July 2020

As organisations grow, so do their layers of legacy systems. In a world of instant payments and real-time treasury management, how can banks keep up? Clarissa Dann takes a closer look at how Deutsche Bank Corporate Bank is tackling migration to a more efficient architecture

Twenty years ago, Microsoft founder Bill Gates enshrined the concept of the digital nervous system uniting the systems and processes under one common infrastructure in Business@The Speed of Thought: Succeeding in the digital economy.1

While this occurred shortly after Gates famously declared “banking is necessary, banks are not”, his blueprint for integrating technology to energise customer/partner relationships, employees and process remains alive and well in the banking sector – along with banks themselves, including Deutsche Bank. Banks are not only needed, but are looked to as providers of essential and reliable infrastructure and business support – that reliability being highlighted during the Covid-19 pandemic as they partner with governments to implement fiscal support measures.

However, banks still have to innovate. “If we want to avoid becoming an easily replaceable provider in this area, we have to create platforms ourselves which are attractive to other providers as well,” said Deutsche Bank CEO Christian Sewing in his speech to shareholders in July 2019.2 He went on to announce a commitment to invest €13bn in technology before 2022 to accelerate the Bank’s progress in the age of cloud-computing and platform economies.

Technology in the front line

To operate at the heart of clients’ businesses demands that technology infrastructure is agile enough to deliver the services at the speed required, robust enough to cope with the volume and security, and future proofed so that legacy technology can be accommodated - rather than remain some sort of albatross.

As with any large organisation that has grown through acquisition, a build-up of disparate networks from the acquired companies can impede the efficiency of the enlarged company. Deutsche Bank would not be the only large financial institution housing legacy systems several decades old and needing to reengineer its IT strategy.

In a PwC paper, Financial Services technology 2020 and beyond: embracing disruption,3 it notes “Incumbents carry a huge burden of IT operating costs, stemming from layer upon layer of systems and code. They have bolted on a range of one-time regulatory fixes, fraud prevention, and cyber-security efforts, too. The ever-spreading cost base leaves less budget available for capital investment into new technology, driving a vicious cycle of increased operating costs. This is in clear contrast to the would-be disruptors, who typically have far lower operating costs, only buying what they need when they need it.”

Fintechs and platform giants have disrupted, by moving goalposts to uncomfortable new positions and changing the technology landscape in the process. Corporate and investment banks, noted the Boston Consulting Group (BCG), “ must become client centric, efficient, and agile, focusing on a select number of high-value areas and applying digital practices and integrated processes to work smarter and leaner”.4

In early October 2019, Deutsche Bank created a new Technology, Data and Innovation (TDI) division to get the technology transformation process underway by reducing administration overhead, taking further ownership of processes previously outsourced and building in-house engineering expertise. Bernd Leukert, who joined the Bank the previous month from enterprise resource planning (ERP) solution providers SAP as Chief Technology, Data and Innovation Officer and a Member of the Management Board, confirmed the new division would focus on five main initiatives:

- Agile teams;

- Engineering culture;

- Commitment to strategic initiatives;

- Investment in modernisation; and

- Simplification.

“Technology has proven to be the enabler for the performance and contribution of not only the Technology Data and Innovation team but the whole company, enabling the entire workforce to work from home at scale, deliver quality service, allowing it to have operational stability at a level beyond that achieved in 2019”, said Leukert during a recent global internal webcast on 11 May. He went on to point out that holding the Bank’s Virtual Annual General Meeting was a testament to that stability.5

“An important part of our technology strategy is to enable our people to securely meet clients at a time and place of their choice,” he adds. On 25 June 2020, Deutsche Bank announced that the Symphony Connect Solution now integrates WhatsApp into Deutsche Bank communication channels with clients.6 The move follows the introduction in November 2019 of the WeChat functionality, which means that more than three million users can now securely and safely communicate with Deutsche Bank employees, who are restricted in the platforms they can use as a result of regulatory requirements.

At Deutsche Bank Corporate Bank, an increasing move to real-time processing and the ramping up of customer demand for integrated systems and access to supporting data means that technology underpins the whole of this part of the Bank’s business.

As Vikram Dewan, its Chief Information Officer puts it, “The heart of our offering is technology and operations. This is very different from corporate finance and investment banking where dealmakers sell deals. We are selling banking as a service all running on technology.”

This article looks at the culture of resilient innovation and technology at the Corporate Bank and shares its journey towards Sewing’s 2022 vision of technology platform overhaul and infrastructure transformation.

“An important part of our technology strategy is to enable our people to securely meet clients at a time and place of their choice”

Teams of engineers

Corporate Bank Technology is in the privileged position of continuing a focused hiring campaign as it builds an engineering centric team. “We are half way through our target of filling 500 engineering roles,” said Dewan. Recruits join an expanding global team of engineers, now totalling 3,000 across more than 30 countries supporting the Cash Management, Securities Services, Trade Finance & Lending and Trust & Agency Services businesses. Growth is through vertically aligned teams, and as well as horizontal ones dedicated to cross-business needs such as client connectivity, surveillance and regulatory issues, infrastructure, and risk and control (see Figure 1)

| Team | Remit |

|---|---|

| Payments and Cheques | Supports the full range of payment types, clearing systems and client payment types from bulk low-value payments made by corporate clients, to 24x7 instant payments made by retail clients, to individual high-value payments made by financial institutions |

| Core Banking, FX4Cash and Client Statements | Has end to end an end-to-end responsibility for application development and management of the IT landscape that supports critical business cash products such as accounts, payments and foreign exchange |

| Liquidity Management | Makes it possible for clients to visualise and manage liquidity positions in real time, automate cash management via rule-based cash pooling solutions, and to invest excess cash through Deutsche Bank investment tools. This provides flexible cash account interest pricing, execution, and reporting services. |

| Client Connectivity | Developing the new unified Corporate Bank portal that all of the client-facing solutions will be delivered into. This team will also be delivering the next generation cash management functionality and customer self-service capabilities that will be available through the portal. Manages the API strategy and develops solutions for the Bank’s fintech customers. Responsible for the Corporate Bank messaging platforms, including the Bank-wide SWIFT messaging infrastructure |

| Surveillance & Regulatory | Delivers solutions that protects Deutsche Bank’s financial and reputational interests from criminal or inappropriate behaviour |

| Billing, Reference Data & Reporting | Delivers the Corporate Bank’s strategic billing solution as well as managing the billing applications across the Cash Management function. |

| Trade Finance & Lending | Enables clients to manage risks, cash and information flow associated with their global trade transactions. The technology teams cover documentary products, commercial lending, financial supply chain management, structured export and commodity trade finance |

| Securities Services | Develops applications providing local market connectivity, settlement, fund services and securities lending for financial services clients such as asset managers, broker-dealers and global custodians. This includes new single page application (SP) web applications, distributed ledger technology (DLT), real-time event processing and analytics |

| Trust & Agency Services (TAS) | Provides corporates, financial institutions, hedge funds and supranational agencies around the world with trustee, agency, escrow and related services. Offers advanced digital operations with the help of Artificial Intelligence tools |

| Production Services | Supports the business teams as well as the Corporate Bank’s own external clients and is responsible for application stability |

Figure 1: Corporate Bank Technology teams

The teams work with many open source tools such as stream-processing software platforms Apache Kafka and Flink, along with search and analytics tool ElasticSearch, and deploy Scala and Java programming languages. “There is a tremendous focus on big data platforms to develop new products and services for our clients,” adds Dewan.

The majority of the new joiners are hands-on coders, with many of the individuals coming from capital markets technology teams in other banks, bringing with them experience of working with real-time platforms (such as trading platforms) at a fast pace. Other key roles in the organisation include program managers, developers, testers and analysts.

“The heart of the Corporate Bank offering is technology and operations”

Culture of learning and innovation

As for the culture – it bears similarities to that of SAP, something flow encountered on a visit to its vast Walldorf headquarters near Mannheim in Germany in June 2019.7 We saw how creativity and trying new things was embedded in this company’s culture, along with its passion for continuous learning – and its people. Data scientists and technology experts need to be in an environment they can feel comfortable in – which is not always easy to get right in a highly regulated financial institution.

The Corporate Bank Technology team is moving away from silos built up through organic growth and acquisitions towards a culture where collaboration, innovation and speed of delivery are core goals. Getting this right for all of the 3,000 team members isn’t easy. There is a continual focus on fostering a team spirit – all the more important with so many working from home. Colleagues are actively encouraged to speak up and share feedback, as it is an opportunity to learn from each other and improve. Attending training courses, conferences and listening to tech talks is also essential to ensure that engineers keep updated on the latest technology trends. Their popular ‘CodeIt’ days, which gave colleagues the opportunity to innovate away from their day job, even inspired the recent tech-wide ‘Engineering Day’.

Partnership with the business is key to everything that Dewan’s team does. When the tender process with US West Coast cloud providers got underway,8 the dialogue between the Deutsche engineers in Dewan’s team and Paul Maley’s Business Development team was another source of learning. “It has been particularly inspiring to work alongside practitioners on cutting edge technology first-hand and instilling their way of working into how we drive our own business forward,” reflects Maley.

Failure is OK, else you would never try anything, but you learn from the failure and push on quickly – just look at vacuum cleaner innovator James Dyson’s 5,127 bag-free cyclone technology prototypes.9 Moving on quickly was a point made by Linda McLaughlin-Moore, Deutsche Bank’s Global Corporate Bank and Branches Operations Executive in flow’s ‘From the engine room’, where she says “it’s important, when building and running scenarios, she continues, to “fail fast, adjust and test again”.

Growth and innovation

Maley is one of Dewan’s key counterparts in the business. An engineer by background, although he has been with Deutsche Bank for more than 20 years, he took up the business development mantle in February 2020. His appointment is part of the Corporate Bank strategy to ensure the future development of the Bank has a cohesive focus. Like Dewan he sees the Corporate Bank as a “platform business”.

Both Dewan and Maley’s teams come together on particular projects, collaborating with the business leaders from our core products (for example Trade Finance or Cash Management) and other partners in the Risk departments such as Anti-Financial Crime and Credit to ensure that solutions meet clients’ needs.

Currently, the multi-disciplinary teams are working on six growth initiatives. “The focus is on projects with real impact – this is separate from research and experimentation, which we do by working closely with Deutsche Bank’s Innovation Labs”, Maley explains. He adds that his team are “building the digital tools that will help the Bank prepare for the post- Covid-19 economy”. “We began with 19 initiatives at the start of the year and shrank it down to six,” he recollects, using a decision-making process similar to that seen in television start-up shows like Dragons Den and Shark Tank. Each of the six has been allocated funding and a team of experts from Technology and the relevant business area that combine the project with their day job. Not all six can be guaranteed of success, but, says Maley “we have set up each project to succeed”. Maley’s aegis includes Breaking Wave, describing itself as "a fintech inside Deutsche Bank”. This comprises a team from a range of backgrounds including consultancy, start-ups and large multinationals. The team in Breaking Wave make it possible for several of the initiatives to become reality.

Two of the “Big bets” (as Corporate Bank Head Stefan Hoops often calls these growth initiatives), will begin delivering later this year so the Bank will see some tangible benefits before 2020 becomes history.

Strategy and architecture

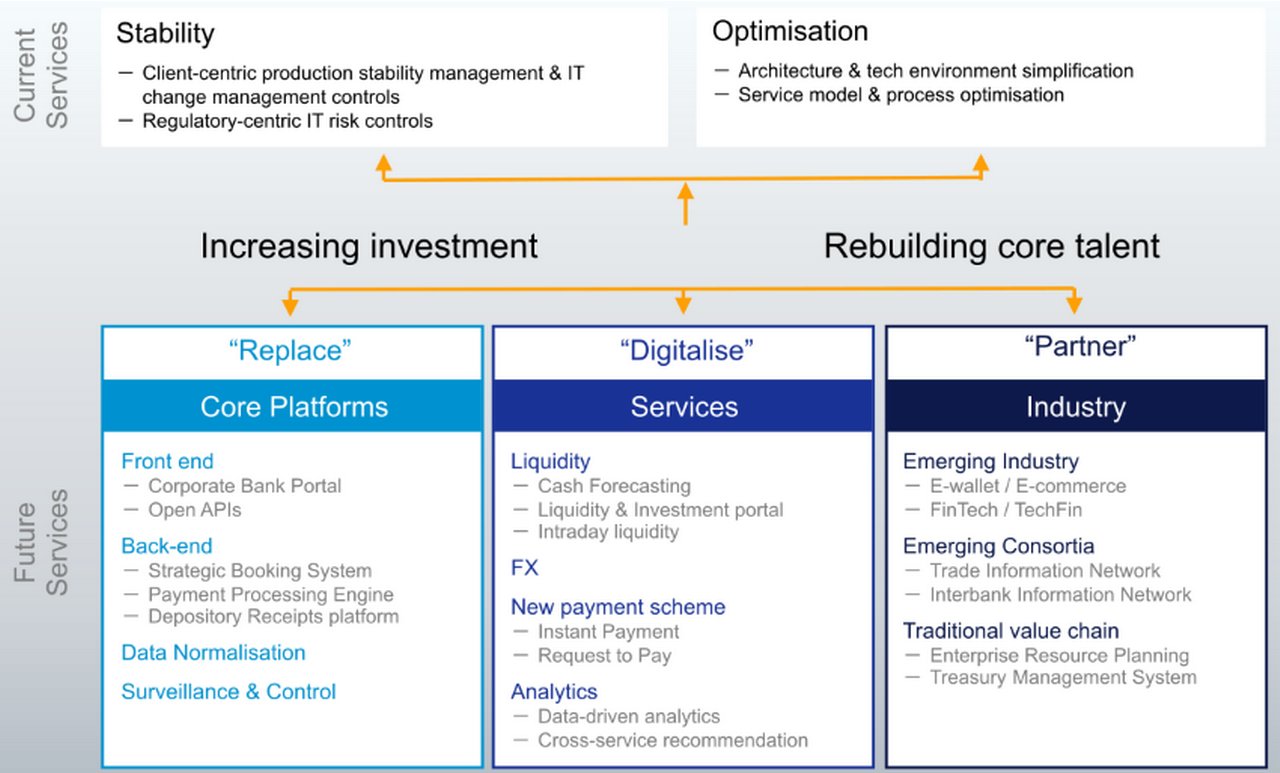

Figure 2: Corporate Bank Technology investment strategy

Increasing investment and rebuilding core talent for optimising current services and gearing towards digitalisation and new services for the future

Having joined Deutsche Bank in 2016 as CIO of Markets Regulatory Technology from UBS, where he was responsible for applications delivery for regulatory compliance in global markets, Dewan was well placed to ensure stability from current architecture, optimising what was already in place while building the platforms and applications needed for future services (see Figure 2). He outlined his action plan thus, “We have to make sure we are stable, that clients can operate, that we retain our own licence to operate, can meet our compliance obligations and reduce costs.” In other words Corporate Bank technology strategy covers not only fixing the foundational technology, but also improving the revenues in the short to medium term, such as those from payments, lending fees and FX services. It is ‘business-led’.

Dewan’s challenge has been to simplify the 550 applications that were developed or that came with acquisitions (such as Bankers Trust in 1998) so that the Bank moves from a vast range of country, entity or business-related “solutions” to a harmonious set of global channel applications. These need to meet two basic requirements:

- Connect Deutsche Bank with its clients and the banking network; and

- Facilitate on-demand deposit taking, billing and lending.

The ramping up of trusted and adopted standards to promote interoperability such as the ongoing adoption of ISO20022 and real time gross settlement systems such Target2 in Europe, or Fedwire in the USA has proved effective. It ensures the rails are in place for banks to retain their know-how and intellectual property when it comes to application architecture. Gone are the days of walled gardens and proprietary systems that cannot talk to each other as everyone is using an agreed network.

As the world’s largest euro clearer, the Bank’s scale, notes Dewan, “warrants us to have capacity, responsiveness and high performance systems to deliver for our clients and maintain market integrity”. He adds, “Building those solutions is unique and gives us a competitive edge as not many banks can come close. We don’t want to buy something off-the-shelf that allows another bank to compete with us, or develop something with a third party that can then be modified and re-sold to a competitor.”

This has meant moving away from third party providers and using in-house expertise to build out the architecture and carefully (with a lot of testing built in) phase the migration to newer platforms so that client services are not interrupted. Open platforms that can easily connect, plug and play with other systems in the Bank as well as external ones do not need to be built with open source technology, he explains.

Increasingly, clients expect insights from the data they generate as part of their banking relationship benefits. As BCG notes, “Corporate and investment banking customers are looking for their banking partners to act as trusted advisers who can provide tailored advice, reduce complexity, and smooth execution,” (see note 4), and this means being in a position to securely collect, store and interrogate their data. What does this mean for technology?

“It has been particularly inspiring to work alongside practitioners on cutting edge technology first hand”

APIs

In May 2018, Deutsche Bank acquired Mumbai-based Quantiguous Solutions, the rationale being the acceleration of Open Banking platform development and connecting corporate clients, fintechs and partner companies via application programming interfaces (APIs).

Quantiguous’ founder Akhilesh Kataria joined Dewan’s management team. “We have always believed that this is the foundation for a connected financial ecosystem,” said Kataria at the time and, two years on, he and the 21 experts that also joined Deutsche Bank have been busy building APIs to help the Bank’s clients access services in a more convenient and intuitive manner. “API is a principle we apply to any new builds we develop, so that our clients can select from a suite of channels when they want to interact with us,” says Dewan.

Working with clients

With major clients, whose technology touch points with the Bank are complex and numerous, dedicated experts are deployed to predict their needs, and make it possible to provide top tier services with transparent channels of communication. This principle of client/Bank technology experts working together is important when it comes to ensuring the technology does what it is meant to.

To ensure that everyone stays on top of performance requirements, a set of Key Performance Indicators (KPI) and the enhancement of analytics and metrics tools, make it possible to remind clients of services they are receiving and of their impact. The Corporate Bank technology team also works directly with individual clients on requested improvements that then benefit the product offering overall.

Outlook

Two years into the new role, Dewan has had his work cut out. In addition to the day job he also serves on the board of the American India Foundation (AIF) for Tri-State in the US and the board of Indian organic milk producer Snow Organics.

“I could not have asked for a better job,” he declares. “Running a business-aligned technology function where the business is very dependent on technology to drive revenue and profits is a great place to be.”

Dewan pays a special tribute to his burgeoning Corporate Bank Technology team and the businesses he works so closely with. “Having such a strong team that I can continue to build is another great place to be. We are changing from maintenance and general management to an engineering culture, which is giving us new assets we can deploy in new markets,” he concludes.

Bill Gates was wrong, banking is necessary − and so are banks. And they’ve raised their game.

Case study: Australia branch build-out

One example of how the Corporate Bank Technology team took the opportunity to build a platform from a new technology “stack” rather than working with an old legacy but proven platform (IDMS) has been the Australia branch build-out that launches in July 2020.

The project was, said Deutsche Bank Head of Corporate Bank Australia Peter Connor when addressing colleagues on an internal update webcast, “a missing piece of infrastructure”, given the number of well-known German corporates operating in the country. Instead of being routed by third party Australian banking partners, the Sydney branch of Deutsche Bank will offer current accounts, overdrafts, term accounts, payments and FX to corporate clients in Australia.

The advantage of a blank drawing board is the opportunity to build in value additions such as real-time processing, instant view on data/risk monitoring and 24/7 availability into the new architecture. It also makes it easier to roll this out again to create other new branches – Ireland, Luxembourg and parts of Eastern Europe are also to benefit from this. The elements of such a component micro-service orientated platform are:

- sDDA ( strategic Demand Deposit Account) as the kernel holding accounts and positions with a strategic new account opening process;

- FIRE (Flexible Interest Calculation Engine) as a micro service to calculate and post interest

- sLimit – a new strategic limit platform that strategically will replace all limit functionality globally and consolidates in one central system;

- Bafir/PLCM - a new payment engine processing low and high value payments with a central data store (PDS) to consumer payment data in AML and billing processes via Standard Data Protocols (SDP);

- sBilling – our strategic billing platform strategically integrated into the landscape by consuming data from PDS and sDDA; and

- DSM – the Bank’s Digital Service Manager to raise online service requests.

Sources

1 See https://bit.ly/38gfuIM at goodreads.com

2 See https://bit.ly/2Zt8WTw at db.com

3 See https://pwc.to/3g5AZ1M at pwc.com

4 See Reinventing Corporate Investment Banks, Boston Consulting Group, March 2020 at bcg.com

5 See https://bit.ly/2Vwd5VA at agm.db.com

6 See https://bit.ly/2YHUgR0 at db.com

7 See Heart of the enterprise at flow.db.com

8 See https://reut.rs/3dHI2fH at reuters.com

9 See https://bit.ly/2Vsnj9e at gizmodo.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

CASH MANAGEMENT, TECHNOLOGY

MultiSafepay and “Request to Pay”: open banking comes of age MultiSafepay and “Request to Pay”: open banking comes of age

The implementation of Europe’s second Payment Services Directive (PSD2) has unlocked a number of new open banking solutions, such as Request to Pay (RtP).

TECHNOLOGY, CASH MANAGEMENT

From the engine room From the engine room

Almost overnight, Deutsche Bank relocated more than 65.000 of its employees to working from home locations ahead of Covid-19 lockdown. flow reports on operational resilience and business continuity management

TECHNOLOGY

Blockchain and corporates: unleashing potential Blockchain and corporates: unleashing potential

Distributed ledger technology has moved from a concept to providing real benefits to industries ranging from insurance to diamonds, which were explored in a recent Deutsche Bank webinar