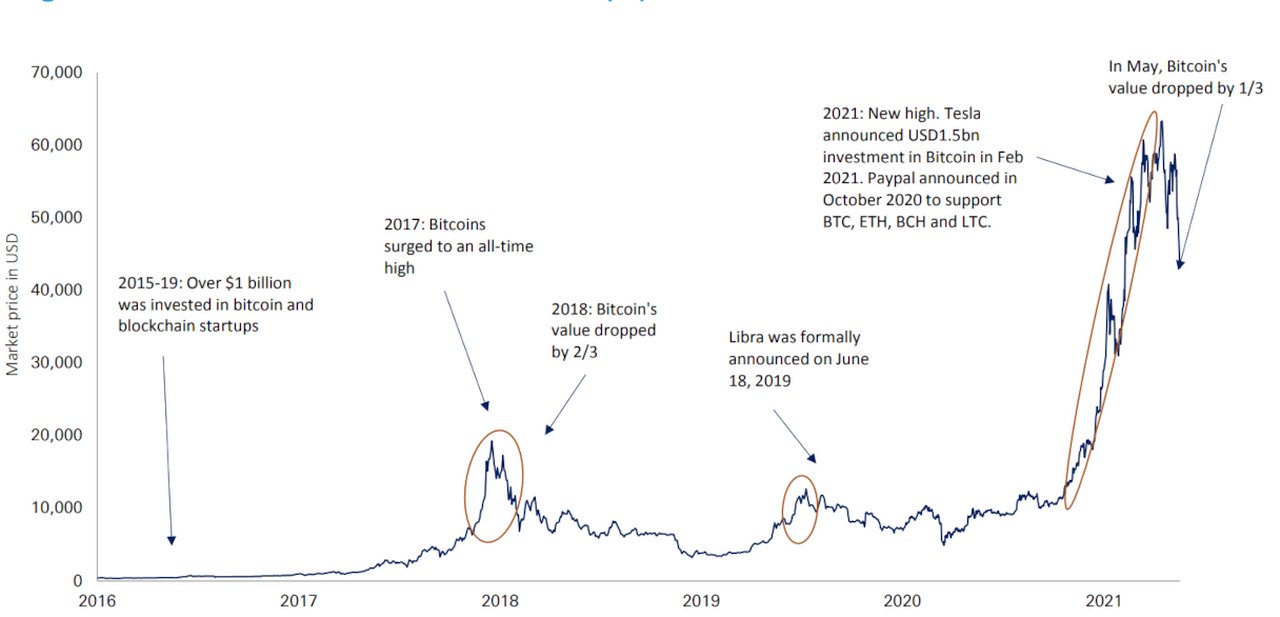

On 19 May, Bitcoin’s price fell sharply to just above US$30,000 at one point (a plunge it repeated on 22 June), losing more than half since it reached an all-time high of nearly US$65,000 in mid-April (See Figure 2). But in the world of trading crypto currencies where there is limited supply and no central bank regulation, price spikes and drastic falls are the order of the day. It is nigh on impossible to set a target price and everything is in discovery mode.

The reason for the 19 May plunge, explains Laboure in Bitcoin: Trendy Is the Last Stage Before Tacky (20 May) was that Tesla founder and CEO Elon Musk had tweeted that his company would not accept Bitcoin as a means of payment. In addition, on 18 May, the People’s Bank of China (PBoC) reiterated that digital tokens cannot be used as a form of payment. She comments, “It is no surprise that governments are not inclined to give up their monetary monopolies. Throughout history, governments first regulate and then take ownership. As cryptocurrencies begin to seriously compete with regular currencies and fiat currencies, regulators and policymakers will crack down.”

Figure 2: Sharp fall in the value of Bitcoin on 19 May

Source: Coindesk, Bloomberg Finance LP, Deutsche Bank.

Crypto-assets and tokenisation

While Bitcoin and other token currencies have been grabbing the headlines, it should be remembered that different types of assets are, as explained by Deloitte in their white paper, Are token assets the securities of tomorrow? “treated differently from and operational and regulatory perspective”.7

“A global consensus has emerged in relation to dividing crypto-assets into four main archetypal assets: payment/exchange (e.g., bitcoin and equivalents), security (investment components including ownership and promise of future cash flows), and utility (access to specific products, services or protocols).” As for the fourth, Deloitte add, “These assets can also be combined in various hybrid forms.”

Specifically, the reports sets out how “ the security token is the security of the future” and that “European and local authorities now acknowledge that DLT platforms and security tokens can provide clear added value in terms of transparency, efficiency and enhanced reporting oversight.”

What this means is that if money and assets are represented as tokens on a DLT, trading and investing becomes easier, cheaper, more efficient and more transparent than today because reconciliation and settlement processes are streamlined. Agile financial institutions are preparing for a world in which a significant fraction of tangible and intangible assets as well as currencies will be tokenised. There is no doubt that blockchain, digital assets and digital currencies are here to stay, and they will change the way the financial services industry does business – within its own ecosystem and in relationships with corporate and private individual customers.

She adds that Bitcoin is now “another treasury tool” and that some publicly traded companies have started converting cash in their treasuries into Bitcoin as an alternative store of value. “For example, in August 2020 MicroStrategy, a business analytics company, converted US$425m worth of cash in its treasury to Bitcoin.

And although, given the volatility of Bitcoin, most merchants are not keen to accept cryptocurrencies as a payment method now, this could change, she adds. “Once we see some stability in the market, the use of crypto for the exchange of goods and services could normalise. Before that, the risks for both merchants and payment providers outweigh the benefits. Usually, settlement is not in real time. This provides merchants with a guarantee of a certain payout (amount); the lack of that timeliness can be tricky for payment providers (they would need high risk provisions or could have transactions end in losses).”

While there is some way to go before any kind of regulatory alignment and the regulatory certainty enjoyed by traditional assets is not quite there for cryptoassets as yet, it would be wise to assume that somehow regulators and the industry will work together to take the tokenisation journey forward. Nobody wants to be left behind.

Deutsche Bank research referenced

Future Payments: Bitcoin: The End of the Beginning? By Marion Laboure (10 June 2021)

Future Payments: Bitcoin: Trendy Is the Last Stage Before Tacky By Marion Laboure (18 May 2021)

Corporate Bank Research: The Future of Payments: Series 2 - Part III. Bitcoins: Can the Tinkerbell Effect Become a Self-Fulfilling Prophecy? By Marion Laboure (March 2021)

Sources

1 See https://reut.rs/3d5XfJS at reuters.com

2 See Regulation driving banking transformation: Second Edition at corporates.db.com

3 See https://bit.ly/3xUmJSF at fca.org.uk

4 See https://bit.ly/2Uy5wQu at eba.europa.eu

5 See https://bit.ly/3zT0jmu at eba.europa.eu

6 See When will digital currencies become mainstream? at flow.db.com

7 See https://bit.ly/2SSIaoh at deloitte.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

SECURITY SERVICES, TECHNOLOGY

Building a future custody model Building a future custody model

The investment landscape is embracing new technologies such as digital assets. Paul Maley, Head of Securities Services at Deutsche Bank, explains why the future of custody will require a co-existence of old and new technologies, how market structure for securities could change and the implications for clients

CASH MANAGEMENT, MACRO AND MARKETS

When will digital currencies become mainstream? When will digital currencies become mainstream?

The Bahamas launched the sand dollar, a nationwide central bank digital currency (CBDC) last October. flow’s Graham Buck reports on why its move will be followed by others around the world over the coming months as CBDCs take on cryptocurrencies

CASH MANAGEMENT

Regulation driving banking transformation: Second Edition Regulation driving banking transformation: Second Edition

A regulatory environment that supports the safe and robust development of the data economy is essential for banking transformation, says new white paper