16 June 2023

Trade settlement fails create added costs and risks for financial institutions. While the largest reason is insufficient securities being available for settlement and liquidity issues, the overall settlement landscape is more nuanced. flow provides a summary of the Deutsche Bank white paper examining failure triggers and potential solutions

MINUTES min read

Although the overwhelming majority of equity and bond trades settle on time, fails do still occur periodically. Data from the European Securities and Markets Authority (ESMA) showed that equity settlement fails in Europe stood at 6% as of December 2022, with a one-year moving average of around 8%.1 While settlement fail rates are lower for government and corporate bonds, these numbers have edged upwards slightly over the same period.2

Why trades fail to settle

Trades fail to settle for several reasons. By far the biggest reason for settlement failure is insufficient securities being available for settlement. An inability to access securities (i.e. because they are out on loan and cannot be recalled, or due to a lack of liquidity in the market) can also contribute to fails. Poor quality data is a significant impediment to seamless trade settlements, with inaccurate or incomplete standing settlement instructions (SSIs) being a major factor in trade settlement fails.

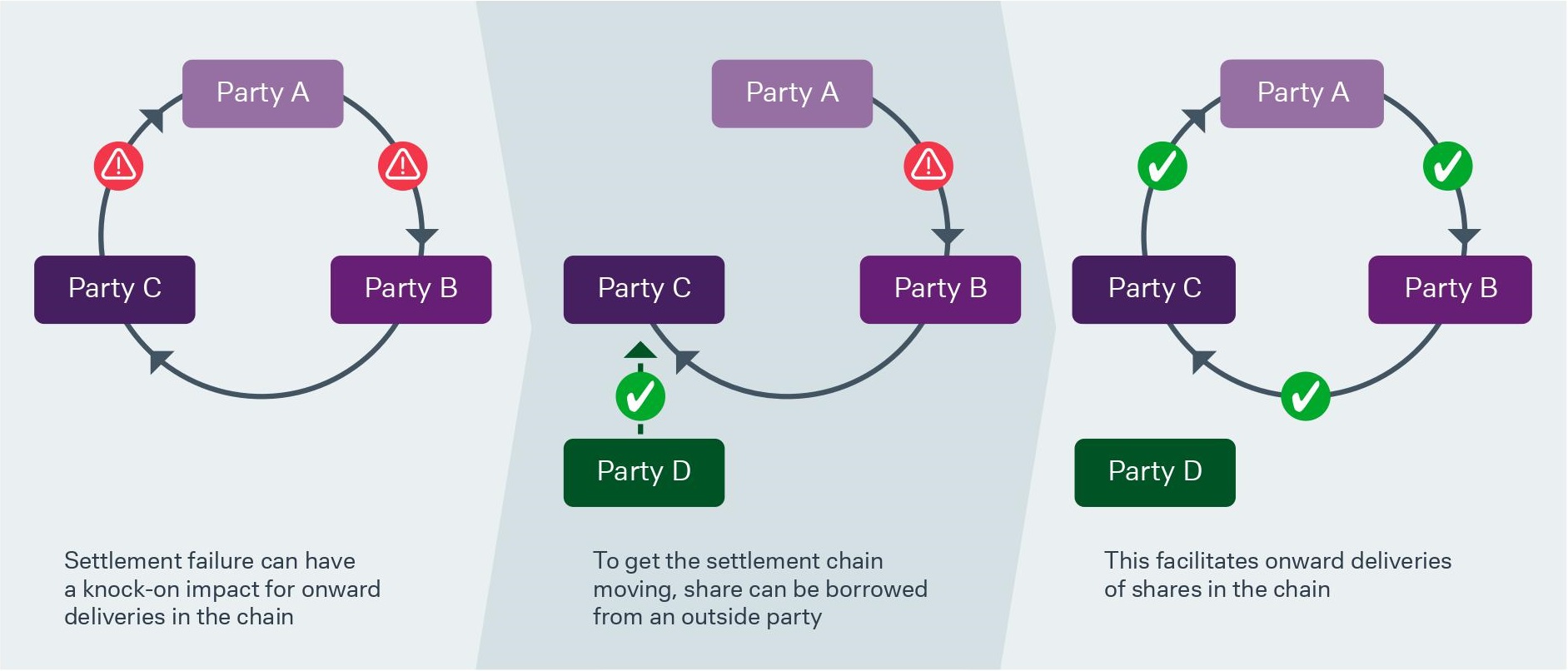

Figure 1: Settlement chains

Source: Deutsche Bank

Figure 1 demonstrates how a failure “circle” arises whereby Party A cannot deliver to Party B, who then cannot deliver to Party C, who needs those shares to deliver to Party A. When this happens, one of the impacted parties will borrow the shares from a separate Party D to get the settlement chain moving.

Another common trigger for trade fails is when there are spikes in transaction volumes, often caused by market volatility. This increases transaction volumes, causing strain on market infrastructures. Markets have remained highly volatile since March 2020 caused initially by the pandemic and then the outbreak of war in Ukraine. These two black swan events have precipitated a sharp jump in trading volumes and trade fails. In addition, there was a notable increase in the number of fails in the immediate aftermath of the UK’s mini budget in September 2022.

All of these problems are exacerbated by the legacy systems and antiquated technologies employed in the back offices at both trading firms and their intermediaries. This ongoing reliance on manual processes during trade matching, confirmations and instructions certainly increases the likelihood of transactions not settling on time. In marked contrast to front office systems, there has been limited investment into post-trade technology since the financial crisis of 2008, although this imbalance is slowly starting to improve.

Cost and risk

Settlement fails can have various adverse impacts on capital markets and these all come down to cost and risk.

- Cost: The rollout of the Settlement Discipline Regime (SDR) under the EU’s Central Securities Depositories Regulation (CSDR, which came into effect in February 2022, imposes cash penalties on counterparties responsible for trade fails.3 In addition to cash penalties, settlement fails can result in interest payments being accrued, eroding margins.

- Risk: If a participant expecting to receive securities or cash on a particular due date is not receiving them because of a settlement fail at its counterparty, then there is a risk that the affected participant will be unable to meet their obligations with other counterparties on the same date. This could result in a potential ‘domino effect’ that could eventually contribute to some sort of systemic risk. Late settlement also carries reputational risk. For example, any financial institution which routinely fails to settle its trades on time may struggle to find counterparties willing to trade with them in the future, due to the operational risks and costs associated with the relationship.

Reforms spark a race to reform

Regulation and market reforms designed to strengthen post-trade processes are expected to prompt financial institutions into addressing settlement discipline with more urgency.

Although EU regulators opted to defer SDR’s Mandatory Buy Ins (MBI) until November 2025, a CSDR Refit was proposed in March 2022 by the European Commission (EC). As part of this plan, the EC recommended the introduction of MBIs if it becomes clear that cash penalties are not having their intended effect. If settlement rates do not improve or meet a certain measurable threshold set by regulators, then the EC and ESMA could well be inclined to introduce MBIs.

The decision by major markets to adopt T+1 will mean there is less time available to complete settlements, in what will put pressure on operational processes and technology systems. This, in turn, will increase the chances of trades failing.

Solutions

There are several solutions available to financial institutions, which could potentially reduce the regularity of trade settlement fails.

One way to minimise settlement fails would be to obtain better transparency into the trading lifecycle. Market participants would then be able to procure more accurate insights into what is happening during the entire transaction process and start to implement tools that allow for multiparty workflows to take place.

Visibility of both sides of the instruction makes it simpler to identify which party needs to act to resolve the issue. There are several ways to achieve this, one of which is the adoption of Swift’s Unique Transaction Identifier (UTI). A UTI is a unique alpha numeric code that is assigned to a securities trade, enabling for the trade to be tracked from end to end throughout the settlement lifecycle. By incorporating the UTI into the settlement process, trading counterparties will be able to identify operational risks or problems during the transaction lifecycle, thereby helping them to avert potential fails.

A useful tool for the market to improve settlement liquidity and reduce the value of penalties is the use of partial settlement. Within a settlement instruction, each party can indicate that they are open to allowing a partial delivery to take place. A partial delivery is one where the seller delivers the shares available in their inventory to the buyer in return for a proportionate amount of cash proceeds. This reduces the outstanding amount that is failing and therefore reduces the size of any penalty.

Furthermore, integration of innovative technologies, such as artificial intelligence, Blockchain or distributed ledger technology (DLT), into existing processes could also potentially drive down settlement fail rates, especially if atomic settlement becomes a reality.

Download the full white paper Download the full white paper

Click here to download the full white paper