30 August 2022

While Covid-19 infection rates are reducing in many parts of the world, the impact on societies, economies and business models will continue. flow shares key points from the latest Economist Impact report, Manoeuvring uncertainty: Treasury priorities in a volatile, post-pandemic market sponsored by Deutsche Bank

MINUTES min read

Treasury has played a key role in managing the repercussions of the pandemic on cash, liquidity and risk and enabling emerging digital business models. On top of this, they are now having to layer on the effects of the ongoing Russia/Ukraine conflict and soaring inflation. The Economist Impact report, sponsored by Deutsche Bank, provides a deeper dive into how treasurers are adapting to the new reality. Based on a survey amongst 150 treasurers across North America, EMEA and Asia Pacific in April and May 2022, the research was published in June 2022. This article shares some of the key findings.

Looking ahead to disruptions facing treasury

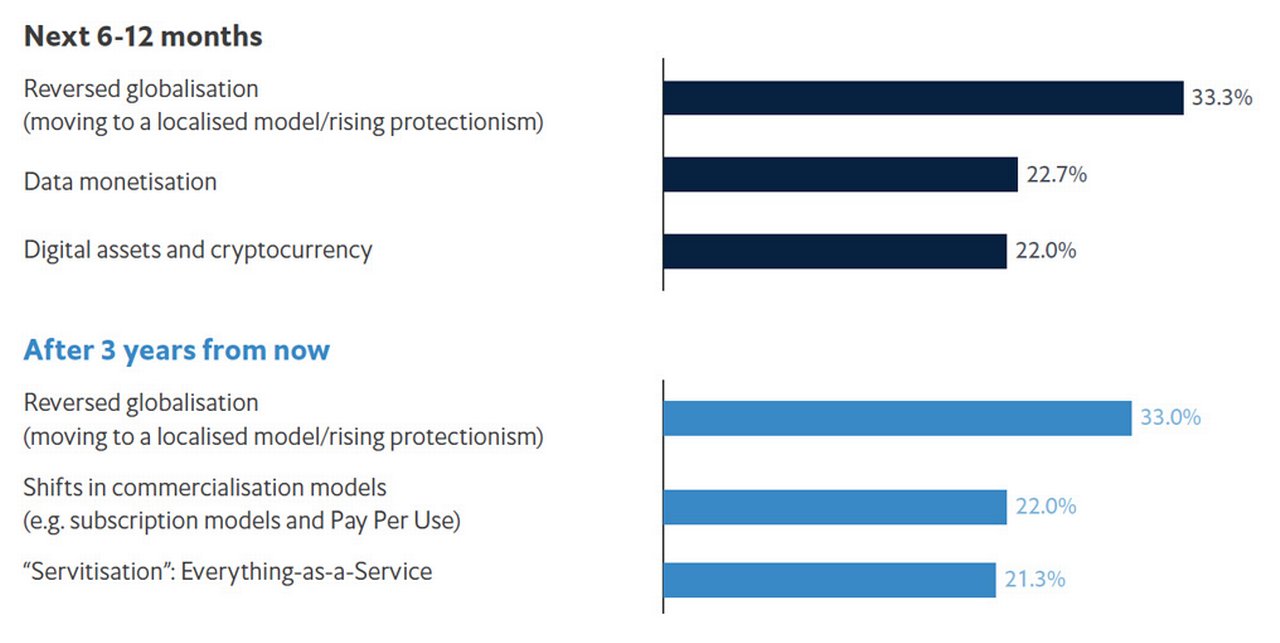

The report illustrates that the reversal in globalisation is the most significant disruption for treasurers, both in the short term (33%) and longer term (Figure 1).

The conflict continues to have repercussions on supply chains, transportation costs and access to critical raw materials.1 In addition, China’s zero-Covid policy and associated lockdowns (including port facilities) mean that products from the world’s biggest supplier face significant barriers in reaching customers.

Figure 1: Disruptions affecting the treasury function the most, Apr-May 2022

Source: Economist Impact survey April-May 2022

The other perhaps more surprisingly notable short-term disruptions highlighted in the study relate to digital assets/cryptocurrencies, with 22.7% of responses highlighting this issue. While some corporations have experimented with cryptocurrencies – the report states that 27 publicly listed US corporations held US$8bn of digital assets in January 20222 – cryptocurrencies have been subject to extreme volatility and concerns continue to be raised around the lack of regulation.3 However, with treasurers facing more immediate economic and trade concerns, it seems likely that this figure would be lower if treasurers were asked the same question today.

Access to high quality, timely and complete data has been a perennial priority for treasury, and the current geopolitical and economic challenges will further exacerbate these concerns.4 While the monetisation of data held by banks or vendors results in a cost for treasurers, the value can exceed this cost by enabling better cash flow forecasting and improved liquidity management, each noted by 19% of treasurers, through to supporting automated processes such as in-house banking and netting (29%).

Claudia Villasis-Wallraff, Head of CCM Treasury Advisory APAC at Deutsche Bank comments, “While there remain challenges in creating, transferring, storing accurate and complete data, these are becoming easier to overcome through better standardisation, e.g. ISO 20022 and APIs for the dynamic and even real-time transfer of information between systems.” She continues, “On top of these, automation and decision support tools help to harness and visualise data more effectively.”

Treasury priorities at a time of uncertain economic recovery

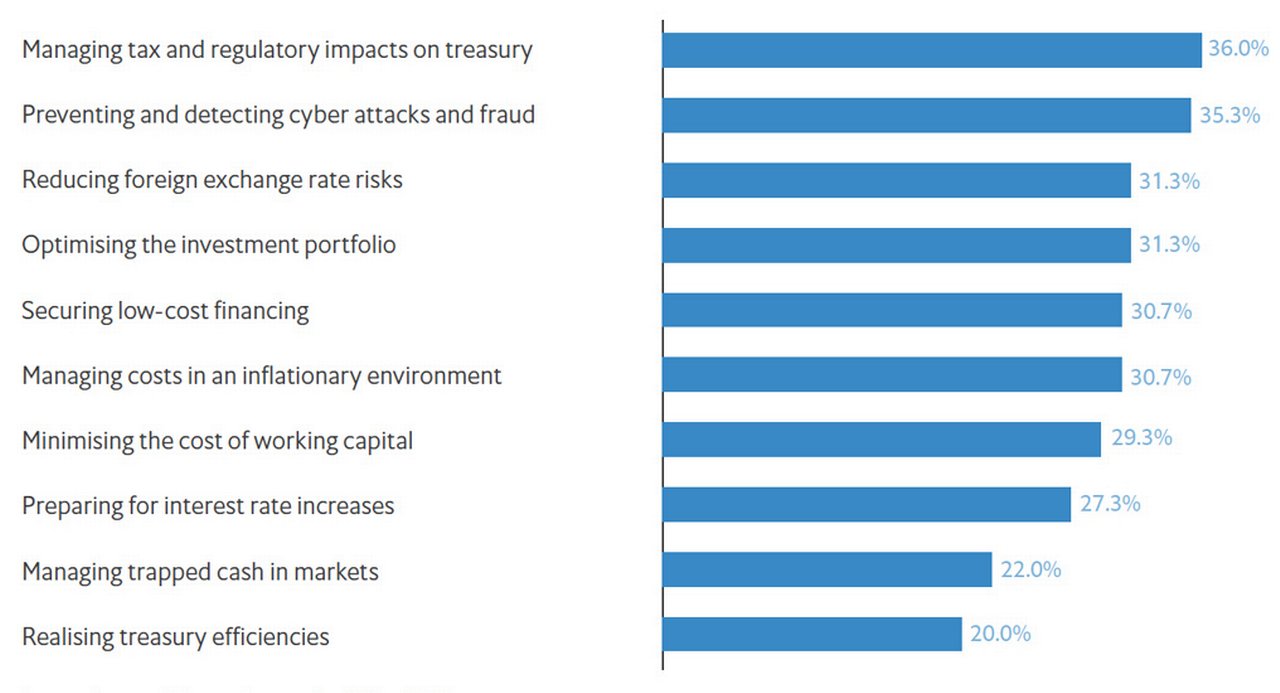

As treasurers start to look ahead to an uncertain future, many of their major priorities relate to the liquidity and risk needs of the business (see Figure 2), such as:

- Managing trapped cash in markets (22%);

- Reducing foreign exchange rate risks (31.3%)

- Optimising the investment portfolio (31.3%)

- Minimising the cost of working capital (29.3%)

Treasurers’ top two concerns, namely managing the effects of tax and regulation in treasury (36%) and cyber risk and fraud (35.3%) are longstanding issues for treasurers, but they have become more immediate in recent months. During the pandemic, fraud and cybersecurity incidences proliferated, with the report pointing to an “all-time high in 2021, with over 900 attacks per organisation in the fourth quarter alone”.

The report also provides an update on the tax concerns noting, “Numerous regulatory reform proposals are set to materialise over the next two years. For example, the OECD is making progress with its proposed global tax agreement, under which large companies will pay a 15% tax in countries where their customers are located, rather than where they are headquartered. In addition, the European Commission is reviewing the EU’s existing Markets in Financial Instruments Directive II, aimed at improving market transparency and structure.”

Figure 2: Top treasury priorities amid an uncertain economic recovery in Apr-May 2022 (%)

Source: Economist Impact survey April-May 2022

Reassessing investment plans

With rising inflation and interest rate hikes, the study notes how treasurers are reassessing their investment plans to take advantage of higher yield opportunities to offset the effects of inflation. More than 40% of surveyed treasurers plan to increase their long-term investments and investments in bonds nearing their maturity dates over the next two years, while reducing investments in repurchase agreements and commercial paper. In addition, the study noted that some treasurers were keen to draw down bank deposits, and ahead of interest rate hikes, “some companies were keen to pay off debt rather than keep cash on the balance sheet”.

“Few treasurers have managed the impact of high, and rapidly increasing inflation during their professional careers, with exceptions in isolated markets”

Embracing expertise and disruption to manage challenge and change

Treasurers have always been adept at managing change and uncertainty, and the effects of the pandemic, together with the ongoing geopolitical and economic challenges mean that managing liquidity and risk will continue to be vitally important. As Ole Matthiessen, Global Head of Cash Management and Head of Corporate Bank APAC, Deutsche Bank emphasises, however, “Few treasurers have managed the impact of high, and rapidly increasing inflation during their professional careers, with exceptions in isolated markets.” He continues, “It is therefore more important than ever to work with trusted banking partners to ensure their business is resilient to liquidity, risk and supply chain shocks, and that their investment portfolios are supporting their risk, liquidity and return requirements.”

In addition to preparing the organisation for challenge and change by doubling down on their traditional liquidity and risk management responsibilities, treasurers are also considering how emerging – potentially disruptive – opportunities could help them to add further value to the enterprise.

Twenty one percent (21%) of survey participants indicated that what is coined “servitisation” in the report, or everything “as-a-service”, will have an impact on treasury over the next three years. As an example, treasurers are increasingly embracing software-as-a-service (SaaS) to access and manage treasury technology solutions more easily than installing on-site. Opportunities are also expanding in areas such as payments-as-a-service to support new payment methods more quickly and connect flows into their existing infrastructure, and data-as-a-service, which is linked to the data monetisation point explained above.

What the report makes clear is that while disruption and new opportunities, such as in the adoption of technology and use of data, may challenge existing ways of thinking in treasury, they are also opening up new avenues to help treasurers tackle the challenges ahead. As Andrea Sottoriva, Group Treasurer and Finance Director of Swiss information technology companty SITA put it in a 2022 Deutsche Bank supported Economist Impact webinar, “Treasurers are policemen for cash. When we lose control, we lose our job.5

The full Economist Impact report, The post-pandemic recovery is available here

Sources

1 See forbes.com

2 See tradingplatforms.com

3 See "Is the crypto party over?" at flow.db.com

4 See "Why treasury automation is a must" at flow.db.com

5 See "Investing strategies in inflationary times" at flow.db.com

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

CASH MANAGEMENT, TECHNOLOGY

Why treasury automation is a must Why treasury automation is a must

Driving treasury automation has taken on added urgency since Covid-19. flow’s Desiree Buchholz and Helen Sanders looks at how the pandemic has altered priorities, why implementing new solutions takes time and how working with fintechs can help to accelerate the process

MACRO AND MARKETS, CASH MANAGEMENT

Is the crypto party over? Is the crypto party over?

The presumption that Bitcoin and its peers offer a hedge against inflation has been debunked by recent sharp falls. The plunge extended to stablecoins, which are supposedly far less volatile. flow summarises Deutsche Bank Research analysis on crypto perception and reality

CASH MANAGEMENT

Investing strategies in inflationary times Investing strategies in inflationary times

In an Economist Impact webinar supported by Deutsche Bank, two corporate treasurers shared how inflationary pressures are affecting their investment strategies – and why the Covid-19 pandemic is still shaping cash policies. flow summarises the three key learning points