22 July 2024

The vision of a “real-time treasury” has been around for several years now. But how do instant payments and access to real-time information really change the way treasury is managed? flow’s Desirée Buchholz hosts a debate on the role of real-time in the future of treasury

MINUTES min read

Participants

Can Balcioglu, Vice President, Global Treasurer, PayPal

Jörg B. Bermüller, Head of Cash and Risk Management, Merck KGaA

Christof Hofmann, Global Head of Corporate Cash Management, Deutsche Bank

Parvathy Ramachandran, Co-Head Workflow Solutions EMEA, Head Cash Management Sales UKI, Nordics, CEEMEA, Deutsche Bank

We are living in difficult times: There are wars in Ukraine and the Middle East, geopolitical tensions between the US and China and economic slowdown in big markets like Germany. But what does that mean for you as corporate treasurers?

Can: From my point of view, uncertainty impacts corporate treasurers in three ways. Firstly, we as treasurers need to ensure that critical processes around cash and liquidity management, FX and regulatory compliance can take place without interruption in a crisis situation. Business continuity plans and cross-training of staff must be in place before a crisis occurs.

Secondly, treasurers need to invest in the right people, processes and systems so that they can understand and monitor exposures around market, counterparty and liquidity risks in times of stress. Taking the latter as an example, this means 100% real-time cash visibility and a strong scenario analysis and stress testing framework, in addition to a set of tools including credit lines and repo access to be able to source liquidity quickly when needed.

And lastly, the volatile environment requires a heightened focus on risk management. At PayPal, we invested heavily in our counterparty risk management framework last year and brought the duration of our investment portfolio down significantly to reduce interest rate risk. So, in volatile times like these, we believe it’s important to maintain a conservative posture and a strong balance sheet.

Jörg: To add to Can, I would frame the tasks as ‘business as usual’. If you have presence in 70 countries and sell your goods to almost the whole of the rest of the world, as Merck does, there is always a crisis somewhere. Today it’s Ukraine/Russia, tomorrow it could be China; or it’s hyperinflation in Argentina and Turkey – not to mention political conflicts in some parts of Africa. So yes, unfortunately there are multiple crises, but it’s our job to deal with a changing environment.

Setting up robust processes is a prerequisite to being prepared for the unexpected. At the same time, our set-up needs to be flexible – especially when it comes to unexpected market distortions for financing and payment methods. Flexibility and adaptability need to be part of a treasurer’s DNA.

Apart from flexibility, what are other elements that could support corporate treasurers to do their jobs? Do you believe that accessing treasury-relevant data in real-time is helpful – to then react quickly to changing conditions?

Christof: Merck and PayPal have two very advanced treasury set-ups. What Jörg and Can talk about is probably not the level every company is operating at. Many companies still need to get the foundation right before thinking about real-time. This means achieving centralisation and automation: setting up an effective in-house bank structure, leveraging virtual accounts to reduce the number of physical bank accounts and so on.

Centralisation not only caters for efficiency and cost reduction, but it also enhances control: the more centralised you are in your set-up, the more you are in control of your cash – which in turn helps you to deal with a crisis. In addition, you need to ensure automation. Most treasury departments are very lean, which means it’s essential to focus the resources you have on the most critical risks and automate others.

“Real-time treasury means having access to the right information at the right time to take decisions quickly”

Let’s talk definitions. The vision of a “real-time treasury” has been around for several years now. In Europe, it appeared with the introduction of SEPA instant payments in 2018, which made it possible to transfer money from one bank account to another 24/7 with finality of payment in less than 10 seconds. Obviously, the term has evolved since then, so what’s your view on this buzzword now?

Christof: For me, real-time treasury means having access to the right information at the right time to take decisions quickly. It is not necessarily about instant payments, which are only critical for some companies, depending on their business model. In essence, real-time treasury means moving away from end of day/MT940-based processes to a more intraday management of cash and risk. That’s clearly a trend we are seeing.

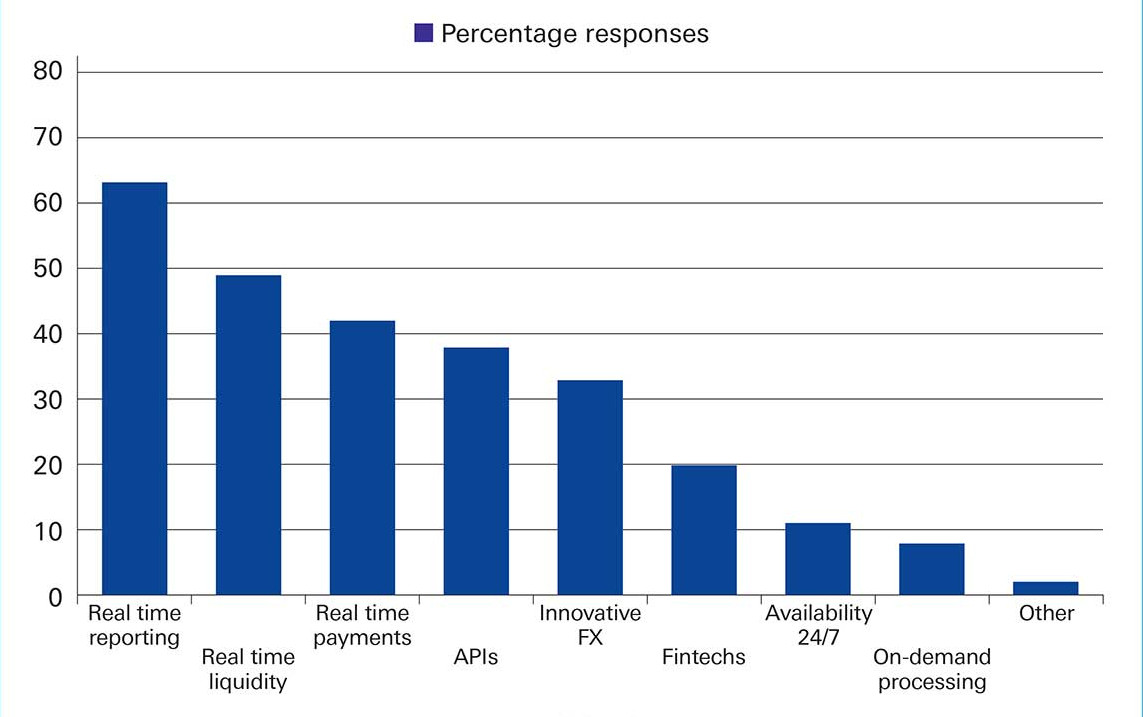

Parvathy: With volatility, uncertainty, complexity and ambiguity (VUCA) the need for speed is increasing across corporates (see Figure 1). Many companies, however, face the challenge of processing the information they receive in real-time. To do so, your enterprise resource planning (ERP) and treasury management systems (TMS) must consume the information instantaneously, and you must have the processes in place to make decisions on funding, hedging or investing quickly based on this information.

Figure 1: Of the greatest interest to Treasury over the next 12 to 24 months

Source: EACT Treasury Survey

Fast and convenient payments sit at the heart of PayPal’s business model. What does that mean for the treasury function? And how are instant payments changing the equation?

Can: As payment transactions are moving to 24/7 and 365 days a year, our liquidity management practices need to change accordingly. Our business model requires receiving payments from our banking or processing partners, and then settling with our customers. Therefore, the difference in settlement timelines of inflows and outflows is a key factor that drives our liquidity management.

Instant payments change this equation meaningfully. As they become more prevalent globally, we don’t need to accommodate the traditional constraints of the legacy financial infrastructure, where banks process payments in blocks and only during workdays. However, in practice, we are still seeing those constraints today, and this impacts our work in treasury.

As an example, we see our customers requesting more real-time access to their funds – which increases our liquidity outflows. So, to the extent that there is no corresponding change in settlement timelines for inflows into our platform, our liquidity needs may actually increase.

“Instant payments change our liquidity management equation meaningfully”

How do you ensure there is sufficient liquidity on the accounts to enable real-time payouts to your customers?

Can: At corporate treasury, we need to evaluate and design new processes to ensure our accounts are always funded properly. The first step for us was to implement changes in our liquidity forecasting models to ensure we account for the increased velocity of real-time payments. Secondly, as we connect with domestic instant payment rails, we may in some cases need to pre-fund the bank accounts enabling payouts. Thirdly, we are working with our banking partners to ensure that the accounts used for instant payments get access to appropriate credit lines.

On the back of what you just described: what’s your view on guidelines like the G20 Roadmap, which aims to speed up cross-border payments?

Can: The G20 roadmap on cross-border payments sets targets, but it doesn’t describe how to get there. There are a number of different models evolving. For example, I am currently based in Singapore and there is bilateral instant payment connectivity between Singapore and Thailand and India. Apart from these bilateral agreements, there is a project driven by the Bank for International Settlements (BIS) to create a single platform for clearing and settling cross-border transactions. It’s good to see that the will is there to make cross-border payments faster, easier and cheaper - but it’s hard to say yet which model will become ubiquitous.

"Getting any faster than 15 minutes wouldn't be a game-changer for us"

Jörg, as a science company operating across healthcare, life science and electronics, Merck has a very different business model to PayPal. You manage a highly centralised treasury set-up, and you have received several awards for implementing automated, straight-through processes. What role do real-time applications play for you?

Jörg: If we look at real-time payments, those are hardly relevant for us as a B2B (business-to-business) company. We have payment terms of 60 to 90 days, so it’s not necessary to pay within seconds. For us, real-time payments may play a role for certain type of transactions such as M&A deals, royalty or tax payments.

Christof: That’s what we hear from many clients in B2B industries. Let me add another use case where real-time payments could become interesting: to avoid the early cut-off times of most ACH (automated clearing house) systems. Instant payments allow treasury to pay later in the day, move liquidity quicker and reduce the effort for short-term forecasting. But that clearly requires the amount threshold to exceed what we typically have in instant payment schemes at the moment. In Europe, for example, the threshold is still at €100,000 for SEPA (Single Euro Payments Area) instant payments. This is why we offer instant payments between our branches for up to €250m, to help clients avoid the early cut-off times.

Jörg: That’s a very valid point. Based on intraday bank statement files such as MT942 and the respective camt. formats, we already withdraw liquidity in some Asian markets prior to day-end to ensure efficient and centralised liquidity management.

For me, real-time treasury is all about transparency and having access to the data whenever it’s needed. Some treasury processes should be managed in close to real-time, in particular FX or interest rate risk. The problem, however, is what Parvathy has pointed out: a real-time solution provided by banks or market infrastructures doesn’t help if your ERP only has a night batch run. It’s nice to have a Formula 1 engine, but if your car has the wheels of a Beetle, you can’t achieve the speed.

In Q1 2014, only 17.34% of all SEPA credit transfers were conducted instantaneously

"Increasingly, we hear that dealing with trapped cash is a key priority for treasurers"

Let’s come back to real-time. Can, you mentioned that PayPal is changing its processes to improve cashflow forecasting. Can you share a few more insights on what you are doing exactly?

Can: Sure, this is a project we undertook to improve our short-term cash positioning on bank accounts that hold our customer cash. The legacy process was based on using historical cash inflow and outflow data to drive our forecast. We saw an opportunity to use customer activity data to inform our cashflow forecast. Therefore, we set up a team of treasury, product and engineering specialists to build a new forecasting tool which essentially uses data from our payment files as the primary input to our forecasting process.

The team built a proof-of-concept which showed that the new process improves forecasting accuracy from around 85% to 98%. This will help us to reduce liquidity buffers; in addition, we’ll be able to better manage risk, as the new methodology allows us to detect any settlement delays from our processing or banking partners on a more real-time basis. We are now rolling out this new tool to cover most of our bank accounts.

Parvathy: There is a lot of buzz around artificial intelligence (AI) in forecasting these days. Did you leverage AI as well for this new tool?

Can: Our engineering team built the forecasting methodology using certain AI techniques. The term ‘AI’ is used pretty freely these days, but if we are speaking about machine learning, which essentially means using statistical techniques to analyse structured data, we at PayPal have been doing that for a long time - for example, when it comes to fraud detection in our payments platform. This institutional knowledge helped us here as well.

We have heard where real-time information could be of value, and we have talked about legacy systems and lean treasury teams holding treasury back to make use of these opportunities. What does that mean for us as a bank?

Parvathy: Treasury tech budgets are always a constraint, so we see a lot of clients facing the challenge to create an internal business case to embark on those transformational journeys – especially if you have a very complex treasury infrastructure. That’s where we try to support our clients by offering technology solutions which reduce the investment required on the corporate side. For example, we enable our clients to automate FX, payment and liquidity workflows in complex markets, or we offer technologies such as virtual ledgers to handle virtual accounts and implement an in-house bank.

Christof: We also work with the traditional ERP and TMS providers, asking them to integrate APIs (application programming interfaces) into their standard set-up as much as possible to ensure it’s not a bespoke, and therefore more costly and time-consuming, set-up for the individual company. We want to offer APIs as a standardised connectivity option to get access to real-time bank account information and instant payments.

Can, Jörg: What’s your take on API-led connectivity?

Can: At the moment we are primarily receiving end of day statements via MT-based Swift messages. We are now evaluating if and how a significant shift to receiving intraday statements to our TMS or moving to API-based bank connectivity would provide tangible benefits for us. We need to weigh these potential benefits against costs and effort, as changing our current construct and infrastructure would require some upfront work.

Jörg: We are constantly monitoring the progress, but we wouldn’t use APIs to replace solid and robust processes, and rather look at them for add-ons to our set-up. These could be applications that increase transparency and mitigate risks with respect to bank account management. However, for us it’s always important to have an agnostic approach to bank connectivity and to roll out new applications to 400 entities in 70 countries.

What are use cases where API-led connectivity could provide benefits?

Christof: Companies will not replace Swift or any other banking connectivity channel to move to APIs in the near future. It’s established and it works. But we see the use of APIs in treasury when it comes to getting additional information in real-time, as Jörg has mentioned. For example, this can be the case in account pre-validation. Using API connectivity means you don’t need to log-in to a particular portal to check whether the account holder and IBAN match, but this pre-validation can be embedded into your payment processes.

Parvathy: Moreover, there are specific use cases in certain industries. Insurers, for example, want to do claim settlements instantaneously. In e-commerce, companies want to initiate refunds immediately. Here it is worthwhile to invest in API technology.

e-commerce is a good keyword. We have talked a lot about real-time from a treasury perspective and less from a consumer’s point of view, which becomes relevant when a company sells online. Jörg, what role does e-commerce play for Merck and how do you look at it from a treasury perspective?

Jörg: Our webshop business is becoming more and more important. It’s still a small part of our business, but it’s growing. When we in treasury first looked at it two years ago, we found that most of the cashflows are paid via invoice followed by credit card. These payment methods are process-efficient and automated. Therefore, I don’t have a problem with it. We don’t offer PayPal or AliPay and, so far, there is no need for us to implement such alternative payment methods as we are selling to businesses which have not yet asked for a change.

So, are you leaving the decisions of which methods to offer up to the business, or are you trying to get treasury involved to make sure your requirements are being considered?

Jörg: We consider ourselves a business enabler. So, if a business needs a specific payment method or payment term to grow sales, we will assist in introducing it. For sure, all processes for executing and receiving payments need to be handled efficiently. But this can be done in a second step.

As e-commerce is PayPal’s home turf, but you also understand the specific needs of a treasurer, what would be your advice to fellow treasurers when it comes to supporting the implementation of e-commerce business models?

Can: There are several aspects to be considered, dependent on the business model, but I would like to point out just three. First, you need proper system integration to ensure a seamless customer journey and efficient internal processes. This becomes all the more important as customers are increasingly switching between shopping channels, i.e. starting a purchase in a retail store and then finalising it online, or the other way around. Second, as you expand internationally you need to deal with FX risks and remain compliant with local regulations such as data privacy. Finally, you need to think about how you manage potential losses and fraud as you deal with a higher volume of smaller transactions. To manage through all these challenges, I would recommend that treasurers work with a reputable Payment Processing Partner who can provide a stable, secure, and scalable platform that is able support growth across multiple channels and geographies.

Let’s look ahead: how will treasury be managed differently in five to ten years?

Can: Payment rails have been static for a very long period of time. But this is changing now with the rise of instant payments schemes, cryptocurrencies and stablecoins (for which we have our own offering with PayPal USD). I believe that the dynamic we see in this space will accelerate even more. There are a lot of unknowns, but it’s for sure that things will look quite different in five to ten years.

Jörg: It will be the same but different. I have been in treasury for several years now and it’s always about liquidity, risk and transparency. What will be different in five to ten years are the tools, the technology and maybe the partners you are working with – maybe there will be more fintechs. That’s what I am telling my people: It will be same but different.

Christof: There will never be a revolution in treasury, only an evolution. Stability is key when you are managing risks, but the outside world changes. I believe that in five to ten years, ACH systems in selected markets will start to be decommissioned and only instant payments will be available. Moreover, new technology will have emerged, APIs will be a standard integration in treasury and certain elements of AI will have found their way in, allowing for more automation. But, in the end, different treasury departments will be at different maturity levels, just as they are today.