4 February 2022

As economies move forward with the implementation of their decarbonisation targets, this changes supply and demand for not only metals and minerals, but also the energy needed to smelt the ores. Drawing on Deutsche Bank’s January 2022 Commodities Outlook, flow’s Clarissa Dann takes a closer look at China’s aluminium output, and the prospect of another oil glut

MINUTES min read

Power and emissions restrictions in China, the prospect of crude oil oversupply and the ongoing reshaping of metals demand due to decarbonisation commitments characterise the global outlook for commodities as 2022 gets underway.

Deutsche Bank’s latest Commodities Outlook (11 January 2022) reflects the huge impact of China’s supply and demand for metals, along with the power needed to make production happen. “Energy and emissions-related supply disruptions in China and globally have continued to dominate through Q4 and the start of 2022,” notes the report, four months after the team pointed out that the power- and emissions-based rationing of China’s metal output looked set to continue in the quarters ahead “leading to ongoing price support for steel and aluminium and downward pressure on iron ore”.1

“Decarbonisation is becoming a material demand driver for several metals, such as aluminium, copper and lithium”

Outside China, says the latest report, industrial metals demand “will slow but should remain solid, supported by a global recovery in auto volumes” and it forecasts “a broad-based lift in supply” in the second half of 2022 although disruption risks “remain high”.

At the same time, decarbonisation is becoming a material demand driver for several metals, such as aluminium, copper and lithium as internal combustion engine (ICE) vehicles are replaced by battery-pack driven electric ones, and clean energy installations (such as wind and solar farms) proliferate.

As the World Economic Forum (WEF) reported on 8 December 2021, “The clean energy transition needed to avoid the worst effects of climate change could unleash unprecedented metals demand in coming decades, requiring as much as three billion tons.”2 The WEF estimates that a typical EV battery pack needs around 8kg of lithium, 35kg of nickel, 20kg of manganese and 14kg of cobalt, while charging stations require substantial amounts of copper. As for green power, solar panels use large quantities, silicon, silver and zinc while wind turbines require iron ore, copper and aluminium.

Shift of Chinese government emissions policy

Ten years ago, the IMF observed how “the impact of China’s economic activity and its policies related to strategic reserve holdings, trade, and the environment are often seen as having a large impact on commodity prices”.3 As the world’s manufacturing superpower,4 this impact has grown to the point that its output has become a bellwether of global economic growth – and recession.

Following China’s most recent Central Economic Work Conference (CEWC) held 8–10 December 2021, which sets the national agenda for the Economy of China and its financial and banking sectors, the country’s policymakers have been adopting a more growth-supportive stance while balancing its commitments to decarbonisation.

“Stabilising the economy is the overwhelming priority and this latest assessment from the CEWC placed emphasis on short-term challenges more than any other time since China’s post-Covid recovery,” notes Deutsche Bank’s China Economist, Yi Xiong. A press release from the government website confirmed, “Economic work next year should prioritise stability while pursuing progress… calling on all regions and departments to assume responsibility for stabilising the macroeconomy, and all sides to take the initiative and launch policies conducive to economic stability.”5

What does this mean for 2022?

The Deutsche Bank Research team expects that commodity consumption will recover through 2022 from current depressed levels, adjoined by a larger-than-usual post winter rebound in activity. Investors would need to navigate “at least a partial unwind of the current extreme energy tightness and a potentially less disruptive approach from China towards emission targets, both of which had led to rationing of metal output in China and Europe”.

Emissions-based output restrictions seen in 2021 nevertheless remain part of China’s broader decarbonisation targets and commitments. “As part of the latest full year plan (FYP), China is aiming to reduce energy and emissions intensity (per unit of GDP) by 3–4% per annum 2021-25 and is targeting peak emissions from the steel and non-ferrous metals sectors by 2025. These targets should continue to constrain output growth and lead to ongoing price/margin support for steel and aluminium in the years ahead,” notes the 11 January Commodities Outlook.

China’s aluminium inflection point

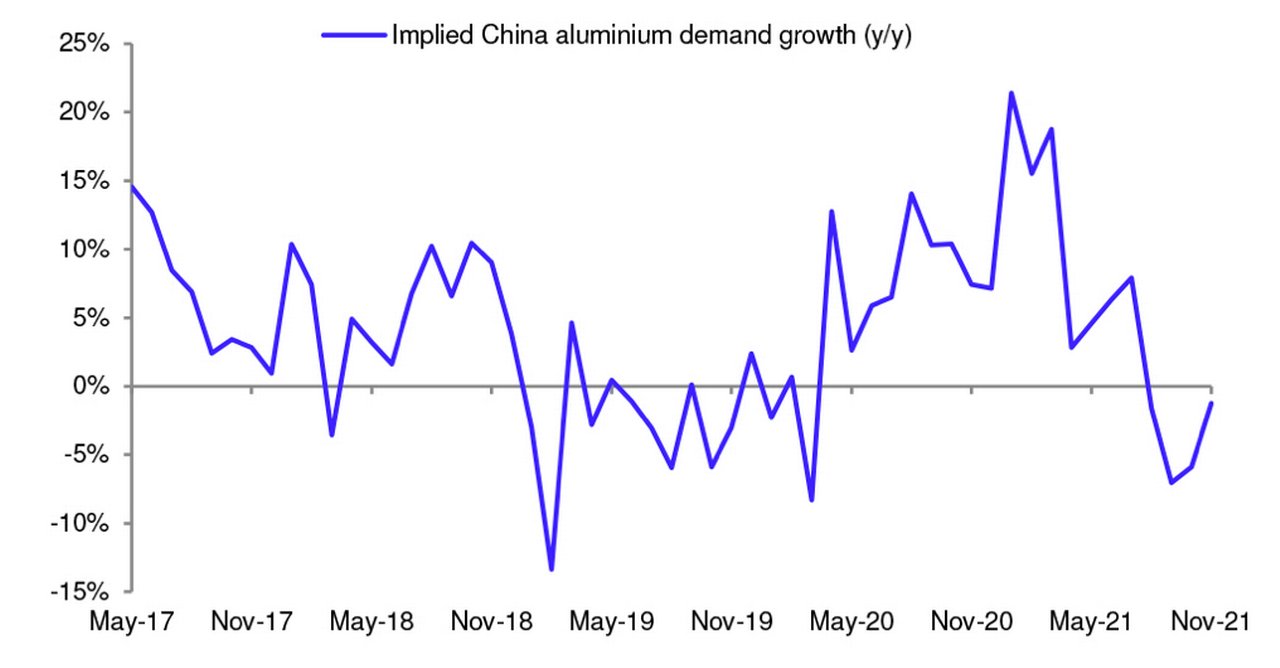

Figure 1: China’s aluminium apparent demand growth

Aluminium touches most aspects of everyday life, and is used in products including cans, foils, kitchen utensils, window frames and aviation components. Importantly, it is a core component of electric vehicles (EVs). Not only is it found in the chassis and wheels of the car, but it is used in the cases that carry the electric batteries in EVs. Demand for aluminium is therefore aligned with that of EVs.

As China continues to diversify and upgrade its automotive and aerospace industries, this creates a consistent demand for aluminium. So, it is hardly surprising that Middle Kingdom is the world’s most prolific producer of this light metal with 37 million metric tonnes produced in 2020 – Russia and India tying for a distant second place at 3.6 million each.6

Although the most abundant metal in the earth’s crust, aluminium first has to be extracted from compounds; the dominant one being bauxite. Once mined, the ore is chemically extracted and refined into alumina, an aluminium oxide compound, and then smelted into aluminium metal. Primary aluminium production is highly CO2 intensive and, notes the Deutsche Bank Research team, “production in China is heavily reliant on coal power”.

“Metals produced and processed with green energy will become more economic and be better priced as long as demand exceeds supply”

As Wood MacKenzie Senior Consultant Xinlin Chen explained in a May 2021 note, “In the past, Chinese producers would strategically choose locations for new smelter projects based on local power tariffs and where self-generated or captive power plants were permitted. This is a more cost-effective solution. However, the strategy of building power plants first and aluminium facilities later has become harder to sustain under China’s goals to control energy consumption and achieve carbon neutrality.”

Transitioning from coal-fired smelting to taking power from the grid which, by 2030, would have a higher percentage of renewable energy in the power mix” is something, says Chen, that the government is providing support for. She continues, “Grid-powered smelters are less at risk and only face the task of increasing operating efficiency and reducing energy consumption. Local grids and power plants will take responsibility for the transition to cleaner energy in the region, leaving a greener carbon footprint for energy-intensive manufacturing. Smelters in Yunnan, Qinghai and Sichuan provinces are adopting grid hydropower, to avoid government intervention and policy-driven suspensions.”

Chinese smelters, having hitherto enjoyed cost efficiency from their own coal-fired electricity will find themselves subject to grid company charges, and, Chen, forecasts, this resetting and relocation of the aluminium industry to renewable-rich regions in China “will inevitably cause the industry’s power tariffs to rise”. In the long run, she adds, increased scrap recycling will be needed to ensure lower carbon emissions production while meeting increased metals demand in China. “Producing secondary aluminium requires a fraction (< 5%) of the energy required to produce primary aluminium, so it is a more sustainable process.”

Commenting on this transition, Deutsche Banks’s Global Head of Natural Resources Finance, Sandra Primiero reflects, “Energy from renewable resources, and especially if transformed into green hydrogen e.g. for transportation, is not the more economic energy form at the moment. However, with scale effects kicking in, and with demand focussing on metals produced and processed with green energy they will become more economic, and be better priced as long as demand exceeds supply.” She adds, “Because of this, I am sure that the investment into renewable energy sources will pay off: environmentally, and economically.”

Oil surplus

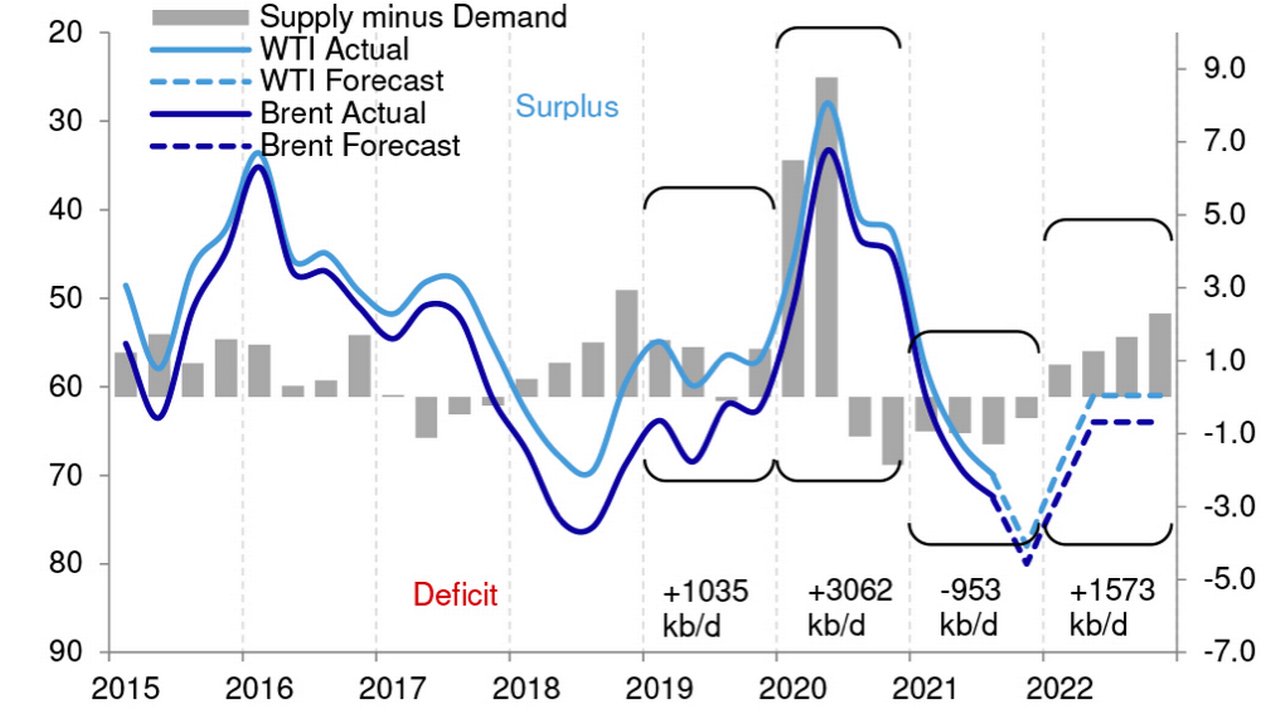

Figure 2: Oil market balance transitioning to oversupply in 2022

Another market that the report looks at is crude oil. Having seen the first wave of Covid-19 prompt a 30-year low oil price when the price of US crude went from US$18/bbl to -US38/bbl on 20 April 2020 as producers had to pay buyers to take the barrels of oil they could not store once storage facilities were full (see Figure 2) – global oil production is again poised to outpace demand.

At present, oil prices directly increase (or decrease) disposable income, as it is the most traded commodity and significantly impacts global transport costs. For this reason, their movement impacts inflation and economic growth.

The International Energy Agency points to output in the US and OPEC+ countries and, it notes, “as this upward trend extends into 2022, the US, Canada and Brazil look set to pump at their highest ever annual levels, lifting overall non-OPEC+ output by 1.8 million bbl/ in 2022.7

In the Commodities Outlook, the Deutsche Bank Research team notes that although they had already assumed that OPEC would halt supply increases, the impact of the February 2022 supply ramp-up was somewhat offset in December 2021 to January 2022 by the Libyan outages and pipeline maintenance, and OPEC+ member countries such as Angola, Nigeria and Russia falling short of allowed production increases. The team’s “bearish one-year view on crude oil prices” with Q1 2022 as a transition quarter from excess demand to excess supply forecasts Brent at US$64/bbl and WTI (US crude) at US$60/bbl.

Deutsche Bank Research referenced

Commodities Outlook, Industry Update (11 January 2022) by the following Research Analysts: Liam Fitzpatrick; Michael Hseuh; Bastian Synagowitz; Abhi Agarwal; Corinne Blanchard; Sathish Kasingathan; and Edward Goldsmith

Sources

1 See the previous 15 September 2021 Commodities Outlook report

2 See https://bit.ly/3goW9tP at imf.org

3 See https://bit.ly/3IVHaDX at imf.org

4 See https://bit.ly/3seoeJW at statista.com

5 See https://bit.ly/35D00Br at gov.cn

6 See https://bit.ly/3oerF2f at statista.com

7 See https://bit.ly/3AQbAEW at iea.org

Corporate Bank solutions Explore more

Find out more about our Corporate Bank solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

TRADE FINANCE, SUSTAINABLE FINANCE

Powering electric vehicles – the commodities impact Powering electric vehicles – the commodities impact

Electric vehicle sales are rising, and progress is underway in finding alternatives to fossil fuel-based vehicle propulsion. What does the transition to EVs mean for the minerals and metals used to reduce emissions, manufacture car batteries and develop fuel cell solutions? Clarissa Dann reports

TECHNOLOGY

Recharging personal transportation Recharging personal transportation

Trade finance and lending

Blue-sky thinking Blue-sky thinking

How can China maintain the war on smog yet ensure steady supplies of home-produced aluminium? flow’s Clarissa Dann investigates how prepayment finance supported Qiya in honing its low-cost, reduced-emissions technology