19 August 2024

Boehringer Ingelheim has grown into Germany’s biggest pharma company. flow’s Desirée Buchholz reports on how its treasury function supports business expansion by taking a deep-dive into an innovative workflow automation project in Asia-Pacific

MINUTES min read

It’s a bit tricky to find your way to the headquarters of Boehringer Ingelheim, located in the small German town of Ingelheim, around 50km west of Frankfurt. When entering the factory, you pass by excavators, trucks and temporary gravel roads. “Every other week, the traffic routing changes,” explains Eric Humbert, Head of Corporate Cash Management at Boehringer Ingelheim, when welcoming visitors at the entrance gate.

These construction sites are proof points of the company’s success: it is currently building a new chemical innovation plant which – starting in 2026 – will develop manufacturing processes for pharmaceutical ingredients and produce drugs for use in clinical trial phases. During the foundation stone ceremony for this €285m investment in May 2023, German Federal Chancellor Olaf Scholz praised the company’s innovation centre as “excellent news” for Germany and Europe and said it will “enhance their resilience by establishing local value chains for life-saving medications”.1

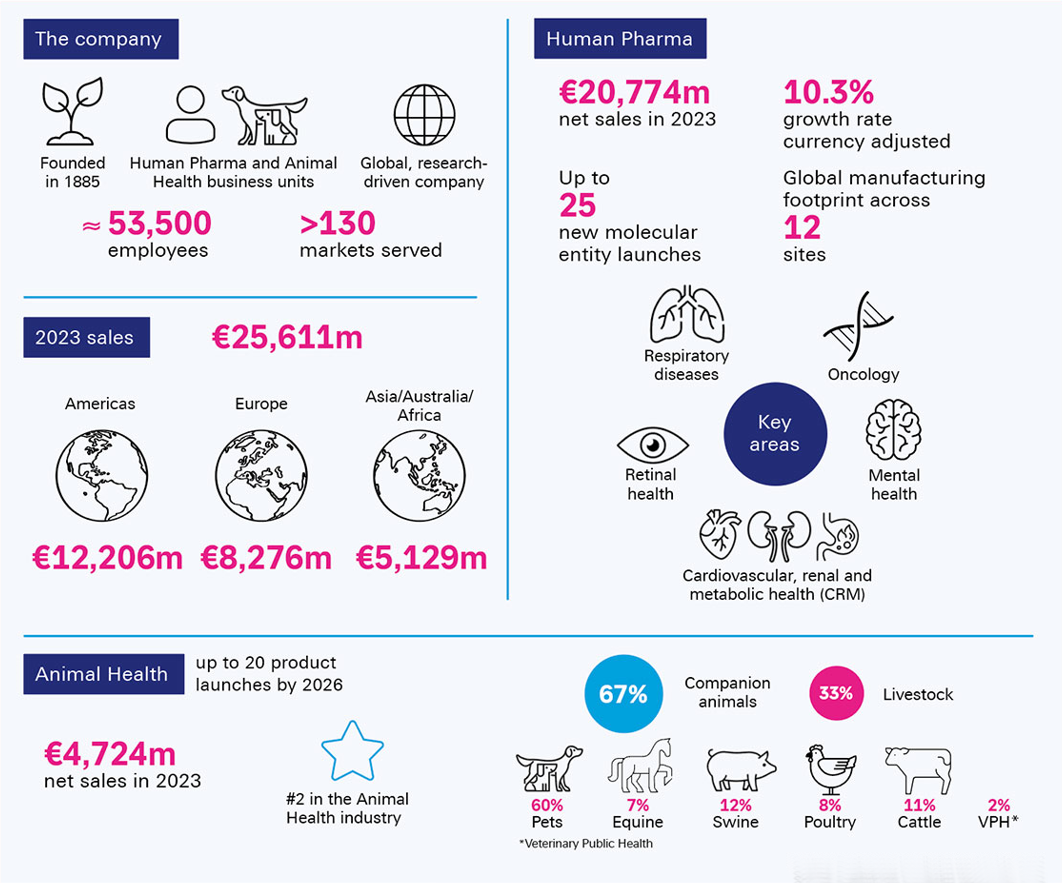

Indeed, with net sales of €25.6bn in 2023, Boehringer Ingelheim has grown into the country’s biggest pharma company – an evolution that founder Albert Boehringer most likely wouldn’t have dreamed of when he purchased a small chemical factory to produce tartaric acid for pharmacies in Ingelheim in 1885. Today, the company remains independent, but now develops treatments for cancer, diabetes and heart, lung, skin and eye diseases, as well as mental disorders such as schizophrenia and Alzheimer’s.

One-hundred and forty years after its founding, Boehringer ranks among the 20 largest pharma providers globally, employing 53,500 people and serving patients in 130 countries worldwide.

“140 years after its founding, Boehringer ranks among the 20 largest pharma providers globally”

And this journey is set to continue. To lay the foundation for future growth and take ‘Life forward’ (to use the company’s brand claim), Boehringer invested 25.1% of its net sales into Research & Development in 2023. By 2030, the company plans to launch 25 new treatments in its Human Pharma segment alone.

A transformative deal

While the company sticks to its roots, it has also undergone a transformation: in 2017, Boehringer acquired Merial, the animal health business of French pharma company Sanofi, and in exchange sold its consumer healthcare business to Sanofi – a business swap worth €23bn which catapulted Boehringer to be the world’s second largest provider for animal health. Vaccines, parasiticides and therapeutics for pets and livestock now account for 20% of the company’s revenue.

“We never had to onboard that many new entities at once,” recalls Humbert, now sitting in a conference room with his colleague Stefan Eckart, who is also responsible for Strategic Cash Management. “Given that Merial was fully integrated within Sanofi, it had no people, no processes and no systems in treasury.”

Following the “severe incision” of this M&A deal, Humbert and his colleagues decided to revamp the company’s cash management setup to be able to absorb new acquisitions more quickly in the future – and to support the ambitious business growth plans. “Nothing would be more painful than losing business due to inefficient processes in cash management,” he adds.

Figure 1: Facts and figures on Boehringer Ingelheim

Source: Boehringer Ingelheim worldwide, 2023

Building a future-proof treasury

Therefore, in 2019, the team from Corporate Cash Management and Global Business Services (GBS) kicked off a cash management transformation project to enhance process efficiency, cut costs and lower risks. The project – which is planned to be completed by mid-2025 – consists of three elements:

- Implementing a central entity to initiate and concentrate all financial flows.

- Modernising the existing in-house bank by streamlining the cash pool and introducing an accounting, payment and collection factory to automate and centralise intercompany flows.

- Harmonising the global payment IT landscape by implementing the payment platform of Treasury Intelligence Solutions (TIS).

To understand the challenges for Boehringer’s cash management, it is important to know that the production entities of the two divisions – Human Pharma and Animal Health – usually don’t sell drugs directly to customers, such as pharma wholesalers or veterinarians. Instead, they sell to the group’s local distribution entities who then trade with the customers. “This means that intercompany (IC) payments are extremely important for us as they represent almost the entire business volume,” explains Eckart.

“We are constantly looking for opportunities to bring efficiency into our processes”

In such highly regulated markets, these IC transactions required additional steps to normal processes in GBS with their regional shared service centres (SSCs). Under the new structure, the payment factory pays on behalf of most of the company’s international entities, which means that – once fully implemented – the central treasury team will have full control over the process and be independent of the bank account structure of the respective entities.

“The transformation of the in-house banking coupled with the introduction of TIS and the implementation of the payment and collection factory now provides the basis for a future-proof treasury,” adds Humbert. Currently, 95% of global payments are initiated via TIS; only Japan and Indonesia still need to be onboarded.

Automating workflows in APAC

Yet there is still room for improvement when it comes to process efficiency – and again, this circles back to the Merial transaction in 2017. To quickly take over administrative tasks from Sanofi, it helped that Boehringer had already planned to establish an SSC in Manila, Philippines. The centre now handles processes for the HR, finance and treasury divisions in the Asia-Pacific (APAC) region and parts of the Americas. However, as many processes were implemented on an ‘as is’ basis, Humbert said the company is “constantly looking for new opportunities to bring efficiency into our processes”.

The pressure to do so is particularly high in regulated markets in APAC, where capital controls, central bank approvals and tax considerations complicate cross-border intercompany payments and liquidity management. In the past, it took Boehringer several steps to get an IC payment from countries with non-convertible currencies to its headquarters in Germany, including collecting, aligning and submitting supporting paper-based documents to the bank (e.g. invoices). “This is why we were looking for an end-to-end automated solution which frees up time for our local treasury team to work on more value-adding projects,” Humbert says.

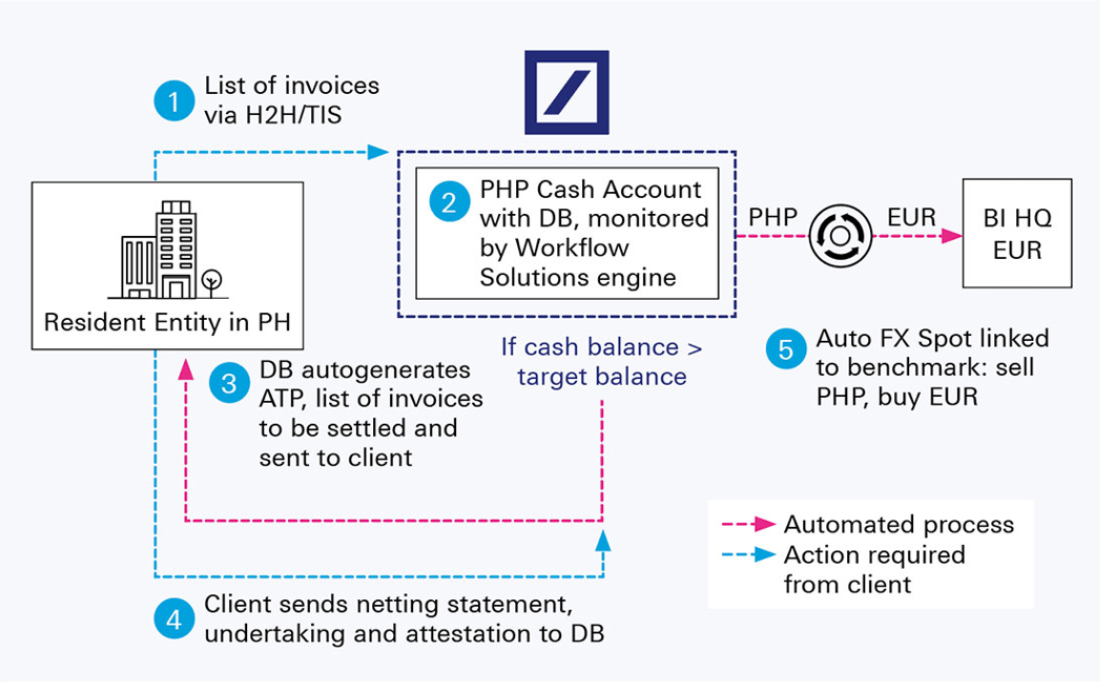

This is where Deutsche Bank came into play and suggested an innovative workflow solution which allows for automated intercompany payments based on target balance and automated FX conversions (see Figure 2). “Through our decadeslong relationship with Boehringer we have developed a good understanding of the company structure and processes,” explains Uta Dewitz, Head of Corporate Coverage Central Germany at Deutsche Bank. “Following several discussions and in-person meetings in Ingelheim, where the Boehringer team explained its pain points to us in whiteboard sessions, we came up with a solution that is now tailored to the company’s needs.” She adds, “This also required close collaboration between local and regional Boehringer and Deutsche Bank teams. Generally, our goal is to support our clients’ financial security and lasting success at home and abroad.”

Figure 2: Detailed workflow description (example based on the Philippines)

Under the new approach, Boehringer only needs to send a file with the details of invoices to be settled to Deutsche Bank, which will then take care of all the remaining steps in the background. Today, Boehringer conducts cross-border intercompany payments only once a month because of the regulation in these markets, particularly in adhering to all regulatory requirements. Going forward, this solution allows for more frequent settlements to optimise group-wide liquidity management.

“The solution reduced the process for IC cross-border payments to just one step and replaces a paper-based process with a digital solution,” explains Eckart. To enable automation, Boehringer negotiated fixed margins on third-party benchmark rates used for the FX deals. “We decided that the efficiency we gain by automating the process trumps the best execution policy for non-convertible currencies – which would have required us to bid out the hedges,” he continues.

Moreover, the team also assigned certain bank accounts to which the money can be transferred – thereby removing the step of payments approval and reducing the risk of payment diversion due to human error.

Going forward, Boehringer plans to do this via the TIS platform to further increase security. This goes hand-in-hand with the treasury team switching off local bank portals and handling all bank communication out of TIS via a central connection, i.e. the Electronic Banking Internet Communication Standard (EBICS), Host-to-Host or – if neither of these two is available – via Swift.

“Deutsche Bank has been a trusted partner for us for more than 70 years – supporting us as a core bank in more than 20 countries across Europe and Asia-Pacific,” says Eric Humbert, Head of Corporate Cash Management at Boehringer Ingelheim. “The provision of innovative and intelligent solutions is a key differentiator when we choose our banking partners – and Deutsche Bank really delivered a state-of-the-art solution that helps us to better manage payments in APAC.”

“Solutions such as the one we have delivered for Boehringer are designed for scale, enabling clients to replicate across their country footprint, supporting rapid digital transformation of treasury processes with zero additional client tech spend,” adds David Cooper, Head of Workflow Solutions, APAC at Deutsche Bank.

Looking ahead

As of August 2024, when this magazine went to press, the solution was already rolled out in South Korea and the Philippines – with Vietnam, Malaysia, Indonesia and Taiwan set to follow within the next couple of months. “We started in countries with non-convertible currencies, as those are most complicated, but we are keen to broaden the perspective to other countries in APAC, for example China, or South America as well to reap further efficiency gains,” says Humbert. Adding to the benefits mentioned above – higher efficiency, better security and more control by central treasury and GBS – another advantage was that the solution did not require any technical implementation work by the Boehringer treasury team. “Apart from explaining our existing processes and negotiating the contract, there were no tasks to be done on our side,” says Humbert. “On the contrary, the time freed up by the automation allows our colleagues to spend more time on other treasury optimisation projects.”

“Deutsche Bank really delivered a state-of-the-art solution that helps us to better manage payments in APAC”

And Boehringer’s treasury roadmap is packed. Apart from completing the roll-out of the workflow solution in several APAC countries, the treasury team also needs to complete the roll-out of its new in-house bank – including the payment factory – for all national entities. Moreover, it plans to reorganise its cash management in China and further leverage the benefits of the TIS platform, by using fraud prevention tools (for master data changes and transactional checks), an advanced and deeper sanction screening and the roll-out of an automised bank fee analyser and eBAM (electronic bank account management) functions.

Strategy for growth

In the longer term – and on a more strategic note – the Boehringer treasury is also working on projects which will directly support future business growth. Among others, the team is looking into supplier and client requirements: “As we are growing faster than the market, we need to support our suppliers and customers. Therefore supplier financing and e-commerce may be a future topic,” explains Humbert.

As Boehringer is moving ‘Life forward’ through medical innovation, treasury needs to embrace technical innovation to enable business growth. Treasury forward – that’s what Humbert, Eckart and their colleagues from GBS are working on, together with strong partners like Deutsche Bank.

Boehringer Ingelheim headquarters, Ingelheim

All photography © Boehringer Ingelheim