22 July 2021

Disrupted by the pandemic in 2020, the European Banking Association’s EBAday 2021 returned its focus to payments transformation issues such as the migration to ISO 20022, open banking, real time payments and cyber security

MINUTES min read

After delaying its 2020 event to November thanks to Covid-19, and revising the format the European Banking Association’s EBAday 2021 took the changed environment in its stride. This year it comprised a virtual three-day meeting that had attracted more than 2,000 delegates online by its first day. Anticipating a gradual return to normality over the coming months and the resumption of traditional meetings, Vienna was confirmed as the venue for EBAday 2022 next May.

With the world forced to adapt to a persistent and global pandemic since early 2020, this year the themes regularly featuring on the conference schedule – from ISO 20022 to open banking – had the added question of how Covid-19 has impacted.

Future proofing payment strategies

After opening panel sessions on the first day, the strategic roundtable ‘Future proofing payment strategies’ was a centrepiece of Day Two. The morning discussion featured Sara Castelhano, EMEA Head of Payments Product & Solutions for J P Morgan and Deutsche Bank’s Head of Corporate & Payment Solutions, Cash Management, Christof Hofmann. Moderator Marc Niederkorn, a partner of McKinsey & Co described global payments as representing a US$2 trillion opportunity and a “remarkably resilient industry” that continued to thrive despite the pandemic and contributed a growing share of banking revenue.

However, these revenues were under increasing pressure as the costs of tech investment and increasing regulation continued to rise and the incumbent financial services providers faced competition from three other contenders, FinTech, BigTech and Merchants/other players in the move towards a world where making payments will increasingly be an invisible process.

An audience poll that posed the question “What are the most important dimensions (of payments) that need attention?” drew the following response:

- Payments infrastructure and technology: 32.5%

- Payments economics (sources of revenue/cost): 12.3%

- Product innovations (real-time, cross-border etc): 37.7%

- Competitors (in particular bigtechs, fintechs): 8.8%

- Changes of paradigm (digital currency, stablecoins, CBDCs): 8.8%

In a second poll, which posited the statement “Payments is a core part of my institution’s ambition and future strategy”, 79.7% indicated they totally agreed and 17.6% “somewhat” agreed, leaving only 2.7% dissenting.

Hofmann said that the payments industry was already in the middle of a revolution that many banks struggled to keep up with due to legacy infrastructure. For them, future proofing depended on the ability to be innovative.

Castelhano agreed, observing that innovation started with the end-to-end user experience, which the industry has made unnecessarily complex in the past. “Innovation should be driven by the customer and not the regulator,” suggested Niederkorn.

Change and innovation were words that also regularly featured in the session “Correspondent banking – a business in transformation”. Panellist Dean Sposito, Deutsche Bank’s Head of Institutional Cash Sales & Client Management, Western Europe was joined by Saskia Devolder, Managing Director, Head of Europe North, SWIFT, Akshat Saharia, Head of European Financial Institutions Product and Propositions, HSBC and Gayathri Vasudev, Head of Global Clearing for J P Morgan. The session was moderated by Veerle Damen, Head of Network Management, Propositions and Customer Journeys, NatWest.

As Sposito commented, despite geopolitical tensions in recent years the global economy “is here to stay” and will continue to grow as client demand for cross-border payments grows with it. As the correspondent banking network enables payments to be made around the world within seconds, those in the industry needed to keep working hard and to continue innovating.

However, to do so requires a level playing field and regulators were currently treating banks very differently from non-banks; in particular placing them under intense scrutiny regarding their anti- money laundering (AML) policies.

Supply chains and stability

Inevitably, the pandemic was never absent long from conversations and featured in a Day Two lunchtime roundtable on global supply chains. “Covid-19 has brought into focus just how important a stable supply chain is as we transition to a new era of payments stability,” commented moderator Teresa Connors, Managing Director of Payment Matters.

Panellist Christian Hausherr, Product Manager Trade Finance/Supply Chain Finance at Deutsche Bank noted that there was an ongoing move to open account or supply chain finance. It was driven by the ‘pull’ factor of companies wanting to maximise their working capital as well as the ‘push’ factor of technology being adopted that makes supply chain finance possible. For him, SCF only works when based on mutual trust between the parties involved, which allows trading to be on an open account basis.

Michael Glaros, Principal Program Manager, Microsoft said that as physical supply chains and financial flows steadily converse, cloud computing technology was being adopted to reduce integration friction. The risk was expanding as connectivity and networking increases, providing more opportunities for the “bad guys” to intercept.

Digital adoption is now reaching smaller companies as they move away from paper-based processes and innovations such as ISO 20022 are introduced, added José Vicente, Deputy Manager of Millennium bcp.

Open account is nothing new, but as the world becomes more real time and data-oriented the improved processes developed around cash management are being applied to the global environment, noted Peter Hazou, Director of Business Development, Microsoft.

“Up until 2008 everything appeared to be steadily moving towards open account, but the financial crisis breathed new life into trade finance, which has always been able to attract innovators,” he added. “Open account is alluring, but at the same time it involves a lot of elements that create risk.”

Asked how prevalent open account is, Hausherr responded that it depends on which region and the size of the client. “Most of the world’s 500 biggest companies use SCF, although it’s less prevalent among smaller companies,” he reported.

“The majority of big buyers have a payables finance programme in place; however classic factoring still plays an important role in Europe. SMEs that currently use classic factoring may in future move over to reverse factoring, as it has a number of attractive features”.

The discussion also touched on ISO 20022’s introduction and its expected impact “From a payments perspective it will help the banks to provide better services,” said Vicente. “It’s a great opportunity to bring in all of the sectors of the bank; as digitalisation won’t solve everything so we need to involve everyone. Banks are trying to develop their end-to-end capabilities using the new data and digital IDs is something that companies will soon have.”

Does the world need CBDCs?

Cryptocurrencies are regularly in the news. The European Central Bank has indicated that a digital euro is in development, Facebook plans to launch its Diem currency soon and El Salvador recently confirmed bitcoin as a legal currency.1 Sweden and Bermuda are moving ahead with digital versions of their currency and JP Morgan has created the JPM coin for payments. These developments were addressed by Robert Bosch, Partner of Bearing Point, who moderated a discussion about central bank digital currencies (CBDCs) on Day Three.

An audience poll on ‘Do we need CBDCs?’ showed nearly half were in favour, but nearly one in three opposed:

- Yes: 47%

- No: 31.5%

- Perhaps: 22.5%

“Crypto is digital, widely accessible and token based, whereas a CBDC is peer-to-peer and issued by a central authority”

Session panellist Marion Laboure, Macro Strategist for Deutsche Bank and Lecturer in Economic and Finance at the Economics Faculty of Harvard University commented that the Bank for International Settlements (BIS) defines four basic dimensions for money: who is the issuer?; how accessible is it?; is the support physical or only digital?; and is the transmission peer-to-peer or through an intermediary? Crypto is digital, widely accessible and token based, whereas a CBDC is peer-to-peer and issued by a central authority.

For Dirk Schrade, Deputy Head of Department Payments and Settlement Systems at Deutsche Bundesbank, the potential development of the CBDC rests on whether it can become widely used in response to continuing digital innovation and a general decline in the use of cash.

“Public trust in the monetary system could be improved by providing a public form of digital money that could act as cash in making peer-to-peer transactions possible,” he said. “You can’t very comfortably use cash in an e-commerce environment, so there will be certain benefits and virtues with a CBDC that make it different from cash.”

There is also the question of whether CBDCs can help to promote an open and innovative ecosystem and improve financial stability.

Sophia Bantanidis, Head of Regulatory Strategy and Policy TTS Innovation, Treasury and Trade Solutions at Citi suggested that they could potentially make things easier; for example, digital traceability could help reduce opportunities for tax evasion. But there are other potential scenarios in which CBDCs might actually work against stability. “Crypto works best as a public-private partnership,” she suggested. “So CBDCs should build on existing foundations – a ‘Goldilocks’ scenario in which it is neither too big or too small is ideal. Too big and there is the risk of the private sector being driven out.”

Asked which countries have made most progress on CBDC development, Jack Fletcher, Government Relations Manager, Digital Currencies at R3 commented that the question implied a prize for whoever is first, although there might be an advantage in being, say, the fourth or fifth in order to learn from the mistakes of whoever is first.

“In APAC, the Bank for International Settlements is co-ordinating work and the Monetary Authority of Singapore has also been at the forefront. The European Central Bank talks of a five- year timeframe for the introduction of the digital euro,” he said. “A multi-tiered system using a central infrastructure looks to be the best arrangement. But we’re all moving at different speeds and a four to five year timeline appears to be commonplace in the US and Europe.”

The limits to innovation

Sabrina Small, Managing Consultant of Lipis Advisors moderated a session on trends in payment innovation. She opened with a reminder of the challenges inherent in innovation, citing Thomas Edison’s quote, “I’ve only found 10,000 ways that don’t work. I haven’t failed,” as an important perspective for the innovation process, which rarely yields perfect solutions on the first attempt.

The struggle for global payments innovation is one such challenge. While the demand is there in force, it is often trumped by the practicalities of local idiosyncrasies in the banking or payments environment. For example, Sweden’s mobile payments app, Swish, works wonderfully in the Nordic cooperative banking environment, but the same approach wouldn’t translate to the US, which has thousands of banks and competition at the payment level itself.

India has become a gold standard of innovation and the cashless society, but the regulatory involvement that made those innovations thrive would be impossible in, say, Germany, which remains very cash-focused, even in a post-pandemic environment.

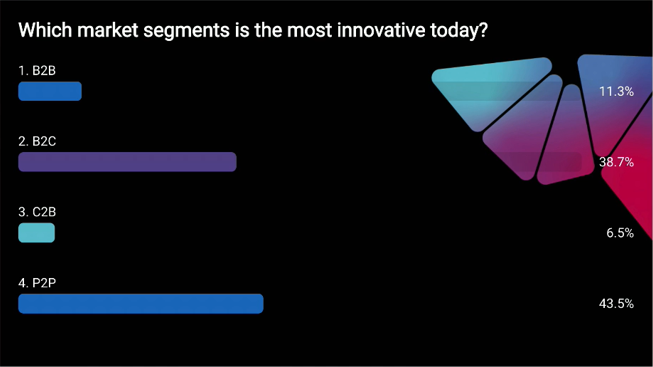

An audience poll (below) found that peer-to-peer (P2P) is still regarded as the most innovative market segment, but since a similar poll was conducted five years ago business-to-consumer (B2C) has narrowed the gap significantly.

Citing the example of Spain’s Bizum, Deutsche Bank’s Head of Global Payments, Corporate Cash Management Christian Schäfer explained that the market has various great P2P solutions that subsequently move into the field of B2C. The discussion also touched on the impact of customer-led innovation and panellists agreed that regulation had also contributed to it in recent years.

An audience question suggested that ISO 20022 was an opportunity to leverage data and transform the industry, but had yet to deliver on this promise.

Jon Levine, Co-Head of Institutional Banking at Banking Circle noted that some in the industry questioned whether ISO 20022 simply reorganises the same old data. Although he didn’t agree, would he go so far as to call ISO 20022 a panacea? “Definitely not. It is a step in the right direction though,” he opined. “Remediation work is ongoing because the standard isn’t being met yet. There will have to be further improvements over time, but it will create loads more data eventually.”

“If you want to create value, it is better orchestrated in a four-corner model”

Building on the theme of data, Schäfer added that a working group on open banking hosted by the Euro Retail Payments Board (ERPB) at the ECB yielded several insights – including the fact that the interest in data is not institution-specific. “If you want to create value, it is better orchestrated in a four-corner model.” he said. “On one hand, you have asset-holders, institutions that hold the data (pertaining to a different party, the asset-owner) and, on the other hand, you have the brokers, who would like to have access to different data sources (from banks and others). For this to happen, there needs to be progress on an institutional level about the transparency and availability of data and there needs to be standardisation.

“The tipping point, the enabler on top of these two factors, is business models. There needs to be a frame and a scheme within which the exchange of data is governed and focused – and which comes with remuneration for those holding the data on behalf of others and those designing business models on top of that. We found that no one institution can manage that – it really requires extrapolation into a four-corner model.” For this purpose, the EPRB invited the EPC to become the scheme owner, which “will bring the next level of baseline to enable business models and innovation around data.”

Readiness for ISO 20022

A later session specifically dedicated to preparations for ISO 20022 noted that while the industry has made significant progress, much remains to be done. Asked to pick the main challenges over the months ahead, an audience poll selected the following:

- Overall readiness (54.4%)

- Differences in migration strategy and timelines between MIs (28.1%)

- Benefits of ISO 20022 are not fully understood (17.5%)

The session, moderated by Tanja Haase, Customer Engagement Lead – Transaction Management at SWIFT, asked panellists their view on the current state of ISO 20022 readiness. Daniele Pasqualini, Head of GTR RFP and Onboarding at Intesa Sanpaolo suggested that the large banks are probably well prepared but smaller banks might lack the budget or resources needed to meet the November 2022 deadline. “We need to have these banks connected as well”, she added.

For Volker Heinze, Head of Business Development at UniFits, ISO 20022 is “the new sheriff in town” and means the same level playing field for all. “Based on this, I see interoperability, and the richer data is an enabler for innovation in payments. And instant payments, request to pay, and the European payment initiative is part of this. In the past month, I’ve received many invitations to hackathons around ISO 20022, so this topic is interesting for fintechs as well.”

Will the benefits of ISO 20022 more than outweigh the significant investment required? Right now, it’s difficult to assess said Neil Brady, Head of Transaction and Surveillance Operations, Deutsche Bank. “We have to take a more medium to longer term view,” he suggested. “When we look at what is going to happen, and compare it to other industries such as telecommunications and the technology industry, which have common practices in place, you can clearly see the benefits of that as well from economic globalisation perspective. I see no reason why we can't reach those same benefits within the banking and payments environment over the coming years.

“And it's not just about the benefits to the banks, but also about the benefit to our clients and the end consumers. That’s something we mustn't forget. At the end of the day, there will be some bumps in the road over the next few years. But if we get this right, you will have happier clients at the end of the day, and a happier end consumer. Ultimately, that's going to benefit us all – particularly when you talk about the banks in this space. The opportunities are there; you just have to grasp them.”

EBAday 2021: The Turning Point in Payments Transformation hosted by the Euro Banking Association and Finextra was held in digital format over the three days 28-30 June 2021. Deutsche Bank was Lead Sponsor of the event

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

Cash management, Technology

E-commerce for treasurers: staying ahead of the game E-commerce for treasurers: staying ahead of the game

No industries are safe from digital disruption and the pandemic has accelerated the pace of change in the world of shopping. At a recent webinar hosted by The Economist, treasurers of a B2B and a B2C company outlined the challenges of expanding e-commerce operations, choosing the right platforms and payment providers, and increasing payments digitalisation to support emerging retail trends

TECHNOLOGY, MACRO AND MARKETS {icon-book}

AI in motion: Tracking the smart money’s journey AI in motion: Tracking the smart money’s journey

Deutsche Bank Senior Strategist Marion Laboure takes a closer look at the explosion in artificial intelligence (AI) commercial applications by examining patent growth areas

Trade finance and lending

More Rethinking global supply chains

Supply chain finance (SCF) industry experts gathered virtually for BCR’s 6th Annual Supply Chain Finance Summit to discuss how the industry is recovering from Covid-19 dislocation, embedding ESG into platforms and schemes, and progress on automation and digitalisation. Clarissa Dann reports