12 January 2022

Electric vehicle sales are rising, and progress is underway in finding alternatives to fossil fuel-based vehicle propulsion. What does the transition to EVs mean for the minerals and metals used to reduce emissions, manufacture car batteries and develop fuel cell solutions? flow's Clarissa Dann reports

MINUTES min read

With the gradual move away from fossil-fuel propelled vehicles to electrical and with that potentially cleaner alternatives gaining momentum, the impact on the supply and demand of metals and minerals used to manufacture them is at a turning point. This article takes a closer look at how Platinum Group Metals (PGMs) have been part of the emission reduction journey of existing petrol and diesel vehicles through catalytic converters, and how this is set to change as the world gears up, as it were, for electric vehicle replacements that deploy battery power and fuel cell technology to propel them.

According to the International Energy Agency (IEA), electric car sales reached three million in 2020, up from 40% in 2019. The IEA adds that following a decade of rapid growth, there are now more than 10 million electric cars on the road, representing around 1% of global car stock.1

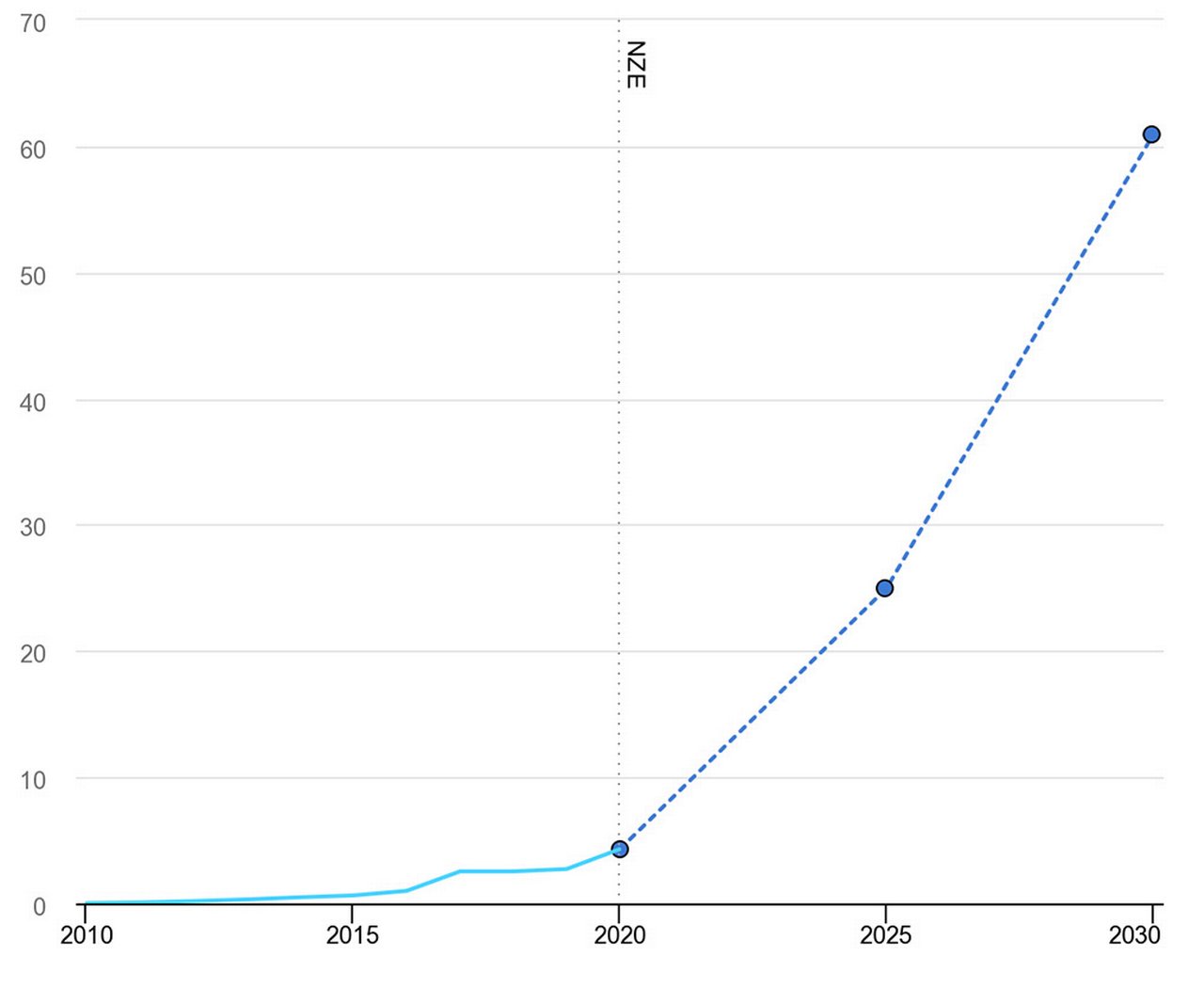

The IEA’s November 2021 report, Electric Vehicles – on track, sets out what achieving the scenario of net zero emissions by 2050 means for future electric car sales with early 2021 market data pointing to “rapid growth in major markets”. Existing regulatory frameworks, along with additional stimulus measures in some countries, have, says the report, “enabled dynamic growth in electric car sales in 2020”. By the end of that year, it adds, more than 20 economies had announced targets to phase out internal combustion vehicles over the next 10–30 years.

Figure 1: Electric car sales share in the Net Zero Scenario, 2000-2030

Source: IEA, Electric car sales share in the Net Zero Scenario, 2000-2030, IEA, Paris

In addition, the COP26 declaration on accelerating the transition to 100% zero emission cars and vans (6 December 2021) commits to “rapidly accelerating the transition to zero emission vehicles to achieve the goals of the Paris Agreement” and that “together, we will work towards all sales of new cars and vans being zero emission globally by 2040 and by no later than 2035 in leading markets”.2

But what does it mean for the supply and demand of the commodities needed to make this happen?

PGMs inflection point

Commodities in the Platinum Group of Metals (PGMs) are currently used for catalytic converters in existing vehicles, with platinum core to fuel cell technology. As helpfully explained by Mordor Intelligence, the PGM metals market is segmented by:

- Metal type – platinum, palladium, rhodium, iridium, ruthenium and osmium;

- Application – Auto catalysts, electrical and electronics, fuel cells, glass, ceramics and pigments, jewellery, medical chemicals and other applications; and

- Geography – Asia Pacific, North America, Europe, South America, Middle East and Africa.

The outlook for PGMs, impacted by Covid-19’s reduction in new vehicle demand and the move towards fully electric vehicles (that don’t need catalytic converters) is set out in a deep-dive analysis of the PGM market by Deutsche Bank Research analysts Abhi Agarwal, Liam Fitzpatrick and Bastian Synagowitz in their 12 October Industry Update Commodities: PGMs – Autos rebound, EVs & Hydrogen economy: PGMs on cusp of shift.

In the near term, notes the team, global auto production cuts have impacted PGM demand. The Deutsche Bank Research auto team recently revised their car volumes down and now expect year-on-year growth of around 7.6% in 2021. However, as the semiconductor shortage eases, this should drive a rebound in auto production (and sales) this year, leading to an improvement in PGM demand from H1 2022. Therefore, in their wider 2022 Mining Outlook, the team says they believe PGM demand “will remain well supported by stricter regulations (with increased loadings expected out to 2030) and rebounding auto production from 2022”.

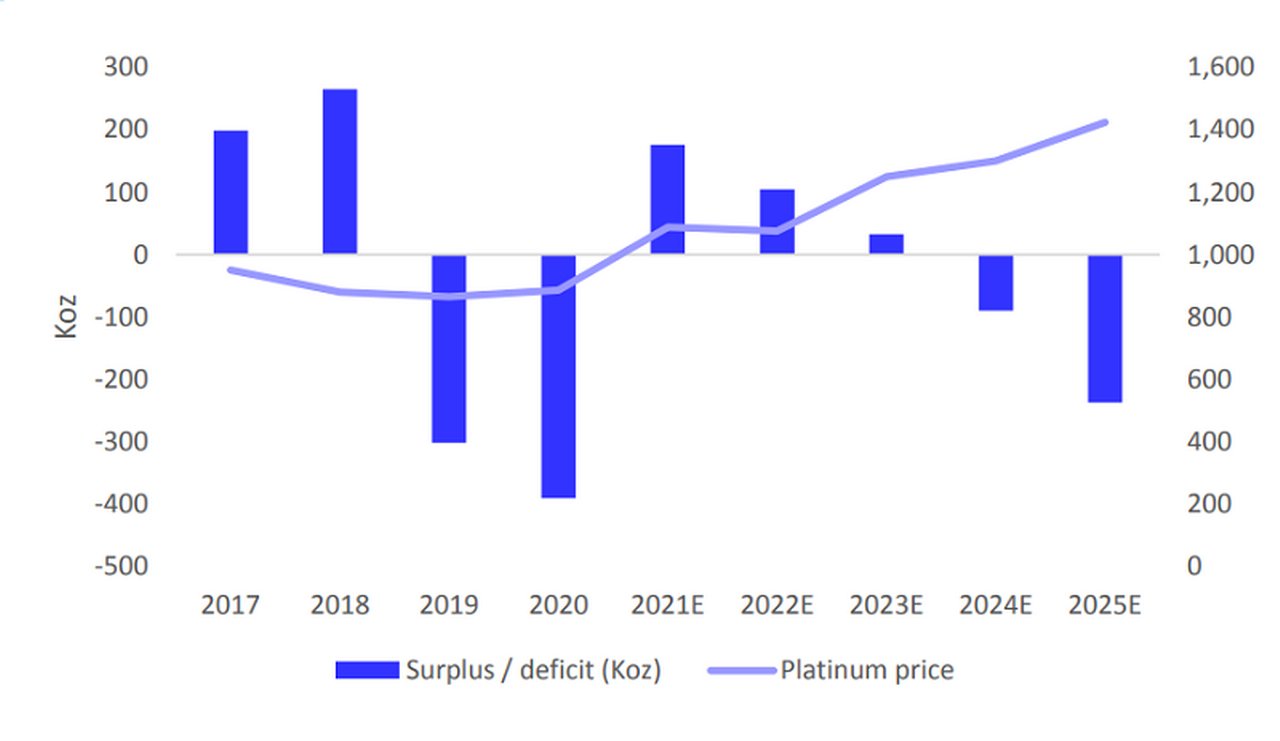

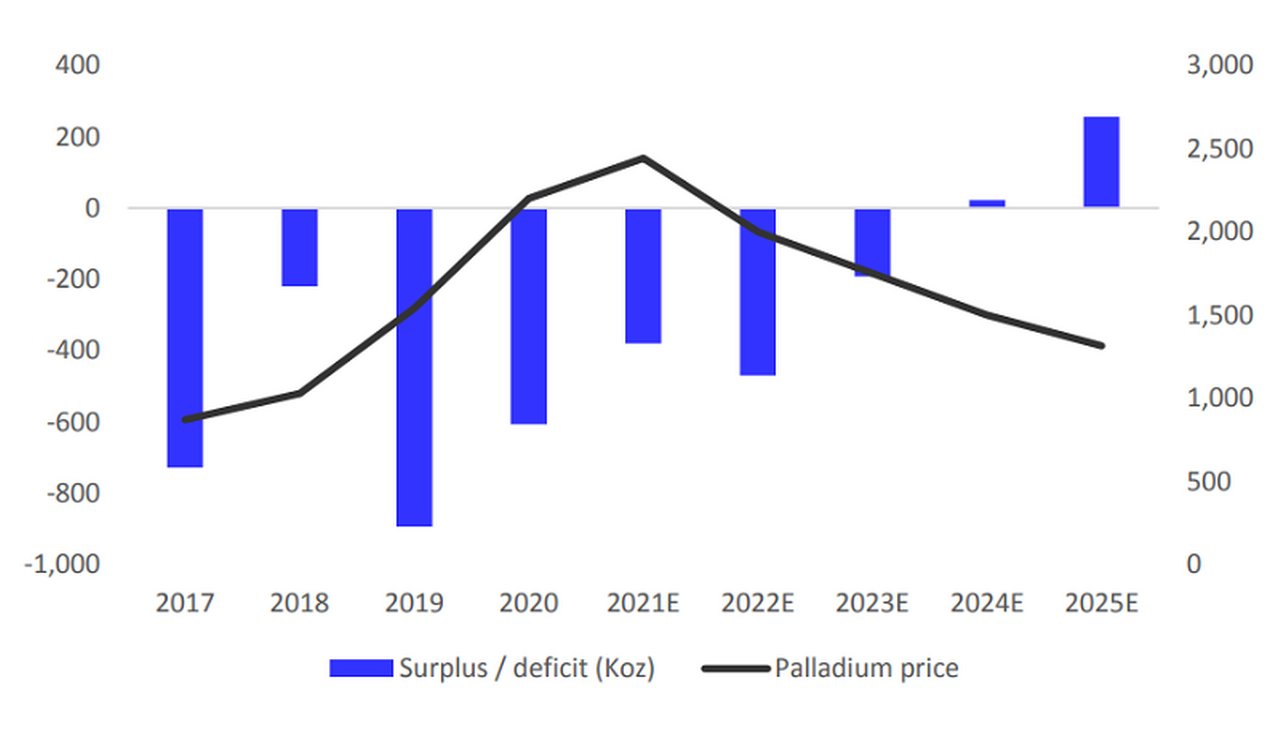

However, over the medium term, increasing EV penetration poses a threat to PGM demand, especially post 2025. As the Deutsche Bank Research team explains, platinum is typically used in diesel vehicles to reduce emissions but can also be employed in gasoline vehicles, while palladium is suitable only for gasoline vehicles and rhodium is used in exhaust systems as a critical catalyst to reduce nitrogen oxide (NOx) levels from emissions. Palladium demand remains geared toward the autocatalyst (autocat) sector, which constitutes 85% of the total demand. The remainder comes from the electrical (5%), chemical (5%), and dental (3%) sectors. Fleet electrification is therefore “likely to be a headwind for all PGMs – especially palladium, given the dominance of autocat demand within total consumption”, the team states.

Figure 2: Platinum is expected to shift into a deficit as the substitution away from palladium picks up

Source: Deutsche Bank estimates, Johnson Matthey PGM review

Figure 3: Palladium, on the other hand, is likely to shift into a surplus from 2024 as demand stagnates and supply picks up

Source: Deutsche Bank estimates, Johnson Matthey PGM review

Platinum and fuel cells

Precious metals refiners at Anglo American Platinum (source, AngloAmerican)

“Studies show the use of zero emissions hydrogen FCEVs will increase as more stringent emissions targets drive technological change in the automotive industry”

While hybrid vehicles use PGMs, pure EVs use no autocats at all and currently (with a few exceptions) are dependent on the raw commodities essential for car battery production, namely lithium, nickel and cobalt. By the end of the decade and onwards, increased uptake of fuel cells and the adoption of hydrogen as a fuel should, says the Deutsche Bank Research team, “be a tailwind for PGMs, especially platinum, given its importance as a catalyst”.

The world’s largest provider of platinum, Anglo American Platinum sees platinum-containing hydrogen powered fuel cell electric vehicles (FCEVs) as “an important innovation”. As the company explains on its website, “Studies show the use of zero emissions hydrogen FCEVs will increase as more stringent emissions targets drive technological change in the automotive industry. The use of platinum in FCEVs, as well as the predicted increase in vehicles using fuel cell technology, translates into an increased demand for platinum by the automotive industry. This innovative technology uses a platinum catalyst and runs solely on hydrogen, emitting only water from the tailpipe.”3 Given concerns about the sustainability of critical commodities for battery production, this is clearly a development to watch.

“PGMs are scarce, and world population is growing, and with that the demand for traditional and electric cars”

ESG Impact of EV battery commodity demand

“Anticipating a world dominated by electric vehicles, materials scientists are working on two big challenges. One is how to cut down on the metals in batteries that are scarce, expensive, or problematic because their mining carries harsh environmental and social costs. Another is to improve battery recycling, so that the valuable metals in spent car batteries can be efficiently reused,” reflected the science journal Nature in ‘Electric cars and batteries: how will the world produce enough?’ on 21 August 2021.4

The Nature article points out that while component amounts vary depending on the battery type and model of vehicle, “a single car lithium-ion battery pack (of a type known as NMC532) could contain around 8 kg of lithium, 35 kg of nickel, 20 kg of manganese and 14 kg of cobalt, according to figures from Argonne National Laboratory”.

The United Nations Conference on Trade and Development (UNCTAD) in its 2020 report, Commodities at a glance: Special issue on strategic battery raw materials,5 suggests that investing in other green technologies that depend less on critical battery raw materials “could help reduce consumers' vulnerability to supply shortfalls in the current mix of materials such as lithium and cobalt, but this would cut the revenues of the countries producing them”.

Reserves of the raw materials for car batteries are highly concentrated in a few countries. Nearly 50% of world cobalt reserves are in the Democratic Republic of the Congo (DRC), 58% of lithium reserves are in Chile, 80% of natural graphite reserves are in China, Brazil and Turkey, while 75% of manganese reserves are in Australia, Brazil, South Africa and Ukraine.

But it’s not only important to diversify supply chains to avoid disruptions and higher prices for car batteries, but also to take into account sustainability aspects, as the extraction of raw materials for car batteries that provide an alternative to petrol and diesel power has had devastating social and environment impact on the exporting countries: “For instance, about 20% of cobalt supplied from the DRC comes from artisanal mines where child labour and human rights abuses have been reported. Up to 40,000 children work in extremely dangerous conditions in the mines for meagre income”,6 according to UNICEF. This challenge can be overcome by a cooperation with NGOs to observe production standards, with which the supply chain can become sustainable from a social perspective.

And in Chile, lithium mining uses nearly 65% of the water in the country's Salar de Atamaca region, one of the driest desert areas in the world, to pump out brines from drilled wells. This has caused groundwater depletion and pollution, forcing local quinoa farmers and llama herders to migrate and abandon ancestral settlements. It has also contributed to environment degradation, landscape damage and soil contamination.” Consequently, different forms of water (waste) management will be required if the lithium extraction not only continues; but is expanded to meet the world’s need for lithium as a battery component.

Reflecting on the overall impact of ongoing and future vehicle demand and how that demand is met, Deutsche Bank’s Global Head of natural Resources Finance Sandra Primiero makes the point that “PGMs are scarce, and world population is growing, and with that the demand for traditional and electric cars”.

Regarding vehicle electrification Primiero sees four basic challenges ahead:

- ESG general concerns from environmental and social perspective (such as those set out by UNCTAD);

- The fact an electric vehicle is only carbon neutral if the car itself is produced from green materials (e.g. green steel or aluminum) for which the demand considerably exceeds the supply;

- Electricity as energy source for electric vehicles is often not yet produced from renewable energy sources; and

- People need to be convinced of the added value of an electric vehicle; and be willing and able to purchase one.

“Bearing that in mind investors might find it worthwhile from an ESG perspective to invest into green car component production, and renewable energy sources, as well as into development of carbon neutral energy sources for large vehicles such as ships, aircrafts and trucks, rather than the aim to turn cars into electric vehicles as quickly as possible,” concludes Primiero.

Outlook

An all-electric future does appear to be lighting up the road ahead as vehicle manufacturers continue to announce what the IEA sees as “increasingly ambitious electrification plans”. However, for this vision to become a reality, a joined-up approach will be needed to secure supply chains in a sustainable way – particularly supplies of those critical commodities that provide the infrastructure to propel the vehicles.

Deutsche Bank reports referenced

2022 Mining Outlook: Will the tiger roar? Seeds of recovery & positive structural drivers in '22 by Abhi Agarwal, Liam Fitzpatrick and Bastian Synagowitz (23 November 2021)

Industry Update – Commodities: PGMs – Autos rebound, EVs & Hydrogen economy: PGMs on cusp of shift by Abhi Agarwal, Liam Fitzpatrick and Bastian Synagowitz (12 October 2021)

Sources

1 See https://bit.ly/3HSS1hD at iea.org

2 See https://bit.ly/3JZA0A4 at gov.uk

3 See https://bit.ly/3qh9nyw at angloamericanplatinum.com

4 See https://go.nature.com/3HSurBv at nature.com

5 See https://bit.ly/3r9glVx at unctad.org

6 See note 5

Trade finance solutions Explore more

Find out more about our Trade finance solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

SUSTAINABLE FINANCE, MACRO AND MARKETS

COP26: Can companies bear the burden? COP26: Can companies bear the burden?

While governments are making announcements to reduce emissions, the responsibility to make the targets happen falls onto the corporates. flow summarises new Deutsche Bank Research demonstrating why costs are a key concern for some corporates and how finance can support the transition

Trade finance and lending

What’s next for commodities? What’s next for commodities?

Commodities are bouncing back from their Covid-19 lows and some even talk of a supercycle. flow reports on longer term issues facing the industry, such as fraud, digitalisation and ESG transition discussed at the May 2021 TXF Virtual Commodity Finance Conference