18 August 2022

Over the past 44 years, China has emerged as a global economic superpower. flow’s Clarissa Dann explores its growth trajectory, and reflects on how Deutsche Bank’s own history in the region has come of age in corporate banking

Ever since former President Deng Xiaoping opened up China’s economic system to the West at the 1978 Third Plenum, China has seen vast economic expansion and growth. Deng’s reforms, which he is said to have likened to crossing a river “by feeling the stones”, introduced private enterprise and market infrastructure incentives to an economy that had been entirely state-led.

Researched as part of Deutsche Bank’s reflections on 150 years in Asia (the first Asian Deutsche Bank offices were opened in Shanghai and Yokohama in 1872), this article provides a backdrop to how foreign banks have built cross-border capabilities, are ramping up their presence in the custody market, and are supporting clients in the region with their ESG transition. China and Japan were the countries where Deutsche Bank first connected European companies to the rest of the world and began directing cross-border capital to finance the growth of industries, economies and markets.

The bumpy growth trajectory

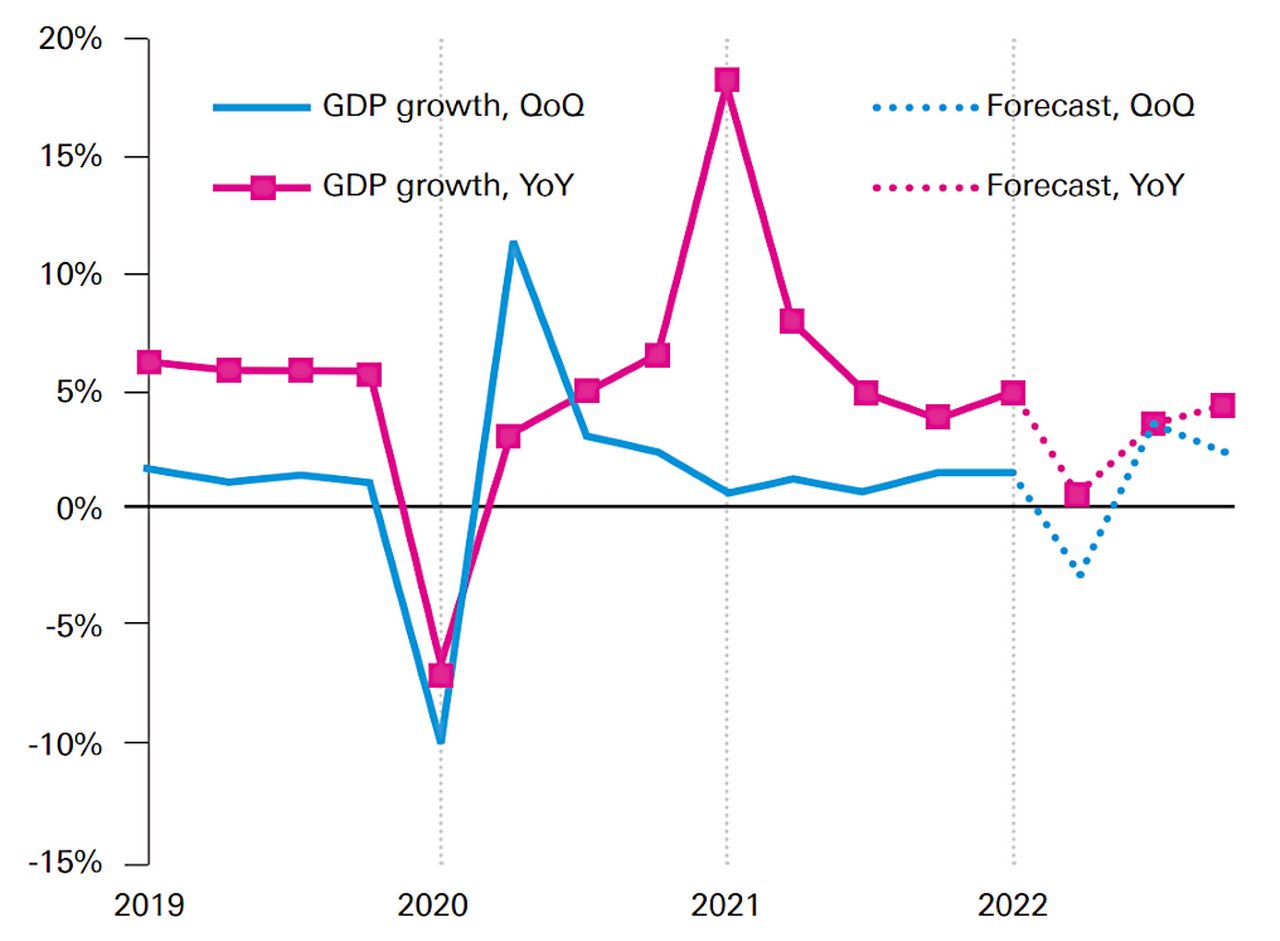

China’s zero-Covid strategy has, for the time being, reduced the pace of growth. Yi Xiong, Deutsche Bank’s Chief Economist for China, has revised down his China growth forecast to 3.3% as the impact of Covid-19 “is even worse than expected”, but his 2023 forecast is revised up to 5.7%. In his ‘China’s “Whatever it takes” moment?’ report of May 2022, Yi points out that it will “take some time for mobility and activity to recover” after lockdowns. However, we should not allow short-term Covid shocks to distract from the long-term picture. “We’re still confident that China will bounce back and grow at a fast pace, given its goal of doubling income again over 15 years by 2035,” says Yi.

Total GDP is second only to that of the US, and by the end of 2020 the total assets under management of China’s asset management industry reached US$15trn; it has remained in double digit growth in the past few years. Nicolas Aguzin, chief executive of Hong Kong’s stock exchange, said in November 2021 that China’s capital markets “would probably more than triple” in size to US$100trn in the next decade.

Deutsche Bank’s Peter Qiu, Greater China Head of Corporate Coverage, notes that China is now a very internationally connected country, and this is a big factor in investor decisions. “China is the number one trading partner of 130-plus countries in the world. From the investor point of view, the levels of FDI into China are very significant”. The first four months of 2022 saw an increase of 20.5% year-on-year to the CNY equivalent of US$70.67bn, according to data from China’s commerce ministry. China’s capital markets continue to experience intense transformation, with global holdings of Chinese stocks and bonds rising by about US$120bn in 2021, and still growing rapidly to cater to surging demand for new asset allocation and diversification. However, there are concerns that small outflows could be on the cards in 2022, given the likely market interest rate differentials between the US Federal Reserve and People’s Bank of China (PBOC).

The environment, says Qiu, is “heavily regulated” with tight capital controls, but “a fast liberalisation process is under way”, and this brings opportunities for an international bank such as Deutsche Bank to support clients as they navigate all this and sort out how to position themselves while this process continues. In addition, he explains, China is a huge knowledge economy, and one of the largest internet economies as well.

“China is the number one trading partner of 130-plus countries in the world”

RMB opportunities

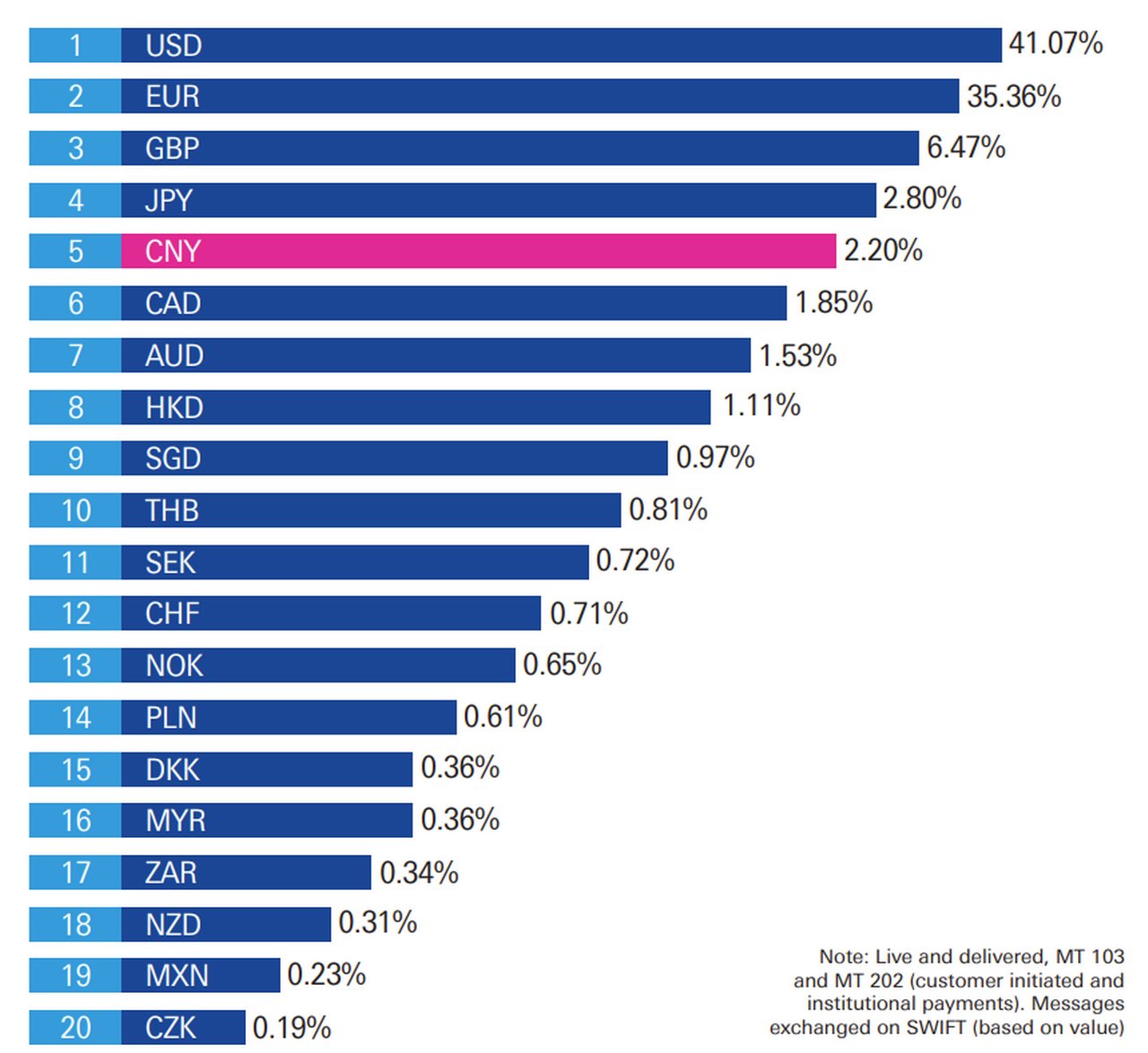

By March 2022, China’s offshore currency, the renminbi (RMB), had retained its position in SWIFT’s RMB Tracker as the fifth most active currency for global payments by value, with a share of 2.20%. “In terms of international payments excluding payments within the Eurozone, the RMB ranked seventh with a share of 1.47% in March 2022,” notes SWIFT.

UNCTAD’s World Investment Report 2021 confirms that, despite the pandemic, flows to developing Asia were “resilient” in 2020 and inflows to China had increased by 21% to almost US$190bn.

The expected increase in usage of RMB internationally could give investors greater confidence to invest in and hold RMB-denominated assets, despite the uneven progression of China’s capital account liberalisation effort. Tony Chao, Head of Securities Services China, Deutsche Bank, sees the internationalisation of RMB as an opportunity, as overseas institutional investors want RMB exposure in bonds and equity markets – and overseas governments want to invest in the currency as part of their wealth fund foreign currency reserves. Going forward, China will encourage the use of RMB for settlements and even as a trade currency. “This will further inject growth into China, because if you look at the actual usage of RMB from a transaction volume standpoint currently, it is quite low, considering the size of economy,” notes Chao.

China is also looking likely to be the first major economy to issue a central bank digital currency (CBDC), as the PBOC ramps up trials for the e-CNY. “The CBDC development is extremely interesting because it offers a way for the currency flows to grow by bypassing the traditional mechanism,” says Chao.

Erin Huang, Manager, Corporate Treasury Services, Deutsche Bank, agrees, adding that “with the two dominant mobile payment service providers (PSPs), Alipay and WeChat, facing increased regulatory oversight, a CBDC might be coming at the right time where, instead of a technology provider, the central bank can provide trust in digital money in the digital age”. Over the last decade, large Chinese corporate groups have emerged as global multinational corporations (MNCs), to the point that examination of the Fortune 500 list reveals more than 145 Chinese entries. In addition, western MNCs are now investing in China at full speed – Qiu points out that many of Deutsche Bank’s clients in Germany are looking to do more in China. “For instance, Volkswagen has about 35% of its total group business in China, and BMW now has 40% of its business there. These corporates are finding that the demand is often even bigger in China than it is in Germany – and it continues to grow.”

To achieve this, cash management solutions such as the CNY Payment on Behalf of (POBO), and Collections on Behalf of (COBO), as well as a nationwide single window (China’s customs clearing system), and automated cross-bank liquidity management, are just some of the ways Deutsche Bank has supported Merck, the science and technology multinational, to maximise liquidity in China. And German automotive parts producer Continental now uses a cross-border RMB cash pooling solution from Deutsche Bank China.

Turning to Chinese corporates, when Shanghai-headquartered fintech XTransfer needed support with cross-border collection and FX on behalf of its Chinese exporting SMEs, Deutsche Bank stepped in with a COBO and FX solution.

In addition, when LianLian Global, a leading international payment solution provider based in Hangzhou, needed support in helping Vietnamese e-commerce merchants to grow their business globally, Deutsche Bank solved the problem with a PSP collection and FX solution.

Figure 1: China 2022 growth forecast

Source: Deutsche Bank Research

Custody and capital markets

One example of this is the provision of custody services from a local perspective. Deutsche Bank is one of only three foreign banks to have obtained a local fund custody licence – something of a milestone – receiving it from the China Securities Regulatory Commission in late 2020. As China’s population has become wealthier, and domestic investors seek asset diversification including overseas asset classes, the ability to meet local demand for custody services is key to being part of China’s ongoing growth story. Custody is a platform business in China and is difficult to do without the ability to allocate portfolios across multiple markets covered by the bank’s network.

Population demographics and wealth creation in China have led not only to domestic advances in the financial instruments available, but also the knock-on effect of attracting more foreign investment to meet the needs of a growing and eager consumer base. “We have a rising number of high-net-worth individuals and more fund managers are emerging that serve these clients – rather than just the traditional houses. The licence is essential to meet these needs,” explains Chao.

Domestic investment behaviour is also evolving. “What’s becoming apparent is the massive shift in interest away from China’s traditional domestic saving method,” adds Chao. “Where the average household traditionally used to put between 30% and 40% of its income into savings accounts, in the past few years people have been increasingly looking at asset diversification as a means of supplementing the returns that banks are providing.”

Merchant and FX solutions

For 150 years, corporate treasury clients were concerned with three main objectives: saving costs, making funds available and getting timely financing. Huang reflects on how the needs of MNCs have changed during his 20-year tenure in the industry. “These three aspects are still important but nowadays, the digitalisation of treasury is growing in popularity and, more often than not, we are talking about automation and standardisation with clients instead.”

Keen to benefit from digitised and paperless payment workflows and merchant solutions, corporate treasurers are helping to drive the digital revolution, transforming traditional economic models. This is true around the world, but it is particularly prevalent in China, where e-commerce and payment channels – such as Alipay and WeChat – are very popular. “We are seeing a rapid move to online business models across sectors,” says Huang. “We have launched several different merchant solutions to meet the needs of the digital corporate treasurer, such as solutions designed to help our multinational corporate clients who are managing an online store or setting up self-managed online stores.”

“People have been increasingly looking at asset diversification”

The internationalisation of China’s economy has also led to new currency flows in corporate treasury. While RMB is still the dominant currency flow, euro flows are gaining popularity in China. However, low euro interest rates have caused problems for banks around the world, incurring costs to place money with central banks overnight. As Huang notes, “Corporate treasury clients in China aren’t happy to be charged for placing euro overnight deposits, so we are setting up an automated FX solution so that corporates with euros can automatically convert their holdings into RMB.”

Given the demand from Chinese corporates for cash management, FX and trade finance solutions as they expand into emerging markets, Deutsche Bank developed a one-stop solution to address funding and risk management needs. Deploying the GEM Connect one-stop workflow automation solution for treasurers in emerging markets (launched in March 2021), the bank helped SANY Group, a leading Chinese construction and engineering machinery manufacturer, improve the efficiency of its intercompany payment settlements and reduce manual processes, thus playing a key role in SANY’s globalisation strategy.

Trade powerhouse

Before China’s economy opened up in 1978, its share of global trade stood at less than 1%. As helpfully explained by UNCTAD, in 1986, to enhance and secure access to foreign markets for its growing exports, China applied to join the General Agreement on Tariffs and Trade. However, it was 15 years before China could formally connect to the multilateral trading system. During these years, China’s share of global trade gradually increased but its participation in the global economy remained well below its potential. But as globalisation took off, along with the emergence of global value chains, China rose to become the world’s number one exporter by 2010, helped by its accession to the World Trade Organization in 2001.

China’s pivotal position in the production of metals and minerals has, however, become a source of concern among other economies in a geopolitical landscape that is moving away from globalisation. Of the 30 critical raw materials that the European Commission identifies, 10 are mostly sourced from China and eight from the African continent, where China increasingly invests in commodity-related infrastructure. Within this group are the metals and minerals needed to produce electric vehicles and the renewable energy equipment that will enable economies to transition away from fossil fuels. “Decarbonisation is becoming a material demand driver for several metals, such as aluminium, copper and lithium,” noted Deutsche Bank Research in January 2022. China is the world’s largest aluminium producer, with an output of 38.5 million metric tons in 2021.

As for financing trade, it remains complex because of the various controls in place. Two years ago, Bank of China’s Yunfei Liu told flow that handling cross-border transactions in China means getting comfortable with more than 200 sets of rules, the majority of which come from the State Administration of Foreign Exchange, with a few from the PBOC.

Figure 2: RMB’s share as a global payments currency

Source: SWIFT BI

Meeting climate goals

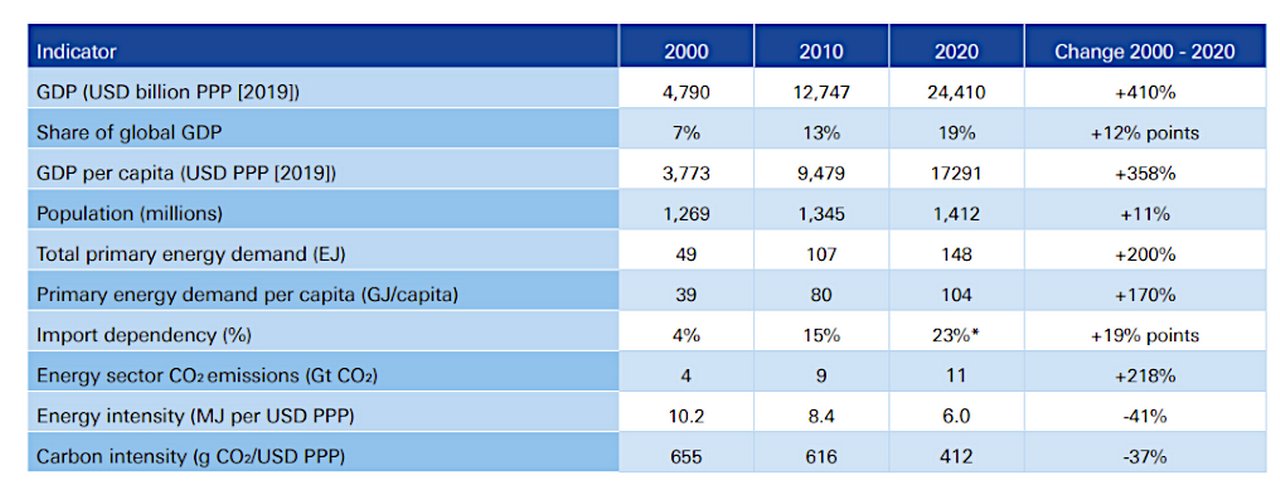

The International Energy Agency puts China’s share of global greenhouse gas emissions at around 25%. With its period of rapid economic growth not having got under way until 1978, its path to carbon neutrality was always going to be rather different from that of the EU and the US, for example – the region that did not achieve universal access to electricity until 2014. At the United Nations General Assembly in September 2020, China’s President Xi announced that the country aims to have CO₂ emissions peak before 2030, and to achieve carbon neutrality before 2060.

This has set the stage for green investment and financing to become the most important market themes of the coming decades. The government’s green transition investment agenda is much more advanced and detailed than it was two years ago, and is another magnet for capital flows and lending and, with that, client demands for innovation and support with ESG transition. Experts estimate China’s average annual green financing demand to be between RMB2.5trn and RMB16trn before 2060. “As green investment accelerates in 2022, so will the structure and breadth of China’s green finance market,” says Deutsche Bank Research China Strategist Linan Liu.

“China is seeing intensive import and export flows related to wind turbines”

As part of its energy transition strategy, China has made a significant commitment to invest in renewables. According to a United Nations Environment Programme report, China has been the biggest investor in renewable energy over the past decade, spending nearly US$760bn between 2010 and 2019 – double the US’s US$356bn investment and greater than the US$698bn from the entire European continent.

Hunter Xiong, Deutsche Bank’s Greater China Corporate Coverage COO, explains that Green Investment Principles that came out of its Belt and Road Initiative (BRI) have evolved as a robust framework to guide investors and corporates doing business in the region. And in July 2020, China and the EU set up a working group to assess existing taxonomies for environmentally sustainable investments. This resulted in the Common Ground Taxonomy, released in November 2021, identifying around 80 climate mitigation activities recognised by both the EU and China. “This paves the way for international collaboration in sustainable finance,” says Xiong.

According to the Frankfurt School of Finance & Management, China has been the top investor in clean energy for nine out of the last 10 years.

“In particular, China is seeing intensive import and export flows related to wind turbines,” says Steven Yu, Head of Trade and Lending for North Asia, Deutsche Bank. “For instance, a wind turbine may be produced in China, but key components are often produced by clients in Europe and then sold to a company in another country, perhaps Australia.” One example of this is the Global Power Generation wind farms in New South Wales, powered by Vestas machinery and supported by China’s export credit agency, Sinosure.

Deutsche Bank has been supporting Chinese power utilities to transition away from fossil fuels with ESG-aligned lending. In May 2022, Deutsche Bank completed its first sustainable trade finance transaction, aligning the Common Ground Taxonomy with the Use of Proceeds to finance a Chinese leasing company’s direct leasing for two wind power developments.

The three-year CNY187m accounts receivable facility aligns with UN Sustainable Development Goals 7 and 9, related to renewable energy and infrastructure development.

Given China’s position as the largest vehicle market in the world since 2009, it has had to contend with the rapid expansion of its vehicle industry and the fact that emissions from vehicles have contributed hugely to air pollution in its cities. Scrapping of older vehicles is one measure being taken, but another is investment in electric vehicles. Participants in the electric vehicle industry have been turning to Deutsche Bank for a range of trade finance and lending services.

Figure 3: Selected economic and energy indicators for China

*2019 values Notes: GDP = gross domestic product; PPP = purchasing power parity. Import dependency is calculated based on the difference between imports and exports relative to total primary energy demand

Source: International Energy Agency

Corporate crossroads

While the landscape of today looks very different from 150 years ago, the role of a corporate bank, and indeed that of the Global Hausbank, remains the same: to support corporates with their unique requirements – something that was recognised by The Asset, with its ‘Best Transaction Bank in China 2021’ award, announced in May 2022.

Having reflected on the past 150 years, Deutsche Bank’s Singapore-based Head of the Corporate Bank, David Lynne, is emphatic that “Deutsche Bank’s strategy has remained the same – providing trade corridor connectivity and long-term commitment – but our delivery mechanisms have evolved.” He adds, “Helping clients transform their business models in these challenging times is our USP.”

From the history book

Martin Mueller, Head of Deutsche Bank’s Historical Institute, provides an illustrated summary of the bank’s China operations. Please click on the magnifying glass and then the arrow in the expanded image to read the caption for each picture.

Corporate Bank solutions Explore more

Find out more about our Corporate Bank solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

Deutsche Bank’s illustrated history of its presence in Asia Pacific can be downloaded from the dedicated APAC anniversary website at

https://country.db.com/asia-pacific/company/150-years-in-asia-pacific-1872-2022

You might be interested in

SECURITIES SERVICES, MACRO AND MARKETS

China’s capital markets path to growth China’s capital markets path to growth

As 300 million of Middle Kingdom’s households become middle class, this step up is one huge driver of investment demand. In a recent Global Custodian webinar organised in partnership with Deutsche Bank, panelists discussed China’s capital markets explosion and the new shape of investor demand

Macro and markets, Trade finance and lending

Commodities 2022 – a transition-tinted landscape Commodities 2022 – a transition-tinted landscape

As economies implement their decarbonisation targets, this changes supply and demand for not only metals and minerals, but also the energy needed to smelt the ores. Drawing on Deutsche Bank Research analysis, flow’s Clarissa Dann takes a closer look at China’s aluminium output, and the prospect of another oil glut

SECURITIES SERVICES, MACRO AND MARKETS

China’s balancing act China’s balancing act

China’s 14th Five-Year Plan for self-sufficiency has not stopped the country’s pursuit of renminbi internationalisation. flow examines the progress of the country’s ambitious capital market liberalisation reforms, and how it is balancing investor appetite with the management of currency inflows and outflows