31 October 2023

German fintech Moss offers small and medium-sized companies real-time visibility and control over their expenses. flow’s Desirée Buchholz reports on why APIs and virtual account numbers are essential for the start-up – and how Moss has teamed up with Deutsche Bank to enable real-time account top ups and withdrawals for its clients

MINUTES min read

‘How can our company save money?’ While business leaders are always looking for opportunities to reduce costs, the pressure to lower business expenses has intensified since the outbreak of the Covid-19 pandemic in 2020. Most recently, elevated inflation rates in Europe coupled with weak GDP growth rates are eating up corporate profits – with the German economy being particularly exposed to the slowdown in China, its most important export destination.

This is where digital spend management platforms such as Moss come into play. Moss allows companies to collect, categorise and evaluate spend data as a pre-requisite for reducing costs for travel, procurement, or administrative expenses. In addition to providing transparency over costs, the Moss platform can contribute to increasing process efficiency and automation in accounting.

While competition in the market for business spend tools is fierce, so are growth perspectives: According to data published by Fortune Business Insights, the global business spend management software market is projected to more than double its size from US$21.08bn in 2023 to US$46.42bn by 2030.1

Reaping the benefits of real-time

One of the providers which is part of this development is Berlin-based fintech Moss: The company, which was founded in 2019 and now comprises a team of 300 finance and software experts, has built a platform which provides finance departments with real-time visibility and control over their expenses. The offering consists of five modules:

- Issuance of virtual and physical credit cards;

- Digital entry and approval of invoices;

- Processing and receipt collection of employee expenses;

- Budget and liquidity management; and

- Pre-accounting.

Moss employees in front of the company building in Berlin

Currently, the fintech’s platform processes more than €2bn of corporate spend annually – mostly European small and medium-sized companies (SMEs) or start-ups. “Our typical client has 30 to 250 employees,” says Maximilian Traugott, Head of Business Operations at Moss. “Companies of this size usually don’t have large teams to handle accounting and budget planning – and thus need to rely on process automation and software support.”

“The new solution allows our customers to top up their debit card account in real time”

Most recently, Moss has reached two important milestones which are essential for the fintech’s ambitious growth plan to become “the leading financial management platform for businesses across Europe.”2 First, in June 2022, the company received a German E-Money Institution (EMI) licence from the German Federal Financial Supervisory Authority (BaFin). “This means that we no longer rely on a payment service provider to manage payments for our clients,” explains Traugott.

Second, the company has teamed up with Deutsche Bank to introduce a combination of API technology and virtual account numbers for its corporate debit card offering. What could sound technical – and this article will go on to describe the new process – is an integral part of improving customer experience for Moss clients, Traugott says, “The new solution allows our customers to top up their debit card account in 24/7 in real time.” This was not possible in the previous set-up without SEPA Instant Payment.

Why is that necessary? Traugott offers an example to outline the relevance of instant payments: It’s late evening on a Friday and a customer of Moss is finalising marketing for its major documentary to appear on Netflix over the weekend. Everything is carefully coordinated, and the plan is that the launch will be accompanied by a big campaign including Google Ads. However, the team notices at the last minute that it has insufficient funds on its corporate debit card account to pay for the ads. In this case, only a real-time transfer allows for the top up and, hence, the big campaign to go ahead.

Another typical use case where Moss’s clients require instant money transfers on their corporate debit cards: An employee is on business travel and checks out of his hotel on Saturday morning – but forgot to top up their company debit card in advance. “In the past, we needed to find manual work arounds for our clients, the combination of API technology and virtual account numbers now enables an automated workflow around the clock for instant top up of the debit card account,” explains Traugott.

Marrying API technology and virtual account numbers

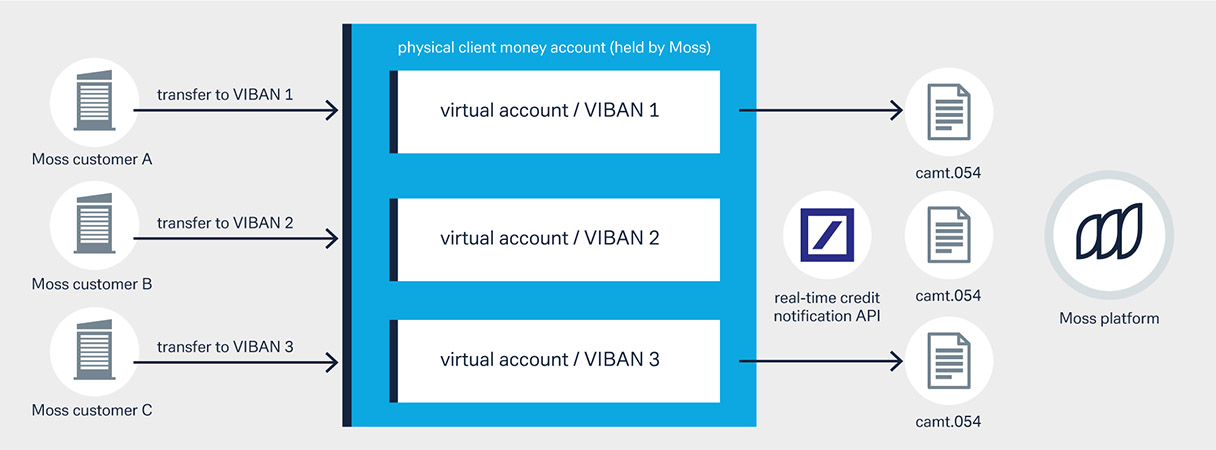

So, what does the new process look like? To get started, Moss customers top up their debit card accounts by transferring funds to a VIBAN, which is individually assigned to them by Moss. From their perspective, VIBANs are identical to traditional account numbers – and each one is linked to one physical client money account held by Moss.

Once the fintech receives a payment from one of its customers, a real-time credit notification gets triggered over the Deutsche Bank API channel. All transactions details – including virtual account number references – are reported in camt.054 messages which are sent to Moss for instant and fully-automated reconciliation.

This means that – thanks to real-time credit notifications and virtual account number-based reconciliation – deposits become instantly available to the fintech’s customers and can be used immediately for business expenses (see Figure 1).

Figure 1: Real-time account top-ups based on corporate API and virtual account numbers

Source: Deutsche Bank

“This new process significantly improves customer experience,” says Traugott. Moreover, it also streamlines Moss’s internal processes, freeing up capacities in the fintech’s payment operations team, “which can now be used for more strategic, value-adding tasks,” he adds.

“Moss is an outstanding example highlighting how the combination of corporate APIs and virtual account numbers not only increases efficiency but can become a differentiating factor when it comes to soliciting new clients,” says Jens Hartmann, Corporate API Partnerships Cash Management at Deutsche Bank Corporate Bank.

More APIs to be introduced

While the process described above covers the deposit side – ensuring that Moss customers have enough money on their debit card account to pay their card expenses – the fintech also plans to offer real-time pay-outs to third parties from early 2024. Once launched, this feature will allow companies to use the fintech’s platform to trigger global, instant pay-outs, i.e. to reimburse employees or pay invoices in real time, which is supposed to give customers maximum control over their spend via the Moss platform. This will be done with the help of Deutsche Bank’s SEPA Instant Payments API (see Figure 2).

Figure 2: Real-time account pay-outs based on SEPA Instant Payment API

Source: Deutsche Bank

“We decided to partner with Deutsche Bank on this project because we were looking for a reliable partner with a global footprint that offers German virtual account numbers,” adds Traugott. “If you’re handling customer money as we are, trust is very important – and ‘made in Germany’ underpins this.” Moreover, the availability of APIs was another mandatory requirement – given that traditional ways of bank connectivity in Europe (for example the Electronic Banking Internet Communication Standard, Ebics) wouldn’t have been as flexible and capable of supporting real-time automation.