21 February 2024

In November 2020, the G20 leaders endorsed a roadmap to make cross-border payments cheaper, faster, more transparent, and accessible by 2027. What has been achieved so far? At mid-term, flow’s Desirée Buchholz shares five key takeaways from the BAFT Europe Bank to Bank Forum in Frankfurt

MINUTES min read

Cross-border payments are the backbone of international trade and, as a higher proportion of global trade growth moves more towards services (particularly those delivered by computer networks such as streaming services – the World Trade Organization confirms significant growth in here1) volumes of low-value cross border payments are also set for rapid expansion.

It is therefore no surprise that G20 leaders have identified improving cross-border payments as a key priority during Covid-19 lockdowns. At a November 2020 meeting in Riyadh, Saudi Arabia they endorsed the so-called Roadmap for Enhancing Cross-border Payments2 which sets quantitative targets to lower costs, increase speed, accessibility, and transparency of international payments by the end of 2027. For example, the G20 aims for 75% of cross-border payments to be credited with the beneficiary within an hour by 2027.

When the transaction banking industry convened at the 2024 BAFT Europe Bank to Bank Forum in Frankfurt from 15–17 January, half of the seven-year period to meet G20 requirements had elapsed. 2023 undoubtfully brought major milestones with respect to this roadmap. Most notably, in March 2023, Swift went live with ISO20022 messages that provide the foundation for banks to communicate in the same language globally when processing cross-border payments.

Yet, the ISO20022 journey has only just begun, and more efforts are needed for the industry to fulfill the G20 targets. This article, one of two post-BAFT reflections, looks at five key takeaways from the panel “The future of cross-border payments and the G20 roadmap” featuring four experts:

- Marc Recker, Global Head of Product, Institutional Cash Management, Deutsche Bank (moderator)

- Amit Hathiramani, Head of Network Management, BBVA

- Patrik Havander, Head of Visa B2B Connect Europe, Visa

- Frantz Teissèdre, Head of Public Affairs, Cash Clearing Services, Societe Generale

From left to right: Marc Recker, Amit Hathiramani, Frantz Teissèdre, Patrik Havander

1) ISO20022 provides the foundation

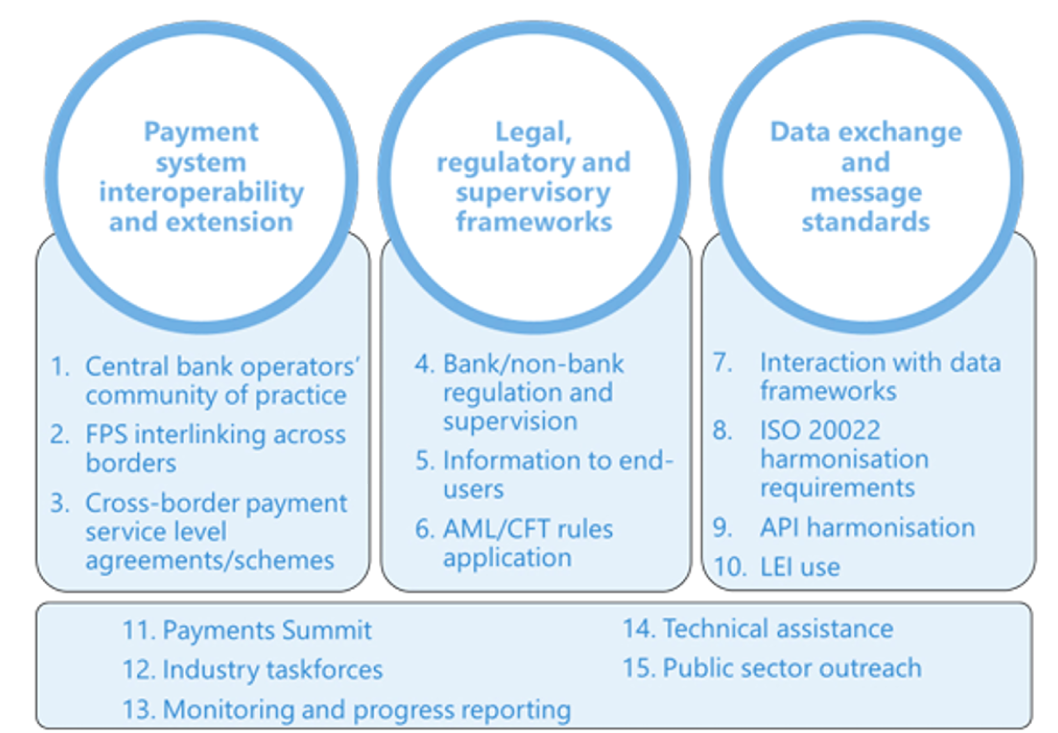

Kicking off the panel, Recker shared the three priority themes of the G20 roadmap: payment system interoperability and extension; legal and regulatory supervisory frameworks; as well as data exchange and messaging standards (see Figure 1). “These pillars will pave the way for making cross-border payments better for us as financial institutions, but even more important for our clients,” he said.

Figure 1: Priority themes of the G20 roadmap

Source: Deutsche Bank

As the panelists agreed, the implementation of ISO20022 by Swift in March 2023 provides the foundation to live up to the G20 targets as the message standard allows banks to reduce costs, improve reconciliation and enhance financial crime detection. “We made significant progress, but there still is a considerable amount of work for us as an industry to do,” Recker said.

Quoting Swift data as of October 2023, Societe Generale’s Teissèdre pointed out that back then only 18% of cross border payments and cash management reporting messaging were based on the ISO format, with a little less than 800 banking institutions systematically issuing payment messages with an ISO syntax. “It’s not a rapid evolution, but I am not surprised as the actual migration will be driven by market infrastructures.” Data published in January 2024, show that these numbers have only slightly increased.3

“In order to reap the fruits of the richness of ISO20022, we need to convince corporates to use ISO20022 and benefit from it”

While the European Central Bank (new Target2 system) and the Bank of England (CHAPS) have already introduced ISO 20022 in March and June 2023 respectively, the US is set to follow in March 2024 (CHIPS) and March 2025 (Fedwire). “By that time, 80 to 90% of all high value payment messages will have migrated to ISO20022,” Teissèdre added. Swift’s co-existing phase – the period in which MT and ISO 20022 messages will remain interoperable – will end in November 2025. By then, banks will need to have migrated their cross-border payment messages to the new standard.

According to Teissèdre, there are two reasons why migration isn’t happening faster: First, the investment to migrate core banking systems is huge. Second, it’s not a pure interbanking migration: “In order to reap the fruits of the richness of ISO20022, we need to convince corporates to use ISO20022 and benefit from it.”

The need for corporate adoption was echoed by BBVA’s Hathiramani, who added two more elements which are necessary to make ISO20022 a success: “We need to go beyond the G20, i.e. to market infrastructures in Africa and Latin America who lack the resources and access to technology to implement the standards.”

Moreover, he stressed that ISO standards need to be harmonised or “otherwise, all potential benefits will be undercut”. In fact, each jurisdiction and each bank interpret ISO 20022 slightly differently, which is why the term “standard” is a bit misleading.

2) Collaboration between the private and public sector is key

The second takeaway from the panel was that collaboration among the private and the public sector is essential to meet G20 targets – in particular when it comes to the first pillar of payment system interoperability. “Cross-border payments are global by nature, but regulation is enforced locally. This divergence in regulation is a major source of friction for cross-border payments,” said Hathiramani.

“Divergence in regulation is a major source of friction for cross-border payments”

In order to drive interoperability, regulatory alignment is necessary – for example with respect to rules of anti-money laundering (AML), countering financing of terrorism (CFT) and data governance. “Currently, there are data frameworks which run into conflict with financial regulations with respect to data privacy and data sharing,” he added. Finally, API standardisation would help to avoid payment system fragmentation.

“The public sectors need to be enablers by setting the roadmap, driving the frameworks and defining the standards. On the back of this, the private sector will be able to drive innovative solutions, share expertise and invest in technology.”

3) Client needs are evolving quickly

In the end, it all comes down to meeting client needs. While the panelists agreed that the G20 goals will improve cross-border payments for clients, Visa’s Patrik Havander stressed that wholesale payments are not yet addressed properly – neither by the G20 roadmap nor by existing industry initiatives: “We see tremendous change in corporate payments. Business models are transforming from analog to digital, platformed-based business models, the internet of things and machine to machine communication are changing payment needs,” he said. “We must recognise that things need to move much faster or otherwise other players will come in.”

“Platformed-based business models, the internet of things and machine to machine communication are changing payment needs”

Some of these themes around payment platforms are discussed in a white paper published by Treasury Management International (TMI) in partnership with Deutsche Bank outlining how corporate treasurers can support the set-up of platform-based business models. Treasury's Role in Creating and Supporting a New Business Model clarifies on how digital marketplaces require new approaches when it comes to payment processing – for example by splitting payments between different merchants – and how treasurers need to consider regional variations in regulation to ensure effective cash management when marketplaces grow internationally.

4) Correspondent banking upgrades are ongoing

So, what is the private sector doing to improve cross-border payments for its customers? At its core, this question touches upon the correspondent banking model – i.e. banks relying on bilateral agreements with partner banks to offer financial services in a jurisdiction where they are not present themselves. While this approach is essential for the functioning of the global economy, it has in the past led to frictions in cross-border payments impeding speed, security and transparency.

“Correspondent banking has evolved significantly since the introduction of Swift GPI in 2017”

Thus, over the last few years, banks have worked with Swift to upgrade the existing correspondent banking model, as Deutsche Bank’s Recker stressed: “Correspondent banking has evolved significantly since the introduction of Swift GPI in 2017.” This service provides end-to-end tracking for high-value cross-border payments.

Built upon these rails, Swift Go focuses on lower-value payments (up to 10,000 in Euro, USD and GBP), enables consumers and SMEs to send fast, predictable, cost-effective and secure low-value payments. For example, participating banks need to credit the beneficiary within four hours, there is a more structured format which drives straight-through-processing and no deduct policy which allows initiating banks to provide predictability.

Due to the success of Swift Go – with more than 660 banks signed up today across 139 countries, and 190 banks now live4, Swift is now considering extending the number of currencies under the service and revisiting the thresholds.

5) Interconnecting infrastructures is tough, but possible

Moreover, there are several initiatives to bring instant payments to the cross-border space by interlinking market infrastructures – a key method by which to achieve the G20’s goals. “Interlinking shortens the transaction chain,” explained BBVA’s Hathiramani. “This helps with speed, cost, transparency, and also allows bank to optimise liquidity and reduce risk.”

Yet, interlinking real time local ACH system serves a purpose only for some use cases, stressed Visa’s Havander, “as some 80% of global trade is invoiced in non-local currencies. This is a problem since only domestic currencies can be handled. Moreover, there are also restrictions on payment amounts in most countries which is a big limitation for B2B payments as it only becomes relevant for SMEs at best.”

Apart from live systems in Singapore, India and other countries in South-East Asia that established interlinking connections for very specific cross-border instant payment use cases; the panel highlighted a pilot conducted by Iberpay, Swift, BBVA and several international banks in July 2023 that demonstrated that instant payments between different currency areas are technically feasible. As part of the pilot, payments originating from banks in Australia, New Zealand, Brazil and UK were sent through the Swift GPI Instant service and processed, settled, and credited in a matter of seconds to the ultimate beneficiary customer's account in Spain.5

The transactions were based on the new One-Leg-Out Instant Credit Transfer (OCT Inst) scheme of the European Payment Council (EPC) which officially came into force in November 2023. The scheme enables payment service provider (PSPs) in the euro area to use “as best as possible the existing SEPA payment ‘rails’ - including procedures, features and standards” for international instant credit transfers, the EPC states on its website.6

“Iberpay has now proposed to the Spanish banking community that, after a certain period of time, adherence to OCT Inst will be mandatory. So, if you are part of the Instant payment domestic scheme in Spain, you must be able to process a cross-border instant payment,” Hathiramani explained. “This is a good example of how a collaborative approach can help achieve the G20 goals and it can be replicated in other markets as well.”

Yet, he stressed: “You need strong political support to establish interlinking connection and to provide investment reassurance due to the high initial costs. You also need to think through technical requirements of interlinking of payment systems; the addressability of accounts, how to control compliance, and how a potential integration of an FX conversation layer could look like.”

From his perspective, countries with aligned economic policy provide good environment for interlinking. Moreover, if there is widespread adoption of instant payments schemes on domestic level, this creates confidence that cross-border instant payments are economically viable: “It’s like when you get married: You need collaboration, flexibility, commitment, and extensive testing.”

Watch the panel here: 2024 BAFT Europe Forum: The Future of Cross border Payments and the G20 Roadmap - YouTube

Sources

1 See wto.org

2 See g20.utoronto.ca

3 See swift.com Note: The data is here for download

4 See swift.com

5 See bbva.com

6 See europeanpaymentscouncil.eu