7 May 2025

US-based specialty materials and chemicals company Celanese is rebuilding its global liquidity structure. Treasury specialists Hugo Rivera and Peter Szucs tell flow’s Desirée Buchholz why virtual account solutions play a key role in this project – and what lessons they have learned from peers

MINUTES min read

From a small shed in a Swiss back yard to a glass skyscraper by the shore of Lake Carolyn in Dallas, Texas; from revolutionising motion picture film to producing materials used in the automotive, consumer electronics, medical, food and many more industries: that’s the story of Celanese Corporation in a nutshell.

Obviously, this summary does not do justice to the eventful past and impressive journey that the specialty materials and chemicals company – which today employs more than 11,000 people in 27 countries – has undergone since the early 20th century, when Swiss chemists Camille and Henri Dreyfus started producing cellulose acetate film in Basel.

During World War I, the brothers relocated from Switzerland to the UK to supervise construction of a factory producing cheaper fabric for airplane manufacturing, while in 1918 Camille Dreyfus went to New York, where he founded the predecessor of today’s Celanese Corporation. In 1987, control moved back to the ‘old continent’ with German company Hoechst AG acquiring Celanese Corporation. But only 12 years later, Celanese was spun off over the stock exchange again.

Acquired by private equity group Blackstone in 2004, Celanese was the subject of an initial public offering on the New York Stock Exchange in 2005, and the company developed into what it is today: a global leader in chemistry, producing specialty material solutions used across most major industries and consumer applications – including for example electric vehicles, battery energy storage, medical and consumer athletic, to name just a few.

Figure 1: Celanese Corporation: key facts

Rethinking the global liquidity structure

Mergers and acquisitions have always been formative for Celanese. For the past 10 years alone, the company lists 12 acquisitions on its website – out of which the November 2022 purchase of the mobility and materials (MM) business from DuPont proved the most challenging for the treasury function.

In retrospect, this acquisition can be described as a trigger moment for the treasury team to rethink its banking and account structure. “It was the right time for us to perform an in-depth review of our liquidity structure,” Hugo Rivera, Global Treasury Director, Celanese Corporation says. On the one hand, the treasury function had already established “a pretty mature setup”, building on payments and collections on behalf of (POBO and COBO) and, since 2009, direct Swift connectivity.

Moreover, following the migration to software provider SAP’s latest enterprise resource planning (ERP) system S/4HANA – which was completed in spring 2023 – the company ran on a single ERP system, which proved to be “a huge advantage”, he adds.

“One of our aims was to reduce the number of bank accounts to increase efficiency and lower costs”

The MM deal caused the number of bank accounts to jump to more than 700 in more than 20 currencies. “So, there was a need to introduce a more efficient liquidity structure to minimise the idle cash in the organisation,” says Rivera. This was why, in Q4 2023, the treasury team kicked off a cash management optimisation project with the following four goals:

- Reduce the number of cash management providers to two or three per region, out of which one had to serve a cross-regional cash pool from Asia through Europe, ending in the US (for USD).

- Reduce the number of bank accounts to increase efficiency and lower costs.

- Increase the number of companies and currencies in the cash pool to improve visibility and accessibility of cash worldwide.

- Introduce new technologies, to allow for process automation and reduce idle cash on non-pooling bank accounts.

Defining a new banking structure

The first step the treasury team took was to set up a Request for Proposal (RfP) to decide how to allocate its cash management business among fewer banks going forward. As part of this process, its relationship banks were invited to present their solutions for the cash management services Celanese uses – in particular POBO, COBO and Swift connectivity for incoming and outgoing communication.

“We also added some additional features such as the regional expansion of the cash pool and capabilities around application programming interfaces (APIs),” Peter Szucs, Director Treasury Europe, Celanese Corporation reveals. “Next to these quantitative measures, customer service and response time were also important as we had a tight deadline for implementation, i.e. five months from selection to the go live.”

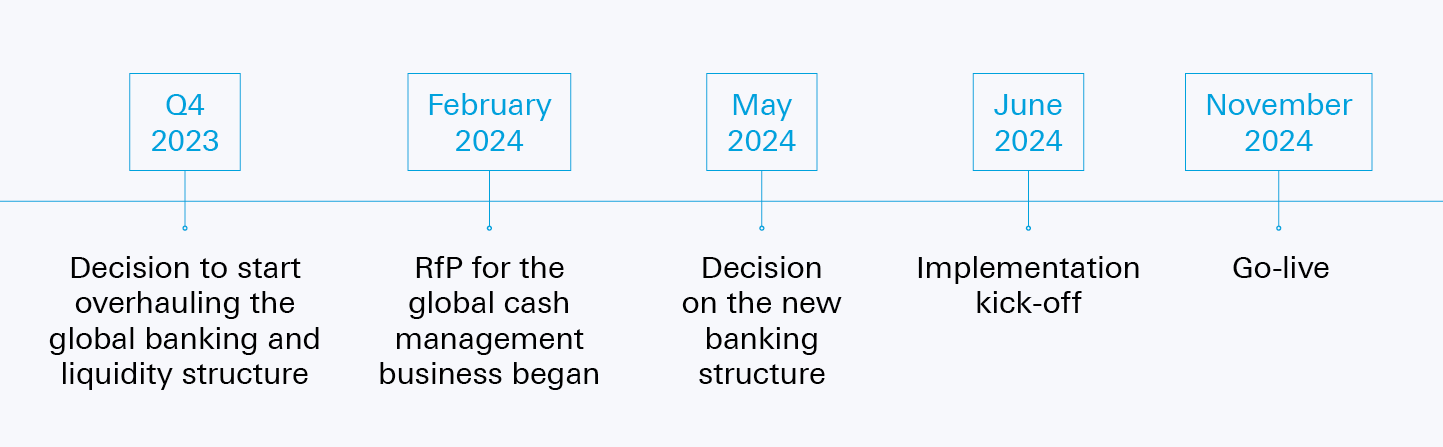

Figure 2: Chronology of the cash management optimisation project

Following the RfP, the Celanese treasury team chose Deutsche Bank as their main cash management provider for Europe – adding markets like the UK and Turkey, where the company had formerly worked with other banks. “Deutsche Bank has a strong presence in Europe, which is a great fit for Celanese,” explains Szucs. “The bank was able to cover all the various currencies and services in scope for Europe. Moreover, new features such as APIs and virtual account structures were also available in countries where we have a strong footprint.”

Role of virtual account solutions

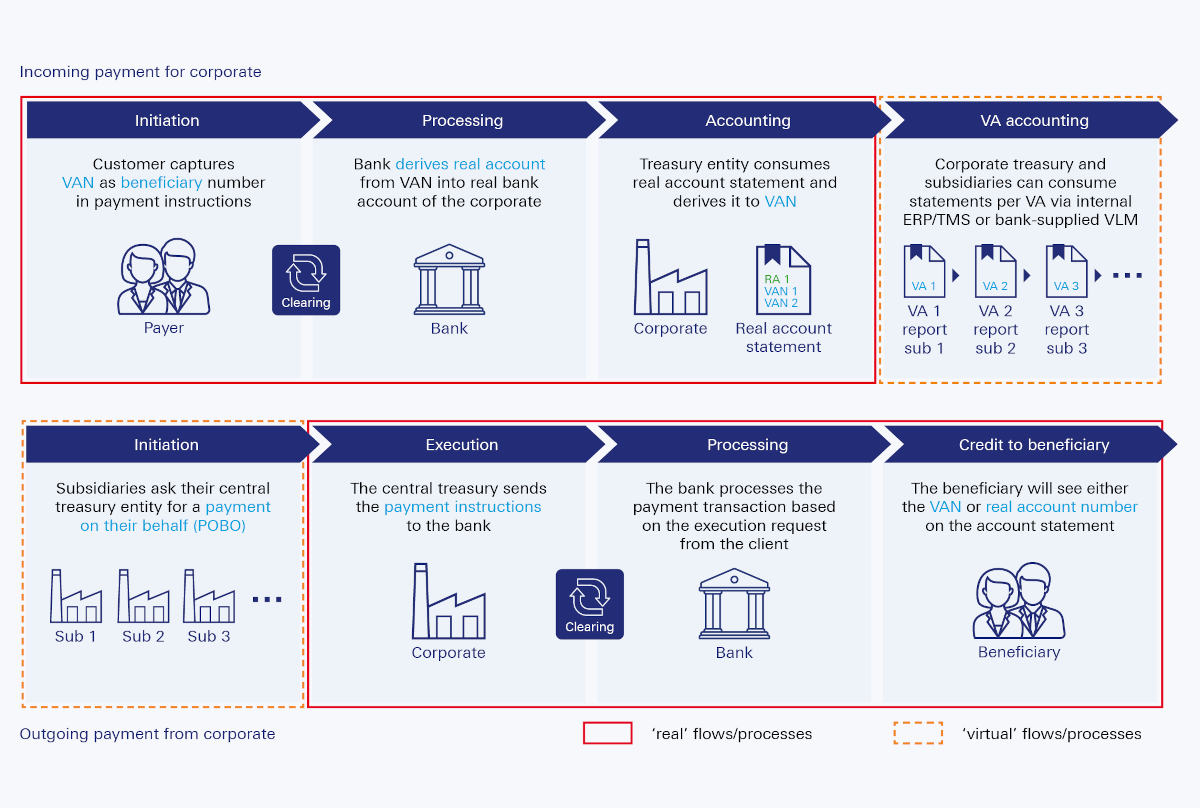

As outlined above, Celanese had been using ‘on behalf of’ structures for many years – which allowed the treasury department to decrease the number of accounts significantly. Yet over this period, the team realised that there were still some bank accounts that were only needed a couple of times a year. This is why it decided to leverage virtual account solutions in connection with its existing on behalf of structures (see Figure 3).

“Essentially, virtualisation of the bank account structure removes the need for physical accounts,” explains Paul Mirabelli, Deutsche Bank’s Head of Cash Sales for US Corporates. “Instead, it connects a theoretically unlimited number of unique aliases, or virtual account numbers, to a single (or more if required) traditional physical master bank account. So, when administrative changes need to be made to an account, like signer edits or account openings/closures, the process becomes much more efficient.”

Hence, virtualisation immediately improves cash centralisation and process efficiency – thereby helping with all the targets the Celanese treasury team aims to achieve with its cash management project. “Additionally, the maintenance costs of virtual account solutions are lower than with physical accounts as they don’t require the complete Know-Your-Customer check needed with real accounts,” adds Szucs.

Figure 3: Payment process with virtual account numbers

Source: Deutsche Bank

Learning from peers

Before the project kicked off, the company also considered a notional pool to concentrate its global liquidity. With notional pooling, a bank aggregates all participating bank balances into one virtual balance at the end of the day – but without actually moving cash. This allows for cross-currency pooling but has wide-ranging implications on the accounting and tax side.

In the end, the cross-currency aspect was not as important to Celanese. “Over the past few years, we have created efficient ways such as using natural hedges to minimise the cash balance of the 20+ currencies we are working with,” says Rivera. “If we don’t consider restricted or non-liquid currencies, we are using 13-plus currencies on a daily basis.” Because of this, “our on behalf of structure, virtual accounts and automation helped even more to decrease the overall number of bank accounts in the group structure.”

“It was important for us to understand whether beneficiaries had any issues when the peer paid or received funds from a virtual account, or received funds via a virtual account number”

As part of this evaluation and due diligence, the Celanese treasury team also had calls with peers “to get an independent opinion on services and features that banks can offer”, adds Szucs. “For example, in the case of virtual account solutions, we needed to understand whether beneficiaries (including authorities) had any issues when the peer paid or received funds via a virtual account number.”

His team also talked to fellow treasurers to understand the challenges and the change management associated with implementing virtual account solutions. “We also asked them about reconciliation, because it is important to see how accounting will reconcile the activities and if they are comfortable with the solution.”

Outlook: API and blockchain technology

So how far has the treasury team come with implementing its new targeted liquidity structure? The first step – revamping its banking landscape – was completed via a “big bang” approach in November 2024. “We had a six-month implementation period to open more than 150 bank accounts, enable Swift connectivity and perform testing of payments and bank statement processing to ensure a successful go live,” recalls Szucs.

In parallel, the team is currently rolling out virtual account solutions in three different currencies in three Celanese locations in Europe. “We can already see the quick wins, and our review has shown that about 10% of our bank accounts can be converted into virtual account numbers – with the opportunity to increase this further,” Rivera says. For example, in Europe it may be possible to reduce the number of accounts by approximately 50%.

Yet, implementing a structure that aligns with the company’s overall business goals and ensures an efficient deployment of cash, reducing set-up times and costs compared to physical accounts, is not a one-time exercise, he adds. As the company grows, technologies evolve and is important to stay at the vanguard. “We have put in place a transformation roadmap, where we have highlighted what steps will be taken when,” he says. Implementing API connectivity for real-time reporting and instant payments, and making use of blockchain technology, are just two items on the roadmap. In any case, the exciting ride for the Celanese treasury team will continue.