30 July 2021

The European Central Bank’s go-ahead for an investigation phase could see a digital currency for Europe issued before the end of 2026, reports flow’s Graham Buck and Clarissa Dann

MINUTES min read

“In July 2021 we decided to launch a digital euro project,” announced the European Central Bank1 (ECB) Governing Council on 14 July. “This doesn’t mean that we will necessarily issue a digital euro, but rather that we will get ready to possibly issue it.

“We are now starting to investigate what a digital euro might look like. This investigation phase will start in October 2021 and last for about two years. Once the investigation phase has ended, we will decide whether or not to start developing a digital euro. We would then create and test possible solutions, working together with banks and companies which could provide the technology and the payment services.”

"The ECB Governing Council has not yet made a decision about whether to issue a digital euro, but it would be a much larger risk to simply avoid the decision"

Given this definite maybe, the prospect of a digital European currency later this decade has moved a step closer. “Assuming all goes well, it will take another three years to issue the digital euro,” says Deutsche Bank Research Analyst Marion Laboure, meaning autumn 2026 is the earliest for the concept becoming a reality.

As Forbes magazine’s crypto and blockchain writer Emily Mason2 observed, a digital euro promises to have a substantial impact on the European and global economy as the second-most traded currency after the US dollar and the official currency of 19 of the European Union’s 27 members, with 26 billion euro banknotes in circulation as of May 2021. However, the ECB has continually stressed that a digital euro would complement cash rather than replace it.

In her 15 July Deutsche Bank Research strategy white paper ‘Future Payments – CBDCs: Ideas are easy but… execution is everything’ Laboure lists the “excellent reasons” to issue a digital euro, headed by the fact it would offer a risk-free means of payment that:

- supports and harmonises a resilient payments landscape (Visa and MasterCard often cannot be used and incur charges some merchants find expensive);

- avoids the risks of new forms of private money creation (such as a global stablecoin or cryptocurrencies);

- supports competition, efficiency, and innovation in payments;

- meets future payment needs in a digital economy;

- improves the availability and usability of central bank money;

- addresses the consequences of a decline in cash; and

- provides a building block for better cross-border payments.

"I think that people do have the right to access the balance sheet of the central bank, which is the only risk-free institution, even less risky than the sovereign"

Interviewed in June 2021 by Martin Arnold of the Financial Times, Executive Board Member Fabio Panetta3 also set out the reasons why consumers would be better protected by the ECB pioneering the digital euro. “If the central bank gets involved in digital payments, privacy is going to be better protected,” Panetta asserted. “Why? Because we’re not like private companies. We have no commercial interest in storing, managing or monetising the data of users of a digital means of payment. We’re not a profit-maximising institution, we work in the interest of citizens. So we’re a different animal than private service providers.”

He continued, “This also emerged from the public consultation. People feel safer if their information is in the hands of the central bank – a public institution – than if it is in the hands of private companies. Second, there are many ways in which we can protect confidential data while allowing the checks foreseen by law to avoid illicit transactions, such as those linked to money laundering, the financing of terrorism or tax evasion.”

Public access to risk-free is, in his view, a public right. “I think that people do have the right to access the balance sheet of the central bank, which is the only risk-free institution, even less risky than the sovereign,” Panetta concluded.

Two barriers to acceptance

However, we are some way from widespread adoption. As Laboure notes in her report, the German Banking Industry Committee4 has lent its support to the development of a digital euro. The main challenge still lies in the execution, with advanced economies facing two barriers that must be overcome to ready populations for adopting digital currencies (central bank or otherwise: lower interest rates and cultural/privacy norms.

And nothing has yet been decided regarding what underlying technology would best suit a digital euro. “The ECB has conducted early research into the benefits and drawbacks of various technologies,” reports Laboure. Experiments have focused on two in particular: both TARGET Instant Payment Settlements (TIPS) and distributed ledger technology (DLT) “could be scaled up to process the roughly 300 billion retail transactions carried out in the euro area each year.”

Among the other issues to be addressed before a digital euro and/or other central bank digital currencies are launched are:

- As deposit accounts currently pay low interest rates, a CBDC could potentially disintermediate the banking system: Should consumers opt to hold their money directly at the central bank, this would disrupt legacy bank franchises and impact financial stability. Credit card volumes, interchange fees, payment transaction fees, and deposit interest margins would all be seriously impacted.

- The ECB might aim to limit the risk on the commercial banking system: To deter people from withdrawing all the money from their bank accounts, the ECB could either impose limits on individual holdings of digital euros or deter excessive amounts by applying an unfavourable interest rate.

- In any scenario, commercial banks should consider their response to a potential loss of deposit funding: Possible solutions suggested by Laboure would be for banks to pay a higher interest rate on deposits, thereby limiting further outflows to a CBDC. Another option is to replace lost deposit funding with alternatives, such as longer-term deposits or wholesale funding. However, both options would raise the cost of funding and could result in them increasing the cost of credit they provide to the economy and/or lending less.

Lowering resistance

Despite talk of the imminent demise of banknotes and coins, the report remarks that many still regard cash as a “store of value” and a “safe haven”. ECB data records the total euro banknotes/coins put into circulation by the national central bank (NCB) of that each country in the euro area since the currency’s introduction. Laboure notes that in April 2021 the ECB reported that the circulation of euro banknotes had risen 12% over the past year; the highest growth rate in a decade and more than double that of 2019 – the ECB tracker (see Figure 1) shows the steady rise.

Figure 1: Rise in banknotes in circulation 1 July 2002 to 1 July 2021

Source: ECB

Higher interest rates are needed before cash is usurped as a store of value. Analysis by Laboure and her DB Research colleagues of cash in circulation and interest rates evidences a strong negative association between the level of central bank interest rates and cash in circulation; the latter increasing when interest rates are low. But with interest rates at or near zero in most economies and change unlikely before 2023 “consumers have little incentive to deposit or save money… so moving cash from under the mattress into a bank account or a digital currency account is unlikely to happen (at scale) in the near term.”

On the issue of privacy versus convenience citizens in advanced economies are more worried about privacy than their peers in emerging economies. Only one in 10 Chinese participants in a survey reported concerns about anonymity and traceability, with respective figures of 42% for Germany, 29% France, 22% the US, 21% the UK and 19% Italy. The pandemic accelerated an ongoing shift among younger consumers away from cash and towards digital payments, most notably in Asia and above all China

The report notes that at the end of 2018, around 73% of internet users in China used online payment services (against 18% in 2008). As demonstrated in Figure 2, digital wallets have gained wide popularity. World Bank data shows 85% of Chinese adults who bought something online also paid for it online, while in other emerging and developed economies where 53% of adults making an internet purchase in the past 12 months paid cash on delivery (COD).

Figure 2: Digital wallet as favourite method of payment

Source: Deutsche Bank dbDIG. Note: Demographics account for the percentage population represented in the 18-34, 35-54, and 55+ brackets. This excludes people under the age of 18. The representation of China is of those with internet access living in cities ranked as tier.

Laboure concluded that for a digital euro to gain broad acceptance, central banks must ensure that personal data is kept private – although not anonymous – and the ECB is considering options to ensure privacy. One possibility is that it might allow offline payments of small amounts of up to, say €100 where information would not be recorded outside the wallets of the payer and payee, something Panetta talked about in his Financial Times interview. “…There is a trade-off between guaranteeing full anonymity and guaranteeing compliance with fundamental regulations in areas such as anti-money laundering, combating the financing of terrorism and tax evasion.”(see Note 3)

More in the pipeline

With the smaller scale ‘Sand Dollar’ initiative already a reality in the Bahamas, more CBDCs are in gestation with China’s digital renminbi a front runner. “Over the past three years, central banks and governments around the world have multiplied and sped up digital cash initiatives,” reports Laboure. A 2021 survey by the Bank of International Settlements (BIS) revealed that 86% of central banks are developing a CBDC.5

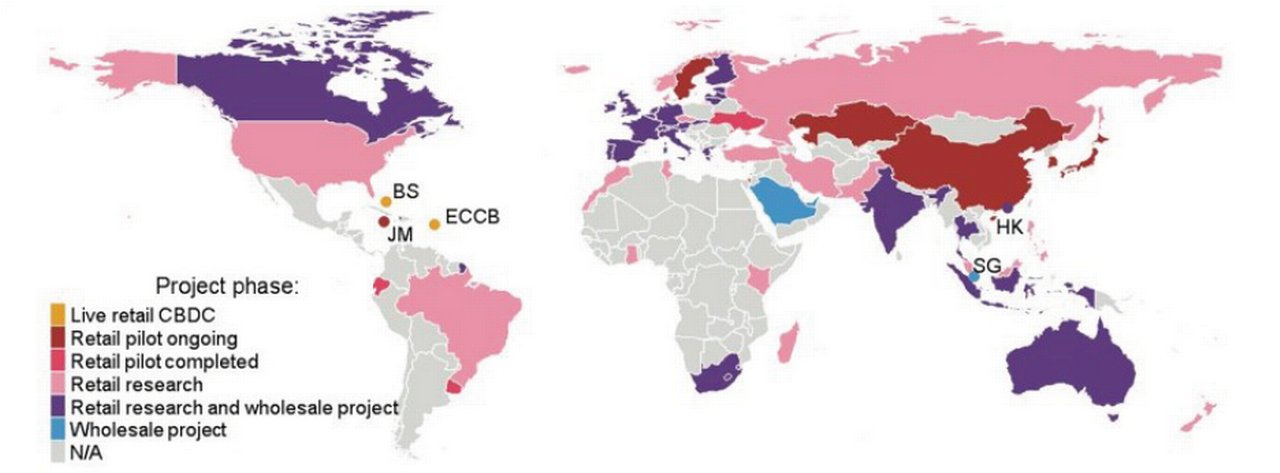

As demonstrated in Figure 3, the work extends beyond research: 14% of central banks are running pilot projects and 60% are experimenting at the proof-of-concept stage. Looking ahead, central banks representing about a fifth of the world’s population are likely to issue a general purpose CBDC in the next two or three years. Most central banks are exploring the possibility of retail CBDCs; several reaching the stage of issuing statements about their motivations and architecture designs, and also publishing research about the risks and benefits of CBDCs. So the ECB might be keeping abreast of the pack, but it is not yet blazing a trail either.

Figure 3: CBDC research and pilots around the world

Source: Updated as of July 2021 based on R Auer, G Cornelli and J Frost (2020), "Rise of the central bank digital currencies: drivers, approaches and technologies", BIS working papers, No 880. Notes: BS = The Bahamas; ECCB = Eastern Caribbean Central Bank; HK = Hong Kong SAR; JM = Jamaica; SG = Singapore.

Deutsche Bank Research report referenced

Future Payments: CBDCs: Ideas are easy but . . . execution is everything, Marion Laboure (15 July 2021)

Sources

1 See https://bit.ly/3i46ugG at ecb.europa.eu

2 See https://bit.ly/3iVGJy3 at forbes.com

3 See https://bit.ly/3x5C5CH at ecb.europa.eu

4 See https://bit.ly/3l2AbQU at die-dk.de

5 See https://bit.ly/374yKcI at bis.org

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

CASH MANAGEMENT, MACRO AND MARKETS {icon-book}

Central bank digital currencies: the game changers Central bank digital currencies: the game changers

Despite their volatility, cryptocurrencies are gaining acceptability as an alternative asset class. However, mass adoption is unlikely, and in the meantime, central bank digital currencies are gaining traction, reports flow’s Graham Buck

CASH MANAGEMENT, MACRO AND MARKETS

When will digital currencies become mainstream? When will digital currencies become mainstream?

The Bahamas launched the sand dollar, a nationwide central bank digital currency (CBDC) last October. flow’s Graham Buck reports on why its move will be followed by others around the world over the coming months as CBDCs take on cryptocurrencies

MACRO AND MARKETS {icon-book}

All-in for Europe All-in for Europe

To achieve its economic potential, should Europe move away from its ‘taking part is everything’ stance and compete to win? Deutsche Bank’s Stefan Hoops considers who holds the chips