16 February 2022

As companies transfer business processes onto the blockchain, existing payment systems are reaching their limits. Does this mean that corporate treasurers will soon need digital currencies or are payment triggers sufficient? Alex Bechtel, Head of Digital Assets & Currencies Strategy at Deutsche Bank shares his views with flow’s Desirée Buchholz

MINUTES min read

There are plentiful examples of how companies are leveraging blockchain technology to improve processes or develop new business models: Singapore Airlines for example operates a blockchain-based loyalty wallet allowing travellers to earn air miles1, and just recently Europe’s largest insurer, Allianz, launched a blockchain platform to streamline international motor insurance claims.2

Another prominent example is Danish container shipping giant Maersk, which in 2017 teamed up with IBM to develop a digital ecosystem that allows for end-to-end visibility in global supply chains.3 The platform, which includes shipment information and trade documents, is used by companies such as Puma4 or Neumann Kaffee Gruppe5 to further automate logistics.

In general, trade finance is among the areas where distributed ledger technologies (DLTs) such as blockchain are most prevalent. So far, digitisation has been difficult as cross-border trade involves many data variables. However, DLT could foster standardisation – and therefore digitalisation – as it allows for transactions to take place in the absence of a trusted central authority. Instead, information is validated in consensus.6

However, even after years of testing and evaluating the use of blockchain technology, there is as yet no certainty that these projects will become mainstream. Yet, if the scale of usage is picking up, this would also be a gamechanger for payments, because “all relevant use cases will at some point require a payment to take place,” explains Alexander Bechtel, Head of Digital Assets & Currencies Strategy at Deutsche Bank. “This means that you have two options: either lifting payments on the blockchain or building a bridge between the blockchain and the existing payment systems.”

So, what is the way forward? How should the banking industry prepare for blockchain and what will it mean for corporate treasurers? Bechtel shares his views with flow.

Connecting the blockchain and existing payment systems

One option for connecting the two – lifting payments on the blockchain – requires tokenised money. This could potentially be achieved by using existing cryptocurrencies such as Bitcoin. “However, due to the volatility these cryptocurrencies are exposed to, this is hardly an option for B2B business models,” Bechtel suggests. “Alternatively, you could use stablecoins that are pegged to fiat currencies, gold, or other stable assets. But in Europe I don’t see any stablecoin likely to gain pace in the short term.”

The same is true for central bank digital currencies (CBDCs): The European Central Bank has only started to investigate what a digital euro could look like in Q4 2021, the earliest for the concept to become a reality is autumn 2026.7 Other countries are moving faster: While the Bahamas and Nigeria have officially launched CBDCs8, China’s central bank is now globally showcasing its digital currency, dubbed e-CNY, as part of the Beijing 2022 Winter Olympic and Paralympic Games9.

"Payment triggers solve about 99% of the blockchain use cases we are currently observing in the corporate spaces"

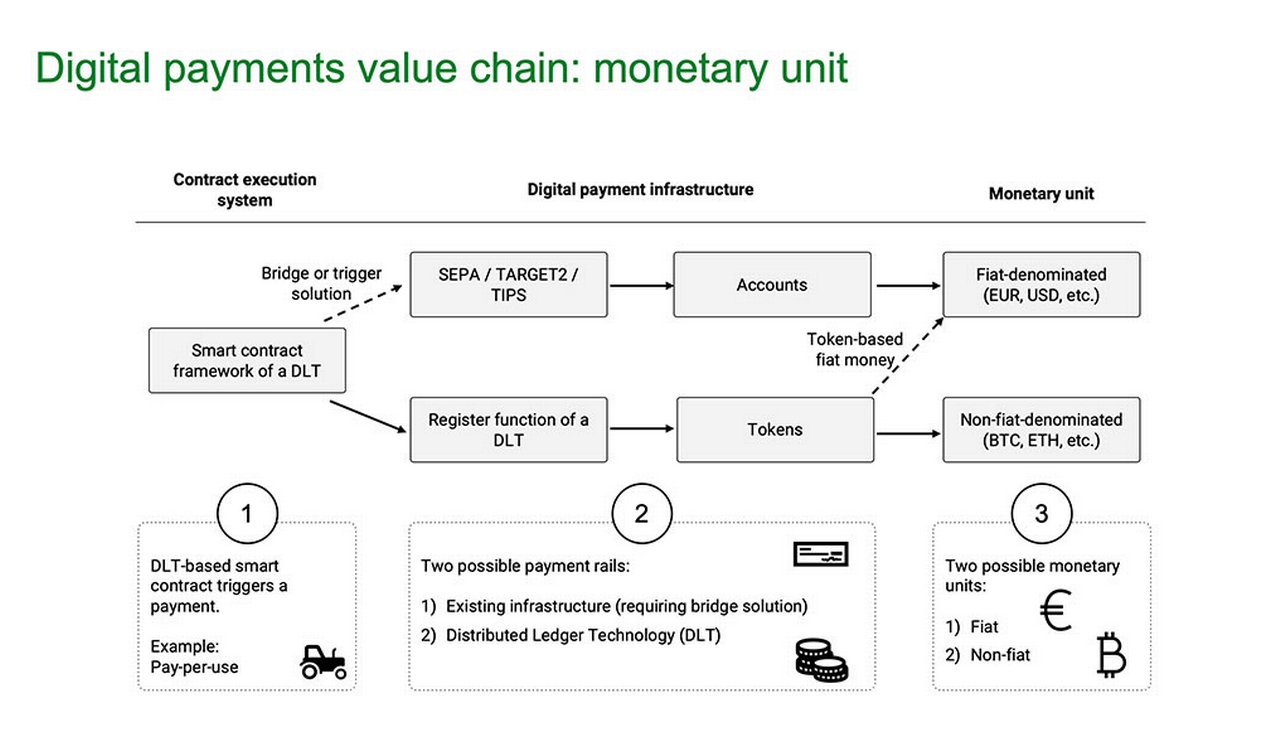

Therefore, Bechtel believes that payment triggers could become important. “They solve about 99% of the blockchain use cases we are currently observing in the corporate space”. In a nutshell “payment triggers are bridging the gap between blockchain platforms and existing payment systems like SEPA or SWIFT,” he explains. This allows companies to seamlessly include and automate payments on their trade finance, procurement or billing platforms (see Figure 1).

Figure 1: Digital payments value chain using a trigger solution

Source: Deutsche Bank

According to Bechtel, one way of building such a trigger solution would be to connect the blockchain platform and banking systems via a standard API. Alternatively, the bank could also become part of the client’s blockchain, “which would make sense if we are talking about an industry-wide initiative that has a certain scale; or if we can offer additional services via that blockchain, such as financing.”

Roche tests smart contracts to automate procurement

"Our goal is to automate contractual milestones via smart contracts and bring cash on chain to accelerate payment procedures"

Deutsche Bank is currently engaged in several projects involving payment triggers. For example, the Bank recently launched a proof of concept with the treasury team of Swiss-based pharma giant Hoffmann-La Roche and various suppliers. The company aims to automate its procurement contracts to eliminate reconciliation costs and increase efficiencies in the purchase to pay process. As its Group Treasurer, Britta Döttger tells flow: “Our goal is to automate contractual milestones via smart contracts and bring cash on chain to accelerate payment procedures.” This would not only increase the efficiency of contract management but also help to prevent payment fraud, she believes, as payment data originates from the blockchain and could only be changed if all parties agree to it.

However, there are also obstacles when using payment triggers: First, it is unclear to what extent machines are allowed to initiate payments which “totally contradicts the idea of a payment trigger”, Bechtel explains.

Second, existing payment systems need also to upgrade their technical capabilities to keep up with tokenised money. “Certain use cases might require payments to be processed instantly and there has to be a confirmation that the payment was settled”, he notes. However, most payment systems do not yet offer such a confirmation message and nor are instant payments globally available.

CBDC versus payment triggers

Another question is what will happen to payment triggers if CBDCs at some point become mainstream? Will they no longer be necessary? Bechtel believes that payment triggers will remain relevant; due mainly to his expectation that CBDCs will mostly be used as an alternative for cash rather than for B2B payments.

With the digital euro, for example, the ECB is considering the imposition of a cap on the amount users are allowed to access which “reduces its appeal”, as Deutsche Bank Research’s July 2021 paper The digital euro: Political ambitions and economic realities pointed out: “It is also doubtful whether the digital euro is even suited for international payments if the total amount per user (private individuals and businesses alike) – and probably access to the currency by non-Europeans as well – is limited,” analyst Heike Mai wrote.

Furthermore, it is still undecided whether the digital euro will be token and therefore blockchain-based, which would enable the user to settle a payment without using any intermediary, or whether it will be account-based.10 “All these design decisions – which are part of the investigation that the ECB is conducting – will influence what the digital euro can be used for,” Bechtel says.

With payment triggers, companies don’t have to wait for these decisions to be made in order to shift business processes on the blockchain. Yet Bechtel admits that he would like to see more concrete projects: “What I am not sure about is whether this is because companies don’t see enough use cases or because they are waiting for others to pave the way for them.” Ultimately, it is also this strength of demand from businesses that puts pressure on existing payment systems to evolve.

Sources

1 See https://bit.ly/3v9LH2j at singaporeair.com

2 See https://bit.ly/3Lzase1 at ledgerinsights.com

3 See https://bit.ly/3sNxtRw at maersk.com

4 See https://bit.ly/3HTMbNf at maersk.com

5 See https://bit.ly/3sNiuY3 at maersk.com

6 See “Trade and the blockchain – where are we now?” at flow.db.com

7 See “March of the digital euro” at flow.db.com

8 See https://bit.ly/3LPluMn at cbdctracker.org

9 See https://bit.ly/3BoOFAQ at pbc.gov.cn

10 See “CBDCs and the impact on cross-border payments” at flow.db.com

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

CASH MANAGEMENT

CBDCs and the impact on cross-border payments CBDCs and the impact on cross-border payments

A growing buzz around central bank digital currencies (CBDCs) is seeing proofs of concept and pilots worked on by many central banks across the world. As these schemes gain traction, Deutsche Bank’s Bradley Lonnen, Alexander Bechtel and Marc Recker outlined in a webinar how CBDCs could transform cross-border payments

Cash Management, Macro & Markets

More March of the digital euro

The European Central Bank’s go-ahead for an investigation phase could see a digital currency for Europe issued before the end of 2026, reports flow’s Graham Buck and Clarissa Dann

TRADE FINANCE, TECHNOLOGY

Trade and the blockchain – where are we now? Trade and the blockchain – where are we now?

What common thread links shipments of dairy products to China, wheat from the United States (US) to Indonesia and sugar cane from Asia to Africa? They were all supported by trade finance completed via blockchain. flow ’s Clarissa Dann provides an update on this technology’s journey towards mainstream adoption