25 January 2023

The combination of rising interest rates, high levels of market liquidity and low appetite for loans is leading banks and their institutional clients to be more inventive with the way they manage their excess liquidity. flow explores the alternatives to current account deposits

After a long period of low and even negative interest rates, a new era of rising rates across major currencies – particularly in USD and EUR – has begun. And as policy makers around the globe battle to keep the decade-high levels of inflation down, this trend is set to continue.

At the same time, the market remains flush with liquidity, while the demand for loans and investment into the real economy remains low – making banks reluctant to take on large current account deposits. As a result, treasurers are increasingly turning to alternative investment instruments to get the most out of their cash reserves 1

Rising rates

In the US, rate hikes started early this year, moving from near zero to a range of 4.25% to 4.5% today. According to the US central bank’s own projections, US dollar rates are expected to peak at 4.5% to 4.75% in 20232 – though other estimates suggest that this could rise to as high as 5%.3 By comparison, rates in Europe have been on the rise since the end of July – and have moved from negative 0.5% to positive 2% so far this year.4 And there is likely more to come – with some estimates suggesting that European interest rates could be pushed to 3% and beyond in the coming year.5

The market expectation is that rates are likely to rise until inflation – the primary driver behind the hikes – begins to slow. But market expectations do not always come true – and a lot will depend on how inflation and the economic landscape develops in the coming months.

“One potential turning point, for example, could be the onset of regional or global recessions, for which central banks would likely begin to reverse the interest rate hikes to drive investments into the real economy,” explains Koral Araskin, Head of Liquidity Solutions, Institutional Cash Management at Deutsche Bank. “Whether this will happen – and the size of this potential correction – is, however, another unknown that is difficult to account for.”

A very liquid market

The current situation is uncommon. Banks face an excess of liquidity even as interest rates are on the rise. This, in turn, is changing the conventional wisdom around how to manage cash in a rising rate environment.

This has been born of a decade of highly accommodative monetary policy from the world’s central banks. Following the financial crisis, and redoubled during the pandemic, central banks sought to stimulate and stabilise the market by flooding it with liquidity – providing banks with “cheap” money in the form of low interest rates, which the banks could then use to offer loans and drive growth in the real economy. Negative interest rates – as seen in Europe, for instance – went a step further by actively incentivising banks not to hold liquidity.

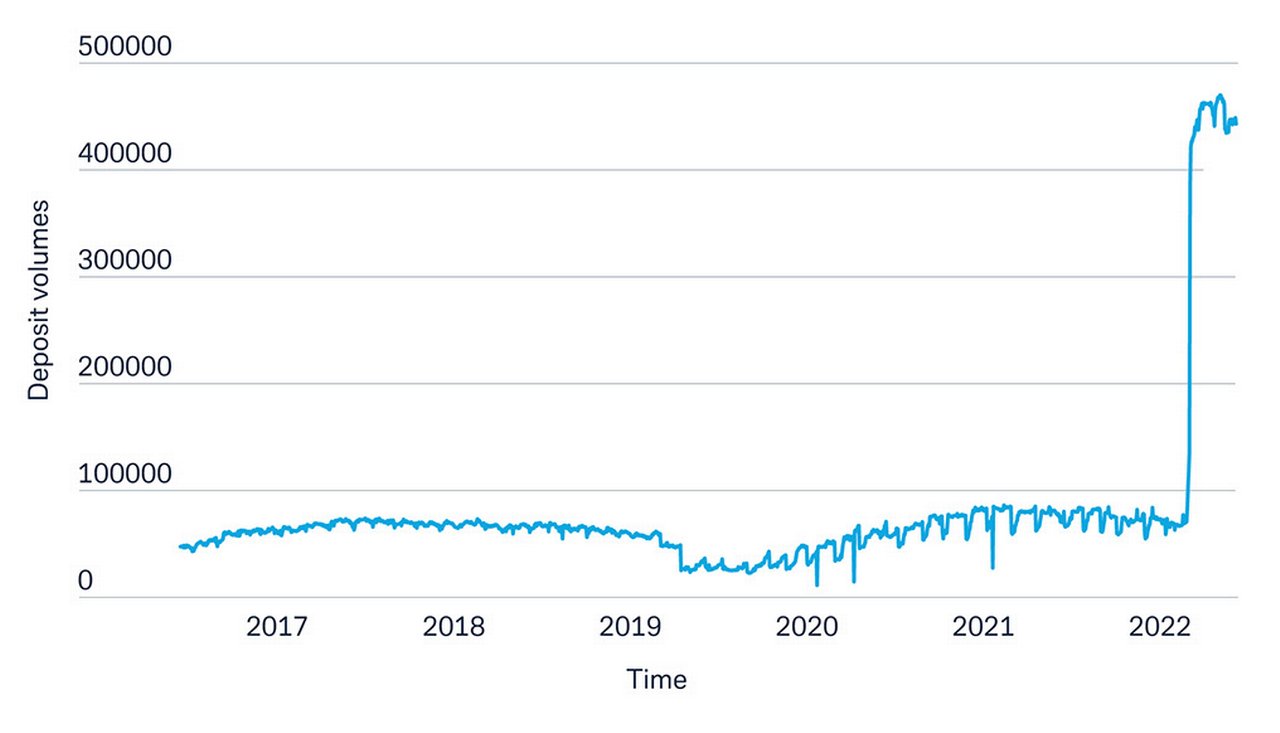

The issue, however, is that you cannot enforce the deployment of liquidity to the market if the demand for this deployment does not exist. Put simply, companies need to require funding for these monetary policies to be effective. For the past few years, the demand has not matched the level of liquidity available – meaning that the cash being provided by central banks has, for the most part, not been deployed in the way it was intended. As a result, these expansive monetary policies have left the market flush with liquidity (see Figure 1).

Figure 1: Bank deposit levels kept at the European Central Bank (ECB) Deposit Facility

Source: Refinitiv Eikon ECBDFU=ECBF

Deploying liquidity

So, what do rising rates and high levels of liquidity mean for banks? If you simplify the business model of a commercial bank, it is about taking deposits and deploying these as loans; and typically, the return on these loans drives the appetite to attract deposits. In last few years, however, sitting on that liquidity has not been an effective strategy for banks from a revenue perspective – as the interest rate was, at best, close to zero.

In the current rising rate environment, it has become profitable to hold liquidity – but that only holds true for banks that want to hold deposits. So, why exactly might banks not want to attract additional liquidity via current accounts?

The funding value of deposits strongly depends on client types and the nature of the deposits. In the past, banks were able to take short-term cash deposits from clients and deposit them in long-term investments. The introduction of the Basel III regulations radically changed this practice. Today, banks can only use “sticky” operational cash – cash that is in regular use by the client – for their long-term investments. By comparison, idle cash in accounts become part of the bank’s own assets and is, in turn, held as cash by the bank in its central bank accounts.

The challenge is that there is already an excess of cash being held in central bank accounts, due to the inability to effectively deploy this liquidity in the market. And with loans and investments not expected to grow significantly, it is less favourable – from a liquidity value contribution and balance sheet management perspective – for banks to take on additional current account deposits from their clients.6 As a result, banks are looking to reduce these deposit types where possible, which is having a knock-on effect for treasurers looking to get returns on their excess cash – as current accounts with partially or even fully idle cash are no longer an efficient or effective option for this.

“The trend towards reshoring and the transformation we will see in various industries has the potential to increase the demand for financing”

The environment could change going forward. In the wake of rising energy prices – precipitated by the ongoing conflict in Ukraine – governments and industries are increasingly looking to restructure how they source energy and other resources, as well as reviewing their global footprint and supply chains.

“The trend towards reshoring and the transformation we will see in various industries has the potential to increase the demand for financing and loans, which in turn would help banks open up to more deposits. But regardless of what happens tomorrow, the challenge today remains the same – how can excess liquidity be effectively managed in this situation?” adds Araskin.

Beyond account balances

Despite the high levels of liquidity in the market, the rising interest rates do offer opportunities to improve returns on excess cash. For example, one of the levers that treasurers can pull is to turn away from traditional account deposits and towards investment instruments, such as term deposits, reverse repos and money market funds.

Term deposits – a type of financial account where money is locked up for a set period in return for higher interest payments – can help institutional clients take advantage of the steep interest rate curves.

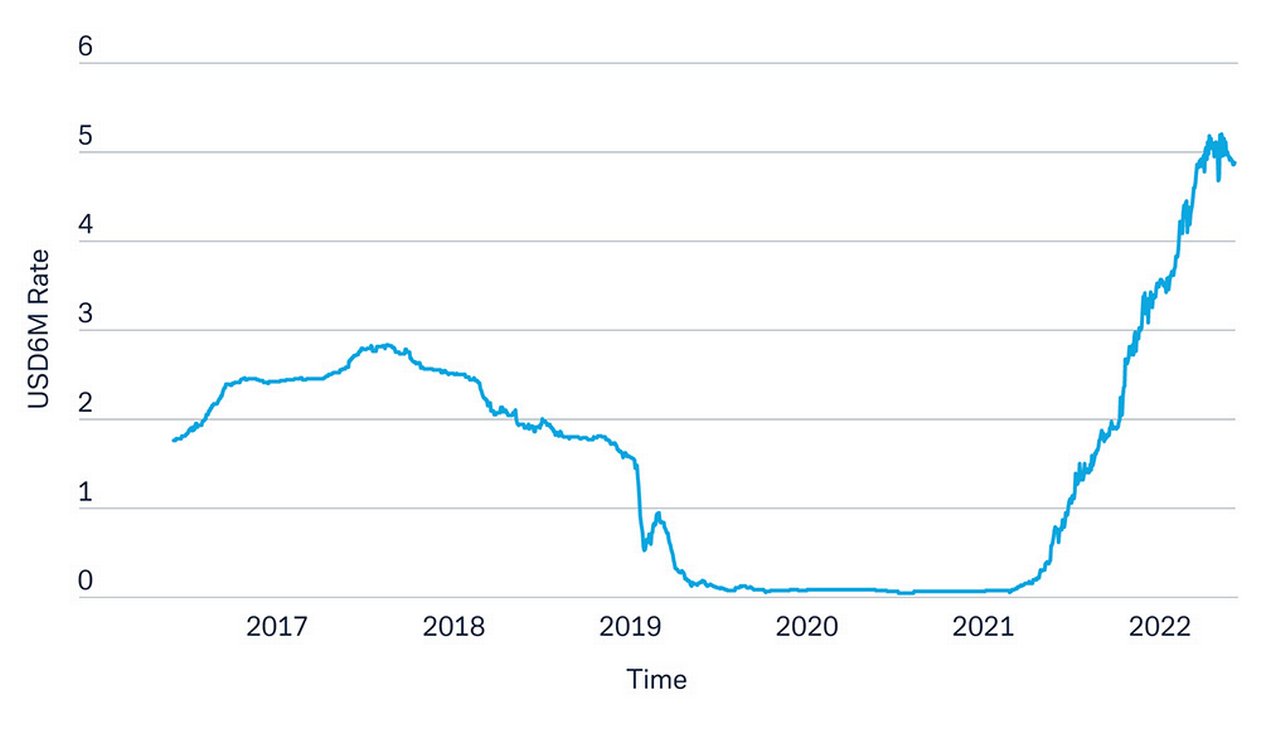

Market rates for fixed term deposits have significantly increased throughout 2022, starting from near zero at the end of 2021 and rising above 5% levels today (see Figure 2). “With term deposits, while clients still have the risk of the bank they deposit with, they can enjoy a higher interest rate,” explains Araskin. “And with rates expected to continue to rise, a 4- or 6-month deposit rate can, for example, provide a very interesting pick-up in terms of returns compared to the overnight rate.”

Figure 2: USD six-month term deposits rate (2017 to 2022)

Source: Refinitiv Eikon USD6MD

Another option is reverse repos, where clients enter into a short-term agreement to purchase securities and then sell them back at a slightly higher price. “The advantage for clients is that they get a higher rate, while reducing their overall exposure and risk position – and instead of cash, they now also have their collateral of choice at hand. As this produce is not held on the bank’s balance sheets acting as an agent, clients are likely to be able to invest larger amounts of their cash as well,” says Araskin.

Money market funds (MMFs) are also a viable alternative, either as a suitable complement or replacement to current account deposits. “MMFs would not usually give higher interest rates – and are much more closely aligned with traditional deposits in this sense,” explains Araskin. “At the same time, however, they provide much greater flexibility as they are, at least conceptually, highly liquid – meaning that you put the cash in and take it out as you choose. And as these volumes do not sit on a bank’s balance sheet, this could be an attractive option for those with larger balances.”

While the situation banks find themselves in is unusual, there are several tools at their disposal to help them and their clients make effective use of the high levels of liquidity in the market. Reviewing these tools and putting them to work is the key to benefiting from the current environment.

For further insights on liquidity management in the current environment, please view Koral Araskin’s Finextra video interview here

Sources

1 See finextra.com

2 See bloomberg.com

3 See bloomberg.com

4 See ecb.europa.eu

5 See reuters.com

6 See dbresearch.com