13 July 2023

What are the biggest challenges facing transaction banking? What is the status of both retail and wholesale central bank digital currencies? Can correspondent banking survive the ongoing payment revolution? The flow team attended EBAday 2023 to bring you the top seven highlights

MINUTES min read

EBAday 2023, the Euro Banking Association’s annual gathering at the IFEMA Conference Centre in Madrid, started with a bang – quite literally. If the free coffee, as provided by Swift, had not been enough to wake delegates, the piercing yet rhythmic entrance of the seven-strong drumming troupe was. For an event that celebrates the steady, but ever increasing, beat of progress within the transaction banking industry, it was, arguably, an apt way to kick off the 18th iteration of the conference.

In his opening address, Wolfgang Ehrmann, EBA chairman, welcomed the 1200+ strong delegates with a key message, “We come together here to discuss the shared vision and goals needed to drive actual progress in our industry”.

Perhaps in choosing to begin with a drum troupe, the organisers were subtly advancing a similar message: that transaction banking players have been banging a different drum for too long – and now is the time to come together with a consistent beat. flow reports on seven key takeaways from the conference.

Seven-strong drumming troupe opens EBAday 2023

1) The biggest threats – and opportunities – for FIs

Transaction banking, which has always been seen as a profitable business for banks, now faces a perfect storm of challenges – characterised by high inflation, interest-rate hikes, geopolitical tensions and an increasingly complex sanctions landscape.

During the strategic roundtable ‘How can FIs thrive in a rapidly evolving payments and transaction banking environment?’, Marc Recker, Global Head of Product, Institutional Cash Management, Deutsche Bank explained that despite all these challenges we have not observed a move away from globalisation. “Demand for cross-border payments is increasing year on year – and I do believe that international banks are well positioned to help meet this demand,” he stated. “For us, it will be about continuing to deliver secure and innovative solutions, while continuing to serve as a trusted partner to clients throughout these difficult periods.”

When it comes to delivering new and improved services, ISO 20022 remains an important topic. The new global standard reached several significant milestones in 2023. It went live in March for the Swift network and for the UK’s CHAPS in June.1 Speaking to FinextraTV during the event, Recker explained that for years a major barrier to faster, more transparent and more secure cross-border payments was the lack of standardisation – and the ISO 20022 standard was a first step in the right direction. “While progress has been promising, it is actually just the beginning – and ISO 20022 still requires immediate focus and ongoing community-wide efforts,” added Recker.

“While progress has been promising, it is actually just the beginning”

To close out the session, each panellist was asked what they needed to thrive as an FI. The key, they agreed, would be continuous industry collaboration to develop products that meet client demands, unlock data-driven insights and drive industry-wide adoption of important initiatives.

2) Instant cross-border: the search for use cases

Three panels at this year’s conference were dedicated to a single topic: instant cross-border payments. A key driver towards this target is the G20 roadmap for enhancing cross-border payments, which aims to make them cheaper, faster, more transparent, and more accessible. Endorsed by the G20 leaders in 2020, the roadmap’s architects have identified three interconnected themes for the next stage of the project – alongside ambitious targets to be achieved by 2027.

A key initiative working towards these goals is the Immediate Cross Border Payment (IXB) initiative, which looks to leverage existing instant payment building blocks – namely The Clearing House’s (TCH) Real-Time Payments (RTP) and EBA Clearing’s RT1 – to provide instant cross-border payments along the euro and US dollar currency corridor. According to one panellist, the key to the success for IXB and similar schemes will be scale in terms of achieving the necessary reach, handling volumes and connecting multiple instant payment systems.

With all the talk of instant payments, the topic of fraud was, unsurprisingly, a central theme. As has been seen with the introduction of instant payments domestically, short settlement windows can introduce new opportunities for fraudsters – and robust, harmonised controls and information sharing will be important in ensuring security.

In addition, panellists were keen to explore the real-world use cases for instant cross-border payments. On the second day, for example, Annie Gilchrist, Product Director, Currencycloud, gave one use case for instant cross-border payments: private jet marketplaces. Paying for a private jet often involves large account-to-account cross-border payments, and the plane will not leave the tarmac until the money has hit the account of the operator. By comparison, another panellist flagged that the need for certainty – e.g. a message confirming the money is on its way – often trumped the need for instant settlement across a host of corporate payment uses cases.

One message was, however, clear: now is the time to ensure that client centricity and real-world use cases – as well as security and anti-fraud measures – are front and centre in instant cross-border payment developments going forward.

3) Towards liquidity management 4.0

High inflation, rapidly rising central bank interest rates, ongoing geopolitical tensions, greater asset volatility and the ongoing supply chain and labour market disruptions are coalescing to shift priorities when it comes to liquidity management.

“During the time of quantitative easing, central banks flushed liquidity into the market to stabilise the market,” explained Koral Araskin, Head of Liquidity Solutions, Institutional Cash Management at Deutsche Bank. “A fair portion of this liquidity remains on the balance sheet within the banking system, yet we do not currently have an environment where this high level of liquidity can be deployed to the real economy,”

This topic was covered in a flow article “Beyond traditional deposits,” which concluded that rising interest rates do offer opportunities to improve returns on excess cash. For example, one of the levers that treasurers can pull is to turn away from traditional account deposits and towards investment instruments, such as term deposits, reverse repos and money market funds.2

Another key topic discussed by the panel was how the ramp-up of instant payments could impact liquidity management. “Every institution has their own methodology on how to build buffers for it – but ultimately, buffers would be needed, and this would also need to be priced in,” added Araskin.

Across of each of these challenges, the panellists agreed that the solution could lie in the adoption of emerging technologies, such as artificial intelligence (AI) and machine learning (ML) for areas such as cash flow forecasting. “I think we should be investing into emerging technology solutions, as well as looking at the classical products, to try and understand what the client drivers are,” concluded Araskin.

“I think we should be investing into emerging technology solutions”

4) CBDCs: to chain or not to chain

At EBAday 2023, there was no shortage of developments in the digital asset space to dig into. In May 2023, for example, the European Council adopted new rules on markets in crypto-assets (MiCA), which aims to ensure that the existing legal framework does not obstruct new digital financial instruments. In practice, this means that e-money tokens can now be issued and circulated on blockchains as a regulated form of private money in Europe.3

In tandem, retail Central Bank Digital Currencies (rCBDCs) have also risen to the top of the agenda in Europe, with the European Central Bank (ECB) now almost having completed the first phase of exploration into a Digital Euro.4 “We see the market moving towards non-cash payments, and we want to give the option to the consumer to always have the ability to pay with central bank money,” explained Daniel McLean, ECB Team Lead.

According to Klein, however, these two developing trends – MiCA and rCBDCs – should not be conflated. And while blockchain could be used to distribute CBDCs, it is by no means a given.

“When I look at the four primary use cases that the ECB has laid out for the digital euro – point of sale transactions, ecommerce, peer-to-peer transactions and also government transactions – you don’t need a blockchain to achieve that,” added Manuel Klein, Product Manager, Blockchain Solutions & Digital Currencies, Deutsche Bank. He believes that the private sector could, for example, provide the infrastructure to deliver the Digital Euro through account-based systems.

Deutsche Bank’s Manuel Klein speaking during the “What is the outlook for CBDCs in Europe” panel at EBAday 2023

Developments are also underway on wholesale CBDCs (wCBDC) – for use with inter-bank or capital market transactions. The benefits, according to Klein, are clear: risk and cost reductions from settling in central bank money, reducing liquidity buffers, and making payments more efficient with the programmability of smart contract and 24/7 capabilities. But how can this be made a reality?

“So far there is no clear decision and clear strategy, where this leads right,” suggested Klein. “Will it be on private Ethereum blockchain? Will it be on a hyperledger fabric blockchain? Or will no blockchain be used at all because, ultimately, you have an API that connects to the existing RTGS systems? So, when it comes to central bank money, I think there are still a lot of different scenarios on the wholesale settlement side.”

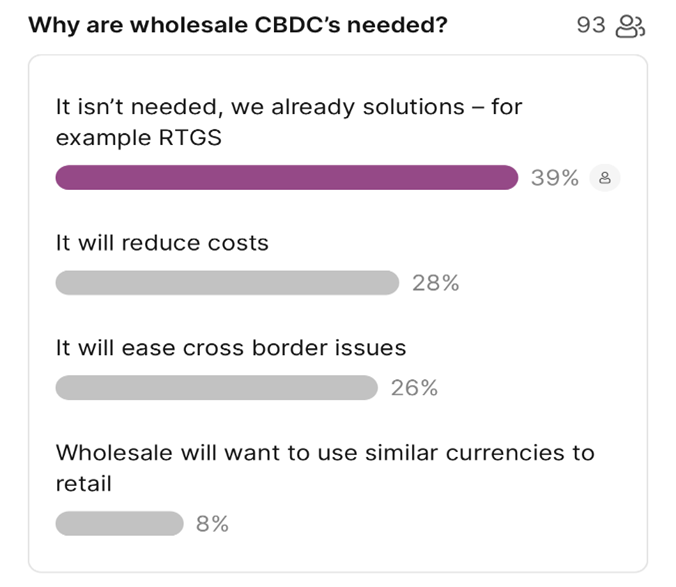

Questions also remain around whether there is the requisite industry demand for wCBDCs. In fact, when asked this during a session on CBDCs, 39% of the audience responded that wCBDCs are not needed as current solutions, such as RTGS, are fit for purpose (see Figure 1). For Klein, the success of wCBDCs will depend on finding and driving solutions that meet relevant use cases.

Figure 1: Audience response to wCBDCs

Source: EBAday poll

5) The future of correspondent banking

For decades correspondent banks have been an essential part of the global payments landscape. Today, the ongoing introduction of new technologies and initiatives to improve the speed, cost and transparency of cross-border transactions – alongside the mounting costs and compliance burdens of the correspondent banking model – are bringing the future of this longstanding model into question.

In the EBAday panel ‘Correspondent Banking – essential or dispensable?’, panellists were asked whether the financial community can continue to work in the same way going forward? For Dayana Borrero, Head of Institutional Cash Management and Trade Sales & Client Management – Iberia at Deutsche Bank, “the simple answer is no”.

It doesn’t necessarily mean there is no way forward for correspondent banking – and ongoing evolution and adaption will play a significant role. Accepting the flaws in the correspondent banking model, the panellists focused on ways to address them – highlighting that efforts that have been underway for several years and are starting to bridge the gap.

“As an industry, we have already made significant progress, with the introduction of Swift gpi and the recent launch of Swift Go, and ongoing work on the IXB initiative and ISO 20022,” said Borrero.

The work, however, is not yet complete. “We cannot lose sight of the fact that our largest cost driver is the demand for regulation and the implementation of robust control frameworks,” added Borrero.

Certainly, the complex compliance processes involved in correspondent banking still needs addressing – and new technologies could, in fact, be the key. Automation can reduce manual efforts and enhance accuracy, ML can streamline know-your customer (KYC) and anti-money laundering (AML) processes and applying AI-based systems for transaction monitoring can help to detect suspicious activities in real-time, reduce false positives and improve overall compliance efficiencies.

According to Borrero, in order to apply these technologies in a standardised way across the network, collaboration and information sharing will be crucial. “Not only do we have the technological background to provide the credibility needed to support cross-border payments, but we are also well-capitalised institutions who provide the necessary security – and we are here to stay,” she concluded.

Deutsche Bank’s Dayana Borrero speaking during the panel “Correspondent Banking – essential or dispensable?” at EBAday 2023

6) Two technologies top of mind: AI and Cloud

AI was front of mind at EBAday. Deemed “the most popular two letters in banking” in the ‘How new technologies are transforming banking’ session, panellists were keen to discuss the top use cases for AI in payments. Examples include predictive analytics, automation of manual tasks, risk management, enhanced customer experiences and internal productivity gains.

There are, however, ethical concerns around AI. Panellists spoke on the importance of governments and regulators coming together to develop a responsible AI standard. “No person, no company and no government is above the law – and a technology should not be either,” explained Cal Corcoran, Vice President, Global Head of Banking, Microsoft.

Another technology playing a major role in the ongoing digital transformation in banking is the cloud. In the session ‘Bridging the cloud migration gap’, panellists discussed how conversations around cloud have rapidly evolved. Companies that once asked why they should migrate to the cloud, now ask how much to put on the cloud, whether to go down the multi-cloud route and consider the benefits of being cloud-native.

While these conversations are advancing, more work is needed on the execution side. According to the panellists, once traditional companies start to understand the organisational issues and technical questions that are holding them back – and are able to migrate as a result – the true benefits of the cloud will emerge.

7) Achieving gender parity, diversity and inclusion

There are still far fewer women in the payments industry than men. At EBAday 2023, a panel session entitled ‘Open Banking – open for women?’ focused on how banks, consultancies and payment service providers can achieve not only gender parity but also diversity and inclusion.

The panellists spoke on the positive change they have seen in financial services industries, with many companies seen to be adopting and supporting diversity. But for many, the pace of change was unsatisfactory. Sara Solana, Senior Relationship Manager, Swift was very clear that she feels the changes we are experiencing are part of an evolution rather than a revolution, even if the velocity of change is increasing.

Another element of the discussion was around the lack of women ascending the career ladder. Research reports – such as McKinsey’s 2022 report Women in the Workplace5 – show equal numbers of men and women at entry level but this changes as jobs become more senior and responsible, where women are then dramatically underrepresented.

And although the panel was focused on women, this is not the only bias of the financial services world – with ageism becoming a more visible problem as people want or need to work longer and with unbalanced representation of ethnicities still apparent. The panellists concluded with the hope that they will experience a work environment where colour, gender, age and beliefs are totally irrelevant and talent, promise, skills, experience was paramount.

Adíos Madrid, Olá Lisbon!

The transaction banking space has seen significant change in recent years. Many of the topics that we have discussed for some time – such as digital transformation, the cloud and real-time payments – have become more or less a reality. Yet as one drumbeat fades out, another steps in to take its place – with new questions around topics like CBDCs, real-time fraud prevention and real-time cross-border payments now emerging.

There is, therefore, much work to be done and progress to be made before we all gather again for EBAday 2024, which will be held in Lisbon on 18–19 June 2024. One thing is certain, the steady beat of transaction banking, and the need for collaboration, will continue – evolving to keep pace with customer demands, new technologies and regulatory guidance.

The Euro Banking Association payments conference, EBA Day 2023: Advancing next generation payments – a quest for global interoperability, took place 20 and 21 June 2023 at the IFEMA, Madrid.

Sources

1 See bankofengland.co.uk

2 See "Beyond traditional deposits" at flow.db.com

3 See consilium.europa.eu

4 See ecb.europa.eu

5 See mckinsey.com