04 August 2021

A growing buzz around central bank digital currencies (CBDCs) is seeing proofs of concept and pilots worked on by many central banks across the world. As these schemes gain traction, Deutsche Bank’s Bradley Lonnen, Alexander Bechtel and Marc Recker outlined in a webinar how CBDCs could transform cross-border payments

MINUTES min read

In recent months, the flurry of initiatives and pilots announced on CBDCs – the digital form of a fiat currency, which is issued and regulated by the monetary authority of a country or region – has become more of a blizzard. Part III of the Bank for International Settlements’ (BIS) 2021 Annual Report, reported research indicating that 85% of central banks are already developing a CBDC.1 While each central bank is at a different stage in their development, for many the work has already extended beyond the research phase; the same study found that 15% of central banks are already running pilot programmes, while 60% are experimenting with a proof of concept. But as these schemes begin to emerge, how close to maturity are they? What models are being used to implement them? And how will they impact the cross-border payments space?

The state of play

Looking ahead, it is forecast that central banks representing around 20% of the world's population will issue a general purpose CBDC within the next three years – potentially unlocking the following benefits:

- Supporting and harmonising a resilient payments landscape;

- Avoiding the risks of new forms of private money creation (such as a global stablecoin or cryptocurrencies);

- Supporting competition, efficiency, and innovation in payments;

- Meeting future payment needs in a digital economy;

- Improving the availability and usability of central bank money;

- Addressing the consequences of a decline in cash;

- Providing a building block for better, faster and more secure cross-border payments.

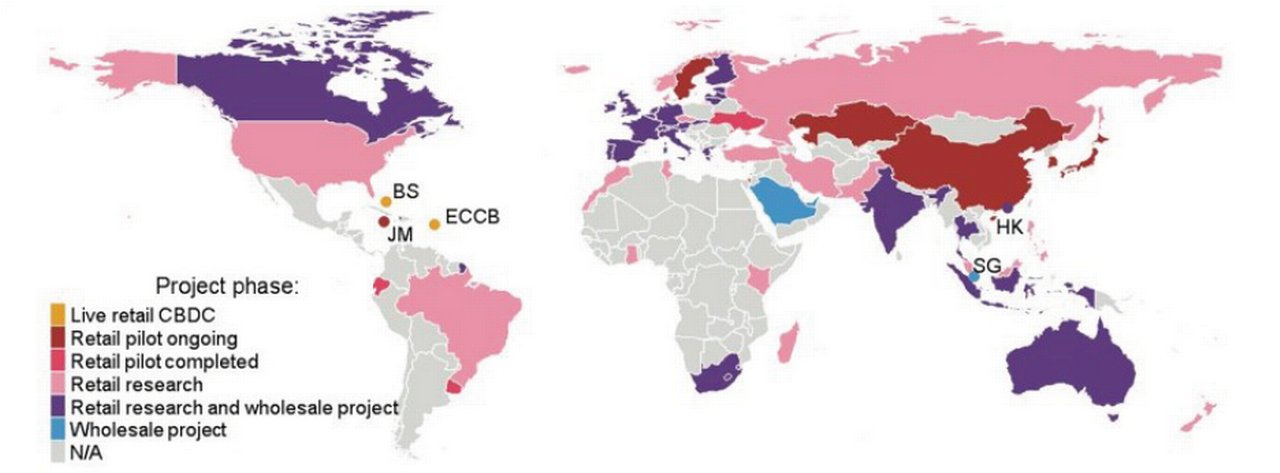

There is, however, still a long way to go, something that the flow article March of the digital euro explained in July 2021. Figure 1, extracted from that article serves as a reminder for the global progress of CBDCs.

During the Deutsche Bank webinar, Bradley Lonnen, Head of Market Management, Institutional Cash Management, Deutsche Bank, commented, “At this stage, many of the central bank schemes are exploring the possibility of retail CBDCs,” he explained, “and there are far fewer projects on the wholesale side”. What’s more, of the retail CBDCs underway, most remain in the development phase – the Bahamas’ October 2020 launch of the ‘Sand Dollar’ and Eastern Caribbean’s ‘DCash’ are to date the only two schemes to have gone live.

That said, exciting developments are on the horizon. On 14 July the European Central Bank (ECB) confirmed the launch of a digital euro and, with the central banks of Spain, Germany, Italy, Greece, Ireland, Latvia and the Netherlands, has been working with Eesti Pank – Estonia's central bank – to assess a possible technical solution. The experiment recently concluded, finding that a blockchain-based digital euro could, in theory, support almost unlimited numbers of payments being processed simultaneously with a very large money supply and with a smaller carbon footprint than the card payment system.2

Figure 1: CBDCs – research and pilot projects around the world

Source: Updated as of July 2021 based on R Auer, G Cornelli and J Frost (2020), "Rise of the central bank digital currencies: drivers, approaches and technologies", BIS working papers, No 880. Notes: BS = The Bahamas; ECCB = Eastern Caribbean Central Bank; HK = Hong Kong SAR; JM = Jamaica; SG = Singapore.

Contextualising CBDCs

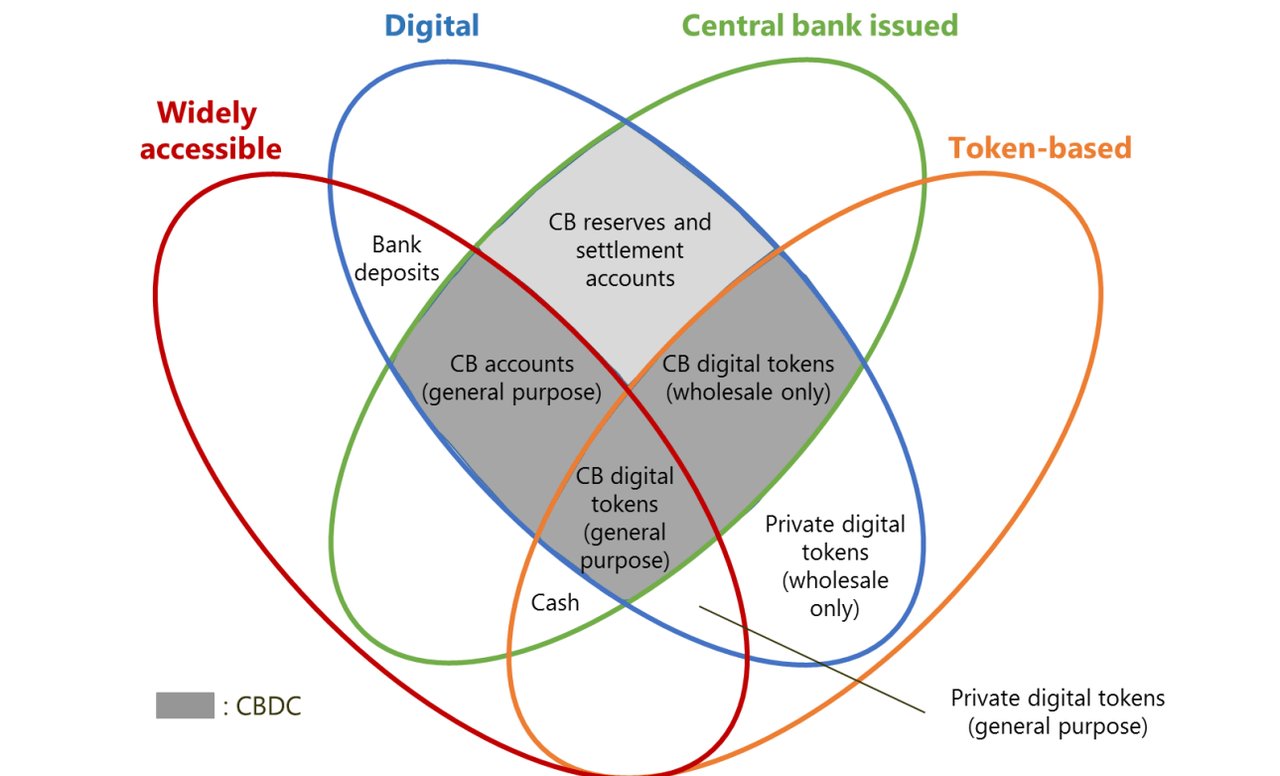

To put CBDCs into context, it is useful to assess them against other available types of payments. In 2017 the BIS released a taxonomy – the “money flower” – for the purpose (see Figure 2). The money flower characterises different forms of money by using four different dimensions: issuer (central bank or other); form (digital or physical); accessibility (widely or restricted); and technology (token- or account-based). 3

The two forms of technology – as CBDCs can be based on either – are distinguished as follows:

- Token-based: A token-based form of money enables the user to use the token to settle a payment without using any intermediary. Physical cash is the most obvious example, as once the money is handed over payment can be considered complete. The invention of blockchain has facilitated digital, token-based forms of money – otherwise known as digital currencies – that enable peer-to-peer (P2P) payments.

- Accounts-based: Balances in reserve accounts and most forms of commercial bank money are account-based. Systems based on account money fundamentally depend on the ability to verify the account holder’s identity.

“You can ultimately improve the efficiency of cross-border payments by removing intermediaries and reconciliation processes”

With this in mind, Alexander Bechtel, Head of Digital Assets and Currencies Strategy, Deutsche Bank, explained that “when we talk about CBDCs, there is no single definition. There are, in fact, several different types of CBDC – [as highlighted by the grey ellipse shown in Figure 2].” Within this, the two main types of CBDC are split across wholesale (only available to banks) and retail (available to all).

Wholesale CBDCs work by putting existing central bank reserve accounts onto a blockchain. By tokenising this central bank money, noted Bechtel, “you can ultimately improve the efficiency of cross-border payments by removing intermediaries and reconciliation processes. For example, you would unlock something called a payment-versus-payment, whereby two CBDC tokens can be exchanged instantly.”

There are two ways to achieve a retail CBDC: via central bank accounts and central bank digital tokens. “The initial step towards a retail CBDC,” explained Bechtel, “has nothing to do with blockchain. The question that central banks address at the outset is whether they should make central bank reserves – traditionally only available to banks – also accessible to non-banks.” Once everybody has access to an account with the central bank, the next step is to decide whether this money should be available on an account or as a digital token.4 And, like wholesale CBDCs, a retail CBDC would offer the added benefit of making cross-border payments, and the accompanying processes, much more efficient.

Figure 2: Taxonomy of money – the money flower

Source: Bank of International Settlements on page 5 at https://www.bis.org/cpmi/publ/d174.pdf

Wholesale CBDCs and cross-border payments

The BIS proposes three different models that could be used to set up wholesale CBDCs and increase the efficiency of cross-border payments:

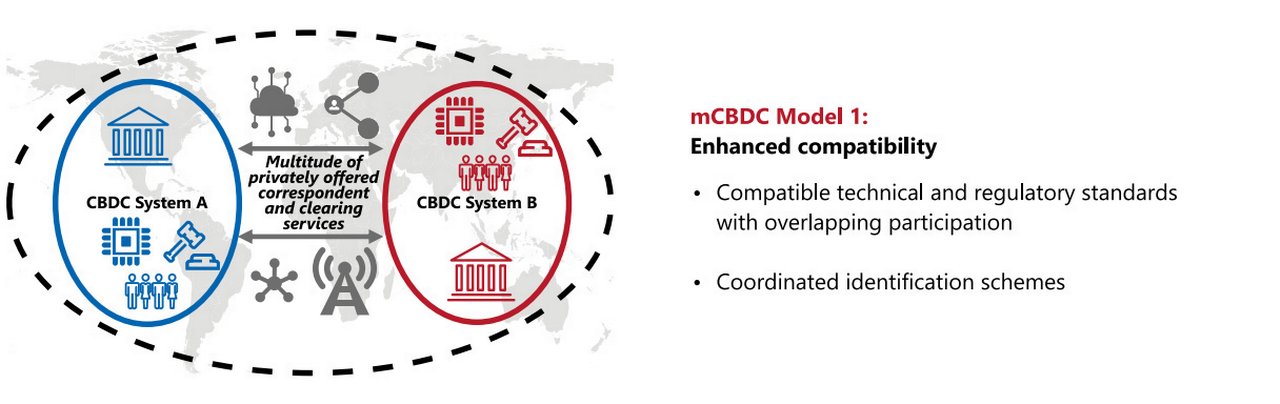

The first model, known as the compatible CBDC system, aims to create interoperability of separate CBDC systems through an adherence to a set of international standards (see Figure 3). This closely resembles today's cross-border payment procedure, whereby banks must agree on messaging standards, cryptographic techniques, or data requirements, etc. “It is all about aligning regulatory standards to simplify processes, such as KYC procedures and transaction monitoring,” added Bechtel, “While this requires a lot of coordination and time, it is something that central banks are actively working on.”

Figure 3: Model one – compatible CBDC system

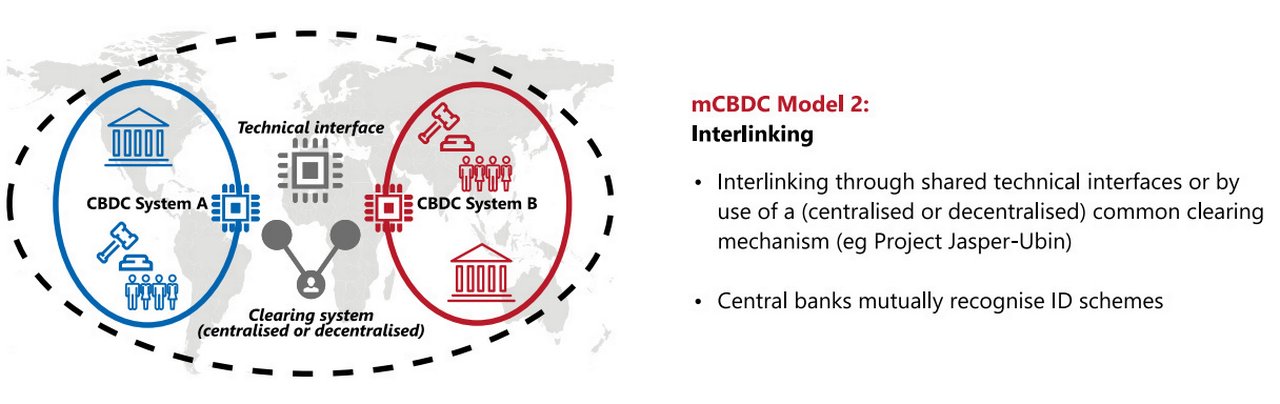

The second model, the interlinked CBDC system (Figure 4) brings the system slightly closer together than Model one, by sharing a single technical interface. This technical interface would allow retail and wholesale participants to make payments in the same system, which could also include a common clearing system. There are many choices for interlinking systems explained Bechtel, but a major consideration is the time required to build them up. “Creating these interlinks is very, very cumbersome. And history tells us that it's very difficult to create and set up the systems.” Despite these challenges, this model is being attempted. For example, since 2016 the Monetary Authority of Singapore and the Bank of Canada have partnered on a project dubbed Jasper-Ubin that links together the domestic wholesale CBDC networks of Singapore and Canada to test cross-border payments between the two wholesale networks. 5

Figure 4: Model two – Interlinked CBDC system

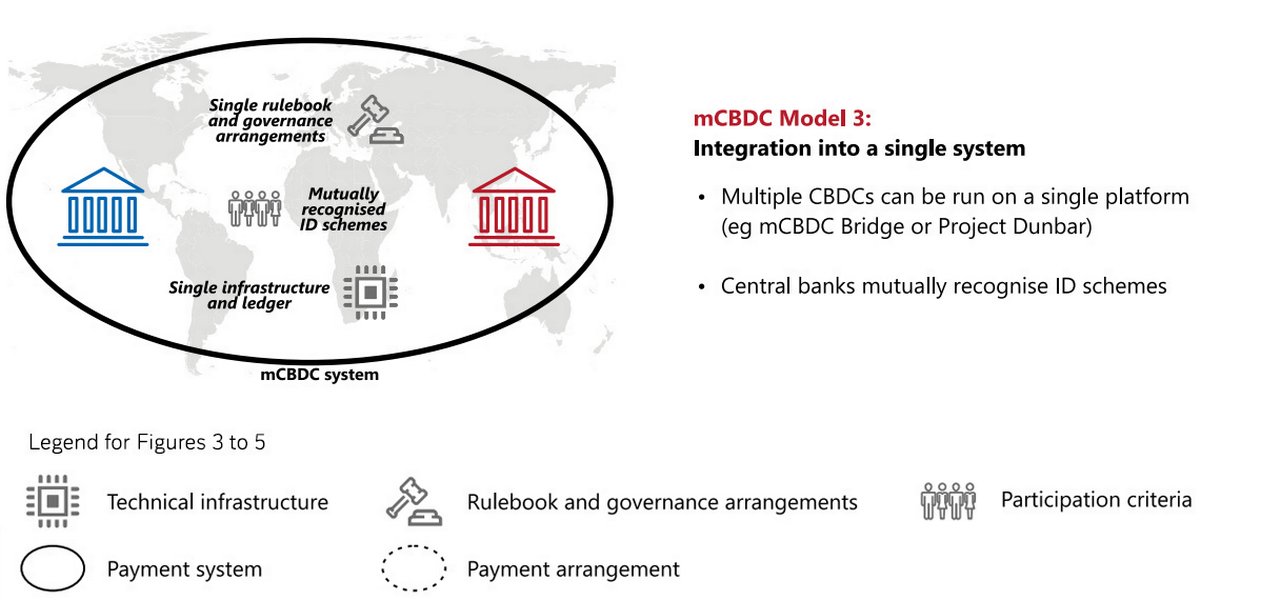

The third and final model, known as the multi-CBDC system (Figure 5), requires strong cooperation among central banks. It would follow a single set of rules, a single technical system, and a single set of participants – and would essentially mean the creation of a new multi-lateral payment platform. This, Bechtel argued, will “allow for a lot more operational functionality and efficiency, as well as increases in governance and controls.” This particular model is also being attempted, through the Multiple CBDC (mCBDC) Bridge project6 – a collaboration between the Hong Kong Monetary Authority, the Bank of Thailand, the People’s Bank of China and the Central Bank of the United Arab Emirates to explore multi-currency cross-border payment capabilities.

Figure 5: The multi-CBDC system

Source for Figures 3 to 5 is graph III.12 on page 88 of the BIS Annual report section, III. CBDCs: an opportunity for the monetary system

Improving cross-border payments

During the subsequent Q&A session, the conversation turned to the efficiencies that CBDCs could potentially bring to the table, setting them in the context of recent improvements to existing infrastructure.

“Tackling the challenges of cross-border payments by means of CBDC is definitely a value-add”

“Tackling the challenges of cross-border payments by means of CBDC is definitely a value-add,” said Marc Recker, Global Head of Product, Institutional Cash Management at Deutsche Bank. “Model three would be the perfect model, with everyone on the same system and the same infrastructure and under the same governance model.”

Attaining these efficiencies seems unlikely though. “On paper, this Model three scenario looks fantastic,” he continued. “But in my view, realistically, even with a more mid-term view it's unrealistic that we can achieve it. Just looking at it from a geopolitical perspective alone, there would need to be a huge degree of consensus across central banks and industry bodies to eliminate the current inefficiencies in cross-border payments.”

In contrast, recent initiatives have helped industry participants successfully eliminate various inefficiencies. “As an industry, we have already done a lot,” noted Recker. “A couple of years back, initiatives like SWIFT gpi were tackling longstanding issues with the transparency and traceability of cross-border payments, and there’s also a lot going on with the transition to ISO 20022.”

So, while CBDCs or wholesale CBDCs represent an important piece of the long-term value chain, “developments in the so-called legacy world are continuing to improve and make cross-border payments more efficient.”

Future challenges

Looking ahead to a longer-term future in which CBDCs have materialised, Bechtel examined their value in reducing the number of contractual agreements banks need to make and therefore the potential to reduce their KYC burden.

For Bechtel, how useful this is will depend on the reach and interoperability of CBDCs. “If you can use CBDCs only in one country or only in a particular region (for example the EU), it may solve certain issues, but it probably won’t solve real cross-border payments needs. There are still open questions here.

“Today, there is a need to have cross-border relationships with institutions covering all the world’s main currencies to fulfil client demand and that won’t go away with CBDCs. What it will do is make it easier. How much easier depends on collaboration between the central banks. If we could achieve a ‘Model three’ in certain corridors, then of course that would reduce the nature and the number of bilateral relationships. But that remains to be seen; there is no clear answer for the time being.”

With this in mind, Lonnen noted that consensus among the different jurisdictions and central banks has traditionally been hard to achieve. The likelihood that they can reach an agreement on CBDCs is therefore very much an open question – not least because of the scale of the undertaking.

For Recker, it also becomes a question of mentality, cost and resources. He explained that “if you think as a bank ‘oh, no, that will never happen’, that is the wrong approach”. But, banks must also be pragmatic. “If you look at the applicability of blockchain technology, payments do not top our priority list. There are things in the domain of securities services or trade finance, with much more potential to make processes easier today. So it is about looking at all the different functions within the bank and tackling the challenges according to client needs.”

While the creation of wholesale CBDCs could prove a boon for banks, retail CBDCs could bring significant challenges. If people are able to open up digital accounts at the central bank, there is a risk that vast amounts could be pulled out of current accounts held with banks. But could this really lead to bank disintermediation? Bechtel conceded that “we need to be a bit cautious, because this is, at least theoretically, a danger for banks”. He added that while people holding CBDCs as a direct replacement for physical cash is not a major concern, an issue arises when they withdraw bank deposits and store this cash in their central bank account. Fortunately, the ECB and Bundesbank have communicated very clearly that they have no interest in disintermediating the banking sector – and are currently discussing the possibility of a cap to CBDC accounts of around €3,000.

So where does this leave the industry? Realistically, at the beginning of a long journey, but one that promises more opportunities than threats.

Deutsche Bank’s webinar, CBDCs - what impact on cross-border payments? took place on28 July 2021 at 10:00 – 10:45 CET. To view a replay of this webinar, visit Road to SIBOS – Corporate Bank

Sources

1 See https://bit.ly/2VuVz6Y at bis.org

2 See https://bit.ly/3fnhjsg at finextra.com

3 See https://bit.ly/3yfPMR0 at bis.org

4 See Token power at flow.db.com for more information on tokenised assets

5 See https://bit.ly/2VhGIwP at mas.gov.sg

6 See https://bit.ly/3ljLepa at bis.org

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

Cash Management, Macro & Markets

More March of the digital euro

The European Central Bank’s go-ahead for an investigation phase could see a digital currency for Europe issued before the end of 2026, reports flow’s Graham Buck and Clarissa Dann

CASH MANAGEMENT, MACRO AND MARKETS {icon-book}

Central bank digital currencies: the game changers Central bank digital currencies: the game changers

Despite their volatility, cryptocurrencies are gaining acceptability as an alternative asset class. However, mass adoption is unlikely, and in the meantime, central bank digital currencies are gaining traction, reports flow’s Graham Buck

TECHNOLOGY, MACRO AND MARKETS, CASH MANAGEMENT

Token power Token power

Despite its volatility, Bitcoin can no longer be ignored and one country has made it legal tender. Where does this leave corporate treasurers and investors – and the financial services industry? flow's Clarissa Dann reports on the prospect of a brave new tokenised world