19 July 2023

Cloud technology is embedded in our daily lives, from storing photos and files from personal devices to sharing files at work. flow reports on how custody in the cloud brings a wealth of self-service and real-time data analytics benefits to both client and custodian – once regulatory frameworks and legacy systems are navigated

MINUTES min read

Countless industries are now using cloud-based technology in their operations. Unlike a traditional IT system, which is managed on-site, cloud solutions, which offer users access to things like data storage and development tools, are hosted at remote data centres.1 Not only does the cloud help businesses reduce their overall IT spend, but it enables them to become more scalable and agile.

Appetite for cloud technology is growing among financial institutions. Although just 13% of financial firms have more than half of their IT footprint in the cloud today, a McKinsey study revealed that 54% intend to move at least half of their operations to the public cloud within the next five years.2 It suggested that adoption of the cloud could result in Fortune 500 financial institutions generating cost savings of between US$60bn to US$80bn in run-rate EBITDA (earnings before interest, tax, depreciation, amortisation) by 2030.3

“Custody in the cloud helps us provide a client service which is highly data-centric”

Custodians turn to the cloud

Conscious of the transformational impact the cloud is having elsewhere, custodians are taking note and are incorporating the technology into their core operations with the following outcomes:

- Real time: Before, it was not uncommon for clients to receive reports about their transactions at the end of the day after batch processing, but cloud technology now means custodians can give them instant access to post-trade data in real time. “Custody in the cloud helps us provide a client service, which is highly data-centric. It’s about pushing data into an environment where settlement instructions, client holdings and information about asset servicing are all accessible to the client in a cloud environment. This means clients see the same information we are operating from in real-time,” explains Mike Clarke, Global Head of Product Management and Head of UK&I Region, Securities Services at Deutsche Bank.

- Analytics: By hosting huge volumes of data, the cloud allows users to conduct deep-dive analytics. By extracting meaningful insights from large pools of data, clients will be able to improve their decision-making processes. “At the heart of the cloud is data – enabling the transfer of data across our clients and ourselves – and the post-trade life cycle we are in,” adds Mathew Kathayanat, Head of Securities Services Product Management, APAC at Deutsche Bank. In other words, cloud users can access a bigger set of data, and can transpose that data at a more granular level.

- Enabling new technology: Importantly, says Kathayanat, “the cloud brings to life the new technology around us, and is the enabler for consuming large data sets – complemented by artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and the ever-present application programming interfaces (APIs). You couldn’t do it before because you had to query a legacy platform and mainframe, which meant building non-standard solutions. Today, the same datasets reside with both custodian and client, so everyone can automate the flow – so we can all do more with the same data”.

- Self-service: The cloud gives clients greater flexibility to run their own queries. Instead of having to phone up their custodians to ask them for an update about the status of a trade, the cloud allows clients to monitor their transactions in real-time. This self-service model allows for resources at both the client and the custodian to be freed up, enabling people to focus on more pressing or revenue generating activities. “It lets our people concentrate more on value-add and highly complex queries, as opposed to simple queries about trade status updates,” reflects Clarke.

- Risk mitigation: The cloud is an effective risk mitigation tool, as it provides customers with robust information security and disaster recovery facilities, a point made by the European Securities and Markets Authority (ESMA).4 Following on from the pandemic and with cyber-crime becoming an increasingly ubiquitous threat, cloud-based solutions are now highly sought after by risk-conscious financial institutions, as firms look to strengthen their cyber-hygiene and IT resilience.

“The cloud will allow us – over time – to layer on service enhancements”

Innovating through the cloud

Longer-term, the cloud will unlock a number of strategic opportunities for custodians and their clients. As Kathayanat notes, the industry is still heavily reliant on legacy systems and infrastructure. In the cloud, however, technology development is more straightforward, with enterprise up and running within minutes.5

“The cloud will allow us (over time) to layer on service enhancements, such as the provision of data insights using AI. Such tools include treasury management solutions, where users receive analytics about their cash balances. The technology can also be used to predict whether or not a trade will settle successfully. There are a lot of tools available in the cloud, which make it easier for providers to develop these sorts of technologies, versus doing it in-house,” according to Clarke.

Cloud solutions are also creating an environment ripe for multi-party workflows to flourish. Once there is trust in the data, and that data is seen as information that can be acted on. “You can start to build servicing calls from that data back into the processing flow. If a client sees something is wrong in the data, they have the ability to take action and correct it in our processing flow without it having to pass through every stage of messaging. They can update their system and our system simultaneously,” explains Clarke.

Overcoming the hurdles

Although the cloud offers extraordinary potential, navigating access is less than straightforward.

One of the biggest obstacles is regulation, as different markets will often adopt their own rules around how data is used and stored. For example, China requires companies to conduct thorough security assessments before transferring data overseas, while others ban the export of data altogether.6 “There are regulatory frameworks in place that we need to follow in all the markets where we offer our services. We operate in 32 different jurisdictions, each of which has their own unique rules and regulations governing cloud and data. It is vitally important that custodians make sure they comply with all of these different guardrails,” says Kathayanat.

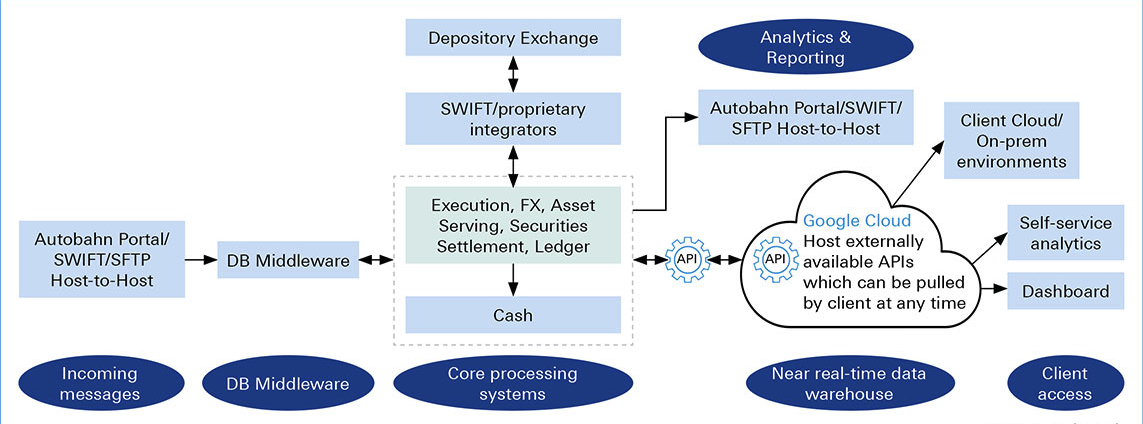

Another difficulty is the walled gardens that result from there being multiple cloud service providers (CSPs), and the difficulty in transferring data between each of them. This is where APIs can be leveraged to enable cloud-to-cloud data transfers. For example, Deutsche Bank has a cloud partnership with Google, but not everyone will use Google as their cloud provider, so a level of interaction is required. While the bank builds new custody solutions within its Google cloud, the data shared with clients is held in a separate space within that Google cloud, with bank and client feeds going in each direction – in real time (see Figure 1).

Figure 1: How data moves between clouds

Source: Deutsche Bank

“Google has built a lot of services as add-on bits of technology that can then operate on the cloud infrastructure this database sits on,” says Clarke. One example is Google BigQuery, part of Google Cloud’s data analytics toolkit. “We can build tailored solutions using BigQuery – and being on the cloud provides access to common code bases that can be linked to on top of the data,” he adds.

The first stage of this data sharing journey is putting the custody API structure into the cloud, ensuring the different channels of data provision – albeit from legacy systems. “We are sharing data with clients on a fully cloud-based push and pull basis,” says Clarke.

This is the start of an exciting journey after all, as Kathayanat concludes: “the cloud is here to stay.”

Sources

1 See ibm.com

2 See mckinsey.com

3 See mckinsey.com

4 See esma.europa.eu

5 See ibm.com

6 See whitecase.com