24 September 2021

As SWIFT’s gpi initiative approaches its fifth anniversary, many of its original goals have been achieved since the 2017 launch while more recent fine tuning has enhanced the service. What’s next on the agenda? The flow team reports

MINUTES min read

Launched in early 2017, by the Society for Worldwide Interbank Financial Telecommunications, aka SWIFT, and promoted as “the biggest thing to happen to correspondent banking in 30 years”1 the guiding concept behind SWIFT gpi since its inception is to improve the experience of making a payment through the SWIFT network for both customers and banks. SWIFT gpi has also been a response to demands for faster speeds, end-to-end tracking and fee transparency in high value international cross-border payments.

Before SWIFT gpi, these payments were unpredictable, lacked traceability and clients were not informed where the payment was at any specific time, nor the fee that had been deducted for the service, says Nicole Stumpf, SWIFT gpi lead for cash management at Deutsche Bank. The payment process could be particularly prolonged when, for example, it involved an Asian currency such as the Malaysian ringgit or Thai baht, which were characterised by particularly long settlement times and high costs.

There was much pressure within the industry to introduce transparency to the process and SWIFT recognised that this could be achieved utilising the new Cloud-based technology. Information on a payment could be absorbed in the Cloud and made readily accessible to each bank in the payment chain, subject to security features such as a unique reference number and six-digit algorithm allocated to each payment.

The main aims

Four specific goals were established for the gpi initiative:

- To increase payment speed using improvements in communication and higher standards for banks to ensure that payments are quicker when made through the SWIFT gpi network;

- To provide end-to-end tracking with payments designated a Unique End-to-End Transaction Reference (UETR), used to check the location of the funds at any point in their journey, in real-time;

- To improve transparency of fees and charges with each bank joining the gpi network required to provide full visibility on processing fees and times that enables individuals to make better decisions and allow banks to improve routing;

- To maintain consistent data records as gpi guarantees that remittance data submitted with payments remains unaltered during the whole payments journey, which enables recipients to easily reconcile payments against invoices or orders.

So gpi incorporates the traditional SWIFT messaging and banking system with a rulebook developed and applied to each bank joining the initiative, whose basic standards include transparency of fees, end-to-end payment tracking and conformation of credit to the payment recipient’s account. Each gpi transaction is required to be intraday to make it quicker, easier and more transparent.

At its launch, use of the new service was limited to a small group of global transaction banks, with the number then steadily expanding over subsequent months. Within the first 12 months of the launch, 30% of international cross-border payments were sent via gpi and by 2020 that percentage had risen to 70%. The number of gpi member banks, which in 2018 numbered 300, had risen to more than 2,000 by 2020. SWIFT data issued in December 2020 revealed that in total 4,100 financial institutions had signed up to become gpi members, although the figure is elevated by individual branches of major international banking groups such as Deutsche Bank becoming members. Almost 90% of all cross-border payments are now sent by SWIFT gpi, made in around 150 different currencies, and banks send the equivalent of over US$420bn in value via gpi each day.

On average, 41% of cross-border payments made via gpi are credited to the beneficiary within five minutes of the transaction being initiated and nearly 100% are completed within 24 hours. Although delays can still occur, often it is because the final leg of a transaction needs to be cleared with the recipient country, where limited operating hours may apply to local clearing systems. SWIFT has worked to improve the speed of service and SWIFT gpi Instant, which launched in October 2019 after trials in Europe, Australia and Singapore, connects gpi’s high-speed cross-border rails with real-time domestic infrastructures such as the UK’s Faster Payments to enable tracked cross-border payments to reach the beneficiary within seconds.2

While the majority of branches in Deutsche Bank’s extensive network are gpi-enabled, in certain countries it has taken longer for the back-end systems to accommodate the service. This is now being completed in five countries – Italy, Spain, Brazil, Turkey and Australia – which are being added during the course of 2021.

Speed barriers

The transparency afforded by gpi offers some interesting revelations. In 2020, SWIFT conducted an in-depth analysis of data captured by the tracking codes on gpi payments.3 This showed that regulatory barriers and capital controls are the most significant frictions impacting speed and seamless delivery. Clearly, these are the domain of local regulators and the banking industry cannot solve this issue alone. What the industry can do though, SWIFT suggests, is to speed up responsiveness to requests for documentation and try to smooth the path through the process.

The data shows currency controls to be the main culprit in reducing speed. When countries that apply capital control restrictions are excluded from SWIFT’s analysis, 57% of gpi payments arrive in under 30 minutes – regardless of geography or routing. For transactions between mature markets – with none of the frictions of currency controls, legacy systems or compliance stops – performance is even better; for example, 72% of gpi payments from the UK to the US arrive in 30 minutes.

Similarly, time zone differences contribute to delays; SWIFT’s data analysis shows that payments following the sun arrive more quickly than those travelling against local operating hours. Improved data standards, notably ISO 20022, will greatly ease the flow and hand-off of data across the ecosystem and facilitate automation. In a world experiencing high levels of financial crime, compliance-based queries can also represent a significant block on cross-border payments.

Tackling the pain points

SWIFT gpi has been enhanced through a number of additions and enhancements since its launch. The pre-validation service, first announced in September 2018, is a methodology that aims to reduce the number of gpi payments that are either rejected or delayed as they require investigation before being approved.

According to SWIFT: “Pre-validation of payments is all about reducing friction, bringing end-to-end efficiency, and an important step in making cross-border payments simpler, faster and more secure.” It ensures, for example, that any potential hiccups created by the IBAN number allocated or from the account holder details are addressed at the outset. Although relatively few in number, errors and queries still demand considerable time and resources to correct. Many rejections and delays result from incorrect or missing information being provided about the beneficiary when payment is initiated. Payment pre-validation allows a sending bank to confirm account details, via an API with the receiving bank at the start of the process, enabling any data or account problems to be identified and corrected before payment is sent.

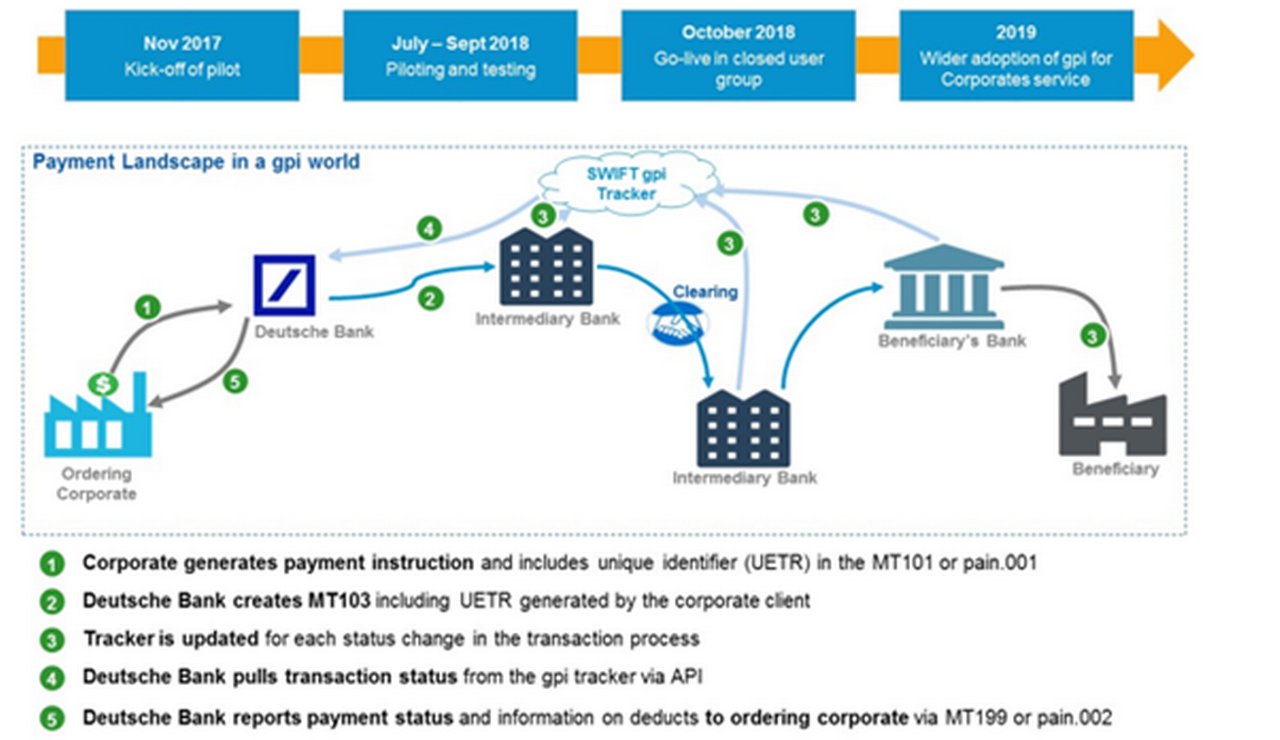

An in-bound tracking service – piloted in late 2019 with Deutsche Bank and several other global banks as well as corporates such as Alibaba and General Electric – was launched the following year as part of the SWIFT gpi for corporates service. The tracker provides corporate treasurers and their banks with real-time insights into incoming payments through features such as payment advice that includes an initial notification issued to the beneficiary when a payment is initiated in the network, status updates and corporate-to-bank API functionality that companies can use to query incoming transactions and be informed of their current status.

Figure 1: Progress of SWIFT gpi for Corporates

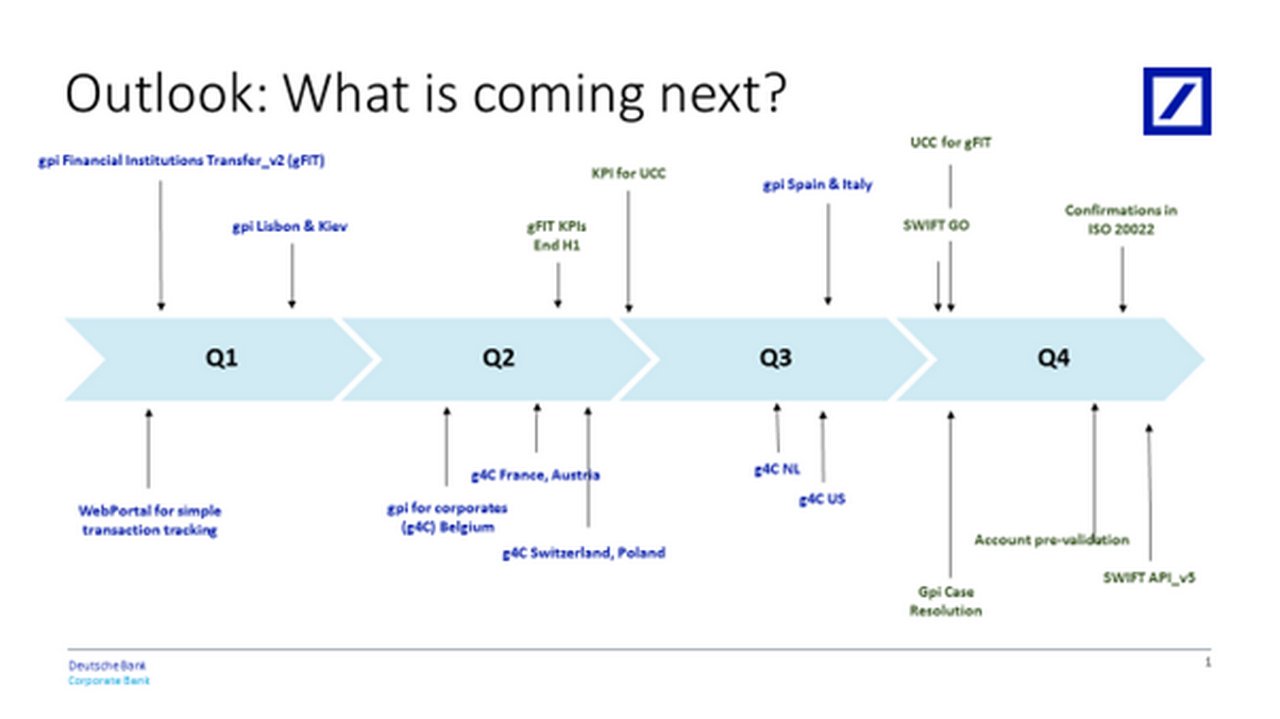

Figure 2: SWIFT gpi developments in 2021

Source: Deutsche Bank. Note that new functionality is shown in green and shortened forms for gpi for Corporates, case resolution, gpi financial institution transfer in subsequent quarters are only used for space reasons and are not their brand names

In March 2021, SWIFT announced that over the next two years and beyond, it would be transforming its platform to enable instant and frictionless payments anywhere in the world, aiming to significantly improve end-to-end efficiency, reduce total costs, and to create services that equip financial institutions to capture growth and create new, differentiated customer experiences. The first release of the platform, which builds on the success of gpi, is scheduled to launch in November 2022, the start date for the use of the new ISO 20022 universal messaging standard for international payments. The platform will provide a set of common transaction processing services, such as pre-validation of essential data, sanctions screening, anomaly detection, data analytics, transaction tracking and exception case management. According to SWIFT: “The platform will ensure interoperability between users of different data formats and connectivity channels, with the full benefits of richer data and advanced platform features available to those using ISO 20022 and APIs.”

“SWIFT’s platform will be a powerful catalyst for innovation for the financial services industry”

The combination of the ISO 20022 messaging standard with APIs promises to address many of the common ‘pain points’ that hinder the progress of cross-border payments, such as sanctions compliance, anti-money laundering (AML) and identity checks, invoice reconciliation, message translation and transparency of speed and fees for end users. The development was also welcomed by Ole Matthiessen, Deutsche Bank’s Global Head of Cash Management, who commented: “SWIFT’s platform will be a powerful catalyst for innovation for the financial services industry. We can already see how the platform will allow our industry to seamlessly integrate new features that will reduce costs and provide for faster, frictionless payments. It perfectly complements and integrates with Deutsche Bank’s own planned products and services to support future industry demand.”

“SWIFT Go will help banks to meet the growing demands of SMEs and consumers for international payments that are fast, predictable, secure and cost effective”

In October 2020, the launch was announced and several banks exchanged the first payments via SWIFT’s new service for low-value cross-border payments – called SWIFT Go – in response to the financial institution community’s wish for the gpi service to be extended to include lower value payments. Many of these are initiated by small and medium-sized businesses (SMEs) to pay suppliers overseas and by consumers sending money to family or friends internationally. SWIFT Go has attracted the interest of Amazon, for example, which plans to use it to trace payments for goods ordered and has agreed a pre-defined set of fees with the banks.

“SWIFT Go will help banks to meet the growing demands of SMEs and consumers for international payments that are fast, predictable, secure and cost effective,” says Rosemary Stone, Chief Business Development Officer at SWIFT. “The service helps position banks to compete effectively in one of the fastest-growing segments of the payments market and allow them to deliver a seamless customer experience, which is a key building block in our strategy to enable instant and frictionless cross-border transactions globally.

“These services are all part of our drive to offer the industry the most compelling back-end for cross-border payments in an instant and digital-first world. We are already seeing financial institutions adopting these services into their front-end customer channels, which is very encouraging.”

SWIFT Go is underpinned by several key features including speed, predictability, ease of use, competitive prices and security. Still in its pilot phase, Deutsche Bank is scheduled to go live in Germany for euro payments at the end of Q3 before it is rolled out to other regions and currencies. It also has the advantage of building on the strength of SWIFT gpi and the high-speed rails that have already transformed the business of high-value payments, so does not require significant additional investment by banks.

“SWIFT Go is a classic example of banks working in unison in a concerted response to clients’ needs,” says Marc Recker, Managing Director – EMEA Market Manager Institutional Cash at Deutsche Bank. “It’s an opportunity for them not only to regain but to increase their market share. Such collaborations needn’t be limited only to SWIFT initiatives now that we’ve demonstrated what the correspondent banking network can achieve when joining forces.”

Payment Pre-validation

July 2021 marked the go-live of SWIFT’s Payment Pre-validation service, enabling banks to verify payee account details before an international payment is sent and removing a key point of friction in cross-border transactions. SWIFT developed the service in close cooperation with financial institutions, and several major global banks have already signalled their commitment to it. SWIFT plans to continue innovating the service, and over the coming months will offer additional checks based on reference data encompassing millions of transactions to further predict, at the point of initiation, when a transaction may potentially run into friction points along the way.

Payment Pre-validation is one of the services to come that will support the first platform release in November 2022.

“SWIFT’s Beneficiary Account Pre-validation not only addresses a key market problem prevalent today but also brings in significant operational benefits in terms of end to end efficiency and fraud reduction to our corporate clients,” adds Jose-M Buey, Global Head of Core Platforms and Accounts Solutions , Deutsche Bank Corporate Bank. “It is also a clear example on the usage of the API technology into an innovate solution, which perfectly aligns with our strategy to build a real time API based Accounts platform.”

Piloting case resolution

As shown in Figure 2 above, Deutsche Bank was one of the small group of banks that recently participated in the pilot of SWIFT’s gpi case resolution service. Integrated directly into SWIFT gpi using a cloud-based payment investigation and resolution service, case resolution speeds up the resolution of operational, compliance and regulatory-related issues that can arise along the payments chain.

The pilot group has deployed the first set of use-cases, although the true benefit is expected to be provided with “Case Resolution” becoming the “new standard” for the whole SWIFT community with the migration to ISO 20022, starting in November 2022. Deutsche Bank is a member of the expert group (defining the use-cases and the rulebook) as well as part of the ISO 20022 standardisation group (designing the messaging standards to be used). This particular solution will not only allow the banking community to maximise the automation in handling cases, but significantly improve the processing time, provide transparency to all parties involved and improve the client experience.

Extending the benefits

Banks’ corporate clients, who are increasingly aware of the efficiencies of gpi, would like direct access to gpi information themselves. Deutsche Bank and others are working to share more gpi information with clients. The Bank’s Autobahn App Market now includes Cash Inquiry, a single integrated app that gives corporates instant access to all payment transactions in real time and the ability to create and monitor investigation cases, including up to six months of historical data. Deutsche Bank has been working in 2021 to further expand this facility; WebPortal for simple transaction tracking launched in Q1 and enables clients to confirm direct with the beneficiary when payment has been received.

Sources

1 See https://bit.ly/3zAPFza at swift.com

2 See https://bit.ly/3nZm8x7 at swift.com

3 See https://bit.ly/39srLvo at swift.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

CASH MANAGEMENT, TRADE FINANCE, SECURITIES SERVICES, TECHNOLOGY {icon-book}

Responsible innovation Responsible innovation

How can you connect four billion accounts across the world in an instant? That is the bold vision of SWIFT’s CEO, Javier Pérez-Tasso. flow's Clarissa Dann talks to him about the responsibilities vested in a cooperative founded to create mutual benefit for the financial community and why a virtual Sibos for 2020 will keep the global financial community engaged

CASH MANAGEMENT, TECHNOLOGY {icon-book}

Reimagining the future of payments Reimagining the future of payments

The pandemic has accelerated the pace of change over the past year and bank-led merchant solutions are among the responses to a huge shift in payment methods and the boost to e-commerce, reports Helen Sanders

CASH MANAGEMENT, TECHNOLOGY

EBAday 2021: Turning point in payments transformation EBAday 2021: Turning point in payments transformation

Disrupted by the pandemic in 2020, the European Banking Association’s EBAday 2021 returned its focus to payments transformation issues such as the migration to ISO 20022, open banking, real time payments and cyber security