24 November 2022

With the FTX bankruptcy having put the jitters into the crypto markets, the Network Forum Asia meeting’s focus on what this means for Asia’s voracious investors – and their custody requirements – was particularly opportune. flow reports from an upbeat Singapore

MINUTES min read

In contrast to other global markets that are feeling the icy blast of rising interest rates and inflation, Asia-Pacific is one of the few regions whose economies are growing.

The Network Forum’s (TNF) Asia Meeting took place in Singapore from 14–15 November, having last been held in person in Hong Kong back in 2019; before the Covid-19 pandemic. More than 130 network managers, direct custody providers, financial market infrastructures and technology leaders from across Asia-Pacific and beyond made their way to Singapore for the two-day conference.

Digital assets move into the mainstream

While appetite among institutional investors for unregulated and volatile digital assets such as crypto currencies and stablecoins is limited, interest in security tokens is gaining momentum in Asia-Pacific.

During TNF Asia 2022, Boon-Hiong Chan, Head of Fund Services and Head of Securities Market & Technology Advocacy at Deutsche Bank, participated on a panel titled “Digital Assets, Tokenisation and DLT Development in the APAC Markets”, alongside Waqar Chaudry, Executive Director, Innovation and Digital Assets Products, Financing and Securities Services, Standard Chartered; Karen Qian, Associate Director at Digital Asset; Samar Sen, Head of APAC at Talos; Irfan Ahmad, Vice President at State Street; and Barnaby Nelson, CEO at The Value Exchange.

During the panel session, TNF delegates were told that one of the principal benefits of tokenisation is that it will facilitate fractional ownership of illiquid assets including private equity, credit, real estate or even intangibles such as copyrights.1 By doing this, once traditionally illiquid or opaque markets can become more accessible to retail investors, enabling portfolio and risk diversification at a time when alpha opportunities have become more limited.

Yet not everyone agrees with this viewpoint. Speaking to flow, Chan highlighted other challenges related to tokenising or fractionalising illiquid assets for end investors and issuers. “Tokenising illiquid assets could result in liquidity and maturity mismatch concerns, which will then require new market makers. Tokenisation and fractionalisation do not automatically mean liquidity creation, and liquidity is needed for optimal pricing,” he observed.

However, there is a compelling argument for tokenising some of the more liquid or on-exchange securities, namely equities and bonds, together with mutual funds. According to a presentation at TNF by Metaco, a technology company specialising in digital asset custody infrastructure, around US$1,000trn plus of assets could theoretically be digitalised in the not-too-distant future, of which US$737trn are existing capital markets securities and US$46trn is traditional fiat currencies.

“Tokenisation can empower retail investors’ financial planning by helping them save for retirement”

By fractionalising liquid assets, said Chan, tokenisation can bring about greater financial inclusion for retail investors. “Buying a share lot in a leading blue-chip company can cost retail investor hundreds – if not thousands – of dollars notwithstanding the various transaction costs. Tokenisation could make this more affordable and inclusive by enabling retail investors to gain exposure to blue-chip securities for a fraction of that cost. Tokenisation can empower retail investors’ financial planning by helping them save for retirement,” he explained.

Several Asia-Pacific markets are exploring the benefits of tokenisation. Thailand is reviewing ways to encourage secondary market liquidity in tokenised securities. In the case of Singapore, Coinbase reports the Monetary Authority of Singapore (MAS) is exploring De-Fi applications in wholesale funding markets by creating a liquidity pool of tokenised bonds and deposits to execute borrowing and lending on a public Blockchain network.2

Tokenisation could also help facilitate efficiencies around asset servicing and trade settlements at a time when the custody industry is facing serious margin pressures. “Programmability of digital assets enabled by application programming interfaces (APIs) and smart contracts could net major efficiency benefits,” said Chan. “Last year in an internal experiment, we found programmability in the over-the-counter (OTC) bond market could remove a significant portion of the processing steps around corporate actions”.

However, tokenisation of assets, even liquid securities, can pose new operational and governance considerations. Chan told the audience at TNF that fractionalisation of shares could create issues around corporate actions. “Imagine if you tokenised and fractionalised an equity security, and there is a mandatory voting requirement. In a fractionalised world, how should fractionalised votes of one share be handled, or can fractions of a vote be counted?” he asked. “Should intermediaries ask all the shareholders who own a fractionalised share about how they intend to vote, and then vote according to what the majority’s preference for one share is? How and when would a separation of dividend income and voting rights impact an issuer’s governance? These sorts of matters will need to be addressed as part of this exciting possibility”.

Why institutional providers matter in the digital asset market

The timing of TNF 2022 was fortuitous, held only days after the sudden collapse of FTX, a Bahamas-based crypto-exchange once valued at US$32bn and whose underlying shareholders included several high-profile institutional investors.

What precipitated FTX’s demise?

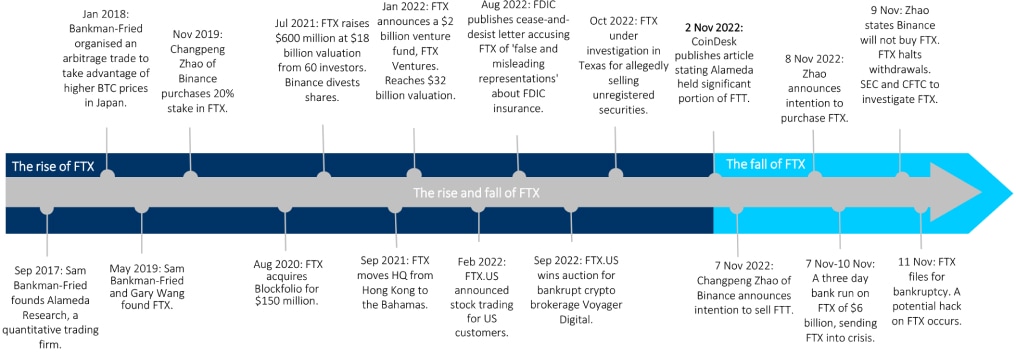

In the Deutsche Bank Research report, Crypto - FTX: Another castle built on sand (14 November) by Research Analysts Marion Laboure and Cassidy Ainsworth-Grace, chart in some detail the rise and fall of the company founded in 2019 by crypto exchange wunderkinder Sam Bankman-Fried (SBF) and Gary Wang. “Documents published by Coinbase in November made apparent that Alameda Research, a trading and investment company founded by SBF, held a majority of the FTX tokens (FTTs). The company had been borrowing against FTT, which generated rumours that FTX had been lending client funds to Alameda using its own token as collateral,” explain Laboure and Ainsworth-Grace.

They continue, “A tipping point was reached when Changpeng Zhao (CZ), the CEO of Binance, tweeted that Binance was unwinding its FTT position. Others took notice and the run on FTT ensued. FTT had been trading between US$22 and US$26 from October until 9 November when the FTT price fell to US$1.12. The shock caused the value of major cryptocurrencies to drop. This further undermined FTX’s position, which had been holding crypto currencies in the form of collateral. The declining value of those cryptocurrencies meant that FTX no longer had the wherewithal to meet its obligations without triggering further price declines. FTX balances dropped from US$8.4bn on 5 November to US$1.1bn on 10 November.” See Figure 1.

Figure 1: Timeline of the rise and fall of FTX

Source: Deutsche Bank Research (click on image to enlarge)

The two analysts see the collapse as a wake-up call for the crypto ecosystem: “Although investors have suffered significant losses, we believe this second ‘crypto winter’ will be net positive because the FTX collapse will edge the crypto ecosystem closer to the established financial sector,” reflect Laboure and Ainsworth-Grace. “The FTX crash spotlighted well known structural issues in the crypto ecosystem: insufficient reserves, conflicts of interest, a lack of regulation, and transparency and unreliable data”.

But what does it mean for custody?

The recent turmoil is likely to prompt investors trading crypto currencies to reassess whether it is prudent to have commercial relationships with crypto exchange groups offering crypto custody solutions, especially if they run affiliated prop trading desks or crypto funds. Problems at such entities – as events at FTX have demonstrated – can have a material impact on the balance sheet strength at a wider group level.

Speaking during the TNF opening session, Margaux Blumenfeld, Head of Sales, Securities Services, South Asia and Head of Non-Bank Financial Institutions Coverage for APAC at Deutsche Bank; said, “The death spiral at FTX raises a lot of good questions about coin custody. I believe we will see investors who focus on digital assets increasingly looking at traditional regulated companies and banks for custody, as opposed to crypto exchanges that have typically also been crypto custodians.”

Asia-Pacific – a bright future lies ahead

Anand Rengarajan, Global Head of Sales and Head of Asia-Pacific, Securities Services at Deutsche Bank, was a keynote speaker at this year’s TNF, and shared his insights into some of the major trends shaping the region’s capital markets.

Rengarajan said that smart apps are proliferating across Asia-Pacific, enabling ordinary consumers to invest their savings seamlessly, and often without manual intervention. “These smart apps do not necessarily need to be promoted by traditional financial institutions. Instead, we could have a travel app, which enables someone with US$100 in their wallets to buy a mutual fund product,” he said.

Such smart apps, continued Rengarajan, will generate enormous amounts of data on customers, which companies can leverage and perform analytics on. From this, firms can better tailor their client solutions accordingly.

He explained that other notable developments include consolidation, as clients increasingly look to simplify their operating models, together with growing collaboration across the industry more generally.

“The increase in ESG AUM is a huge opportunity for post-trade providers”

Finally, Rengarajan noted that environmental, social, governance (ESG) was gaining traction in Asia-Pacific. From an asset management perspective, ESG linked assets under management (AUM) in Asia-Pacific are projected to reach US$3.3trn by 2026.3 “This increase in ESG AUM is a huge opportunity for post-trade providers,” he concluded.

The increase comes as several post-trade providers look to augment their ESG asset servicing capabilities by launching ESG reporting toolkits and analytics.

Don’t write off China

Although China is facing various challenges, Tony Chao, Managing Director and Head of Securities Services, Greater China, at Deutsche Bank, advised international investors against writing the country off during a TNF panel session titled “China in Focus: Next Phase of Capital Market Evolution”. This also featured Siraz Mouhamadmoussa, Global Head of Buy Side Custody Product & Solutions at BNP Paribas and Ching Yng Choi, Founder at CYC Asia Europe Consulting Limited.

The audience largely concurred with a poll showing that 77% of TNF attendees still regard China as a viable investment destination. “China is a long-term opportunity for investors, although allocators are going to need to find ways to mitigate some of the short-term risks,” he said.

Despite some of the recent headwinds, China’s commitment to market reform has not wavered. For example, Chao said that the country was pushing ahead with the establishment of an onshore derivatives market. China’s derivatives market accounts for just 1% of global derivatives market turnover, despite it being the world’s second largest economy.4

The recent passage of the Futures and Derivatives Law (FDL) creates a framework for trading onshore derivatives and futures, and also includes provisions facilitating close-out netting, an internationally accepted best practice. “Not only do these financial instruments help international investors hedge their market risk inside China, but it also creates extensive alpha opportunities for them too,” added Chao.

Foreign asset managers also see China as a potential source for new capital. “China has a large middle-income population, estimated to be in the region of 707 million people. China also has a sizeable high-net-worth-investor market, and this segment is growing faster than the rest of the world. Consequentially, more of our global fund manager clients are looking to build a presence inside China,” said Chao.5

Several high-profile fund managers are leveraging the Wholly Owned Foreign Enterprise (WFOE) programme to access prospective domestic retail clients. Although foreign managers no longer need to enter into a joint venture with a local financial services firm to distribute onshore, building up a track record in China does require time and patience.

The Network Forum Asia Meeting was held on 14–15 November 2022 in Singapore

Sources

1 See „Token power“ at flow.db.com

2 See cointelegraph.com

3 See theasset.com

4 See thetradenews.com

5 See „New frontiers for China’s big spenders“ at flow.db.com

Securities services solutions Explore more

Find out more about our Securities services solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

SECURITIES SERVICES

Sibos – unwrapped Part 2 Sibos – unwrapped (Part 2)

In the second of three Sibos 2022 reports, flow’s Clarissa Dann takes a closer look at the evolving post-trade landscape and key themes such as settlement compression and efficiency that impact global custodians, sub-custodians and network managers

TECHNOLOGY, MACRO AND MARKETS, CASH MANAGEMENT

Token power Token power

Despite its volatility, Bitcoin can no longer be ignored and one country has made it legal tender. Where does this leave corporate treasurers and investors – and the financial services industry? flow's Clarissa Dann reports on the prospect of a brave new tokenised world

SECURITIES SERVICES, MACRO AND MARKETS

New frontiers for China’s big spenders New frontiers for China’s big spenders

High net worth individuals (HNWIs) and mass-affluent investors in China want to invest more of their wealth outside of the country. flow explores some of the options currently available to them