24 November 2022

High net worth individuals (HNWIs) and mass-affluent investors in China want to invest more of their wealth outside of the country. flow explores some of the options currently available to them

MINUTES min read

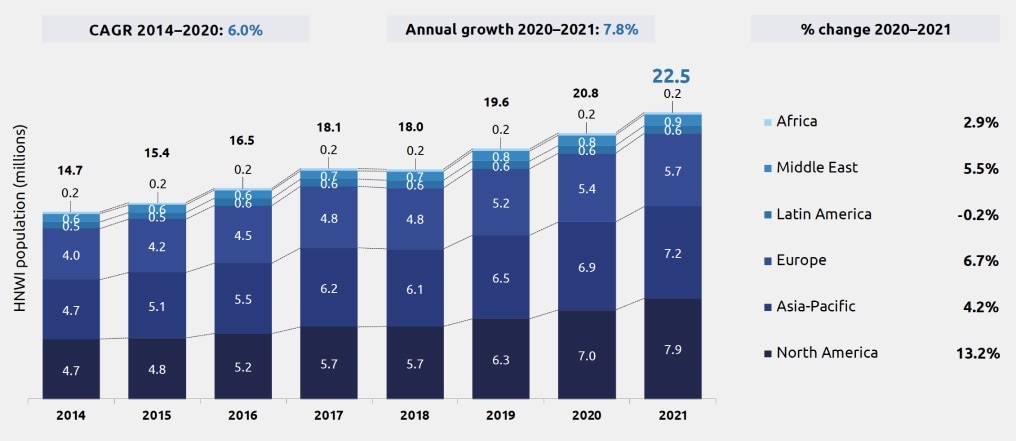

The combined wealth of all HNWIs (private investors with at least US$1m in liquid assets) located in Asia is second only in size to that of the US, with assets totalling US$25.3trn, compared with US$27.7trn in the latter, according to Cap Gemini’s World Wealth Report 2022 (see Figure 1).1 Within Asia itself, mainland China has more HNWIs than anywhere else. Despite the various challenges facing China’s economy, the country’s fast expanding HNWI population still grew by 5% between 2020 and 2021, although this increase is less than in previous years.

Figure 1: Number of HNWIs by region

Note: Chart numbers and percentages may not add up due to rounding

Source: Cap Gemini Research Institute for Financial Services Analysis 2022

Irrespective of the short-term macro headwinds buffeting China, experts are bullish about the trajectory of its HNWI population size. According to investment advisory firm Henley & Partners, the number of Chinese US dollar millionaires and billionaires is projected to increase by 60% over the next decade –dwarfing the projected rises in the US (20%), France, Germany, Italy and the UK (all 10%).2 As China’s HNWI population grows, it is expected these allocators will increasingly start investing their wealth overseas.

Issues inhibiting overseas investment

Ben Li, Head of Securities Services for China at Deutsche Bank, told flow that while Chinese HNWIs are still major buyers of domestic securities and mutual funds, many allocators are now looking to diversify their exposures by investing into overseas securities and global money managers. “HNWIs inside China are looking to diversify their investments outside of the country. This is a trend we have seen over the last two to three years,” he reports. Other experts concur. “For both domestic and foreign investors, cross-border investment is an important component of asset allocation, and domestic investors have a need to allocate into foreign assets,” says Robert Li, General Manager of the International Investment and Business Development Department at CCB Principal Asset Management.

There are, nonetheless, several issues inhibiting overseas investment by China’s HNWIs. “Government restrictions on capital flows, transaction costs, liquidity considerations, exchange rate fluctuations, a lack of information, high tax rates, together with language and cultural barriers are all difficulties in cross-border investment,” explains CCB Principal Asset Management’s Li. He adds that in recent years, geopolitical instability has also become a significant factor. However, through the growing maturity of investors and the popularity of investor education, the concept of asset allocation has been gradually accepted.

While HNWIs and affluent investors have been boosting their overseas exposures, Chinese ultra- HNWIs (U-HNWIs), defined as individuals with more than €25m in investable assets, are being more cautious. Speaking to flow, Jeffrey Peng, Head of Wealth Management, China at Deutsche Bank International Private Bank, says foreign investments by Chinese U-HNWIs have declined because of the country’s strict Covid-19 controls, making it difficult for allocators to visit foreign fund managers, wealth managers and private banks.

“In contrast to retail investors and HNWIs, who are happy to communicate with their fund managers or brokers through virtual calls such as Zoom, U-HNWIs favour in person meetings,” says Peng. “U-HNWIs are not only talking about investments but succession planning and business expansion; including M&A, bond issuances, and potentially even initial public offerings, so they prefer face to face meetings.”

Gaining direct exposure to stocks and bonds

There are various access channels available which allow Chinese HNWIs to obtain holdings in overseas assets, according to Eva Huang, Managing Director and Head of the Client Coverage Group, Greater China for DWS Investments in Hong Kong. So, what investment routes are Chinese HNWIs now using?

There are several mechanisms with which Chinese HNWIs and mass affluent investors can gain foreign exposures. One of these investment channels is Stock Connect, a market access programme that launched in 2014. This provides a trading and clearing link between Hong Kong Exchanges and Clearing (HKEX) and the stock exchanges located in Shanghai and Shenzhen – and potentially one day even Beijing. Although the northbound leg of Stock Connect has historically enjoyed the biggest trading volumes, southbound activity is starting to gather momentum, says Huang. The growing southbound traffic has been triggered by a surge in re-listings of major Chinese technology companies on the HKEX. “This has prompted mainland HNWI interest in technology companies listed on HKEX – with which they are familiar. In addition, the valuations of a lot of Hong Kong’s stocks are also attractive,” notes Deutsche Bank’s Li.

HNWIs’ access to overseas fixed income instruments is more restricted through Bond Connect, and this status quo is unlikely to change anytime soon. Established in 2017, Bond Connect is an access route available to foreign institutional investors looking to participate in the Chinese bond market, which is the second largest fixed income market in the world after the US. At the time of its introduction, Bond Connect only supported Northbound activity via trading infrastructure in Hong Kong. Although a Southbound trading leg opened in September 2021, this was only available to institutional investors on the mainland. “Although Stock Connect has a minimum size threshold for investment, the southbound channel of Bond Connect is only available to institutions,” says Deutsche Bank’s Ben Li.

The funds market opens up to China

Instead of investing directly into overseas equities and bonds, a number of HNWIs and affluent investors are gaining international exposures with the assistance of local fund managers. Many people are investing through domestic funds or brokers, who in turn will have some foreign holdings. Introduced in 2006, the Qualified Domestic Institutional Investor (QDII) scheme allows certain domestic institutions – including fund managers – to invest offshore, albeit subject to strict quotas.3 Although the issuance of quotas was suspended between April 2019 and September 2020, the State Administration of Foreign Exchange (SAFE) granted an additional US$3.5bn in outbound QDII quotas in December 2021.4 According to data from SAFE (reported by Reuters on 15 December 20215), QDII quotas in December 2021 totalled US$157.5bn; spread across 34 banks, 68 securities firms, 48 insurance companies and 24 trusts.

“For domestic investors, adding assets from different countries and asset classes to a portfolio through QDII products can diversify risk and reduce the overall portfolio volatility, while improving the risk return characteristics of the portfolio,” comments CCB Principal Asset Management’s Robert Li.

“Local fund managers are picking up the pace to build up their offshore capabilities”

Deutsche Bank’s Ben Li agrees: “Driven by the demand from HNWIs, we have seen that local fund managers are picking up the pace to build up their offshore capabilities to serve the HNWIs’ offshore investment needs. As one of the major foreign custodian banks in China since 2004, our engagement with local financial institutions including fund managers, trust companies and brokers in recent years has helped facilitate their access via the QDII scheme to offshore markets or enabled them to invest into IPOs, bonds and private placement projects.” Some of the top tier local managers are also accelerating the expansion of their footprints in offshore markets by setting up overseas subsidiaries in Hong Kong, Singapore, Europe, and the US, he adds.

There are also several schemes enabling foreign fund managers to raise capital from mainland sophisticated Chinese investors, including HNWIs. Huang said the Qualified Domestic Limited Partnership (QDLP) programme is one of these initiatives. But what is it?

Created by various local governments in China, QDLP, as helpfully explained by the law firm Simmons & Simmons in an update published 18 June 2021,6 allows both foreign and domestic asset managers to raise a limited amount of RMB funds from HNWIs and institutional investors in several select Chinese cities for the purposes of overseas investments in publicly traded stocks, bonds and derivatives – through Chinese feeder products. QDLP pilots were already underway in Shanghai, Shenzhen and Qingdao, and these cities have since seen their QDLP quotas increased by SAFE. QDLP was also recently extended to other major Chinese cities which included Guangdong, Chongqing, Qingdao and Hainan. The Simmons & Simmons update noted there are currently 37 registered QDLP managers running 40 QDLP funds.

In addition to QDLP, foreign asset managers can also target Chinese HNWIs through the WFOE (Wholly Owned Foreign Enterprise) programme. Previously, foreign managers looking to set up a business in China were required to enter into a joint venture with a local financial services firm, but this is no longer necessary. By procuring a Private Fund Management (PFM) licence, foreign asset managers can sell to qualified domestic investors in accordance with the relevant local regulations and rules. Moreover, a manager operating as a WFOE PFM will no longer be required to establish a new corporate entity if it wants to create a QDLP as well.7 A handful of global fund managers have obtained WFOE PFM licenses, but Deutsche Bank’s Li warned it could take a while for these firms to build up a reputation and attract domestic money. “Several global fund houses are looking to distribute their products through the WFOE PFM, but it takes time to build a track record and connections in China. Investors need to familiarise themselves with these global brands,” he said.

More recently, several ‘Connect’ programmes have been launched to give Chinese investors greater access to a wider selection of investment products and wealth advisory solutions. Among these are Wealth Management Connect and ETF (exchange traded fund) Connect. Wealth Management Connect is being trialled in the Guangdong-Hong Kong-Macau Greater China Bay Area (GBA), a region that is home to approximately 450,000 HNWI families with investable assets totalling RMB 2.7trn (around US$375bn).8 According to the Hong Kong Monetary Authority (HKMA), the scheme will allow eligible residents in the GBA “to invest in wealth management products distributed by banks in each other’s market through a closed loop funds flow channel, established between their respective banking systems.”9

In the case of ETF Connect, mainland and Hong Kong investors – including retail allocators and HNWIs – can now (as explained by the law firm Linklaters) purchase ETFs listed on each other’s respective stock exchanges.10 Deutsche Bank’s Li said the two Connect programmes are still very much in their infancy, suggesting that sizeable flows will not be immediately forthcoming. “Mainland investors are still digesting what both schemes mean and their wider implications. However, many investors still prefer traditional securities such as equities and bonds versus ETFs,” he added. “ETF Connect may take a while to get onto people’s radars.”

The next frontier

“We expect China’s HNWI market segment to continue its growth trajectory”

While domestic bias is still commonplace among Chinese HNWIs and mass affluent investors, this mindset is rapidly changing. Macro challenges within China are prompting more local investors to diversify their portfolio holdings overseas. Often, this is through schemes such as Stock Connect, giving domestic investors access to equities via Hong Kong, or QDII. It is also becoming easier for Chinese investors to obtain exposures to foreign funds, through schemes such as QDLP and WFOE. As these investment channels become more established and better understood, it is likely that China’s burgeoning HNWI and mass affluent populations will continue boosting their overseas holdings.

Global banks with a licence to operate in China are facilitating these inbound and outbound flows. For example, in December 2020, Deutsche Bank received its domestic fund custody licence from the China Securities Regulatory Commission,11 enabling it to provide post-trade services and other solutions for funds established in China, including WFOEs and the domestic asset management industry.

Tony Chao, Managing Director and Head of Securities Services, Greater China, at Deutsche Bank reflected on the inflow and outflow securities services business in the 2021 flow article ‘China’s balancing act’. “Deutsche Bank’s global network makes it easier to support cross-border investment flows…Not only can we help domestic investors with their overseas requirements, but we can also support offshore clients when accessing China too.” A year later, reflects how this is particularly opportune when it comes to supporting China’s burgeoning group of HNWIs looking at overseas assets.

“Although the market continues to evolve, it has been challenging in the past few years with Covid-19 and other macro events instilling uncertainty and volatility in local markets. Despite all this, we expect China’s HNWI market segment to continue its growth trajectory.” He concludes, “In times of uncertainty, wealth protection, risk management and good estate planning are even more important to HNWIs, and it is here that international firms bring expertise to a very receptive customer group.”

Sources

1 See worldwealthreport.com

2 See theasset.com

3 See fundselectorasia.com

4 See fundselectorasia.com

5 See reuters.com

6 See simmons-simmons.com

7 See simmons-simmons.com

8 See deloitte.com

9 See hkma.gov.hk

10 See linklaters.com

11 See db.com

Securities services solutions Explore more

Find out more about our Securities services solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

SECURITIES SERVICES, MACRO AND MARKETS

China’s capital markets path to growth China’s capital markets path to growth

As 300 million of Middle Kingdom’s households become middle class, this step up is one huge driver of investment demand. In a recent Global Custodian webinar organised in partnership with Deutsche Bank, panelists discussed China’s capital markets explosion and the new shape of investor demand

MACRO AND MARKETS {icon-book}

The road from Shanghai The road from Shanghai

Over the past 44 years, China has emerged as a global economic superpower. flow’s Clarissa Dann explores its growth trajectory, and reflects on how Deutsche Bank’s own history in the region has come of age in corporate banking

SECURITIES SERVICES, MACRO AND MARKETS

China’s balancing act China’s balancing act

China’s 14th Five-Year Plan for self-sufficiency has not stopped the country’s pursuit of renminbi internationalisation. flow examines the progress of the country’s ambitious capital market liberalisation reforms, and how it is balancing investor appetite with the management of currency inflows and outflows