23 December 2022

What’s next for a treasury team that already excels in automation and efficiency? For Roche, the answer is to explore the use of new technology, notably blockchain, to create a new way of working with its suppliers, and signpost fundamental changes to financial markets infrastructure, as Helen Sanders reports

MINUTES min read

Roche has a centralised treasury function, including an innovative treasury operations team that, for the past decade, has led the profession in making its vision of centralisation, optimisation and value creation a reality.

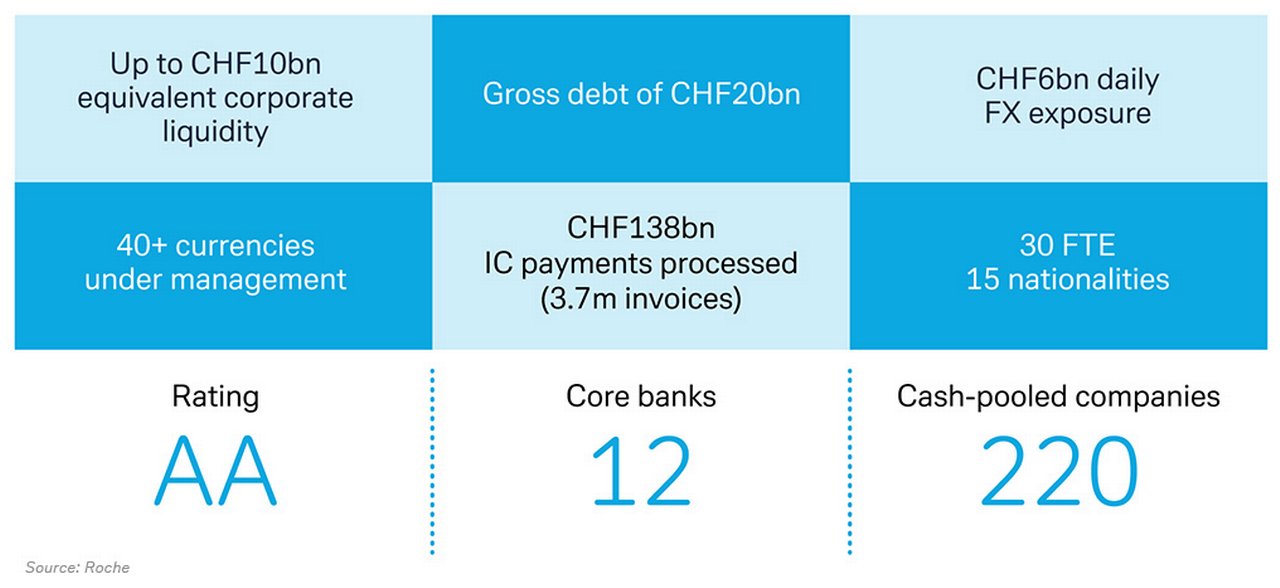

Roche’s approach to innovation, digitisation and automation has been at the heart of Roche’s centralisation and transformation. As a result, with only a small team (Figure 1), treasury manages CHF 10bn in corporate liquidity, gross debt of CHF20bn (US$ 21.58bn) and CHF 6bn (US$6.47bn) in daily FX exposures across 40 currencies.

Figure 1: Roche treasury at a glance

Source: Roche

Exploring the potential of blockchain technology

This philosophy has led the team to explore the opportunities created by distributed ledger technologies (DLT) or blockchain as they consider both the efficiencies that they can gain across their own ecosystem, and the future of money more widely. At a recent Deutsche Bank webinar Britta Döttger, Group Treasurer, Roche said, “Our blockchain journey started with the Libra (later Diem) white paper in 2019 which was based on the idea of a world cryptocurrency that is more accessible to the unbanked, more efficient with fewer fees, more stable in value than Bitcoin etc. and more long lasting through decentralisation. This really resonated with us.”

Roche therefore explored the research that was taking place through the Diem consortium in Switzerland, and looked more closely at the technology itself. Döttger continues, “DLT and blockchain offer more than standardisation, automation and efficiency that have been the main focus of new technologies for us in the past. Alongside the internet of things (IoT), web 3.0 and artificial intelligence, we could be part of a journey where we would, together with the business, implement new business processes, and maybe even new business models.”

As the name suggests, blockchains contain all transaction information in blocks that are chained together. Blockchains can be either public or private, with transaction data publicly available and transparent to all participants, together with block explorers and blockchain analytics. Each action on a transaction is time stamped and updated in real-time, so every participant has a single, up-to-date view. Smart contracts are emerging as a valuable way of leveraging blockchain technology in financial services to replace labour- and time-intensive processes. A smart contract is a digital agreement between two or more parties. It takes the form of code that runs on a distributed computer network that orchestrates processes that the participants have agreed on. The smart contract executes automatically based on fulfilment of the contract terms without the need of a validating third party.

“We teamed up with procurement colleagues who had … a complete case across procure-to-pay”

Roche’s business case for blockchain

The purpose of the first blockchain-based pilot project on which Roche’s treasury has embarked is to showcase what the technology is capable of, and the benefits it can deliver. In particular, the team was attracted to the technology’s ability to support a single source of truth, automate payments processing and position the business for future digital currencies. To do this, treasury partnered with the procurement business, to enhance process automation as well as the procure-to-pay processes and streamline working capital financing. Stefan Windisch, Senior Cash Manager, Roche explains, “We came to the conclusion that blockchain technology would allow us to share and create transparency over information across multiple perspectives. We teamed up with procurement colleagues who had concrete needs and a complete case across procure-to-pay.”

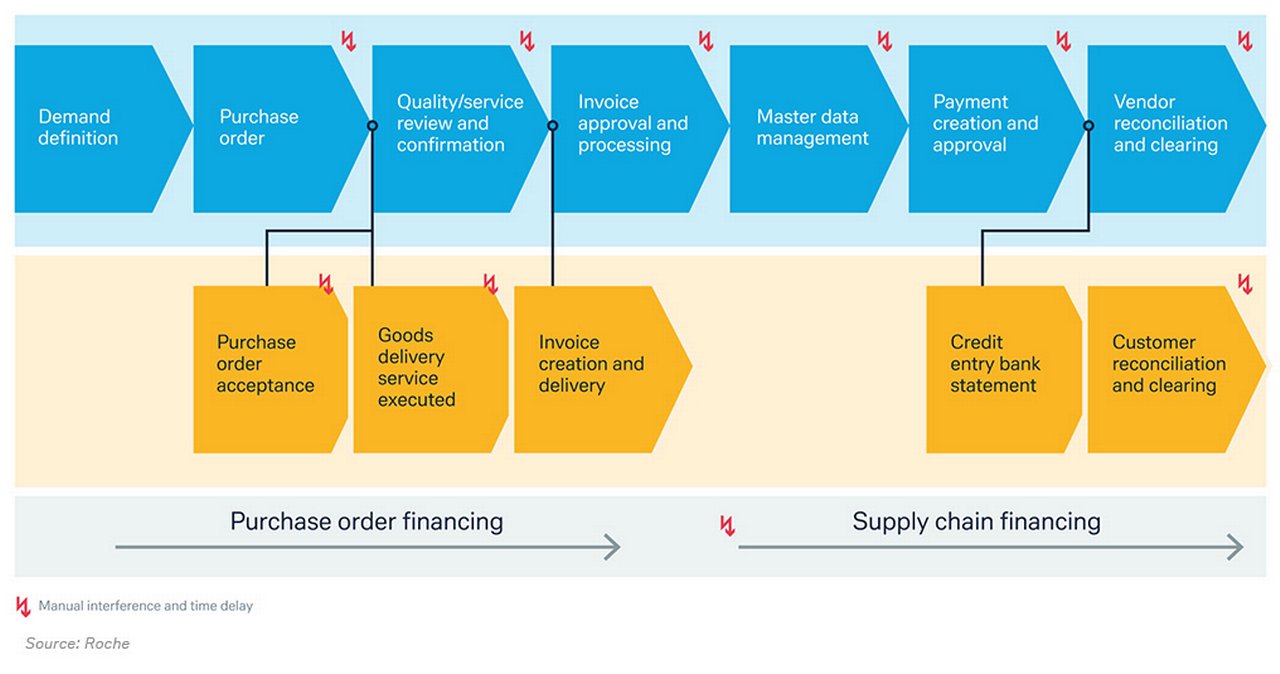

In most projects, companies focus on improving their own internal efficiencies and automation, without looking at how the value of these improvements can be replicated across the value chain. From a procure-to-pay perspective, this includes the buyer, the seller, but also the banks that transfer payments between them. Roche already had a purchase order (PO) and supply chain financing programme in place but recognised that inefficiencies across the value chain can result in delays between raising the purchase order and receiving the invoice, with multiple manual interventions (see Figure 2). This has a negative impact on operational efficiency, suppliers’ liquidity, and on Roche’s forecasting ability.

Figure 2: Friction in procure-to-pay

Source: Roche

With a blockchain solution, however, Roche recognised that it could bring together multiple suppliers and potentially multiple banks with a single view of data. By using smart contracts, the process flow would be automated, without the delays that characterised the previous process.

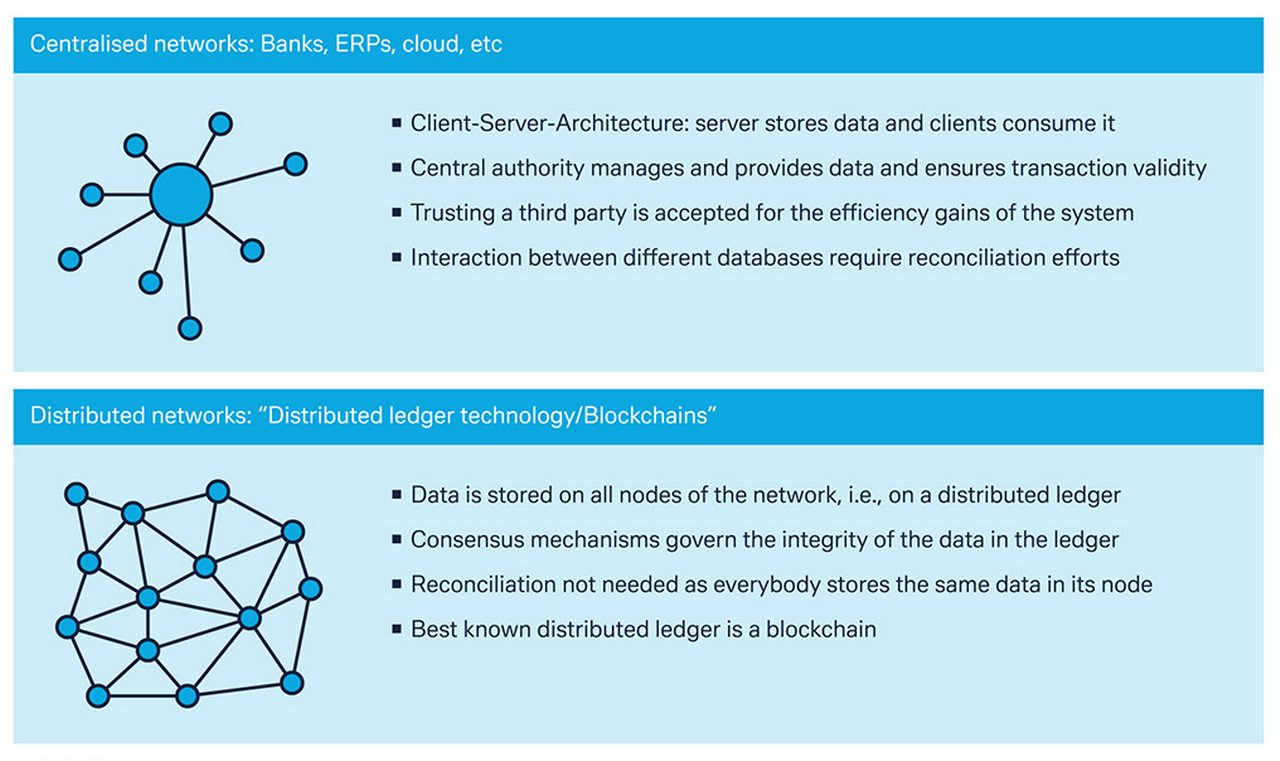

Roche set up its own private (as opposed to public) blockchain to maintain control over security and participation. The blockchain has nodes (see Figure 3) to which other parties can connect their own systems e.g., their enterprise resource planning (ERP) platform or treasury management system (TMS) via their chosen middleware layer. Looking ahead to future iterations of blockchain-based platforms, where middleware to connect to nodes run by Roche is not required, the cost and effort to participate will be lower, but at present, each vendor needs to determine whether the value of direct participation in the distributed ledger justifies the investment.

Figure 3: Connecting to distributed ledgers (blockchain)

Source: Deutsche Bank

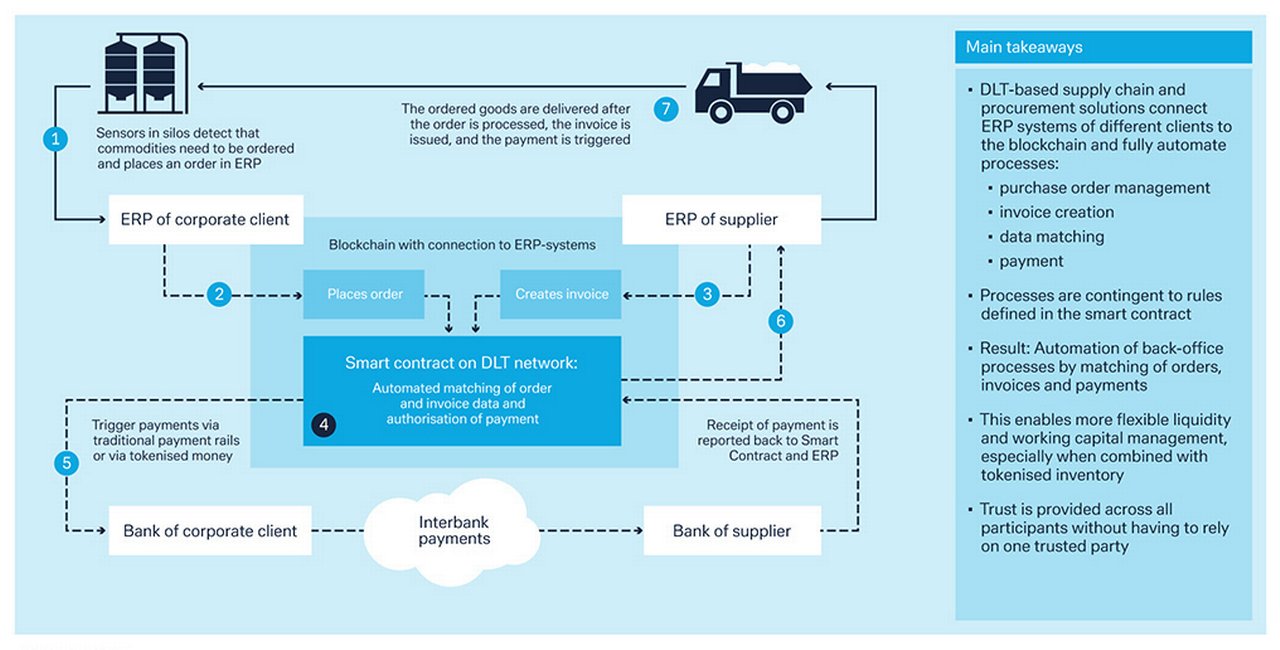

Figure 4: Using blockchain and smart contracts for procurement management

Source: Deutsche Bank

Figure 4 shows how the process works in practice:

- The company sets up an order (which could be manually-initiated or via IoT).

- This order updates the blockchain via middleware connected to the company’s internal systems, to which the supplier has access. A smart contract governs and orchestrates the procurement process.

- Based on the order information on the blockchain, the supplier provides an offer and ultimately, upon agreement, raises an invoice.

- The smart contract matches the data of the order, invoice and approval data.

- Based on the defined terms of the smart contract, a payment is automatically generated by the company’s bank, whether via payment APIs and existing payment mechanisms or in future, potentially via blockchain-based (tokenised) money.

- A confirmation of the payment is presented to the smart contract – either by the sending or beneficiary bank.

The blockchain provides a single source of truth for all information that relates to the purchase order through to the invoice, including payment schedules, triggers etc. Participants have access to this same data, which can then be integrated into their internal systems. This approach also has significant advantages in preventing fraud. The smart contract, via the blockchain, indicates the account to which payments would be made, for example, so processes for managing changes to master data become obsolete.

Deutsche Bank can either receive a payment API-call to instruct a payment after all conditions that were defined in the smart contract are met. Alternatively, the bank could also run a node and verify if all defined conditions in the smart contract are met and therefore initiate the payment on behalf of Roche.

Furthermore, the smart contract creates a new model for PO or invoice (supply chain) financing. In the case of PO financing, the company’s bank can see the PO immediately, so financing can be accelerated. Likewise, the gap between PO and invoice can be virtually eliminated, so suppliers can access financing more quickly. In future, this also means supply chain financing programmes can be expanded more easily, as multiple financiers can be connected to the blockchain.

The benefits of a blockchain-based approach

Roche’s platform offers greater efficiency, transparency and security with a single source of truth – not only within Roche, but across the value chain, with less manual administration. Stefan Windisch, Roche explains, “We can process invoices faster and reduce mutability of master data, which is essential in reducing fraud risk. We believe the solution is scalable too. From a vendor's perspective, there are fewer manual steps, and access to funding is faster, with the same visibility over the contract status as we have at Roche.”

There are also advantages for Roche’s banks. Windisch continues, “We can show that we are in a better position to handle digital currencies or tokenised fiat money, which may encourage investment in these areas amongst our bank. From a functional perspective, we can move from PO to supply chain financing more quickly, as the bank is no longer waiting for us to instruct an invoice or confirm a payment, which could otherwise take days or even weeks.”

Creating a new financial markets paradigm?

The benefits extend beyond the procurement function.

- First, while treasury could focus its resources on automating the final one or two percent of its in-house banking activities, there is more value to the group if it allocates its resources and expertise to areas in which automation could have a greater impact on the business, hence the importance of partnering with complementary business functions such as procurement.

- Second, the project has been a valuable proof of concept on how smart contracts on the blockchain can increase efficiency and transparency. This aligns with treasury’s wider standardisation and automation objectives and offers lessons for other treasury activities. Roche’s Döttger, reflects, “There are lots of potential applications around the financial markets infrastructure. For example, we could issue and settle digital bonds on the blockchain, which would be quicker and more efficient, with shared information on the bond issue terms. As a smart contract, it could even go so far as orchestrating the coupon payments and the repayment of a bond.” Likewise, there is potential for streamlining and accelerating cross-border clearing, and payment diagnostics and effectively eliminating the need for confirmation matching.

There are still many questions to resolve, such as how the cash element fits with smart contracts and blockchain, and the future role of central bank digital currencies or tokenised deposits. There are also complex legal and regulatory issues to explore and resolve, particularly cross-border, with some countries more advanced than others. The sustainability of blockchain-based solutions remains a challenge, particularly for large, decentralised networks that consume large amounts of energy, as opposed to private blockchains where participation and processing overheads are far lower. Even so, companies, together with their commercial, technology and financial partners, will need to weigh up their operational, security, sustainability and cost priorities to determine how blockchain solutions may complement existing and other emerging technologies.

Key points

- Blockchain-based supply chain and procurement solutions connect counterparties via a shared database to streamline and automate:

- Purchase order management

- Invoice creation

- Data matching and

- Payments

- Processes are structured in accordance with rules defined in the smart contract and automated through matching of orders, invoices and payments.

- This enables more flexible liquidity and working capital management, especially when combined with tokenised inventory. The solution promotes trust between participants as opposed to relying on a single, trusted party.

Helen Sanders is a consultant to the financial services sector, and former Editor of Treasury Management International

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

CASH MANAGEMENT, TECHNOLOGY

Bridges into the blockchain world Bridges into the blockchain world

More and more companies are testing blockchain applications to automate processes. This is changing the requirements for payment transactions. Treasurers should be aware of the options, says Deutsche Bank’s Christof Hofmann

Cash Management, Technology, Trade Finance

What treasurers should know about blockchain payment triggers What treasurers should know about blockchain payment triggers

As companies transfer business processes onto the blockchain, existing payment systems are reaching their limits. Does this mean that corporate treasurers will soon need digital currencies or are payment triggers sufficient? Alex Bechtel, Head of Digital Assets & Currencies Strategy at Deutsche Bank shares his views with flow’s Desirée Buchholz

CORPORATE BANK SOLUTIONS

The triple revolution in securities post-trade The triple revolution in securities post-trade

Digital assets custodial capabilities are under scrutiny and digital ecosystems such as decentralised finance (DeFi) and stablecoins in the cryptocurrency space have expanded the post-trade possibilities. Our new flow special white paper explains the implications for post-trade securities services