10 September 2021

The advent of the next generation of financial services products will build on new customer services originating from securities services, predicts Deutsche Bank’s Paul Maley. He also shares with flow’s Clarissa Dann his passion for iconic sports cars and the road from engineering to corporate banking

MINUTES min read

Why do banks want engineers on their payrolls? Those vital analytical and mathematical skills are not only highly transferable, but integral to managing technology, operations and innovation.

So it should probably have come as little surprise that Deutsche Bank’s Global Head of Securities Services, Paul Maley found himself at the receiving end of an approach from Deutsche Bank’s talent scouts in the final year of his Electrical and Mechanical Engineering degree at Brunel University in London.

In fact, this was a student sponsored by Ford Motor Company, and the original plan was that all that vacation work with Ford, Jaguar and Aston Martin would consolidate into a career in automotive engineering. But unbeknown to Maley, an unexpected crossroads lay ahead that wasn’t on the roadmap.

Petrolhead to custodian

With Covid-19 restrictions lifting, among the benefits of returning to the Bank’s offices (complete with face covering of course), is the opportunity to have one of those impromptu conversations at the coffee machine.

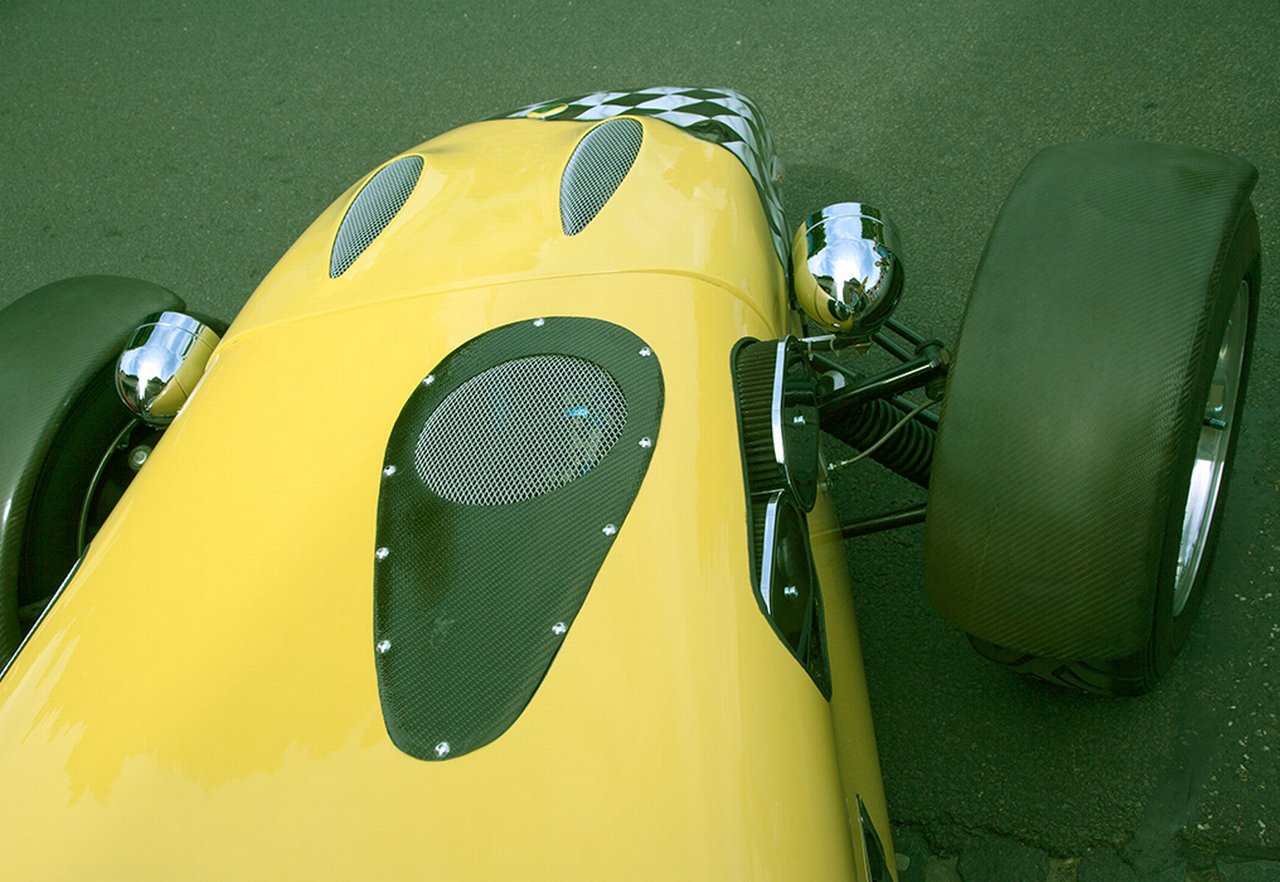

While reaching for the flat white, I found myself somehow talking with Maley about building kit cars (I grew up around the corner from Caterham Car’s origins in Surrey back in the Seventies and saw the Caterham 7 and other early models in their display window as a child). “It takes about 200 people hours to build the car to a high standard. So no short-cuts or bodging, which can be important for safety,” he explains. He should know, having built two Caterham Cars himself and had huge fun with them.

Vintage Caterham Super Seven sports car

It is this methodical approach to building and growing businesses that has characterised much of Maley’s career trajectory. He took up his current role at the start of 2021, having joined the Bank as a graduate trainee in 1998. Over the past 23 years regulatory and economic pressures, together with technological innovations, have transformed the competitive landscape occupied by global custodians, local custodians and fund services specialists.

The Bank provides custody and clearing, asset servicing, securities financing and liquidity services in more than 30 markets around the world and has around EUR3.1trn in assets under management. However, in a market dominated by global custodian giants such as BNY Mellon and State Street (the latter announcing on 7 September a huge US$3.5bn acquisition of Brown Brothers Harriman), the raison d’être is not about scale but rather an anchor service touching the whole Bank. “This is a completely fundamental business to what Deutsche Bank does,” reflects Maley. “We are always going to be a custodian; we are always going to need to do asset servicing and we are always going to need to offer fund administration to both our external and internal clients”.

His remit is to take a platform business with a global network and move it more onto a growth trajectory – no easy task with pandemic-induced economic contraction in 2020 and uncertainty around the speed, scale and extent of any bounce-back.

In the beginning

Born in Dundee, Scotland, Maley was accustomed to being regularly on the move and adapting rapidly to new situations. His father was a store manager at apparel retailer C&A – a client of Deutsche Bank – which meant relocating every three to five years to a different part of the UK. “I spent most of my formative years wanting to be a car designer – I had my heart set on being a Formula 1 engineer,” he recalls.

The crossroads that suddenly presented itself in 1998 when the allure of free drinks and dinner with a glamorous investment bank was irresistible to a student managing from week to week on a grant. “It was one of those seminal moments where you never quite know where fate is going to take you,” Maley observes. “I enjoyed my experience meeting the Bank. Interestingly they had only invited mathematicians, physicists and engineers to the event.” But of course, this was the late 1990s when fledgling derivatives were taking off and banks wanted graduates with an applied mathematics background.

As it happened a student friend was supplementing her income working as a bartender when all the young hopefuls had gone home for the evening and overheard the “wrap-up” conversation. At lectures the next day she wasted no time telling Maley he needed to apply to Deutsche Bank. “They really liked you,” she assured him.

“Never have I been so grateful to a friend being in the right place at the right time, that message changed my life,” reflects Maley. He applied, was invited to a full day of exams and interviews in London at the erstwhile Bishopsgate offices, and staggered home exhausted. The student phone (shared by around 40 others) rang later that evening at 8.30pm, and he was summoned to take the call by one of his flatmates. “Within 12 hours Deutsche Bank went from not knowing me to offering me a job. Ford had known me for four years and took months to decide whether to take me on or not.” Ever the shrewd strategist, he told Ford he was taking a year off, accepted the Deutsche Bank job…and never looked back.

Bulls and bears

As a graduate trainee, the classroom training coincided with the 1998 Russian financial crisis that saw a devaluation of the ruble and “a very intense period in the markets”. “We were supposed to have had people from FX and emerging markets teaching the classes, but they were too busy dealing with the markets. So, a few sessions never happened,” he recalls. At the end of the training period there was an opportunity to “help out in Frankfurt for a couple of weeks”. In fact, that period ran for nearly 6 months. With a whole basket of currencies about to be supplanted by the Euro on 1 January 1999, Maley spent “a really fun few months” in Frankfurt preparing for the launch of the single currency. “Be careful what you raise your hand for,” he smiles.

“If you have only worked during a bull market, you will behave in a particular way”

On returning to London, his next role was in equity derivatives, which as he reminds me are products when a financial asset derives its price from an underlying share or index. “The simplest example is a future, which tries to anticipate the price of an individual index or commodity or debt instrument at a future point in time. The other is an option – the right to buy or sell at a certain point in the future.” These structures, he maintains are quite straightforward, despite all the talk of complexity. “Every single derivative is a combination of puts, calls and futures. Investors and regulators get understandably excited about these products because they often are inherently levered. You can put down one dollar and get exposure to US$10.” But of course this is also a huge source of risk.

As 1999 unfolded, equity prices were high, there was a lot of options being traded and volatility was traded as an asset class for the first time. When the dotcom bubble burst a year later, this was the first time Maley had experienced a bear market – which became useful early training for the Global Financial Crisis that followed seven years later.

“if you have only worked during a bull market, you will behave in a particular way,” says Maley. In December 2003 he was moved to the equity derivatives team in New York and that led, through a twist of fate to being in the Big Apple over the weekend of 13−14 September 2008 when rescue attempts to save Lehman Brothers failed and the erstwhile fourth largest bank in the US filed for bankruptcy on the Monday morning.

Maley found himself an unexpected part of the cavalry sent to try and rescue Lehman Brothers when it turned out most of the Deutsche Bank leadership were in Europe that weekend. He got the call on the Saturday afternoon and was told he needed to get over to the New York Federal Reserve to join the other banks so the contagion from Lehman’s demise could be contained. Working with Chairman Timothy Geithner and his team, observing how they tried to deal with “a completely seismic event” was hugely educational. “You certainly got to see the beginning of what would turn into a major tipping point for the global economy.”

Upon his return to London for the final two-year stint in equity derivatives, he found the 2009 management team had left the Bank rather suddenly and the average age of the new Executive Committee was around 35 without many grey hairs in sight. “Apart from mine,” Maley, who went grey at 26, adds ruefully. “We had just inherited an enormous business,” he smiles. Which conferred a certain level of responsibility to get it right.

In the pit

A decade later and it was time for a change. In February 2019 Maley joined what was then the Global Transaction Bank, as Chief Operating Officer working with the Frankfurt team on the project that created what is now the Corporate Bank headed by Stefan Hoops. “Can you come to Frankfurt tomorrow please?” asked Hoops during a phone call one Sunday afternoon. Needless to say some hasty travel arrangements had to be made.

On 9 July that year, CEO Christian Sewing said in a message to staff, “We have no choice other than to concentrate our strengths and resources where we play to win and where we can make a true difference for our clients.”1

Maley’s engineering, markets and crisis management experience were all vital and were deployed in helping to implement the new structure that would serve corporate and commercial clients. Not only did this mean ensuring that the rails were all in place, but that the new Corporate Bank was set for growth. The ambitious new agenda was, he reflects, “very inspiring and very entrepreneurial”, comprising projects such as Deutsche Bank’s new contextual banking and Asset-as-a-Service products.

He assumed responsibility for Breaking Wave too, best described as a “fintech inside Deutsche Bank” but governed as a software company, allowing engineers to build with the same freedom as a start-up. This, explains, Maley, gives it a unique risk framework, akin to a sandbox, making it possible to work in a laboratory environment without risking data privacy and compromising the regulatory requirements demanded of banks.

Growing securities services

Having delved back through more than two decades, we return to the current plan for the Bank’s Securities Services portfolio. “We will optimise what we have and make it as efficient as possible and develop our internal capabilities rather than paying other firms to do what we can do ourselves,” says Maley. The third element of growth will come from new products and services, something he talks about in more detail in the flow article Building a future custody model.2 Two front runners are:

- An emerging fixed income prime brokerage business (a joint venture with the Fixed Income team in the Investment Bank). Maley sees this as “a real growth accelerator in years to come”.

- Digital assets brought about through the emergence of Blockchain technology – the ongoing interest in distributed ledger technology prompted the decision that the anchor product for digital assets “needs to be custody”. Maley admits to being amused that “the advent of the next generation of financial services products will hinge on a new custody service that will work in parallel with securities services”.

It is not often that a securities services head also conceals a pit stop engineer and an amateur racing driver. As our coffee meeting draws to a close, it is clear what was the Ford Motor Company’s loss has clearly been Deutsch Bank’s gain as its renaissance gathers momentum – on 4 August the Bank's Counterparty Rating and Long-Term Deposit Rating was upgraded to A2 from A3, by Moody’s.3

Sources

1 See https://bit.ly/3jYXEBT at db.com

2 See Building a future custody model at flow.db.com

3 See https://bit.ly/3DZrrCd at db.com

Paul Maley

Head of Securities Services at Deutsche Bank

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

SECURITY SERVICES, TECHNOLOGY

Building a future custody model Building a future custody model

The investment landscape is embracing new technologies such as digital assets. Paul Maley, Head of Securities Services at Deutsche Bank, explains why the future of custody will require a co-existence of old and new technologies, how market structure for securities could change and the implications for clients

Securities services, Technology, Regulation

Post-trade’s quantum leap Post-trade’s quantum leap

New technologies and the roll out of various regulations are rapidly transforming the post-trade landscape. flow attended the Network Forum Virtual Annual Meeting and reports on how these themes are shaping the future custody model

TECHNOLOGY

Tomorrow’s technology today Tomorrow’s technology today

As organisations grow, so do their layers of legacy systems. In a world of instant payments and real-time treasury management, how can banks keep up? Clarissa Dann reports on how Deutsche Bank Corporate Bank is addressing this