12 April 2024

As a new EU regulation will mandate banks to offer euro instant payments to their customers, solutions such as Request to Pay (RTP) are set to gain importance. flow’s Desirée Buchholz reports on how credit manager Lowell uses RTP to simplify payments for the consumer – and improve efficiency

MINUTES min read

In a digital world where consumers can buy goods such as washing machines with same-day delivery, it’s hard to explain why it takes a day or more for payments to be credited to the beneficiary. That is why, in 2017 the euro area introduced the so-called SEPA instant credit transfers (SCT Inst), where funds are available in a payee’s account within 10 seconds of the payment instruction.1

Yet, according to the ECB, SCT Inst only accounted for about 14% of all conventional SEPA credit transfers as of May 20232 – due, at least to some extent, to the unavailability of this payment method. “One in three payment service providers (PSPs) do not offer euro instant payments,” said Valdis Dombrovskis, Vice President of the EU Commission in October 2022 when presenting a new regulatory initiative.3

To speed up the adoption of instant payments, the EU will soon require all PSPs to offer the service of sending and receiving instant payments in euros. Moreover, they will not be allowed to charge more for instant payments than for a standard credit transfer, which can take days. By 9 January 2025, all PSPs in the EU will have to be able to receive instant payments from their customers. On 9 October 2025, they will be required to offer their customers to send instant payments. For bank-PSPs in non-eurozone member states, the deadline for receiving instant payments is 9 January 2027, for sending it is 9 July 2027..4

The EU places high hopes on this initiative, believing that the “new rules will improve the strategic autonomy of the European economic and financial sector as they will help reduce any excessive reliance on third-country financial institutions and infrastructures.” This statement refers to non-bank PSPs such as PayPal, Google Pay or Alipay, each popular with European consumers as well. Expected benefits also include “improving the possibilities to mobilise cashflows will bring benefits for citizens and companies and allow for innovative added value services.”

Lowell: Introducing a new, reliable payment method

What are the benefits of instant payments? The question can, for example, be answered by looking at the case of Lowell, one of Europe’s largest credit management companies operating in the UK, Germany, Austria, Switzerland, Denmark, Norway, Finland, and Sweden. The company was formed in 2015 from the merger of the UK-based Lowell Group and Germany’s GFKL Group and backers are global private equity firm Permira and Ontario Teachers’ Pension Plan.5 In 2023, the group employed more than 4,000 people and generated a cash income of £1.233bn (€1.44bn).6

Lowell offers a range of services across debt collection, credit risk reduction and business process outsourcing. Most importantly, the company collects money on behalf of companies in the following sectors: e-commerce and retail; utilities and public transport; financial services; insurance, telecommunications and travel; and publishing as well as fitness and health.7 When a consumer is unable to pay their bill in time, Lowell acts as the intermediary between its clients and their consumers to resolve the issue.

“We want to offer the consumers a range of different payment methods to choose from”

Its services require Lowell to have reliable mechanisms for collecting the outstanding payments from consumers, explains Manfred Demuth, who is responsible for online payments at Lowell in Germany, Austria and Switzerland: “We want to offer the consumers a range of different payment methods to choose from, which are secure, convenient and easy to use,” he says.

Combining SEPA instant payments and PSD2

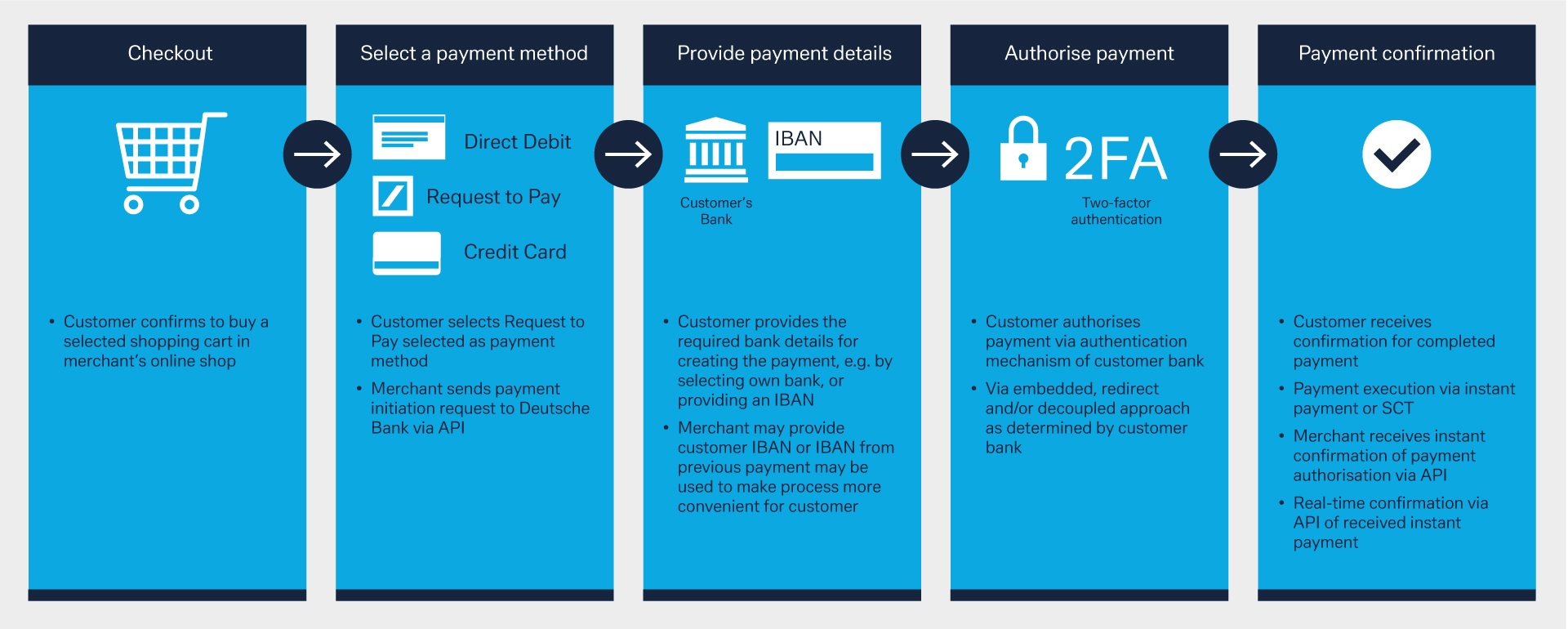

This is where Request to Pay (RTP), a relatively new payment method, comes into play. “This service allows merchants and companies like Lowell to collect funds from customers in an integrated, automated and secure manner,” explains Florian Nowack, Product Manager for Request to Pay at Deutsche Bank Corporate Bank. “The payment is embedded into the communication with the consumer in a way that they can easily transition from the shopping cart, the invoice or a payment reminder to the payment process.” (see Figure 1).

Figure 1: Request to Pay – Steps for the consumer

Source: Deutsche Bank

In the euro area, Request to Pay is based on two foundations:

- The EU’s Revised Payment Service Directive (PSD2)

- SEPA instant payments

While PSD2 allows for licensed third parties like Deutsche Bank to access and service accounts held by other banks, SEPA instant payments enable the money to be transferred in real time with finality of payment in less than 10 seconds. Drawing on these characteristics, RTP is one of the new open banking solutions that aim to improve the payment process for merchants, corporate treasury departments and consumers.

“This initiative is part of our digital transformation journey”

Digital Transformation at Lowell

At Lowell in Germany, Request to Pay was implemented in early 2023 in cooperation with Deutsche Bank and Serrala, the company’s payment software provider. “This initiative is part of our digital transformation journey, which was successfully launched in 2023. With RTP we react to the needs of our consumers, which is in line with our commitment to digitalisation,” explains Carmen Czyszczon, Treasurer Cash & Liquidity Management at Lowell.

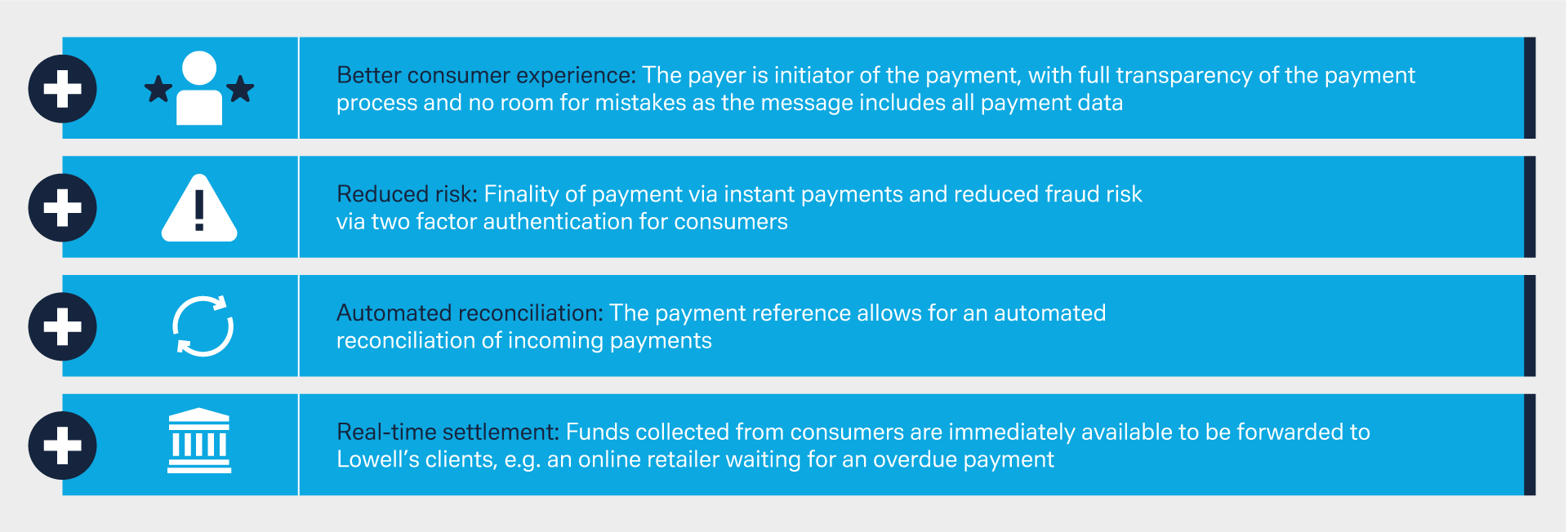

The goal is to move away from collecting outstanding payments in manual and at least partially analogue processes – i.e., by issuing payment reminders via letters, emails or phone calls – to an end-to-end integrated digital process. Request to Pay allows for this, Demuth adds, by including a payment link or QR code in the communication with the consumers. “By clicking on the link or scanning the QR code, the consumer gets redirected to the Request to Pay page where they get in contact with their bank and ultimately approve a pre-defined payment amount.” As the RTP also includes a unique payment reference, this allows for an automated reconciliation of the payment at Lowell’s end.

Figure 2: Benefits of Request to Pay for Lowell

Source: Deutsche Bank, Lowell

Within the first year of offering, RTP has become the third most-used payment methods by Lowell’s customers, Demuth explains. To date, the company has implemented RTP in Germany only but going forward it plans to offer the payment methods in its other markets as well, he adds: “The EU instant payment regulation will help us because – as of now – not all of our customers’ banks support instant payment.” As they will be required to do so under the new regulation, RTP could get a boost as well.

Sources

1 See europeanpaymentscouncil.eu

2 See ecb.europa.eu

3 See ec.europa.eu

4 See eur-lex.europa.eu

5 See lowell.com

6 See lowell.com

7 See lowell.com