10 June 2024

As expectations grow for faster and cheaper cross-border payments, banks and corporates have their work cut out to meet demand. Deutsche Bank’s Marc Recker looks at how the G20 Roadmap contributes to these goals – and what its shortcomings are

MINUTES min read

The cross-border payments space is at an inflection point, as changing client needs adjust priorities for the industry. At the front end, the driving force is remarkably simple: retail customers, consciously or not, are demanding more from the companies they transact with and from the institutions they bank with. This was first evident in the domestic payments space, where new, increasingly real-time-enabled business models, combined with a growing e-commerce market, necessitated the introduction of faster and more convenient payment methods.

A similar trend has extended to the cross-border payments space – with transparency, speed, security and lower costs the goals. Take a typical German consumer: when purchasing goods or paying for services in another European nation, they do not want to pay additional fees or endure lengthy payment delays. Instead, they expect their cross-border experience to be in line with what they experience in their domestic transactions. For them, consistency is a no-brainer and is fast becoming a “must have”.

“The G20 Roadmap is often viewed as a much-needed guiding light for the industry”

At the back end, meeting these needs presents challenges, including misaligned payment messaging standards and divergent regulations between jurisdictions. Add to this equation the absence of any silver bullet solution to address the challenges and you arrive at today’s cross-border payment situation, where the question on everyone’s lips is the same: where do we go from here?

The road to the G20 Roadmap

Getting a payment from A to B in a domestic setting is facilitated by the fact that the payment is, for the most part, governed by the same regulations and requirements end to end. By comparison, cross-border payments must contend with complex jurisdictional regulations and differing compliance burdens. The goalposts change as the payment moves from country to country, adding unwanted complexity to the transaction. This is further compounded by fragmented standards and differing levels of data granularity, as well as diverse payment systems that lack technological alignment or standardised protocols.

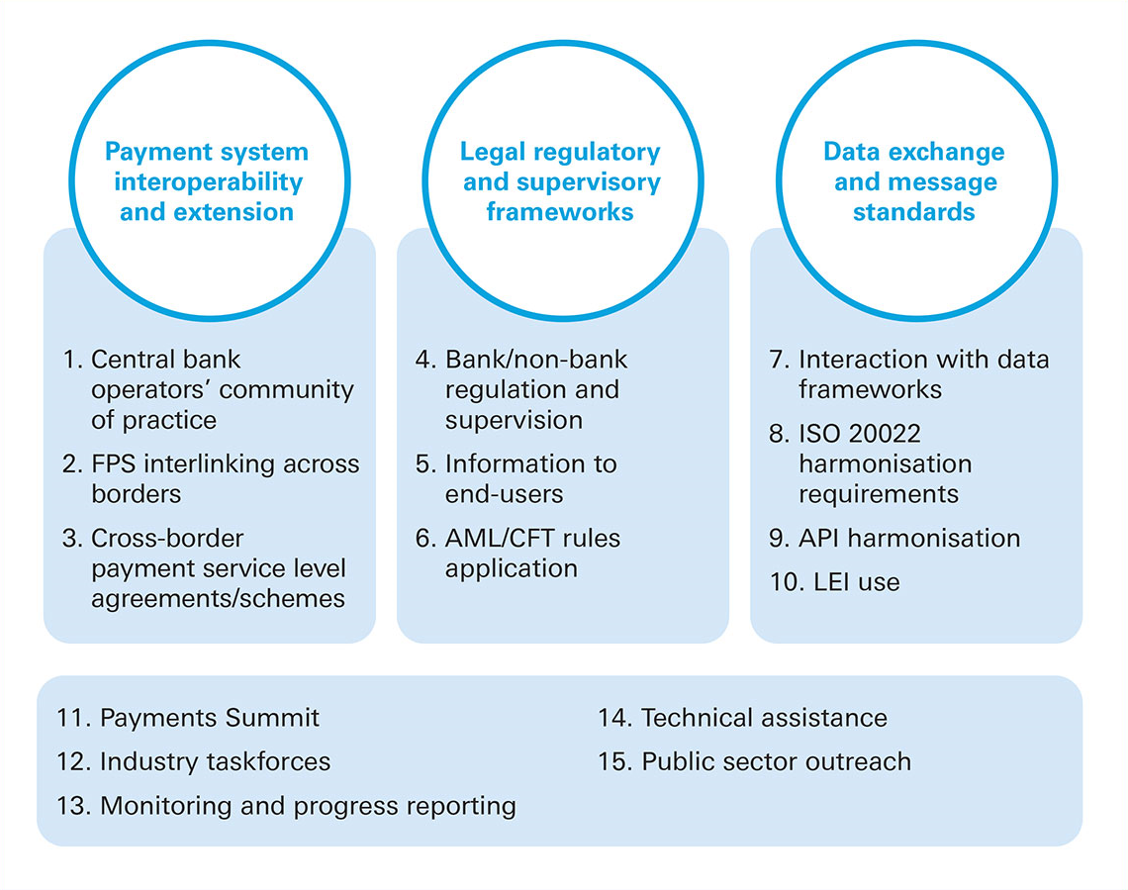

In 2020, seeking to modernise the payments infrastructure by addressing these challenges, G20 members endorsed the Roadmap for Enhancing Cross-border Payments (the Roadmap), which sets quantitative targets to lower costs and increase the speed, accessibility and transparency of international payments by the end of 2027.1 These goals have been organised under three priority themes: payment system interoperability and extension; legal, regulatory and supervisory frameworks; and data exchange message standards (see Figure 1).

Figure 1: Priority themes of the G20 roadmap

As banks look to navigate the various initiatives at play, the Roadmap is often viewed as a much-needed guiding light for the industry. Yet, while the Roadmap is a step in the right direction, there will be no “big bang”, transformative moment for the industry in 2027. Ultimately, what it has achieved so far is to organise a series of disparate cross-border payment initiatives under a distinct set of goals – making it, in theory, easier for the industry to sing from the same hymn sheet.

Under the hood

Under the umbrella of the G20 Roadmap, there has already been major progress. The ISO 20022 migration is under way around the world. Introducing this common, interoperable standard for payment message exchange means that interoperability can be achieved regardless of jurisdiction. This will, in turn, help to lay the foundation for further efficiencies and improved client service.2

In tandem, efforts are under way to create service level agreements that foster greater transparency in international payments. Two industry initiatives, led by Swift and supported by banks, are having a transformative effect in creating fast, predictable, cost-effective and secure cross-border payments – namely, Swift GPI (Global Payment Initiative), which provides end-to-end tracking for high-value cross-border payments3, and Swift Go, a comparable service focused on lower-value payments.4

“The goals of the G20 Roadmap are not yet backed by regulatory or legal mandates”

Efforts are also being made to interlink domestic payment systems to enable instant cross-border flows. So far, such schemes have found success in Singapore, India and other countries across South-East Asia5, where connections have been established to solve specific cross-border instant payment use cases. Additional initiatives remain in development, such as the Immediate Cross-Border Payments (IXB) Pilot devised by EBA Clearing, The Clearing House (TCH) and Swift, to interconnect systems in the United States and Europe, as well as the European Payments Council’s (EPC) new One-Leg-Out Instant Credit Transfer (OCT Inst), which aims to use the existing SEPA (single Euro payments area) payment rails for international instant credit transfers6.

As the instant cross-border payment systems are explored and expanded, one criticism of the Roadmap is its lack of recommendations around the increased risk of fraud, and the associated potential for money laundering. If you are increasing the speed, these risk elements should be a focus – and this is an area that we, as an industry, will need to address.

A reality check

The goals of the Roadmap are not yet backed by regulatory or legal mandates. So, rather like the speed limits on certain parts of the German autobahn, adherence to the Roadmap is only advisory. Sceptics would suggest that this makes it toothless – and though not an entirely fair assessment, the approach of the Roadmap does raise several concerns.

Take the ISO 20022 migration as an example. Where central banks are mandating the use of ISO 20022, every single participant is working on the initiative. Where it is not mandated, we are finding that the opposite is often true – making progress much slower. The worry, therefore, is that without clear consequences resulting from not meeting the KPIs, and if local regulators and lawmakers do not incorporate the Roadmap’s essentials, banks could deprioritise the goals in favour of more urgent activities.

This is where global transaction banks have an important role to play – both in driving progress and bringing their FI and corporate clients along for the ride. It is our job to fill the lack of formal mandates with consistent and well-resourced market action. In this way, the G20 Roadmap should form part of the action plan of every large transaction bank – and together we can make its aim a reality.

Sources

1 See fsb.org

2 See "Getting ISO 20022 over the line" at flow.db.com

3 See swift.com

4 See "Going the distance with Swift Go" at flow.db.com

5 See weforum.org

6 See europeanpaymentscouncil.eu