03 November 2022

In the second of three Sibos 2022 reports, flow’s Clarissa Dann takes a closer look at the evolving post-trade landscape and key themes such as settlement compression and efficiency that impact global custodians, sub-custodians and network managers

MINUTES min read

Having navigated the operational disruption brought about by the pandemic, the securities services industry continues its quest to improve its underlying business model – and this was what shaped discussions and conference sessions at Sibos Amsterdam 2022. Adoption of shorter post-trade settlement cycles, development of products and services supporting digital assets, as well an open-minded approach to new technologies – such as the Metaverse – were among the leading topics.

With Sibos – unwrapped (Part 1) having reviewed key payment themes, this article (Part 2) turns to issues impacting global custodians, sub-custodians and network managers.

Settlement fails

“A trade is said to fail if on the settlement date either the seller does not deliver the securities or the buyer does not deliver funds,” explains the Bank of England.1 The central bank goes on to outline how settlement fails may have consequences for the parties directly involved and for the system as a whole. “Chains of fails, for example, could lead to gridlock situations and a large volume of fails can affect the liquidity and smooth functioning of financial markets.”

Securities settlement fails create both added costs and operational risks for trading counterparties, noted SWIFT in April 2022. “These challenges are only going to intensify under CSDR’s Settlement Discipline Regime and the decision by certain markets to adopt T+1,” it added.2

Therefore, it was no surprise that the Sibos session, “Tackling the root of securities settlement fails” – was a popular one. Moderated by SWIFT Product Manager Simon Daniel, on the Meet the Experts Stage, delegates heard from David Wouters (Bank of New York Mellon), Paul Baybutt (HSBC) and Emma Johnson (J.P. Morgan).

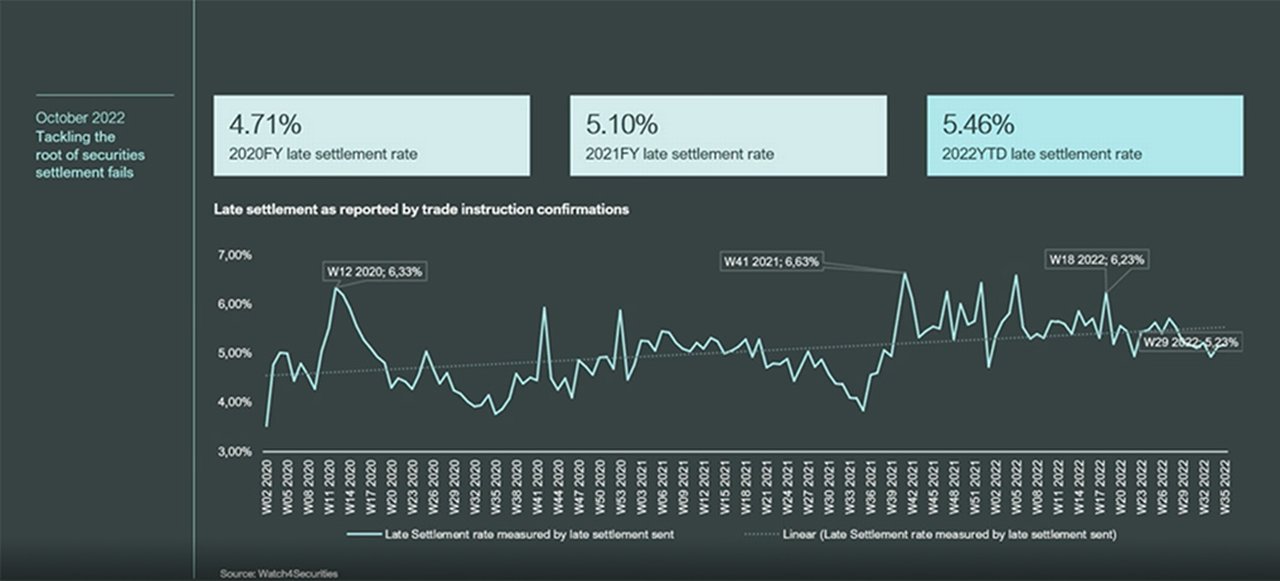

“While we see peaks and troughs from market events such as pandemics and the US election, it does appear – unfortunately – that overall global settlement efficiency rates are trending in the wrong direction,” said Simon Daniel, Product Manager at SWIFT (see Figure 1).

Figure 1: Tackling the root of securities settlement fails

Source: SWIFT

This regression comes despite the introduction of the Central Securities Depositories Regulation (CSDR), a landmark piece of EU legislation which aimed to improve settlement discipline by imposing financial penalties on at-fault counterparties for trade settlement fails.

If cash penalties do not result in settlement rates improving, mandatory buy-ins could be re-introduced by the European Commission following its review of the CSDR, according to one panellist. Consequentially, there is a strong incentive for market participants to get a better grip on why their trades are not settling.

Another panellist observed that one of the reasons why remedying settlement fails proves so challenging is because there is a lack of transparency together with a series of fragmented processes built into the trading lifecycle. This makes it difficult to identify the causes behind fails or delays. A simple purchase can flow through in multiple shapes and the complexity of back-office operations is always underestimated. Another issue is that at the point of the trade, the trader might not actually have the securities; and this creates a gap in the process – the trade cannot be settled until the liquidity is found.

What can be done to rectify this? End-to-end transparency would be a good start. Mike Clarke, Global Head of Product Management at Deutsche Bank, told flow that industry initiatives (such as the SWIFT Unique Transaction Identifier (UTI)) “could help financial institutions gain better insights into the trading lifecycle”.

In addition, the role of the ISO 20022 standard in post-trade should not be forgotten. SWIFT’s Capital Markets Strategy Director, Charifa El Otmani moderated the panel, ‘What’s next for securities standards?’ (Day 2 at the SWIFT Standards Forum) that took a closer look at how the use of a standardised set of data “creates opportunities for faster and better reconciliation, enhanced trade-to- post-trade processes and seamless customer experiences”. While there are no plans to make ISO 20022 mandatory, it is the preferred standard and market participants are encouraged to use it as best practice, although many still use the ISO 15022 standard. SWIFT has said it will continue to “enhance the common ISO 20022 data dictionary and promote its adoption to facilitate interoperability between different messaging standards and to minimise friction”.3

T+1 – when will Europe move?

Left to right: Virginie O’Shea (Firebrand Research); Pierre Davoust (Euronext); Olivier Grimonpont (Euroclear); Javier Hernani (SIX); and Julia Romhanyi (UniCredit)

Settlement compression remains a major topic of discussion in The Network Forum events around the world, with Sibos a key forum for its further discussion. With India currently adopting T+1 for equity trade settlements and the US and Canada following suit in March 2024; all eyes are now turned to what Europe’s plans are.

An audience survey during the full-house Day 1 Sibos panel ‘Is T+1 the goal or a step to instant securities settlement?’ found that 51% believed Europe would move to T+1 in the next two to three years, while 37% reckoned the transition would take four to five years. A handful of session participants even believed that Europe would keep using T+2 indefinitely. Moderated by Virginie O’Shea, Founder and CEO at Firebrand Research, expert guests comprising Julia Romhanyi (UniCredit), Javier Hernani (SIX), Olivier Grimonpont (Euroclear), Pierre Davoust (Euronext) debated what it is that prevents the securities industry settling instantly – “technology, time zones, liquidity or something else?”. After all, explained Euronext’s Davoust, “the technology is there to support the shortening of the lifecycle”.

Turning to Europe, the panel was divided as to what approach it should take in terms of T+1 implementation. Some believe the region should adopt T+1 in one big swoop, whereas others favour a more incremental roll-out, similar to that of India. But Europe is very different, said SIX’s Hernani, “The industry has to say to what extent this is beneficial to them…we are talking about 14 currencies and 31 CSDs [Central Securities Depositaries] in Europe.”

“India moved in batches - starting with the less liquid stocks, and then migrated the most liquid stocks onto T+1 at the end. This staged approach has drawbacks as market participants must manage several settlement cycles in the same geography, but we should not rule out a phased migration to T+1 in Europe,” observed Davoust.

Adoption of T+1 in Europe does face barriers. Although the technology is there to facilitate T+1 in the region, there are logistical issues. “One of my main concerns centres around the time constraints which are difficult to manage in an environment where trades settle on T+1. If you settle on T+1, that means you have to settle at the end of the day following the trade, which gives you a few hours to trade, match and source the cash and securities to settle the trade. This is a real constraint,” Davoust added.

Such limited time horizons could result in firms incurring fines for settlement fails under CSDR, a point made by Deutsche Bank’s Clarke afterwards to flow. “The EU has only just got through the imposition of T+2, together with the implementation of CSDR. For the moment, the focus in Europe is on boosting settlement efficiency. If European regulators choose to shorten the settlement cycle to T+1 when there are still inefficiencies, then the number of trade fails will increase,” he forecast.

Additionally, institutions located in different time-zones to that of Europe could also find it difficult to manage their FX transactions, forcing certain firms to pre-fund some of their trades.

When flow caught up with Kamalita Abdool, Managing Director, Head of Americas, Securities Services at Deutsche Bank, on the bank’s Sibos stand, she added, “The decision by markets to adopt T+1 and when to adopt it will depend on a number of trade-offs. There are material trade-offs that need to be reached between the potential for higher balance sheet efficiency at domestic broker dealers, versus the increased funding costs and operational risks facing intermediaries and foreign investors.”

Even though T+1 appears to be a long way off in Europe, experts are already talking up the possibility of markets adopting T+0 or same day settlement. “Over time, we will see more markets look to shorten their settlement periods to T+1, and eventually T+0,” said Abdool.

“By leveraging w-CBDCs, cross- border transactions could potentially be settled more quickly”

Some speakers believed that adopting T+1 is a prerequisite for transitioning to T+0, although others point out Europe could leapfrog the rest of the world on T+0 by building new digital trading infrastructure from scratch – instead of investing into legacy systems to make them T+0 compatible.

“I believe the advent of things like wholesale central bank digital currencies (w-CBDCs) could play a role in helping the industry expedite settlements. By leveraging w-CBDCs, cross- border transactions could potentially be settled more quickly, culminating in T+0 or even atomic settlement,” said Clarke.

Digital assets – it is still early days

Of all the various types of digital assets in the market today, the securities services industry is most interested in regulated security tokens – as opposed to crypto-currencies and non-fungible tokens (NFTs), the latter of which are unregulated and volatile. This issue flow reported on in the article, ‘Token power’ (June 2021) and expanded further in the white paper, The triple revolution in securities post-trade.

Rachel Levi, Global Head of Innovation Engineering at SWIFT, who spoke on the panel session – ‘Overcoming fragmentation in the tokenised assets Market’ gave delegates a helpful explanation of what tokenisation means.

“Tokenisation is where you take a real tradeable asset – such as an equity, bond, a piece of art or real estate, and represent it on a Blockchain network by issuing a digital token. Tokens can be traded by buyers and sellers, and the token becomes a representation of things that exist today. In the future, it will theoretically be possible to tokenise anything. Asset tokenisation is a growing trend in financial services aimed at increasing liquidity and creating broader access to investment markets. By 2030, it is expected that up to 30% of all securities assets will be tokenised,” she said.

Proponents of tokenisation argue the practice will drive up liquidity as security tokens can be fractionalised (in other words divided up into smaller units), making them cheaper to buy. This could then attract more retail investment, especially from people who do not have enough disposable income to purchase traditional assets.

For tokenisation to realise its potential, there needs to be greater interoperability between different tokenisation platforms, otherwise fragmentation will become a very real risk, continued Levi.

Although it is still early days, custodians are developing digital custody solutions to meet client demand, as and when it materialises. “Deutsche Bank is looking to offer custody for digital assets by 2024. We are also exploring opportunities around tokenising cash and security assets. In addition, we are looking at ways to enable clients to execute trades for crypto-underlying products settled in fiat cash,” said Abdool.

Despite this, not everyone is convinced about tokenisation’s merits. Speaking on the panel, ‘A tokenised future – what does it mean for financial services and its customers?’ – Yuval Rooz, CEO and co-founder at Digital Asset, questions how much value tokenisation will bring, given that retail trading platforms – such as Robin Hood – already give ordinary investors access to fractionalised shares.

Rooz also warned that the purported cost benefits of tokenising illiquid assets - such as real estate - have been misrepresented. He added that any tokenised real estate transaction – irrespective of its size – will always involve lawyers and copious amounts of manual processing – due to its sheer complexity, which in turn will generate costs.

What about the metaverse?

If successful, the metaverse – a Web3-enabled internet platform whose users can interact in a 3D virtual world – has the potential to reshape financial services. Some believe the metaverse could be worth many trillions of dollars within the next decade – a projection that has prompted a handful of leading corporates – including banks – to acquire virtual real estate in this parallel digital universe. “As at September 2022, we estimate the global retail e-commerce market size on the metaverse to be around US$2trn by 2030. Of that US$2trn, US$1trn would be newly generated from the metaverse ecosystems based on virtual reality (VR), augmented reality (AR), haptic and other technologies, with the other half being realised on the metaverse ecosystems accessed on mobile and desktop channels,” declare the authors of the Deutsche Bank white paper, Metaverse – the next e-commerce revolution.

Right now, the metaverse’s target market is overwhelmingly retail, namely young millennials, Generation Z’ers, and other digital natives. Virginie O’Shea of Firebrand Research, said it is possible that this cohort of youngsters could one day use the Metaverse for things like immersive shopping experiences or even financial planning.

But does the metaverse have much relevance in securities markets?

O’Shea noted the Metaverse could be leveraged by banks for networking or marketing purposes in the future. “Financial institutions are looking to reduce spending and save carbon, which means travel is going to come under the spotlight. We are already seeing travel restrictions being imposed on people attending conferences. As a result, we could see people attending conferences in the metaverse moving forward instead of physically,” she added.

Network managers – whose travel itineraries are already facing intense scrutiny – might one day conduct their due diligences on agent banks in the metaverse, added O’Shea.

“Agent banks could, for example, replicate their data centres in the metaverse. Right now, network managers cannot visit data centres on security grounds, but agent banks could mock up their data centres, and allow network managers to take virtual tours in the metaverse of them. However, the metaverse could exacerbate social isolation among employees, undermining the S in ESG (environmental, social, governance),” she said.

Custody moves to the next level

“We need to look again at how we communicate back through the chain”

An off-site reflection on the sheer amount of change the securities services industry has accommodated already as it continues to evolve was helpfully summarised in the Global Custodian Sub-custody roundtable: Are times really changing? Moderated by Richard Schwartz, GC’s Head of Research, viewers heard from Deutsche Bank’s Steven Hondelink, Global Head of Securities Services Operations & Head of Securities Services EMEA, Kelly Matheson, Client Experience Team, Digital Asset, and Jesús Benito, Head of Trade Custody and depositary operations at SIX Group.

Hondelink (who represents Deutsche Bank on the International Securities Services Association (ISSA) board4 confirmed that the industry had felt “massive cost pressure in the past couple of years”. The perfect storm of regulation compliance costs and a low interest rate environment has made it essential to look right across the transaction chain at what could be done more efficiently. “Settlement fails are not improving so we need to look again at how we communicate back through the chain,” he noted.

Living with change is very much business as usual in this industry. The advent of trade settlement compression – together with digitalisation – is reshaping financial services, and the conversation at Sibos in the securities industry demonstrated how providers are sufficiently agile to evolve with the times so that they can properly support clients in the future.

Sibos 2022 Amsterdam took place at the RAI Convention Centre from 10 to 13 October 2022 and is available virtually to Sibos registrants on demand

Deutsche Bank Stand B44 at Sibos Amsterdam 2022

Securities services solutions Explore more

Find out more about our Securities services solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

CASH MANAGEMENT

Sibos – unwrapped (Part 1) Sibos – unwrapped (Part 1)

Sibos Amsterdam 2022 returned to an in-person event at the RAI Convention Centre against the backdrop of rising inflation, energy security worries and increased levels of financial crime. In the first of three post-Sibos reports, flow’s Clarissa Dann takes a deep dive into post-pandemic payments

SECURITIES SERVICES {icon-book}

Settlement compression – where next? Settlement compression – where next?

Now that India, the US and Canada have confirmed they are reducing trade settlement cycles from T+2 to T+1, what are the risks and what are the benefits? flow takes a closer look at accelerated settlement

TECHNOLOGY, MACRO AND MARKETS

Metaverse – The next e-commerce revolution Metaverse – The next e-commerce revolution

The Metaverse, roughly defined as 3-D virtual worlds that mimic the real world, has drawn much attention since late 2021. It could usher in the next e-commerce revolution as it starts to gain traction with advances in technology and becomes more mainstream. Financial services firms have a significant role in powering this e-commerce explosion, say Deutsche Bank’s Sabih Behzad and Akash Jain