18 February 2022

What will post-trade settlement in Gulf Cooperation Council countries look like in the future? And how can the OTC settlement process be improved? Deutsche Bank’s Manoj Aidasani proposes a blockchain-based solution, using non-fungible tokens (NFTs) and smart contracts to settle money market instruments

MINUTES min read

Post-trade securities services, is, as an industry, racing to transform and harness the new technologies and digitalisation initiatives.

As explained in flow articles such as ‘Token power’, and ‘What will be the shape of digital custody?’, blockchain, distributed ledger technology (DLT), artificial intelligence (AI), tokens and digital assets are all very much part of the new securities services landscape.

Helpfully summarised by the European Parliament (EP), crypto assets are defined as digital assets that may depend on cryptography and exist on a distributed ledger. The EP states that “a basic taxonomy distinguishes between:

- payment tokens (means of exchange or payment);

- investment tokens (have profit rights attached); and

- utility tokens (enabling access to a specific product or service).”1

If one takes the entire life cycle of a security, from issuance through trading, post-trade and ending with maturity (that in some cases is perpetual), all these functions can be viewed through the lens of blockchain and the DLT process.

Regulators are developing frameworks to ensure fair competition, as well as consumer and investor protection for, in the EP’s words, “the issuance and provision of services related to crypto-assets.” In April 2021, the European Central Bank (ECB) published the report ‘The Use of DLT in post-trade processes’ by the Advisory Group on Market Infrastructures for Securities and Collateral (AMI-SeCo) that observed, “Various institutional actors, such as governments and central banks, are actively undertaking initiatives to investigate and develop potential DLT-based use cases. In addition, market players are experimenting increasingly with the technology, despite the current lack of common practices and standards.

“While the diverse nature of the initiatives is likely to result in a wide range of different findings and is part of a competitive mechanism in the initial phase of a new technology, it also entails the risk of market fragmentation and potentially of a delay in progressing towards a capital markets union.”2

In Saudi Arabia, most of the current regulations on fintech are the remit of the Saudi Central Bank (SAMA) and the Kingdom’s Capital Markets Authority (CMA), which supervise areas such as payments processing, e-wallets, and crowdfunding. Both bodies are supportive of key fintech and blockchain initiatives to enable and develop fintech in the Kingdom. The CMA also launched the Saudi fintech lab initiative in December 2017 to stimulate the fintech environment through developing the fintech infrastructure and providing support for entrepreneurs.

The Lab is a legislative experimental environment under CMA supervision that enables fintech products and services to test their business models with specific criteria, time periods, and regulatory requirements.3

Current difficulties

Physical securities, which are settled over the counter (OTC) – in other words traded directly between counterparties without being listed on an exchange or depository – are acknowledged as problematical for custodians and regulators. Lack of identification, an inefficient settlement process and the inability to record and reconcile all contribute to overall governance risks.

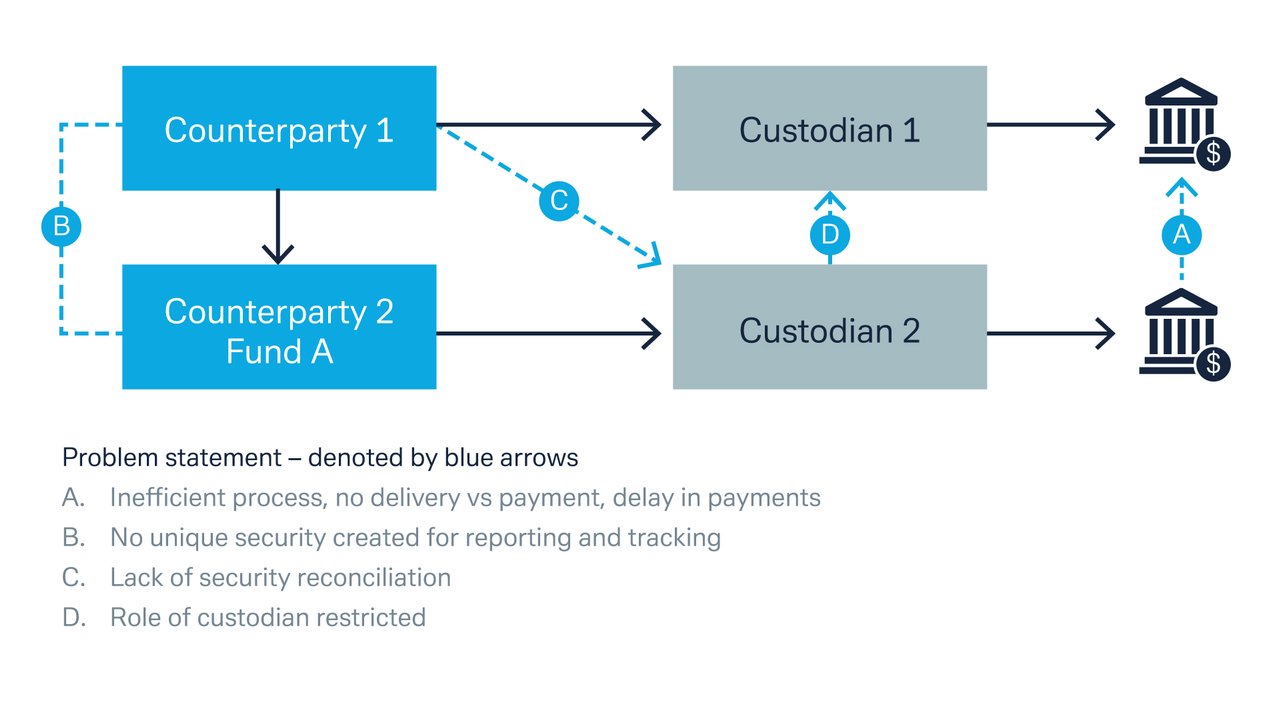

Deutsche Bank Securities Services has reviewed an existing B2B post-trade settlement process of Money Market instruments, a physical security issued and settled in Saudi Arabia. The current settlement model restricts the role of the custodian to that of record keeping, cash transfers and reporting. This contributes to delays in payments and has a downstream impact on funds use, as outlined by Figure 1 below.

Figure 1: Problem statements

Source: Deutsche Bank

Solution objectives

How did we tackle the problem? First, we set out to identify current workflow gaps, review market infrastructures and the support models available. Once completed, and mindful of the counterparty needs and custodian roles, we explored a solution based on non-fungible tokens (NFTs) and smart contracts using blockchain and DLT.

The beauty of the proposed model is that even though this is on blockchain, it retains the essence of a clearing and settlement model. This makes it possible for custodians to record and reconcile post-trade. As the workflows are automated, this addresses the inefficiency issue, and the whole model is compliant with current regulation.

We propose the use of NFTs and smart contracts on private blockchain model to solve issues of efficiency and transparency. There are other options that can be considered as a solution, such as decentralised exchanges and the creation of a marketplace, but the rationale of this article is to find one that ensures regulatory compliance from a custody perspective rather than further opacity. The following sections further explain the background of money market instruments, the current settlement process, and a proposed solution to the problem.

Definitions

As a helpful reminder, set out below are some definitions of NFTs, smart contracts, oracles and token platforms.

Non-fungible tokens (NFT)

- An NFT represents ownership of unique items with unique properties (such as art, real estate etc). There can only be one owner at a time;

- NFTs are secured on the blockchain;

- No two NFTs are the same – each is unique;

- Ownership is transferable; and

- NFTs can be burned and removed from the blockchain.

Smart contract

- A smart contract is a digital contract where the terms of agreement between the parties is set in software code.

- This can be programmed to self-execute when a set of predefined conditions are fulfilled.

- They can hold digital assets, NFTs and cryptocurrencies – these digital assets can be distributed upon execution as per the code defined in the contract.

- While a smart contract will contain security details, the custodian and settlement process has yet to be defined.

Oracle

- An oracle is a trusted third party that provides smart contracts with authenticated external sources of data and information (such as FX rates and pricing) from the real world through an API.

- Oracles connect smart contracts with external events, and act as a bridge between the blockchain and the real world.

- They can be entrusted with the triggering of smart contracts based on the outside events they are connected to.

Token platform

- This is an enterprise platform that acts as a common interface between all parties and the DLT framework (public or private).

- It provides an easy-to-use web interface for minting NFTs, creating smart contracts, reports etc.

- It can be integrated with a public blockchain or private blockchain such as Ethereum – an example of a decentralised open-source blockchain with smart contract functionality.4

Background to Money Market (MM) securities in Saudi Arabia

Saudi Arabia’s Financial Sector Development Program was launched in 2017 to “enable financial institutions to support the growth of the private sector, develop an advanced capital market and to boost and enable financial planning.”5

As explained on the Program’s website, the Kingdom is “aiming to develop the financial market to become and advanced capital market without weakening the financial sector’s stability.” Subsectors include banking, insurance, investment, stock and debt markets.

These money market instruments comprised sharia (Islamic finance) short-term instruments carrying profit rates and a fixed maturity date. These securities are settled OTC between counterparties that include local banks and asset management firms.

According to Saudi financial news portal Argaam, by Q3 2021 the Saudi asset management industry had around Riyal (SAR) 740bn (US$197bn) under management, made up of public funds, private funds, real estate and discretionary mandates.

The Deutsche Bank Securities Services team collated data from publicly available sources and estimates that more than US$30bn of assets are invested in money market funds which are non-depository eligible, cannot be put under custody and settled outside the depository settlement process.

MM security and the current settlement process

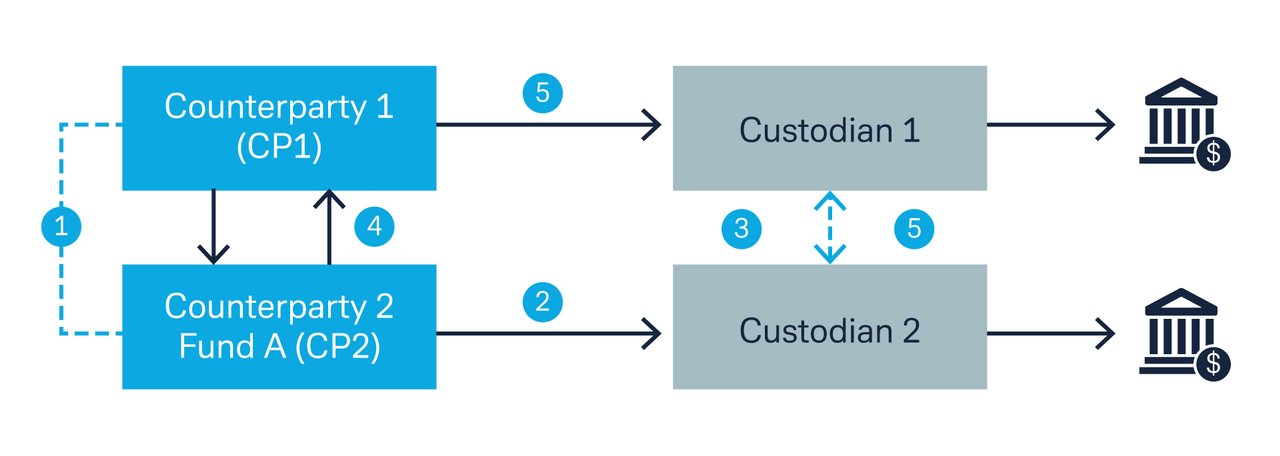

Figure 2: Current process

Source: Deutsche Bank

In summary, this is how the process currently works:

Buy

1. Counterparty (CP) 1 and CP2 (Fund A) agree on an OTC deal to buy the MM security. It is basically a fixed coupon/profit rate with short-term maturity of < 365 days. No security is created, or common identifier exchanged for security, and contracts are signed for the deal.

2. CP2 instructs their custodian to pay the settlement amount to the CP1 custodian/bank.

3. Custodian 2 pays the amount but receives no security in return as the process is not delivery versus payment (DvP), thus no periodic reporting and no reconciliation. The custodian creates their own International Securities Identification Number (ISIN) for the security as a short-term MM instrument

Maturity

4. On maturity, manual chasers are sent out to CP1 for the release of payment. This approach is very inefficient, and clients face delays in receiving funds upon the maturity date, CP2 cannot deploy funds on the same day, which can also have downstream impact on other payments such as redemptions to investors.

5. Once CP1 instructs to Custodian 1, maturity proceeds are paid to Custodian 2 of CP2.

Proposed solution

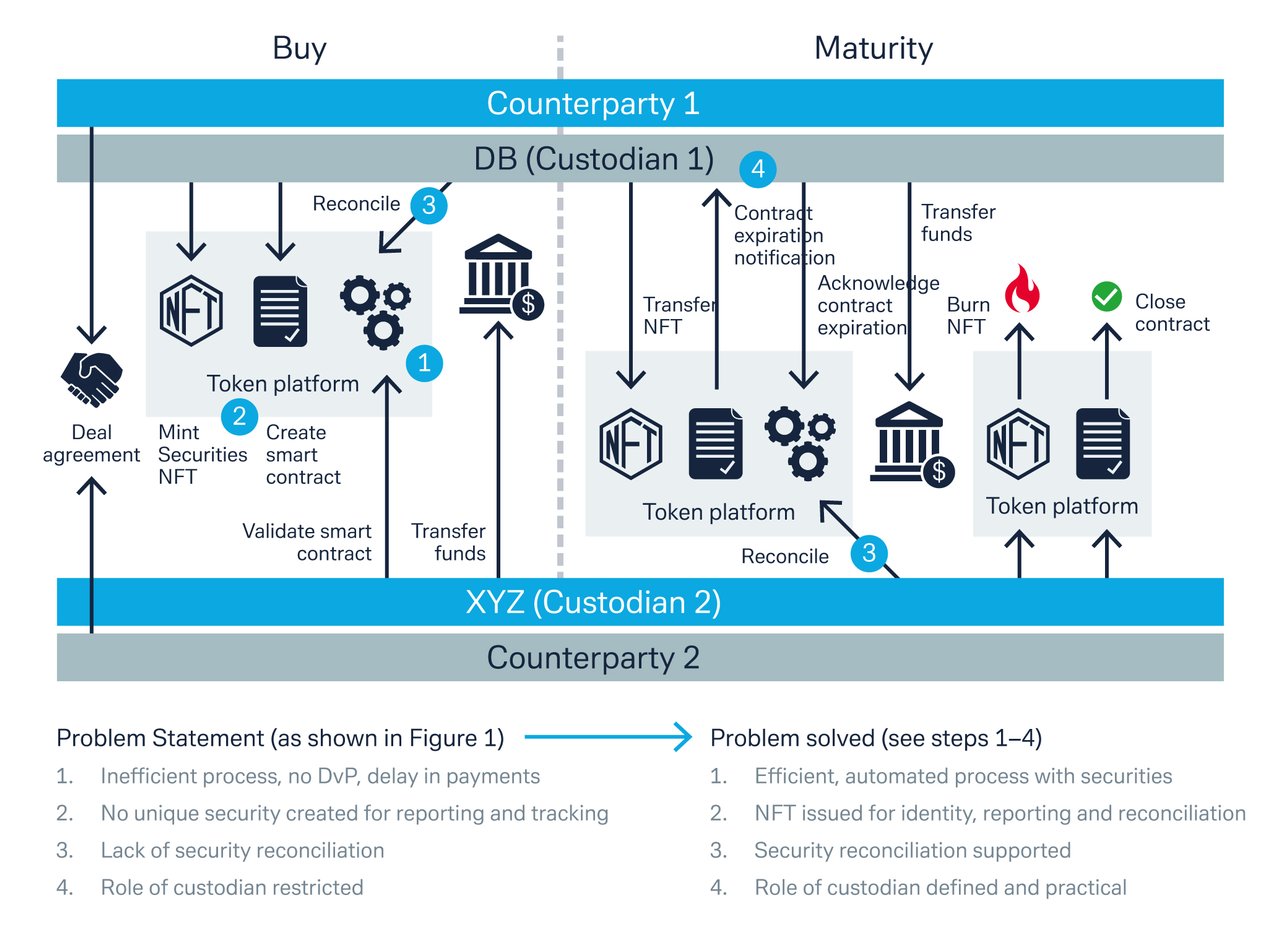

Figure 3 provides a summary of how the problem statement set out in Figure 1 could be resolved using NFT and a smart contract with a token platform

Figure 3 Solution overview

Source: Deutsche Bank

The proposed solution to issue NFT on the token platform can help eliminate problems from the legacy model and move towards a more efficient and secure post-trade settlement model. If the model is built, this is how the proposed process would work:

Buy

- Counterparty 1 (CP1) and Counterparty 2 (CP2) agree on an OTC deal to buy a MM security whereby CP1 will issue NFT and CP2 will transfer funds.

- CP1 mints (creates) an NFT for the underlying security using the Token platform.

- CP1 creates a smart contract, using the Token platform, as per the terms agreed and links the NFT created in the previous step.

- Oracle 2 (Custodian 2) verifies and executes the smart contract thus releasing the funds from CP2 to CP1 and smart contract.

- This triggers the transfer of the NFT from CP1 to CP2.

- NFT position reports available, supporting reconciliation for both custodians.

Maturity

- On maturity, an alert is sent to the Oracle 1 reminding of the smart contract expiration.

- Oracle 1 (Custodian 1) releases the funds from CP1 to CP2.

- Oracle 2 (Custodian 2) on receipt of funds, triggers burning of the NFT.

- Oracle 1 (Custodian 1) confirms the burn and triggers the smart contract closure.

Advantages of the proposed new blockchain-enabled model

Once this model is implemented it has the potential to solve the market-wide problem of the OTC securities settlement model, by making the process easier to use for all participants (counterparties, custodians, and regulators), It also brings greater post-trade settlement efficiency and defines the custody role properly for regulatory compliance. The proposal would be a first of its kind in the GCC markets, bringing a new technology into the region to improve the securities services experience.

One key area which requires consensus at industry level is about the co-existence of the future technology with regulations and asset safety for clients. An important aspect of these changes is the regulatory support to identify these securities and associated technology and embed them in the value chain. The Bank has seen openness form the regulators in the region and we believe this is the right time to start engaging for a market wide initiative for change.

This is, in my view, what could be achieved by working on this proposed token platform for MM securities in Saudi Arabia. I do believe the advantages more than justify the effort and at Deutsche Bank we shall continue to review the model, which offers the building blocks for a future model that can work for other OTC traded and settled securities in the GCC region.

Sources

1 See https://bit.ly/34UFH29 at europarl.europa.eu

2 See https://bit.ly/3gSDbMF at ecb.europa.eu

3 See https://bit.ly/3JuCyoK at cma.org.sa

4 See https://bit.ly/3BxDoOU at ethereum.org

5 See https://bit.ly/3504L87 at vision2030.gov.sa

6 See https://bit.ly/3LBUuQ8 at argaam.com

Manoj Aidasani

Head of Securities Services GCC at Deutsche Bank

Securities services solutions Explore more

Find out more about our Securities services solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

SECURITIES SERVICES

Where next in the Gulf for securities services? Where next in the Gulf for securities services?

Having bounced back from Covid-19-related shocks, liquidity in local equity and bond markets is now the priority in the Middle East as GCC economies attract overseas investors following market infrastructure reforms. Securities services in the region are also navigating ESG and digital asset developments. flow reports on discussions at The Network Forum Virtual Middle East meeting

SECURITIES SERVICES, TECHNOLOGY

What will be the shape of digital custody? What will be the shape of digital custody?

As investors build digital asset portfolios while they chase superior returns and diversification, custodian banks are building digital custody solutions to help them. Clarissa Dann reports on the risks and regulatory arms embracing these new asset classes

SECURITIES SERVICES, MACRO AND MARKETS

Pole position for growth Pole position for growth

The advent of the next generation of financial services products will build on new customer services originating from securities services, predicts Deutsche Bank’s Paul Maley. He also shares with flow’s Clarissa Dann his passion for iconic sports cars and the road from engineering to corporate banking