14 August 2020

What common thread links shipments of dairy products to China, wheat from the United States (US) to Indonesia and sugar cane from Asia to Africa? They were all supported by trade finance completed via blockchain. flow’s Clarissa Dann provides an update on this technology’s journey towards mainstream adoption

When will blockchain come of age in trade? The question appears with relentless regularity on most trade-related conference programmes, and while there have been many proofs of concept and pilots, how close is the industry to seeing action?

Digitisation has been difficult: cross-border trade involves many data variables, such as the country of origin and product details, and transactions generate high volumes of documentation – making digitising and standardising a difficult and often uneconomical process. It is for this reason that distributed ledger technologies (DLT) such as blockchain – which use a consensus formation among participants to enable transactions to take place in the absence of a trusted central authority – have been pursued as possible solutions.

Today, corporates are keen to sample the benefits of this technology and simplify the process of trade finance across borders. Banks and technology companies are pairing up and forming a range of consortia to promote the use of blockchain in trade finance. On 28 April 2020, GTR’s ‘Trade finance blockchain consortia: where are we now?’ provided a useful summary of where the main players in trade finance have got to. “ komgo, we.trade, Marco Polo and Contour have seemingly stuck the landing and moved – or have definitive plans to move – beyond the proof of concept and pilot stages,” notes the article.1

In December 2017, we presented three case studies on the blockchain in the article ‘Trade Finance and the blockchain’, covering Irish agri-food co-operative Ornua, Japanese business conglomerate Marubeni and the joint development by IBM and Maersk, the Danish container shipping giant that tested a blockchain solution. Almost three years later it remains one of the most frequently read articles on this website.

This update takes a closer look at the progress made to date, including the key established platforms, the transactions signalling growing trends and the nascent innovations set to shape the trade finance transaction landscape of tomorrow.

Blockchain and the financial sector

It is worth reminding ourselves exactly what blockchain is, and why it attracts so much attention. As a record of information managed by a network of decentralised computers worldwide it is, in theory, permanent and unalterable. Any change of data is validated by a number of computers and stored across the network, so no single computer can manipulate the information.

A useful general summary of the technology, its different providers, and what it can do for the financial sector was published by Deutsche Bank Wealth Management in 2018 in the report CIO Insights Reflections: Demystifying distributed ledger technology. Its authors Markus Müller and Anja Bedford make the important point, “Blockchain is still an emerging technology and there are challenges (legal, regulatory, technology, standardisation) to overcome before it can go mainstream. From the regulatory point of view it is very important that new rules do not restrict the technology itself, but are focused on the respective use cases”. At the time they noted that the technology was at the “enlightenment” stage of the “hype cycle”, but that barriers to mainstream adoption were considerable.

“The principal challenge associated with blockchain is a lack of awareness of the technology, especially in sectors other than banking, and a widespread lack of understanding of how it works. This is hampering investment and the exploration of ideas,” they said. These points are still valid, and two years later, along with the distractions brought by Covid-19, adoption remains a slow process.

Turning to trade finance in particular, another helpful summary can be found in Deutsche Bank’s Guide to Trade Finance (Section 10.4 with Figure 17 summarising how the transactions are validated). “Blockchain can be regarded as a decentralised or distributed ledger for validating and recording transactions. As in the physical world, whenever a transaction is initiated, it requires validation and authentication,” the guide noted.

“However, as opposed to the physical world where such authentication is handled by a trusted third party (often a financial institution), the pending transaction is broadcast to a network of decentralised users (defined as ‘miners’) who, using specialised software, compete to verify and authenticate the cryptographic key added to a transaction. In essence, the ‘miners’ are verifying and confirming a bookkeeping record. For this activity, known as ‘proof of work’, they receive a reward in bitcoin.”

In her 2018 paper, Can blockchain revolutionise trade finance? Emmanuel Ganne from the World Trade Organization explains the technology (and the paper is regarded as one of the most helpful explanations of how the technology works and its potential impact on the flow of goods and services across borders).

She clarifies: “A blockchain is a decentralised, distributed record or “ledger” of transactions in which the transactions are stored in a permanent and near inalterable way using cryptographic techniques. Unlike traditional databases, which are administered by a central entity, blockchains rely on a peer-to-peer (P2P) network that no single party can control. Authentication of transactions is achieved through cryptographic means and a mathematical “consensus protocol” that determines the rules by which the ledger is updated, which allows participants with no particular trust in each other to collaborate without having to rely on a single trusted third party. Thus, Blockchain is, as The Economist calls it, a “trust machine”. Participants in a blockchain can access and check the ledger at any time.”2

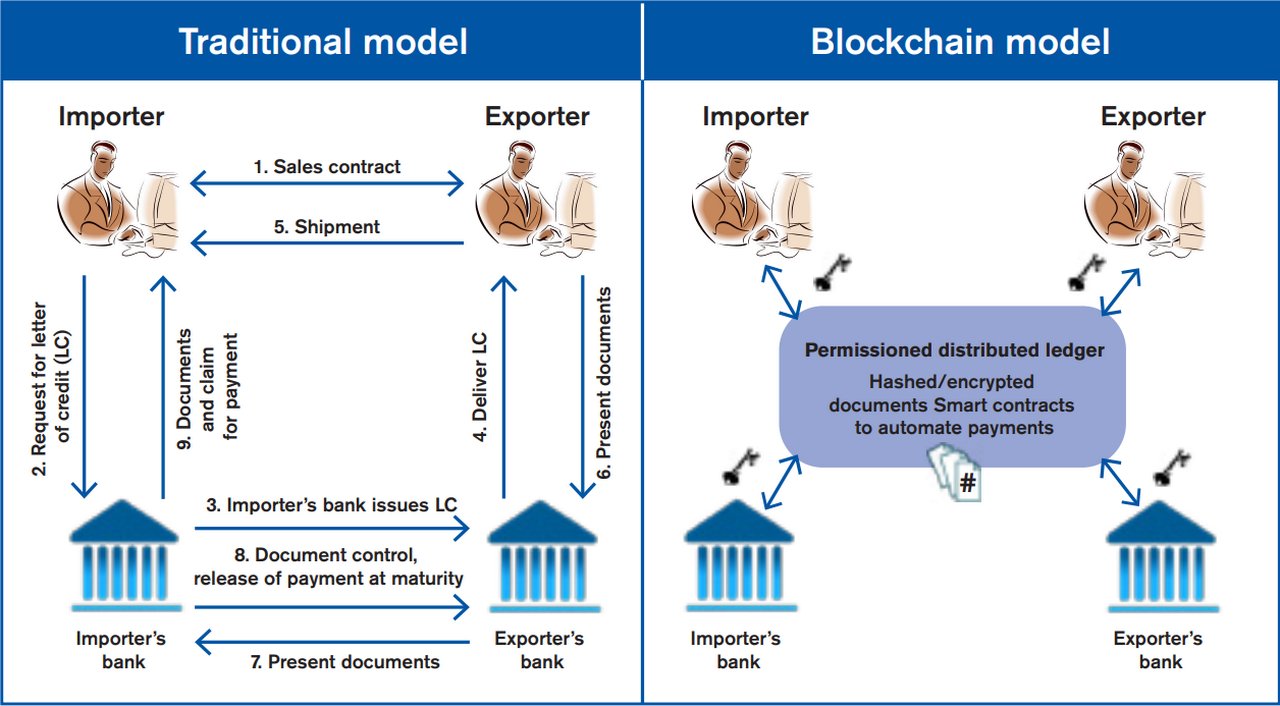

Ganne’s paper explains the differences between the traditional model for trade finance and the blockchain model, helpfully summarising (along with various other deals) how a blockchain application mirrors a traditional letter of credit transaction by sharing information between exporters, importers and their respective banks on a permissioned distributed ledger (see Figure 1).

Figure 1: Example of a letter of credit process

The specific features of blockchain platforms (e.g. types of payment) depend on the characteristics chosen by participants

Source: Can Blockchain revolutionise trade finance? by Emmanuel Ganne, World Trade Organization

In the financial sector, where building trust and ensuring transactions have transparent and accurate information are paramount, the technology would appear to be an ideal solution. Yet despite all this potential, no leading players have really emerged for investors and a profitable, scalable application still seems years away.

End-to-end cargo visibility

The Ebba Maersk, one of the largest container ships in the world in the port of Hamburg

Despite this sluggish progress, the technology is being used in certain sectors – trade being one of them – and already lending its considerable support to the movement of more than half the world’s ocean cargo

Following a first proof of concept tracking a container of flowers from the Kenyan port of Mombasa to Rotterdam in the Netherlands, IBM and Maersk announced their collaboration in March 2017, signalling the intention “to use blockchain technology to help transform the global, cross-border supply chain”, working with “a network of shippers, freight forwarders, ocean carriers, ports and customs authorities to build the new global trade digitalisation solution.”3

More than three years on, this has metamorphosed into the TradeLens platform, built on the Hyperledger Fabric – an open source blockchain infrastructure started by the non-profit tech consortium the Linux Foundation – and designed to support multiple parties across the ocean shipping ecosystem by digitising supply chain processes from end to end. It connects with users’ in-house systems via non-proprietary, publicly available APIs that are designed for ease of set-up and use.

Today, TradeLens states that it captures millions of supply chain events and tens of thousands of documents per week, having processed information on over 15 million containers worldwide since its launch. Its website confirms that TradeLens ecosystem consists of more than 150 members, including 100+ ports and terminals, 20+ ocean carriers and intermodal providers, and 10+ government authorities. The solution has been commercially available since December 2018 and its standards-based open APIs are openly available to the entire community.

The ‘TradeLens and blockchain technology supply chain demo’ video on YouTube explains the advantages of the technology using the example of a shipment from mainland China to a US West Coast destination with a change of destination to Georgia part way through the process. A blockchain-encrypted audit trail of all actions makes it possible to see where the shipment has got to throughout its journey.

With the addition in 2019 of Hapag-Lloyd, Ocean Network Express (ONE) Pte. Ltd, CMA CGM and MSC Mediterranean Shipping Company, the scope of the platform now extends to more than half of the world’s ocean container cargo.5

By March 2020, Standard Chartered had signed up. Michael Spiegel, Global Head of Trade at the bank (and former Global Head of Cash Management at Deutsche Bank) said, “Supply chains are continuing to become more international, drawing on many parties from around the world. Digital ecosystems have the potential to promote the sustainability agenda of many participants in international trade.”6

"Digital ecosystems have the potential to promote the sustainability agenda of many participants in international trade"

“Blockchain for the enterprise is solving previously unsolvable problems,” noted Bridget van Kralingen, Senior Vice President, Global Industries, Clients, Platforms & Blockchain, IBM in a press release.7 She added, “Through improved trust, simplicity and improved insight into provenance, blockchain solutions such as TradeLens are delivering proven value across business processes for our clients and their ecosystems. Massive new efficiencies in global trade are now possible and we’re seeing similar effects across the food industry, mining, trade finance, banking and other industries where the value of blockchain is more apparent than ever before.”

Other banks – including Deutsche Bank – are adopting more of a wait and see approach on how TradeLens progresses with reaching a compelling market share. Confirming an ongoing dialogue with IBM, Kirsten Kunz, Deutsche Bank’s Head of Trade Finance Product Management and Lending said, “We keep watching the ecosystem and remain open for engagements if and when we can see that industry standards start emerging and or there is demand and a benefit case for our clients.”

"We keep watching the ecosystem and remain open for engagements if and when we can see that industry standards start emerging"

Increasing access to higher-risk clients

Even before the Covid-19 pandemic struck, the trade finance gap – in other words the difference between known demand for trade finance and that made available – has been estimated by the Asian Development Bank to be firmly stuck at US$1.5trn. In May 2020, the International Chamber of Commerce (ICC) Banking Commission published a paper, Trade Financing and Covid-19, where it estimated “potentially as much as US$5trn” is required to support “a rapid rebound in global trade” to tackle the “potential decline in global merchandise trade in the order of 13–32% in 2020” (to take World Trade Organization’s estimate of the impact on trade).8

David Meynell, Senior Technical Advisor to the ICC Banking Commission confirms the ICC’s Digitalisation Working Group is aiming to produce a guidance document towards automation of the document checking process under documentary credits. “Evolving technologies such as Artificial Intelligence (AI) and Machine Learning (ML) are already being utilised to update existing manual processes while taking cognisance of ICC rules and standards,” he says. “Packaging such advances with Smart Contracts and DLT could well act as a catalyst to take these developments to the next stage.

Given the shortfall and the ongoing difficulties of getting trade finance through to small and medium-sized enterprises (SMEs), the use of blockchain to reduce risk and increase transparency could be especially useful, as well as for those regions with a less acceptable risk profile such as sub-Saharan Africa.

Progress is underway here. In November 2019, Eastern and Southern African Trade and Development Bank (TDB) became the first African development finance institution (DFI) to close a live end-to-end trade finance transaction with blockchain technology. With dltledgers, the Asian platform launched in 2017 as the technology partner, over 50,000MT of white sugar cane was moved from Singapore’s Agrocorp to one of TDB’s member states.9

By performing their operations digitally on a single blockchain, the parties involved were able to shorten the process by four days – a figure that could further improve to eight for future transactions. Beyond the speed benefits, the blockchain transaction also made it possible to reduce all parties’ risks, with secure encryption and verification technologies, as well as a decreased carbon footprint resulting from the elimination of paper from the workflow.

Cross-border commodity transactions such as these are becoming increasingly popular for their speed and risk mitigation benefits – other examples include Cargill and Agrocorp’s first cross-continent commodity trade finance transaction in April 2020, where the transaction was settled in five days, in contrast to traditional processes taking up to a month.10

Reducing fraud, increasing visibility

The risk of fraud in trade finance remains significant, with phantom cargoes and fabricated documents, among other potential trade-finance-based crimes, continuing to pose frequent challenges to the industry. The 2014 Qingdao metal warehousing scandal where fake receipts were used to raise trade finance remains a warning of what can go wrong.11

With this in mind, another milestone for the traditionally paper-heavy trade finance industry has come from the interplay of blockchain with other technologies such as the Internet of Things (IoT) for greater visibility and transparency into more granular aspects of a transaction throughout its full lifecycle.

In October 2019, CIMB Singapore and trade financing platform iTrust completed their first blockchain transaction using IoT technology.12

The transaction involved the financing of dairy products into China, using the iTrust platform to track the cargo via IoT sensors, while data and documents were also logged using DLT. This allowed for increased visibility of the goods in transit and on arrival in the warehouse.

Here again, greater transparency and reduced fraud risk were both key outcomes from the use of blockchain, and also IoT.

Innovation and cooperation in trade

These cases are a just a few in a string of trade-based blockchain transactions in recent years. Many more proofs of concept and projects are in development, with regular news stories about new collaborations and concluded trials. While impossible to showcase them all, we’ve chosen the following two examples, showcasing some of the innovation and cooperation currently ongoing in the blockchain-trade finance space.

essDOCS

In April 2019, essDOCS, an enabler of paperless trade, agreed to integrate its CargoDocs DocEx solution into the blockchain-based Voltron application (since rebranded as Contour). The integration allows banks and corporates to access all data logged under a letter of credit via one consolidated solution within the Contour application.13

This is one example of a collaboration to address the often-cited concern of siloed data. In addition, the collaboration will also enable the connection of Contour member banks with essDOCS’ CargoDocs DocEx user network of more than 6,000 exporters, traders, importers, ship owners, ship agents and independent inspectors.

BAFT (The Banker’s Association for Finance and Trade)

Now that many different platforms and applications are in use across the trade finance industry, interoperability between platforms and the use of common standards is becoming a major objective for market participants.

BAFT established a working group in 2018 to develop the distributed ledger payment commitment (DLPC). Co-chaired by California-based blockchain specialist Skuchain, the framework allows banks to create a legally binding promise to pay and represent monetary value based on a negotiable instrument. It can be assigned and distributed to third parties and is sufficient to trigger payment. In today’s world a payment is only trackable by each entity separately. The DLPC, however, will allow all parties to a trade transaction to know where the payment is.

In April 2019 BAFT published the business and technical best practices for the DLPC and has said that will be updated in 2020 to reflect industry feedback and implementation experience (although the pandemic has, for now, delayed this).14

In March 2020 Skuchain established cross-blockchain interoperability in trade finance by linking together its Hyperledger-based EC3 platform with the Corda Network in the first real-life example of the BAFT DLPC. The connection between the two parties will enable trade initiated on the Hyperledger Fabric – the blockchain infrastructure supporting the EC3 platform – to be extended to participants on the Corda network, another prominent blockchain-based platform.

The transaction is explained at length – complete with explanatory diagrams – on the Corda website.15

Where to next?

Blockchain is far more than just a tool to be used within the financial services industry. Indeed, the most immediate impact of DLT technology won’t be seen here, but in other, less regulated industries such as energy, supply chain management and the insurance sector.

Trust, transparency and automation are three keywords often associated with blockchain. Three elements the technology can, in the long run, bring to the trade finance industry, and the wider global economy.

Circling back to Deutsche Bank’s Müller and Bedford’s concern about regulatory barriers, they could not have foreseen the latest developments in the United States (US) where lawmakers seek to introduce the Lawful Access to Encrypted Data Act of 2020 introduced by two Republican senators, that would ensure the country’s law enforcement team can access encrypted information on any device, platform or system.16 This would mean blockchain data would have to be decryptable upon request, calling the security of blockchain transactions into question.

While innovation in the sector looks set to continue, and pockets of activity will be seen in trade finance where the participation works for that particular community, we are still some years away from full adoption. Could the pandemic be an accelerator? And could trade lead the way? Nothing is impossible.

Sources

1 See https://bit.ly/3gQ5MjS at gtreview.com

2 See https://bit.ly/3gMxKgH at wto.org

3 See https://ibm.co/2PHsFu3 at ibm.com

4 See https://bit.ly/3iw033q at youtube.com

5 See https://ibm.co/2ChyMlL at ibm.com

6 See https://bit.ly/2CmLYWA at sc.com

7 See https://bit.ly/2DNgGbD at maersk.com

8 See https://bit.ly/31Mtc3E at iccwbo.org

9 See https://bit.ly/2DQrndt at tdbgroup.org

10 See https://bit.ly/2DVUxI1 at gtreview.com

11 See https://reut.rs/31UFNSr at reuters.com

12 See https://bit.ly/2DSpVr0 at gtreview.com

13 See https://bit.ly/33KiSvv at essdocs.com

14 See https://bit.ly/3uidUBL at baft.org

15 See https://bit.ly/3irzAWB at corda.net

16 See https://bit.ly/3fN9vNR at news.bitcoin.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

CORPORATES BANK SOLUTIONS

A Guide to Digital Trade Finance A Guide to Digital Trade Finance

Digitalisation has long been a priority for the trade finance industry, with operational efficiency and lower transaction costs among the anticipated benefits. Where has the journey got to? And how have common frameworks evolved? With contributions from experts across the trade finance industry, this Guide to Digital Trade Finance charts the direction of travel

A Guide to Digital Trade Finance MoreShandong Qingyuan, Trade finance and lending {icon-book}

A refined approach A refined approach

Were it not for China’s economic reforms, Ma Zhi Qing would still be running a farm. Today he leads a multi-billion-dollar petrochemical corporate. Clarissa Dann visited the team to hear more about Shandong Qingyuan’s growth story

Trade finance and lending

Trade rides the Covid-19 storm Trade rides the Covid-19 storm

Are corporate treasurers unhappy with the level of support they receive from banks? Can we expect trade to bounce back in the next 12 months? flow reports on these and other pressing issues featured at TXF’s Global Trade 2020 virtual conference